When construction began at the 830 Brickell office project in Miami about four years ago, the developers expected it to be completed in 2022.

Yet, work still is ongoing.

The schedule took a hit due to delivery delays of exterior window glazing and electrical switchgear equipment, said William Real, CEO of Civic Construction, 830 Brickell’s general contractor. Plus, Covid increased health consciousness, prompting developers OKO Group and Cain International to redo designs so the air-conditioning brings in outdoor air at 30-second intervals to filter allergens and bacteria.

“They wanted to have a super techy office building,” Real said. “We got caught in the whole supply-chain [issue].… In addition, there are a lot of accommodations being made [for] the tenants.”

Civic isn’t the only builder that experienced work delays in recent years. Over the past half-decade, general contractors say they have dealt with issues at projects across Miami, finding workarounds to one problem just to brace for another.

During the pandemic, contractors got slammed with delivery delays of materials and skyrocketing prices. Just as costs for some — but not all — supplies started stabilizing last year, contractors got hit with record insurance hikes. Meanwhile, Miami has become a magnet for out-of-state residents and companies, largely because of its early pandemic reopening and business-friendly climate. The in-migration became the rallying cry to surmount challenges and build, build, build.

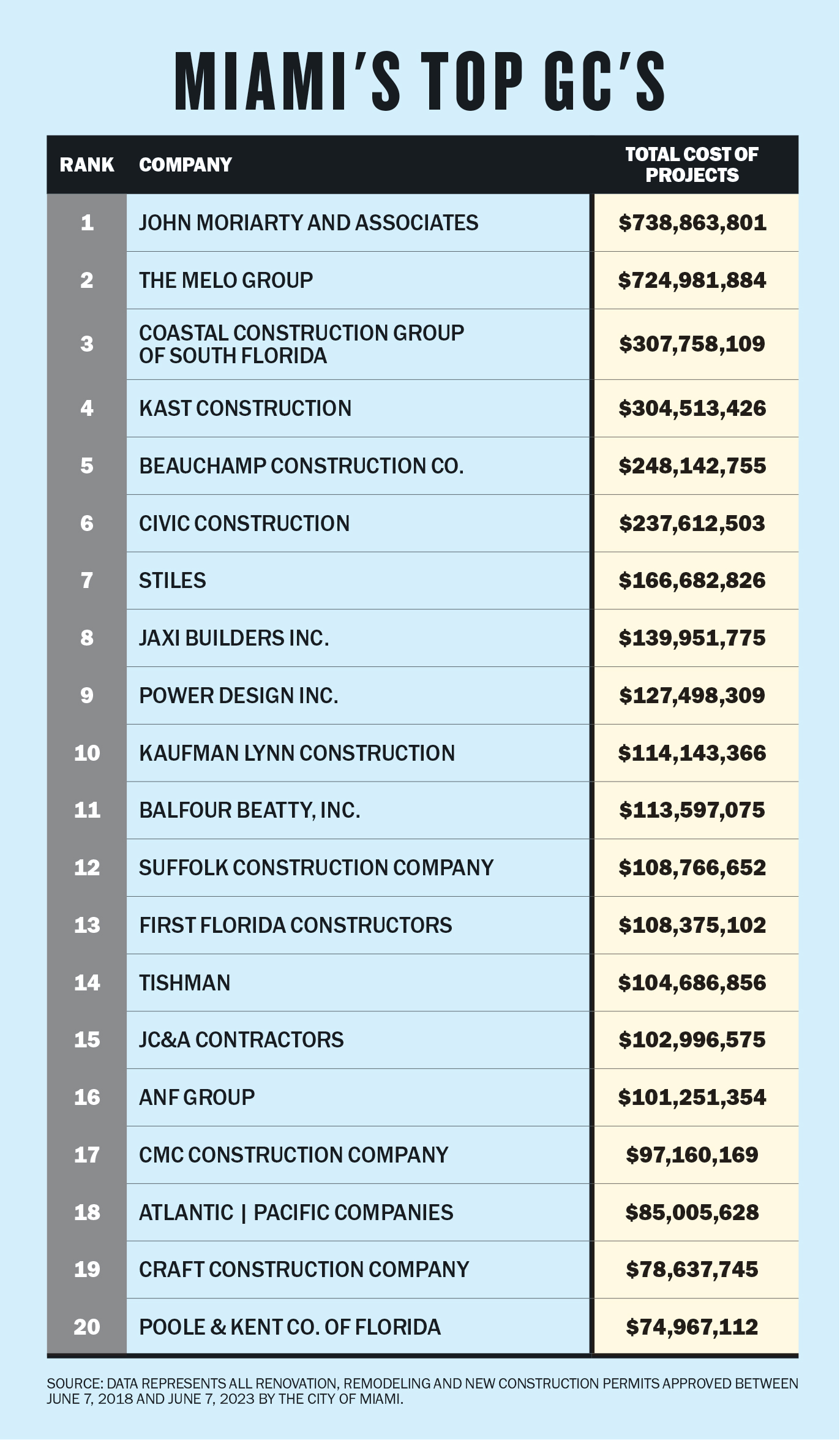

General contractors pulled over 72,000 permits for more than $10 billion in total project costs for commercial and residential new development and remodeling over the past five years, according to The Real Deal’s analysis of city records from June 7, 2018, to June 7, 2023.

