UPDATED, May 8, 3:40 p.m.: Dealmakers faced a rapidly shifting market in the city last year as a post-pandemic boom gave way to rising mortgage rates and a growing disconnect between bargain-hungry buyers and overconfident sellers.

But few adjusted better than those who finished atop The Real Deal’s annual ranking of the city’s leading residential brokers.

Despite a slowdown midway through the year caused in part by the Federal Reserve’s efforts to beat back runaway inflation, top sellers still made some serious dough, even if most didn’t match their lofty totals from 2021.

“For most of the first half, we were riding on the coattails of all the success in ‘21,” said John Gomes, who runs Douglas Elliman’s Eklund-Gomes Team with celebrity broker Fredrik Eklund. “Of course, in the latter half of the year, [the market] changed considerably and got more challenging.”

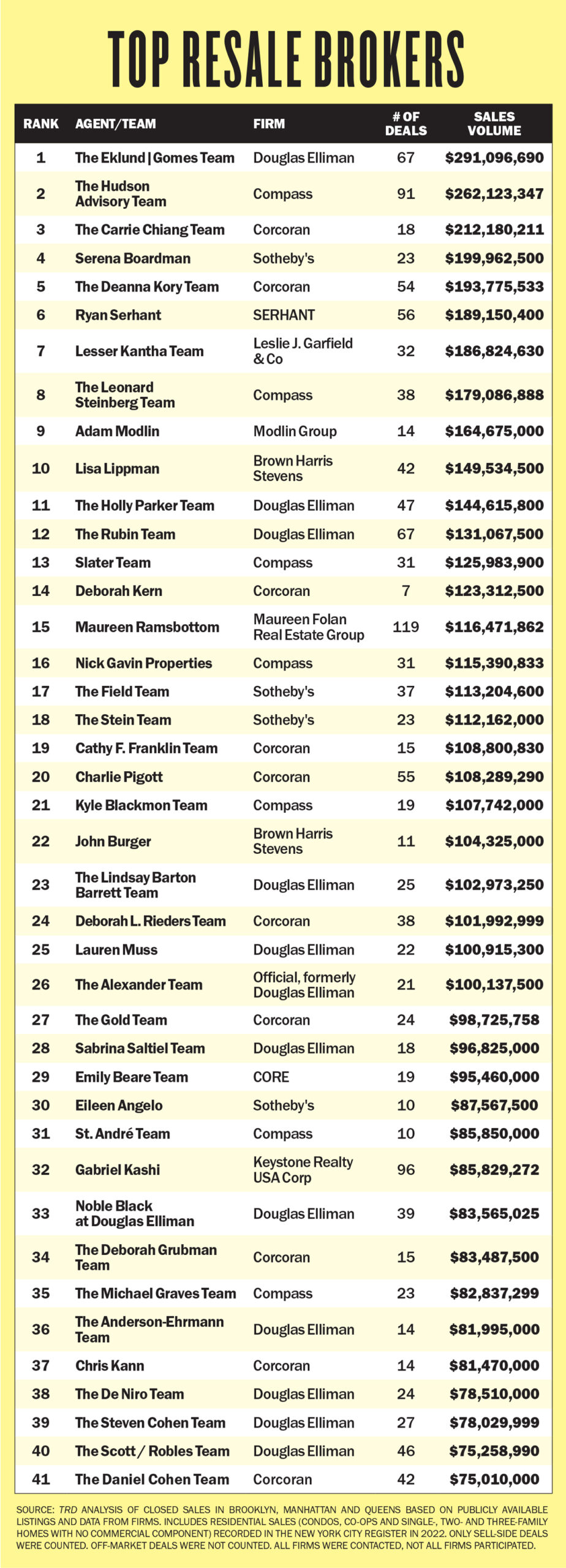

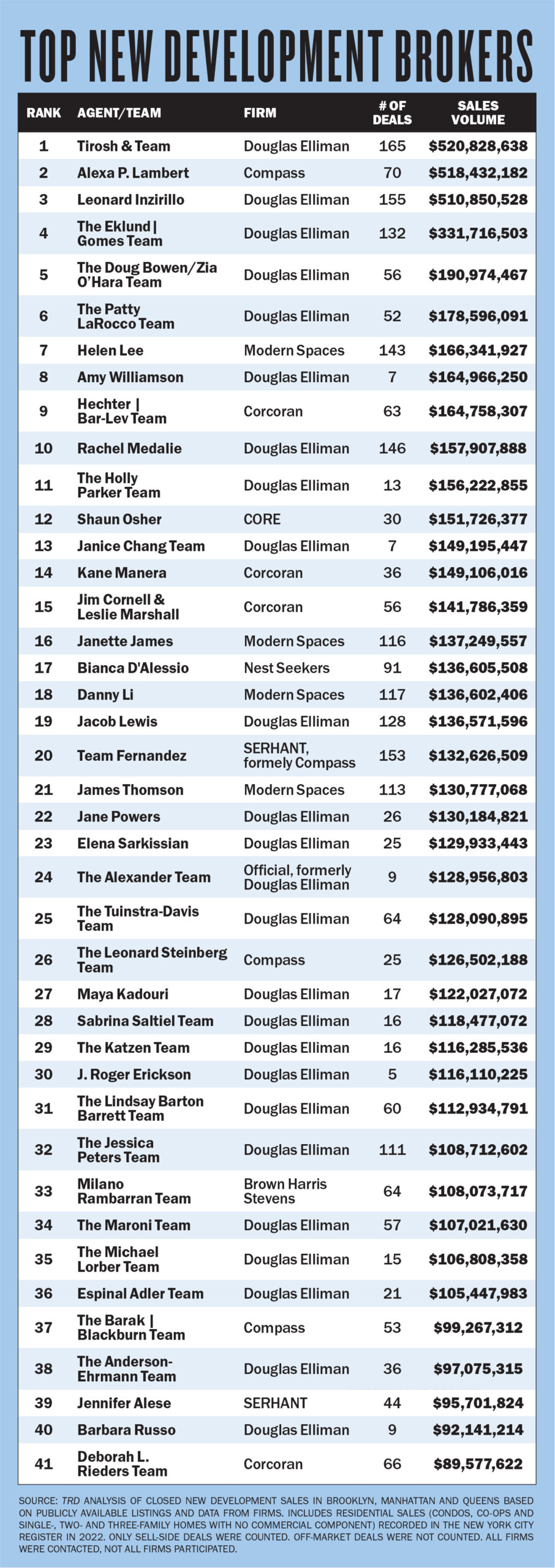

This year, TRD created two lists — one for resale brokers and another for new development teams — pulling listings from Manhattan, Brooklyn and Queens and verifying them against public sales records and with brokerages. Off-market deals and those arranged by developers’ in-house sales teams were not included.

Eklund-Gomes, which signed a five-year contract to remain with Elliman in December, was the only team in the top 10 for both resales and new developments. It ranked first for resales with $291 million in volume and fourth for new-inventory sales with nearly $332 million.

Rising rates, stubborn sellers

