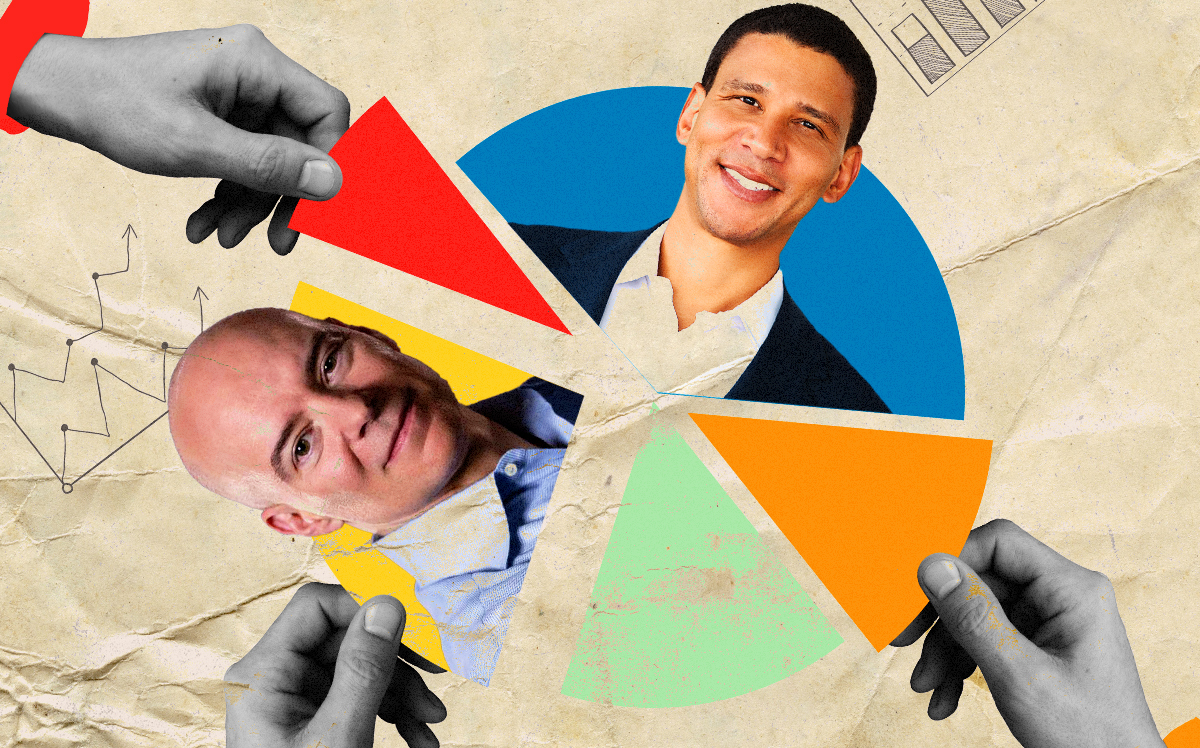

Executives at residential brokerages, beset by rising interest rates and a banking crisis, led their firms through a barren winter.

The frigid retreat from a historically hot spring market, carried over from the post-pandemic boom, saw plenty of casualties along the way for residential brokerages. Layoffs and other cost-cutting measures hit players across the field — from franchisors like The Agency to tech-forward firms like Redfin and behemoths like Anywhere and Compass — as transactions and revenues fell.

But rank-and-file employees and agents nursing sinking bottom lines weren’t the only ones who felt the sting of the historic slowdown: Brokerage executives also saw their compensation fall in 2022 as a result of the penny-pinching, and some C-suite paydays shrank to what might be better called C-minus-suite.

Declining executive compensation isn’t unique to the residential brokerage world. For the first time in a decade, two-thirds of Fortune 500 CEOs saw their pay fall last year, according to the Wall Street Journal. That’s partly due to a new SEC rule that mandates companies track the fluctuations of stock awards, but it’s also emblematic of overall market performance.

When discussing executive compensation, it’s important to distinguish between base salary and performance-based payments, like stock awards and bonuses. Base salaries generally don’t decline, but the value of stocks and bonuses tend to move with a company’s bottom line.

It could be a minute before executives pad their pockets like they did in 2021, according to RealTrends co-founder and residential brokerage analyst Steve Murray.

