Updated Sept. 27, 2:57 p.m. Comparing his own brokerage to a speedboat, Douglas Elliman Florida CEO Jay Phillip Parker says one of his biggest competitors, Coldwell Banker, is more akin to an ocean liner.

“They are a massive operation, and it’s always easier to turn a speedboat than an ocean liner,” Parker declared. “We have much more flexibility.”

Indeed, Coldwell Banker is a far larger brokerage than Douglas Elliman. The former is 88,000 agents strong, with offices in 49 countries and all 50 states, plus the District of Columbia. Within South Florida, Coldwell Banker has 1,600 agents in Miami-Dade, Broward and Palm Beach counties.

In contrast, Douglas Elliman has 7,000 agents with offices in the northeast United States, Colorado, California and Florida. In South Florida, Douglas Elliman’s sales force, which has a greater focus on selling luxury real estate, consists of 1,000 agents — nearly 40 percent less than Coldwell’s representation in the region.

Not surprisingly, Nancy Klock Corey, regional vice president of Coldwell Banker’s Southeast Division, takes issue with Parker’s ocean liner metaphor, saying she thinks her brokerage has more than enough flexibility and aggressiveness to move quickly, closing deals in all manner of residential real estate, luxury or otherwise. However, the brand does benefit from the scale of its operations.

“We are a global brand, literally a global brand,” Corey said. “You see our signs in South America and Europe. That’s very powerful for incoming buyers and sellers.”

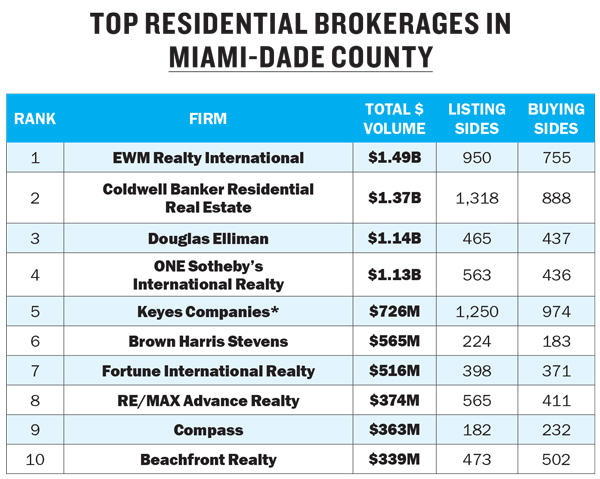

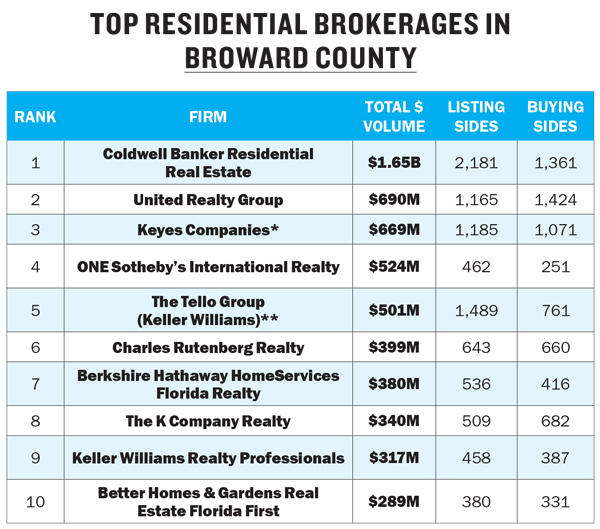

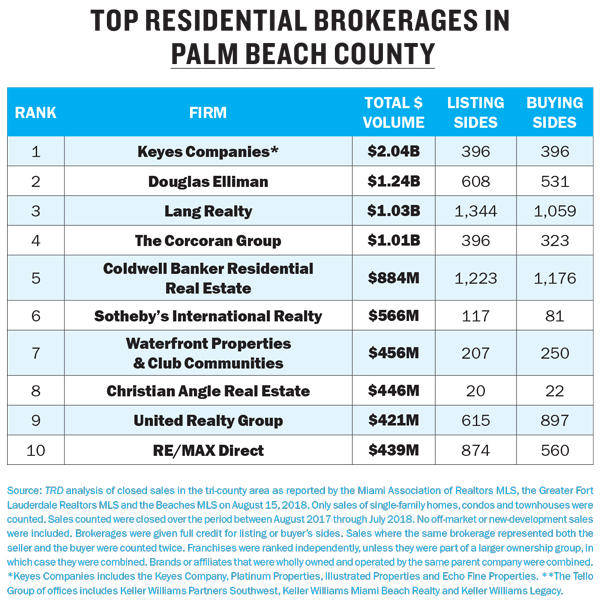

The numbers back her claim. In The Real Deal’s ranking of the top brokerages within Palm Beach, Broward and Miami-Dade counties, Coldwell Banker, which closed $3.9 billion in residential deals across all three counties over 12 months, had the highest combined sales volume of the residential brokerages that appear in the rankings.

