For the South Florida commercial broker community, 2019 was a banner year. Yet three months into 2020, an alarming existential threat to the bullish momentum has emerged. As the first global crisis since the Great Recession, the coronavirus pandemic seems more than likely to short-circuit deal flow over the next two quarters, maybe more, according to recent reports from two top brokerages.

On March 4, JLL released a report stating that prolonged disruptions such as quarantines, cancellations of public events and closures of schools and businesses would create a pronounced impact on the economy. As of press time, we’ve seen President Donald Trump ban European nationals from flying into the U.S. City, county and state elected officials have virtually shut down all leisure activities such as dining out, going to the gym and drinking beers at a bar.

“At this juncture, it is far too early to make a specific call on this,” the JLL report stated. “But the risks clearly line up on the downside.”

If the disruption caused by the coronavirus pandemic is short, then the negative impact should only last a couple of quarters, the report predicted. But “if the impact persists, and the response becomes more pronounced, then the probability of our more prolonged, severe downside scenarios will increase,” the firm concluded.

Avison Young forecasted on March 3 that leasing activity across most sectors and markets would experience a decline in transaction volume, and some deals already in the works will get delayed.

“A heightened sense of uncertainty over the economic and business outlook will cause some deals to be withdrawn,” a report from the firm stated. “Fewer new transactions will be initiated, and some expansion plans will be put on hold.”

In South Florida, some institutional investor groups are hitting the pause button in order to figure out how to behave in this new environment, said Robert Given of Cushman & Wakefield.

Despite that, “we are seeing heightened activity the last two weeks,” Given said on March 13. “Investors would rather be in hard assets over the stock market. Overall, the debt rates are fueling CRE activity.”

Given leads a team that landed in second place on The Real Deal’s ranking of South Florida’s best-performing commercial brokers. To compile the ranking, researchers analyzed the 25 most expensive on-market, fee simple commercial sales in Broward, Miami-Dade and Palm Beach counties in 2019. If more than one agent from the same firm represented the same party in a deal, the sale price was divided by the number of brokers and the quotient was credited evenly to each broker.

If agents were members of official teams or worked on at least five deals with another broker or group of brokers, their deal volume was pro-rated and credited to the team. Portfolio deals that exclusively included properties in the aforementioned counties were counted; deals with properties outside these counties weren’t included in the analysis.

Most of the usual firms showed up, including CBRE, Cushman, JLL, Walker & Dunlop and Eastdil Secured. In the local market, brokerages seem to compete for sellers, while buyers largely do their research and market analysis in-house. Only Eastdil Secured, Darryl R. Kaplan Company and Casal Group represented buyers in the deals included in the ranking.

It’s not easy to go it alone in this business. The top two entries in our ranking were teams, from CBRE (with six members) and Cushman & Wakefield (with five teammates). The individual broker who brought in the highest volume in the ranking was Chris Conklin of Walker & Dunlop, who represented sellers in two multifamily deals, each priced over $100 million. Another individual top performer is Ernesto Casal, who runs his own local brokerage, Miami-based Casal Group, which represents major buyers like Brookfield in huge industrial deals.

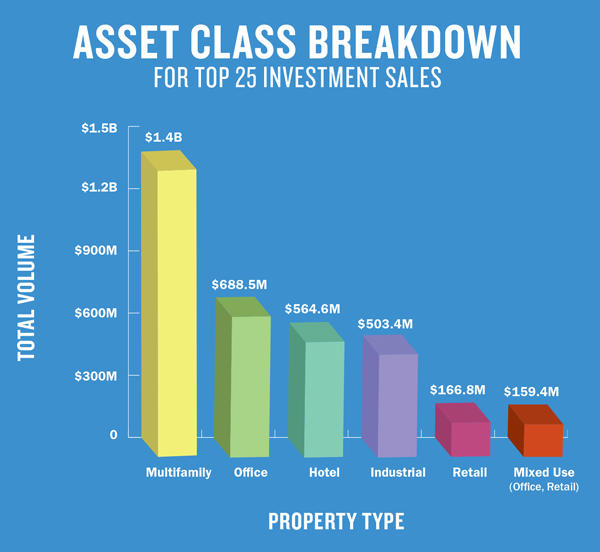

Multifamily properties dominated the top 25 investment sales analyzed for the ranking. Cushman’s South Florida Multifamily Team reached the No. 2 spot by selling a few huge multifamily properties with a combined 1,720 units. The CBRE Capital Markets Institutional Properties Team, which took the top spot, exclusively sold office and industrial properties in the $70 million-to-$200 million range.

Kind of a big deal

CBRE South Florida’s Christian Lee and José Lobón led the top ranking team, which closed seven transactions totaling $773.8 million, according to TRD’s analysis. Among those deals, Lee and Lobón’s team marketed and sold two Class B office buildings in Fort Lauderdale and Miami for a combined $242.5 million. They also sold a Hialeah warehouse complex for $178 million, the largest industrial transaction in Miami-Dade last year.