“My view is we won’t see much of a rebound this year, even into next year,” he said, citing high interest rates and low inventory. “We won’t go back to what ’21 was in a hurry.”

Total compensation was down nearly across the board among executives at Anywhere, Compass and Douglas Elliman, according to their public filings. Nearly all of that can be accounted for by the falling value of stock awards and the elimination of incentive-based rewards and bonuses.

Read more

Anywhere CEO Ryan Schneider took a roughly 40 percent cut in total compensation, Douglas Elliman Chairman Howard Lorber’s salary fell nearly 50 percent and Compass CEO Robert Reffkin’s compensation fell to $400,000 from more than $90 million two years ago — though nearly all the decline is due to the $89 million in stock awards he was granted in 2021.

Reffkin’s cash compensation fell to $400,000, his base salary, from roughly $730,000 in 2021, when he got a $130,00 bonus and $201,500 in additional compensation.

Bonuses at Anywhere and Compass were down last year, according to their annual filings. Anywhere paid out one bonus of $67,000 last year to Susan Yannaccone, president and CEO of Anywhere Brands. That’s down from more than $2.6 million paid out in 2021 to Anywhere CEO Ryan Schneider ($1 million), CFO Charlotte Simonelli ($750,000) and executive vice president Marilyn Wasser ($900,000).

Compass dished out a $1.6 million bonus to COO Greg Hart, down from his 2021 bonus of $3.1 million. Incoming CFO Kalani Reelitz also got a $50,000 bonus. Last year’s bonuses are down significantly from 2021, when CEO Robert Reffkin and three now-departed executives received roughly $4 million in combined payments.

Compass and Anywhere declined to comment for the story.

Douglas Elliman President Scott Durkin got a $100,000 raise last year and a bonus, though the bonus fell to $650,000, down from $1 million in 2021. The firm’s two other returning executives — CEO Howard Lorber and executive vice president Richard Lampen — took pay cuts last year, with Lorber’s base salary falling to $1.8 million from $3.4 million and Lampen’s falling to $650,000 from $1.2 million.

Lorber’s stock compensation fell to zero from $21.5 million in 2021.

But a spokesperson for Elliman’s parent company said there were extenuating circumstances, as last year’s salaries are the first that reflect Elliman’s spinoff from conglomerate Vector Group.

“Since the spinoff, Mr. Lorber and Mr. Lampen have been paid salaries by Vector Group as well as Douglas Elliman Inc., whereas prior to the spinoff, their compensation for both companies was reflected in the one salary they received from Vector Group,” said the spokesperson.

Last year, 55 percent of executive compensation was at-risk, or variable, a figure that Elliman projects will rise to 78 percent this year as the company resumes regular equity incentive award payments, which were interrupted by the spinoff. Stock grants from the spinoff were paid on the last day of the 2021 fiscal year, and Elliman officials decided those would be sufficient for the 2022 year.

Compass, which embarked on a $320 million cost-cutting mission in addition to navigating the down market, saw several shakeups in its C-suite, in addition to lower compensation last year. Kristen Ankerbrandt resigned as CFO in May, three months before the company let go of Joseph Sirosh as CTO. Priyanka Singh was let go from her role as CPO in November.

Of the three, only Ankerbrandt was followed by a C-suite-level replacement. Compass hired Kalani Reelitz to take over as CFO in November. Singh was replaced by her deputy, Margaret Smith, who wasn’t promoted into the C-suite, according to the firm’s annual filings. Sirosh wasn’t replaced at all, as Compass said there was no need to fill the position following the successful roll-out of its at-the-time $900 million tech platform — that number has since risen to more than $1 billion, according to Compass’ president of growth, Rory Golod.

Golod, who took over the helm of the company’s communications team late last year, also quietly replaced the former head of customer success, Danielle Wilkie, who left the firm in January, according to company filings.

Compass racked up some hefty severance fees with all that turnover: The firm paid its departing executives more than $4 million in combined severance payments, almost four times their base salaries.

Compass isn’t the only brokerage that shrank its C-suite last year. In perhaps the most high-profile shakeup of the year, Anywhere let go of Coldwell Banker CEO Ryan Gorman in December. Instead of replacing its $3.5 million man with a new hire, Anywhere promoted Susan Yannaccone to absorb his position. Her total package is roughly half that of Gorman’s.