Douglas Elliman finished third with $2.6 billion in residential transactions in South Florida in the past year, according to the analysis of MLS data by TRD.

And coming in second? That would be the Keyes Company, a real estate firm that started in Miami back in 1926 and has been owned by the Pappas family since 1969. Keyes, with 3,000 associates, closed $3.4 billion in transactions across the tri-county region.

Mike Pappas, CEO of Keyes, said his company’s success has a lot to do with it being rooted in “family values,” unlike the “outside Wall Street firms that are trying to disrupt the market.”

To drill into the mechanics of the top-performing brokerages in the tri-county region, TRD ranked them by closed sales volume between August 2017 and July 2018. TRD obtained the data from the Miami Association of Realtors MLS, the Realtor Association of Palm Beach & Greater Fort Lauderdale Realtors MLS, and confirmed the sales totals with the brokerages themselves. Off-market transactions and presales for planned residential projects were not counted. Brokerages were given full credit for agents closing sales on the listing side and the buyer’s side; if the same brokerage represented both the buyer and seller in a closed deal, the closing was counted twice for that brokerage.

As the rankings show, hundreds of millions of dollars have been traded on South Florida properties as median home prices rose in all three counties. In Miami-Dade, the median sales price for single-family homes in August was $369,450 — that’s up 10.3 percent from the same month the year before. The median price for townhouses and condo units was up 2.2 percent from August 2017, to $230,000, according to the Miami Association of Realtors. In Broward and Palm Beach counties, the median sales price for single-family homes inched up too — by 2.9 and just over 4 percent, respectively, according to Greater Fort Lauderdale Realtors and the Realtor Association of Palm Beach.

It’s a market that is showing signs of “maturity,” Parker said. “We are evolving from a boom-bust type market,” he said. “People are moving here as full-time residents. We’re no longer a destination for flight capital.”

It’s also a market that is seeing more American purchasers instead of foreign buyers, added Ron Shuffield, president and CEO of EWM Realty International, which ranked first in Miami-Dade, closing almost $1.5 billion in transactions there.

“Domestic buyers have increased dramatically over the last 10 years, including New Yorkers and all the major cities,” Shuffield said. “International buyers, they don’t have the buying power they once had.”

Headhunting

No matter what the state of the market may be, a brokerage is only as good as the talent it employs. Thus, efforts to recruit are a constant and of paramount importance.

“The lifeblood of this business is people,” said Shuffield, whose company has 900 associates and staff in South Florida. Poaching from other companies is a part of that. “We will certainly reach out to them,” he said of agents at other firms. “I think that happens in every field.”

Still, Shuffield said EWM isn’t obnoxious about its recruiting efforts, unlike some other companies he declined to name. “We don’t hound people. We don’t call them relentlessly,” Shuffield said. “Some of our competitors … oh my gosh, they keep calling.”

Parker said Douglas Elliman poaches from other brokerages, too, though he doesn’t seem particularly fond of the practice. “I think it’s one of the more disturbing [things] we do,” he said. Often agents acquired from poaching aren’t very loyal to the brokerage, Parker observed, adding that he finds it frustrating when competing brokerages try to poach Douglas Elliman agents with inflated offers. “They’re being offered the moon and the stars,” he said.

Pappas said Keyes hired between 100 and 150 brokers in the past year alone. He noted that the firm recently lured “a $25-million-dollar producer” away from one of its competitors. “If you talk to a brokerage that doesn’t recruit, they’re not going to be in business,” said Pappas, whose company closed more than $2 billion in transactions within Palm Beach County alone, making it the top firm in that county.

And Pappas did embrace the competitive nature of getting good people, adding that his company’s recruits tend to stick with his company: “We are very competitive. We are very aggressive. Our top producers stay with us 30 or 40 years.”

Most brokerage leaders declined to say what they offered to brokers they wished to poach, although Parker insisted he has never given out a signing bonus for brokers coming to Douglas Elliman.

Pappas said that what his brokerage offers its recruits varies, but involves the “transition dollars” and “marketing dollars” necessary to bring an individual into the Keyes fold.

“I think each individual deal is unique. You’ve got to understand the individual and what he wants and desires,” Pappas said.

David Chambless, owner and vice president of United Realty Group, said his company refuses to poach.“We don’t poach from anybody,” Chambless declared. “We don’t believe in it.”

Instead, United Realty Group, a Plantation-headquartered company of 2,500 agents, lets everyone in real estate know that URG agents get to keep 100 percent of their commission, minus a $299 flat transaction fee.

“We try to pay them within 24 to 48 hours of closing,” Chambless said.

