When the Hamptons residential market hit a slowdown last summer, it sent the area’s top brokers back to school.

The region’s top agents say they stayed hot in a cold market by revisiting the fundamentals: daily outreach and networking with clients.

“You go back to real estate 101,” said Compass’ Joe Fuer. “You engage with your network and your sphere of influence.”

The onset of the pandemic sent wealthy buyers to the Hamptons in search of spacious homes and safe, isolated yards in a buying frenzy that meant agents had no trouble lining their pockets.

“With Covid, it was like, ‘Yes, I want it, and I want it now. And I’m gonna do it quickly,’” said Nest Seekers’ Geoff Gifkins. “Things got into bidding wars, and prices kind of skyrocketed.”

While deals continued to pour in during the first half of 2022, some teams expanded to keep up with growing books of business. Nest Seekers’ James Giugliano said he added two agents to what’s now his 14-person team and ramped up his once-a-week meeting to three times weekly.

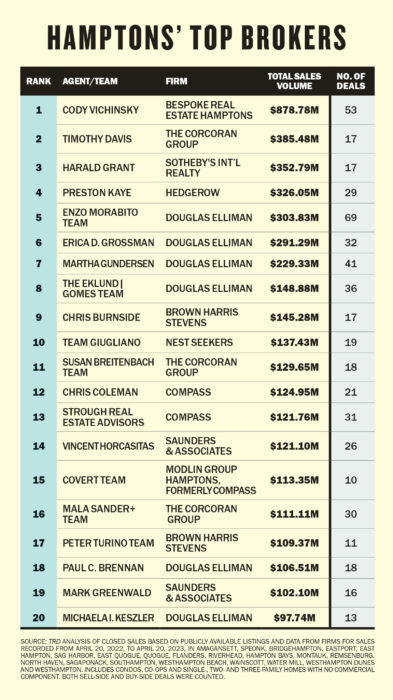

“Things were happening hourly,” said Giugliano, whose team ranked 10th with $137 million in closed sales across 19 deals. “I was going to meet [buyers] at these banks to make sure the funds were wired so that they can move into the house immediately.”

Despite the downturn that followed, the top 20 agents combined for $4.3 billion in sales between April 20, 2022, and April 20, 2023, according to data from One Key, East End LI and Out East and verified by the brokerages.

But the market’s slow to a crawl meant each deal also required more heft from agents, said Douglas Elliman’s Enzo Morabito. The broker, whose team ranked fifth with $304 million in closed sales across 69 deals, said his advertising efforts managed to still bring in business in the slow months, but he saw other brokers and newcomers to the market step up their activity.

“A lot of people have really had to work like crazy to make money,” Morabito said. “You don’t turn your umbrella upside down.”

The cooler market meant more lead-generation work, according to agents at the top of the market.

“Now more than ever, inside information, off-market knowledge and command of the data all come into play,” said Modlin Group’s Christopher Covert, whose team finished 15th with $113.3 million across 10 deals. “And extra hustle, not that I wasn’t already.”

The Federal Reserve raised interest rates to combat inflation, and buyers became more cautious. Sellers, those who weren’t scared off by the risk of losing a lower mortgage rate, kept demanding high prices.

The region’s top-selling agent was Cody Vichinsky, with a sales volume just shy of $880 million. Bespoke, the boutique firm he founded with his brother, caters exclusively to the ultra-luxury market of homes asking $10 million or more.

A strong contingent of buyers is waiting in the wings for inventory to enter the market after the pandemic-era frenzy sapped supply, agents said. But Corcoran’s Tim Davis, who finished second with $385 million in volume across 17 deals, cautioned against leaning too far into the pent-up demand by seeking a bidding war for a property.

“You find there’s always a loser, and sometimes it can be the seller,” he said. “If it’s not properly handled, they end up with multiple offers and the person who gets the high bid steps away.”

Read more

The pandemic sales surge also ushered in a shift among the types of people buying in the Hamptons that continued into the start of 2023, according to Sotheby’s International’s Harald Grant, who finished in third place with $353 million across 17 deals.

Previous years drew international buyers from Europe or South America, but the area has since seen an influx from the tristate area.

“It’s going back to what we call ‘the triangle,’” Grant said. “People from New York buy in the Hamptons, and then they go down to Palm Beach.”

The market may have weathered the same ups and downs as its tristate neighbors and markets across the country, but Vichinsky deemed it a beast of its own.

“This is a desire market, not a necessity market,” said Vichinsky. “If you want to boil all of the bullshit down to that, this is an area where it’s a luxury to be here. If it makes sense, it makes sense; if it doesn’t, it’s OK. It’s much more psychology than anything else.”