Even as rising rates made borrowing more costly, many sellers refused to budge and buyers were left waiting for price drops that never came. That trend is expected to hold for some time, leading appraiser Jonathan Miller to dub 2023 “the year of disappointment.”

“People think they’re going to be buying great assets at great discounts and that’s just not what’s going on,” said Tal Alexander, whose Alexander Team ranked 23rd for new development sales and 26th for resales.

Tal and his brother, Oren Alexander, made headlines midway through the year when they left Elliman to launch their own firm, Official, backed by the white-label brokerage startup Side. Tal said his team, which is also active in the Hamptons, Los Angeles and Miami, did over $1.3 billion in sales last year. In New York City they generated just under $230 million across 30 resales and new development deals.

Tal and his brother, Oren Alexander, made headlines midway through the year when they left Elliman to launch their own firm, Official, backed by the white-label brokerage startup Side. Tal said his team, which is also active in the Hamptons, Los Angeles and Miami, did over $1.3 billion in sales last year. In New York City they generated just under $230 million across 30 resales and new development deals.

“If you compare it to 2021, volume was down. The Covid craze was behind us,” Tal said of the luxury market. “Of course inventory is down because 2021 was such an abnormal year. A lot of this product sold out.”

As office workers continued to trickle back to the city, brokers said a major driver of the market last year was young families.