Other brokerage leaders TRD contacted for this story declined to specify the commission splits on deals.

Scooping up smaller firms

Many of the biggest players in the market have in the last few years been acquiring smaller firms to gain market share or expand into new territory. Keyes, for example, acquired the Palm Beach Country Realty Group in Boynton Beach in June. Keyes also bought Realty Pros in Boynton Beach and Rickenbacker Realty in Aventura in January of this year. And, in the past eight years, Keyes has acquired several other companies in South Florida, including the Valore Group, Echo Fine Properties and Illustrated Properties.

ONE Sotheby’s International, which came in fourth in TRD’s ranking in Miami-Dade and Broward counties, is less than 10 years old. It was founded by Mayi de la Vega in December 2008. Nevertheless, it has assembled a force of 850 agents thanks to recruiting and acquiring three real estate brokerages between 2015 and 2017: South Beach Investment Realty (founded by hotelier Diane Lieberman); Bay Harbor Island-based Crescendo Real Estate; and Aventura-based Turnberry International Realty. “They had a lot of top producing agents and they fit well with the Sotheby’s brand,” said Daniel de la Vega, president of ONE Sotheby’s (and Mayi’s son).

Douglas Elliman has grown its South Florida presence by absorbing smaller brokerages, too. Just this past July, the brokerage took over Pink Palm Properties in Boca Raton.

And Brown Harris Stephens entered the Miami market — and grew its presence within it — through acquisitions, starting with its purchase of Zilbert International Realty and following up with Ocean Club Realty, Avatar Real Estate Services and Opulence International Realty. It’s now the sixth top brokerage by closed sales in Miami-Dade, with $565 million in transactions.

The out-of-state hookup

As “tax refugees” from other states come looking for properties under Florida’s eminently more appealing tax laws, relationships with brokerages outside the state are helpful in scoring those incoming buyers. Coldwell Banker’s affiliation with real estate giant NRT, for example, makes it part of a global network where agents can trade leads, intel and clients. “That’s what generates most of the business, back and forth,” Corey said.

Executives of other top producing brokerages say their reach beyond Florida is potent, too. Keyes and EWM are part of Leading Real Estate Companies of the World, a networking alliance with 130,000 sales associates in 70 nations. “They share broker-to-broker referrals across the globe,” EWM’s Shuffield explained.

EWM itself has been a part of a larger empire — Berkshire Hathaway — since 2003. That allows EWM to draw on the resources and referrals of 45 “sister companies” across the U.S., Shuffield said.

EWM itself has been a part of a larger empire — Berkshire Hathaway — since 2003. That allows EWM to draw on the resources and referrals of 45 “sister companies” across the U.S., Shuffield said.

Parker said Douglas Elliman is also uniquely positioned to take advantage of the wave of wealthy individuals moving away from states with high income state taxes. “We’re in constant dialogue with our offices in New York and California,” Parker said.

Daniel de la Vega said ONE Sotheby’s regularly interacts with other Sotheby’s International franchises across the world. He’s particularly proud of his partnership with Daniel Gale Sotheby’s International Realty, a top-producing brokerage in Long Island, New York, which employs 750 agents. Thanks to that relationship, de la Vega said, ONE Sotheby’s has been able to reach lots of potential buyers from New York’s tri-state area who are interested in purchasing houses or condos in South Florida. “We probably have the strongest presence when you look at the tri-state area,” de la Vega bragged.

An out-of-state connection makes a difference even when a brokerage doesn’t have a large presence in South Florida. The Corcoran Group, headquartered in New York City, has just two offices in Palm Beach County — one in Delray Beach and the other in the Town of Palm Beach. Between them, the two offices have just 150 agents. Nevertheless, Corcoran managed to close just over $1 billion in transactions, the fourth highest level in Palm Beach County.

John Hackett, senior managing director of Corcoran South Florida, said his company is focused on Palm Beach County’s coastal communities “where typically the highest price sales occur.” They’re also very particular about their associates.

“Our model is basically to bring the finest talent we can find to our company,” Hackett added. “We don’t generally bring on brand-new agents straight out of real estate school. We’re hiring seasoned agents.”

Other real estate executives tout their local focus as a reason for their strength. Chambless noted that United Realty Group has no presence outside the tri-county area, yet it managed to close about $690 million in transactions, putting it in second place in Broward County in TRD’s ranking.

“That’s where we began our company [in 2002] and that’s where we began our own base,” said Chambless.

United Realty Group also closed the ninth highest number of transactions in Palm Beach County with $421 million. Chambless said he’s grown his company’s presence there by recently opening an office in Boynton Beach, and added that “Palm Beach has a very strong market.”

Correction: This story has been amended to reflect that sale prices for condos and townhomes in Miami-Dade County increased by 2 percent year-over-year, to a July 2018 median of $230,000. The article had erroneously stated it had increased by eight percent.