Lee, Lobón and their partner Amy Julian have been working together for 10 years. The team is very close. “We eat together most days,” Lee said. “We gather outside of the office together often. We take great pride in what we do and strive to get better on every deal.”

Other CBRE brokers pulling their weight are Dennis Carson and Casey Rosen, co-leaders of the firm’s National Retail Partners Team, which placed eighth in the ranking. In 2019, the duo represented the Blackstone Group in selling a Costco-anchored shopping center in Royal Palm Beach. An affiliate of InvenTrust Properties paid $96.75 million for Southern Palm Crossing.

According to Lee and other brokers interviewed for this article, sales were largely driven by healthy economic conditions in the industrial, office and retail categories.

“Office is definitely in demand, and so is industrial,” said Hermen Rodriguez, a senior managing director in JLL’s Miami office.

Rodriguez, senior director Ike Ojala and director Matthew McCormack, who together placed ninth in the ranking, listed and sold a nearly 349,000-square-foot portfolio at Sawgrass International Corporate Park in Broward County. Brookdale Group paid $80.27 million for the site.

Rodriguez said he is not worried about the coronavirus crisis, but is monitoring new developments regularly. “You have to keep your eyes on things,” he said. “But debt pricing and loans are much more favorable in times of general unrest.”

Multifamily’s hot streak

In 2019, Cushman & Wakefield closed 60 multifamily deals between South and Central Florida involving roughly 13,000 units that sold for a total of $3.1 billion, Given said.

Two multifamily deals totaling $303 million snagged second place for his Cushman & Wakefield team. In one of those transactions, Given and his colleagues Troy Ballard, Zachary Sackley and Neal Victor handled the $208.75 million sale of two apartment complexes in Doral. The Blackstone Group bought the garden-style communities from the Related Group and Rockpoint Group, both of which were represented by the Cushman & Wakefield team.

Given told TRD that Cushman & Wakefield also did four separate deals between $140 million and $250 million involving buyers he could not name due to nondisclosure agreements.

Given explained that multifamily institutional investors are searching for Florida assets to buy as they move out of states that have enacted rent control laws.

“It was private capital out of New York, which we are seeing a lot of,” Given said. “Last year and this year we are getting a lot of movement from the Northeast U.S. and California.”

Hospitality’s biggest sale

Institutional investor demand for Florida’s five-star resorts propelled a pair of JLL executives to third place in the TRD analysis with a single marquee deal. Gregory Rumpel and Jeffrey Davis marketed and sold the 1,047-room Boca Raton Resort & Club on behalf of Blackstone Group. Billionaire Michael Dell paid $461.6 million, representing nearly $441,000 per room, for the 337-acre resort at 501 East Camino Real.

“Obviously the Boca Raton Resort & Club was the big headline transaction,” Rumpel said. “That was a deal with a fairly lengthy time frame. But we had a patient seller and a patient buyer.”

In 2019, JLL’s hotel capital markets team expanded its market share in Florida even though overall transaction volume was down a little compared to the previous year, Rumpel said. “This is a market that ebbs and flows,” he said. “We are pretty active in Tampa and Orlando right now.”

While he and Davis lead their own teams at JLL, brokers in the Miami office collaborate on just about every deal they get, Rumpel said. “Jeffrey Davis and I have been working deals together for 15 years,” Rumpel said. “There has always been strong respect and support between our respective offices.”

Office-ial deal

Another broker who cracked the top 10 with a single transaction is Darryl Kaplan, who ranked seventh in the TRD analysis. He represented Gatsby Enterprises and Master Mind LLC, entities controlled by New York-based real estate investors Nader Shalom and Babak Ebrahimzadeh, respectively. Together they purchased 800 Brickell — a 209,122-square-foot office building and an adjacent nine-story parking garage. Gatsby and Master Mind paid $125.5 million to the seller, Deutsche Bank’s RREEF, which was represented by CBRE’s Lee and LobÓn.

Kaplan told TRD that the buyers wanted to acquire a premier office property in South Florida. “We were made aware 800 Brickell was on the market and made it a high priority to acquire it,” Kaplan said. “We looked at two others that we passed on. For us, 800 Brickell was the prize.”

He said his clients began looking at 800 Brickell in February of last year and went through several rounds of bidding and negotiations. He said Gatsby and Master Mind plan on renovating 800 Brickell from a Class B to a Class A office building that will have a 12,000-square-foot fine dining restaurant and new space for a bank tenant.

Since 1989, Kaplan has headed his own brokerage, representing property owners on the buy and leasing side. He also provides retail real estate services to upscale retailers and restaurants looking to expand throughout the U.S.

Kaplan said the coronavirus crisis has not deterred any of his New York clients from making deals in South Florida yet, but there is a heightened sense of awareness. “People are being cautious,” he said. “Everybody is holding their breath.”