“Family apartments that are fairly and reasonably priced in the single-digit and lower double-digit [millions] have been a very saleable commodity in this environment,” said Serena Boardman, a luxury specialist with Sotheby’s who ranked fourth for resales with just under $200 million across just 24 deals. “It is the families that are staying put in New York and powering our market in terms of volume.”

Boardman added that not all are returning full-time. Many have primary residences in states like Texas and Florida but picked New York for a home away from home.

“People think they’re going to be buying great assets at great discounts and that’s just not what’s going on.”

Tal Alexander, Official

“I’m seeing quite a few people who have relocated to other locales who are saying, ‘You know, I’m happy there. It’s working. But we still want to have a foothold in New York City,” she said.

Compass’ Hudson Advisory Team, led by Stephen Ferrara and Clayton Orrigo, placed second for resales with $262 million. A pair of Corcoran teams led by Carrie Chiang and Deanna Kory ranked third and fifth with $212 million and $193 million, respectively.

Ryan Serhant, who was sixth with $189 million, said demand for turnkey properties, a major theme in 2021, has stayed strong.

“In some instances it’s taking triple or quadruple the time, for triple or quadruple the money” to get renovations done compared to before the pandemic, he said.

That was especially true in the townhouse market, which had another banner year as newly renovated properties commanded premium prices. Several townhouse deals set new neighborhood highs in both Manhattan and Brooklyn, including a passive house in Fort Greene that smashed an area record when it sold for $7.9 million in May.

Ravi Kantha of the Lesser Kantha Team at townhouse specialist Leslie J. Garfield, which placed seventh with nearly $187 million, said he’s seeing an “astronomical” number of five-to-seven-year adjustable-rate mortgages along with an increase in cash buyers.

“There’s a number of ways people are getting to the finish line, but I think the consensus across the board is nobody’s looking to hold these mortgages for a long period of time,” he said.

Concessions return to new condos

Buyers were snatching up units at the start of the year as sales launched at highly anticipated projects on both sides of the East River, but by fall, concessions were on the rise again.

“We felt more negotiability, as everyone did, in October, November and December, definitely,” said Nest Seekers’ Bianca D’Alessio, who ranked 17th for new-inventory sales with nearly $137 million across 91 deals.

Led by Ariel Tirosh, Elliman’s Tirosh & Team topped the list for new condo sales with $521 million across 165 deals, just ahead of Compass’ Alexa Lambert, who closed nearly $518 million across just 70 sales, including several high-priced units at two Miki Naftali projects on the Upper East Side: 200 East 83rd Street and The Bellemont at 1165 Fifth Avenue.

Led by Ariel Tirosh, Elliman’s Tirosh & Team topped the list for new condo sales with $521 million across 165 deals, just ahead of Compass’ Alexa Lambert, who closed nearly $518 million across just 70 sales, including several high-priced units at two Miki Naftali projects on the Upper East Side: 200 East 83rd Street and The Bellemont at 1165 Fifth Avenue.

While amenities play an important role in defining top-tier projects, location is still king, Tirosh said.

“You want to have a great building on the main location,” he said. “Even through tough times, main, central locations are always the best-selling product.”

Still, Tirosh conceded, the luxury set demands a certain baseline when it comes to amenities.

“Everybody wants a swimming pool,” he said.

Tirosh & Team’s banner year included several deals at the Madison House, JD Carlisle and Fosun International’s 62-story 200-unit luxury tower at 15 East 30th Street in NoMad — one of the city’s top-selling projects in 2022.

If Chris Jiashu Xu is to realize his ambition of a $1 billion sellout at Skyline Tower, Queens’ tallest building, the project’s 20,000 square feet of amenities — including a two-story spa with a 75-foot indoor pool — will certainly play a part.

Modern Space’s Helen Lee-Elias, who oversees sales there, brought in $166 million last year across 143 sales, good for seventh on the list.

“We’re just kind of beating everybody with everything that we have,” said Lee, noting that the building is now over 70 percent sold. “Our primary residence rate is really high, it’s close to 90 percent.”

Tirosh said that with developers filing for fewer projects, he expects a shortage of new inventory over the next two years.

“There’s not much going on,” Tirosh said. “When we have the privilege to work on a few of these projects that will come to market, how do we interpret that to cater to the future buyer two or three years from now?”

This article has been updated according to previously undisclosed data for broker activity in New York City resales.