Temperatures ran hot at the Pension Real Estate Association’s annual spring conference. Developers and real estate financiers boiled over with questions with no clear or immediate answers — what’s going on with the office market? How will AI and the currently amorphous tech industry reshape real estate? How can a firm pivot in this climate?

They’re questions that have dramatically built out the front ends of projects, continuously adding pressure onto the people trying to lay out the blueprints.

But some of New York’s most prominent architects beat the heat, coming up with resourceful solutions to some of the industry’s challenges. They’ve implemented tech to invent office-to-residential conversion tools and snubbed supply chain woes by spurring proactive conversations with manufacturers. Others let their imaginations run wild, envisioning large-scale opportunities for neighborhood overhauls in the midst of runaway office distress.

Where developers and clients saw problems, New York’s architects saw potential.

Across the board, three years out from the onset of the pandemic, architects were all able to agree on one thing: 2023 is definitely not “business as usual.”

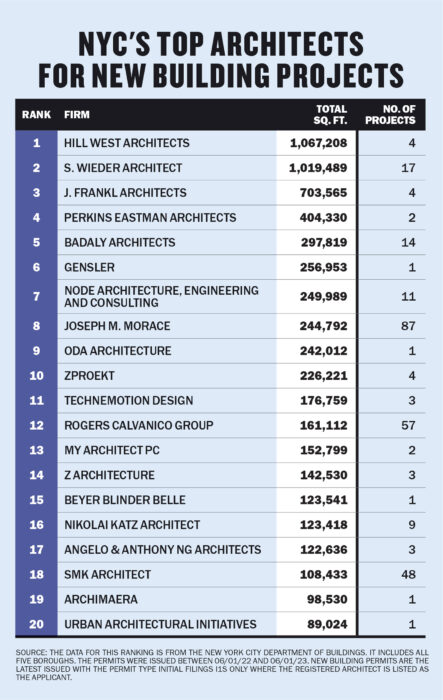

The Real Deal has assembled rankings of the most active New York architecture firms over the past year. One is based on the estimated initial costs of major renovations, as shown on permits filed between June 2022 and June 2023, while the other is based on the total square footage of new construction as shown on permits over the same period. Within the data we see ultra-luxury residential developments, as well as logistics and health care projects, that saw investments across the five boroughs. Likewise, architects capitalized on education and infrastructure projects.

Adaptive measures

Unlike last year, many assets, including office buildings, have been put on hold until they’re revalued by developers.

“As some of these assets get revalued, it may get harder before it gets easier,” said Joseph Brancato, chair and co-managing principal at Gensler, who credited the best-in-class ranking of his firm on the renovations list to a diversified portfolio. “Once they revalue, I think there’s tremendous opportunity on the design side.”

High vacancy rates in older office buildings have led to a drop in value for the corporate assets compared to before the pandemic, sometimes forcing developers to hand back the keys to lenders.

Companies and landlords insistent on keeping their office spaces are looking to improve them in an effort to reel the workforce back in, calling for a post-pandemic wave of investment to retrofit a bevy of aging buildings.

In addition, architects are anticipating what to do next with the underused assets, including big box conversions and transforming shorter buildings into strip malls.

“You’re either gonna sink a lot of money into a Class B or C office building, or you may be looking into doing something else with it,” Brancato said.

Multifamily switch-up

Combined with stress in multifamily projects, which have suffered significantly in the last year under a deluge of political promises that have fallen flat, some New York City-based developers have started to shy away from business in the Big Apple.

“There are a good amount of New York City-based developers who are looking elsewhere and maybe for the first time are looking to develop in emerging markets,” said ODA Architecture’s Eran Chen, referring to cities like Charlotte, Washington, D.C., or Tampa. “It’s an interesting trend for the world of architecture, because it brings some of the most sophisticated developers to markets that may have seen more generic forms of development.”

Despite this, permits by firms across the city grew by nearly 60 percent compared to 2022, with 1,088 renovation filings by the top 10 firms alone.

Alteration revelation

Once again, International architecture firm Gensler ranks above the rest in alteration projects in the Big Apple, projecting more than $681 million in initial costs for its 230 projects across the five boroughs.

The largest stand-out projects within that tally included a multi-floor building overhaul at 40 Worth Street in Tribeca, which serves as the East Coast headquarters for The Gap, as well as an array of nonprofits including the Legal Aid Society, the Acumen Fund and the Innocence Project. Gensler is also overseeing several renovations at the Morgan Stanley Building at 1585 Broadway.

The firm, which masterminded that building’s interior along with Gwathmey Siegel, was tapped again last year to oversee more than $125 million of renovation work on the second, fourth, eighth, ninth and 10th floors of the investment bank’s 42-story global headquarters.

Jumping two spots into second place was TPG Architecture. Like Gensler, the 44-year-old firm’s extensive portfolio runs the gamut, covering corporate office buildouts and renovations as well as luxury retail, hospitality and health care. Recent jobs include a 120,000-square-foot renovation for JLL’s Mutual of America Building at 320 Park Avenue, as well as a 523,000-square-foot alteration at 498 Seventh Avenue in Times Square South.

Ted Moudis Associates, at No. 3, improved its position in the list significantly thanks in large part to a 210,000-square-foot alteration at Paramount Group’s Crédit Agricole CIB building at 1301 Sixth Avenue. A block away, the firm has logged a $26.5 million job renovating nearly 100,000 square feet at Brookfield Properties’ 660 Fifth Avenue.

On the other end of the spectrum, a different set of firms racked up square footage for new builds that will transform the city.

Ground up

The top 10 architecture firms across the city filed for 145 new projects — a collective 4.7 million square feet of development.

New York City-based Hill West Architects stands atop its competitors with more than 1 million square feet planned, primarily in Queens and Brooklyn.

Those jobs include Silverstein Properties’ 427,000-square-foot mixed-use project on a triangular plot at 44-01 Northern Boulevard in Astoria, Queens, which plans to offer 351 one- and two-bedroom apartments and 25,000 square feet of retail space, and Naftali Group’s 22-story two-tower project at 480 and 490 Kent Avenue along the East River in Williamsburg.

S. Wieder Architects secured its second-place spot with 17 permits covering a combined 1,019,000 square feet, which include a 236,000-square-foot mixed-use project by developer Chess Builders in Brooklyn’s Vinegar Hill that’s slated to offer 218 apartments, 66 of which will be affordable.

J. Frankl Architects had a strong showing as well, coming in at No. 3 with filings for more than 700,000 square feet in new builds, mostly attributable to a 23-story, 488,000-square-foot building at 147-35 95th Ave in Queens, near the Van Wyck Expressway and the Long Island Rail Road’s Jamaica Yard.

The rankings show an abundance of activity that points to growing improvements rather than growing pains.

Looking ahead to next year, the city’s most successful architects are optimistic about new business but wary of political inaction that may cause stagnation in the industry, pointing to tax incentive programs in other states that have helped developers make the jump on office-to-residential conversions.

“I’m hoping New York City follows suit,” ODA’s Chen said.