Hollywood-based John Moriarty and Associates, took the No. 1 spot with $738.9 million of total project costs. This included the 57-story, 100-unit bayfront Elysee Miami condominium in Edgewater, completed in 2021.

“On the one hand, you have the interest rates going up, but on the other, when you have 1,000 people a day [moving to Florida], that counterbalances.”

Close behind was The Melo Group, a Miami-based, family-owned and run development firm that serves as its own general contractor. It pulled permits for $725 million worth of projects in the past five years, ranking second in TRD’s analysis. Among the projects: two 62-story Aria Reserve towers with roughly 800 condos under construction in Edgewater.

Despite concerns that expensive construction financing will threaten developers’ pipelines, contractors vow that cranes and scaffolding will continue to rise across Miami this year and next.

“On the one hand, you have the interest rates going up, but on the other, when you have 1,000 people a day [moving to Florida], that counterbalances,” said Peter Dyga, CEO of Associated Builders and Contractors’ Florida East Coast Chapter. “Economies are complex.”

Multifamily dominates

Jaxi Builders is developer Lissette Calderon’s go-to general contractor, helping the firm take the eighth spot on TRD’s ranking, with nearly $140 million in total project costs.

Doral-based Jaxi has about 270 crewmembers, both its own employees and subcontractors, working on two of Calderon’s Neology Life Development Group’s apartment buildings with a combined 560 units in Miami’s Allapattah neighborhood. In the same area, Jaxi completed Neology’s 192-unit No. 17 Residences in 2021.

Next, Jaxi has two big Miami projects in final design and approval stages that will amount to more than $140 million, said Eduardo Caballero, vice president of Jaxi. Both are multifamily.

Indeed, the asset class proved a boon for contractors, and it’s expected to remain so.

Amid heightened demand, South Florida led the nation with a 58 percent hike in median rent from March 2020 to March 2022. Although skyrocketing rent growth has calmed, average monthly rents now topping $2,100 aren’t expected to drop. More than 57,000 apartments are under construction in South Florida, or a 28 percent increase year-over-year, according to Lee & Associates’ second-quarter report.

By contrast, the office market’s future is murkier due to a remote-work shift. Most contractors said they aren’t betting much on offices in the near future — though they cite some exceptions.

Coastal Construction, which took the third spot in TRD’s ranking, hopes to score two “significant office buildings that are coming up in the next two years,” said Tom C. Murphy, co-president of the firm.

In Brickell, Swire and Related Companies plan One Brickell City Centre, and billionaire hedge funder Ken Griffin will have a headquarters developed for his Citadel and Citadel Securities.

Murphy declined to disclose which office projects Coastal wants to nab, but he offered a hint at how heated competition is for the jobs.

“One of them,” he said, “everyone is looking at.”

Costs, costs, costs

By now, materials costs have stabilized with two exceptions: concrete and electrical switchgear equipment.

“It’s unfathomable to me that we still have three of the major concrete suppliers in town, and they can’t get their hands around this concrete issue,” Real said, adding that prices are going up every two months. “One goes up, and then the other two go up.”

To get around the yearlong delivery times for electrical switchgear, Delray Beach-based Kaufman Lynn Construction works with developers to order the equipment before even signing a construction contract. Prices for electrical work on a project, which includes switchgears, lights and labor, have surged by 30 percent, said Chris Long, president of Kaufman, which took the 10th spot on TRD’s ranking.

“Less than 1 percent of all computer chips manufactured go to electrical switchgear,” he said. “They go to automobiles and appliances and things with higher demand.”

In the meantime, insurance costs have skyrocketed. In the two-year period that ended late last year, builders’ risk premiums went up 30 percent. And that’s not the only insurance contractors have to cover.

“Health insurance for crews is probably the biggest insurance cost for general contractors,” said Dyga of ABC.

For Long, just securing enough workers on a site can be an issue.

For years, the construction industry was strained with ever-increasing labor costs and a lack of skilled workers. Now, an immigration law that requires companies with at least 25 employees to use a federal verification system could empty development sites, as workers fear being reported or deported.

“From an hourly person’s perspective, they can quit a job and work on any other job for $1 [more] or $2 more an hour,” Long said. “There’s still quite a war there on talent.”

Praying for a slump

It may be counterintuitive, but contractors are quietly praying for a mini trough in the market.

The Federal Reserve’s interest rate hikes since the spring of last year have pushed up construction financing costs, which could prompt some developers to pause their projects. That may not be so bad for contractors.

“People will privately tell you that a little bit — nobody is asking for a grand recession — but a slight slowdown would be a positive thing,” Dyga said. It would provide time for materials costs to further stabilize and for a ramp-up of the workforce.

“It would allow a lot of these inflationary pressures on the market to ease,” he said. It would be “a little relief on the pressure cooker.”