Behind the glistening pool of their waterfront compound in Coconut Grove, Miami developers Caroline and Alitza Weiss have more than 1.3 acres of unused green space with a boat dock fronting Biscayne Bay.

Looking to capitalize on South Florida’s booming waterfront mansion market, the mother and daughter recently listed the vacant portion of their 1.6-acre homestead at 3187 Royal Road for an astonishing $59 million.

Alitza Weiss believes there’s still demand from corporate bigwigs willing to pay top dollar for the opportunity to own a large waterfront lot in one of Miami’s most exclusive residential neighborhoods.

“My mother is getting older, and I don’t want to stay with all this land,” she said. “It’s too much, and I am single.”

Other sellers of vacant waterfront lots in Miami and Miami Beach are aiming high, too, listing their properties for prices that appear to bend reality.

But rising construction costs and long construction timelines are dampening demand for vacant lots, according to spec home builders and brokers. This suggests some sellers have overpriced their properties.

Buyers of lots can expect to spend $1,200 to $2,000 per square foot for construction, which includes a new dock, a raised seawall and “everything but the furniture [and] drapery,” said spec home developer Todd Michael Glaser.

That translates to as much as $20 million to build a 10,000-square-foot mansion. Add that to a sky-high price for the lot and the overall cost becomes infeasible, according to experts.

“The supply chain and construction costs are limiting the buyer pool on vacant lots,” Manny Varas, CEO of Miami-based developer MV Group USA, said. “No one wants to deal with construction costs and delays. They want a turnkey, completed product.”

Moonshots

Alitza Weiss, who is also a real estate broker, insists the $59 million asking price is in line with the market, based on comparable sales in Miami-Dade County.

“What I have noticed and different brokers have told me is that you have so many wealthy people moving from California, Chicago and New York,” Weiss said. “All these big CEOs are looking for properties, especially that guy from Citadel who just purchased Adrienne Arsht’s house.”

“That guy” is Ken Griffin, the billionaire mega-investor who is moving his companies Citadel and Citadel Securities to South Florida from Chicago. In recent years, Griffin’s South Florida real estate portfolio has ballooned to well over $1 billion. Griffin paid $106.9 million for Arsht’s 4-acre waterfront estate about 3 miles east of the Weiss’ property.

“That guy” is Ken Griffin, the billionaire mega-investor who is moving his companies Citadel and Citadel Securities to South Florida from Chicago. In recent years, Griffin’s South Florida real estate portfolio has ballooned to well over $1 billion. Griffin paid $106.9 million for Arsht’s 4-acre waterfront estate about 3 miles east of the Weiss’ property.

Pascal Nicolai, CEO of Miami-based Sabal Development, said anyone asking $30 million or more for a waterfront lot is “not anywhere close to being realistic.”

But Weiss is confident that a Griffin-type buyer will see the potential to build a mansion behind her home, which shares a canal with her neighbor, Ransom Everglades, a nearly 18-acre private middle and high school. “This is an opportunity for someone to build their dream home featuring a private, protected marina, which nobody else has,” Weiss said. “And your neighbor is the most prestigious school in Miami.”

Initially, in September, Weiss enlisted commercial broker Arthur Porosoff of Compass to list her property. Porosoff marketed it as a development opportunity to subdivide the remaining 1.3 acres into six lots to attract spec builders.

But Weiss quickly switched brokers, hiring top agent Jill Hertzberg of Coldwell Banker’s The Jills Zeder Group, who is marketing the property as a single-mansion development.

Despite the hype surrounding waterfront properties in Coconut Grove, Nicolai, the spec developer, is finding owners willing to sell lots at reasonable prices.

“I am buying land from people who have permits, because they are scared how much it will cost to build per square foot,” he said. “If you want a 15,000-square-foot house, you can imagine it will cost $20 million to build. Then you have to wait almost three years to complete it.”

The Weiss property is overpriced and “not a prime waterfront location,” Nicolai said. “Most of the waterfront view is blocked by the school,” he added. “I don’t see people paying $59 million, to be honest.”

As a developer, he also sees problems with building several homes on the 1.3 acres, Nicolai said. “Maybe you could do four or five houses on one side, and then two more closest to the water. Those would face Ransom’s football field,” he said. “Who wants to pay at least $10 million for a house to see kids playing every day?”

Having a large, vacant waterfront lot is not enough to entice wealthy buyers currently shopping in Miami-Dade County, MV Group’s Varas said.

“One of our clients bought a half-acre property for $21.5 million and is spending $10 million to build a mansion,” he said. “Once it’s finished, it will end up being a $50 million property. So it’s not just about the lot. It’s about what you can create on it.”

Exaggerated pricing may also be an issue plaguing some land sellers in Miami Beach who are chasing 2021 prices, according to top brokers.

Former SoftBank and WeWork honcho Marcelo Claure recently listed his waterfront property on prestigious North Bay Road for nearly $40 million — or more than three times his purchase price just two years ago.

Claure is asking about $1,500 per square foot for the 0.6-acre property at 5212 North Bay Road.

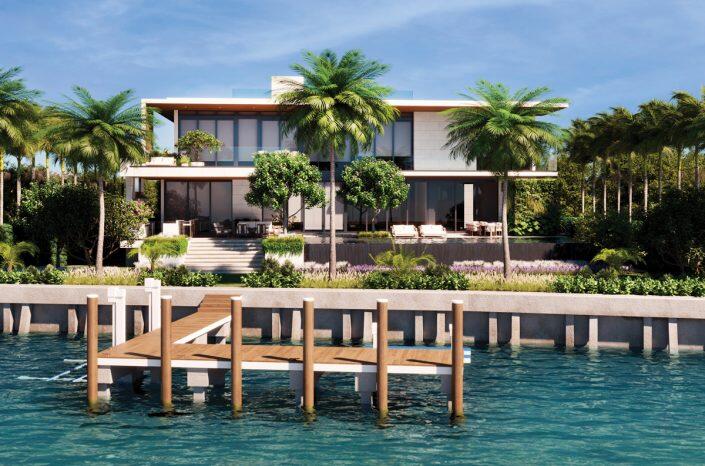

A rendering of 4736 North Bay Road

His listing broker, Nelson Gonzalez of Berkshire Hathaway HomeServices EWM Realty, said the price is justified because Claure had the former house demolished and secured approvals and permits for a new Kobi Karp-designed 14,000-square-foot mansion with nine bedrooms, eight full baths and six half-baths. The property’s 150 feet of bay frontage also played into the price, giving nearly every room in the planned home a waterfront view.

“I don’t think anything that’s on the market right now comes with a set of fully permitted plans,” he said, calling that a “minimum of two years’ work.”

Yet spec home developer Glaser called the asking price for 5212 North Bay Road “outrageous.”

“This guy is out of his mind for $40 million,” he said.

Glaser said that any buyer spending that kind of money on land leaves no room for any gains, especially with still-rising construction costs and pandemic-related delays with materials, appliances and permitting.

Leading luxury broker Dora Puig, owner of Luxe Living Realty, agrees that completed homes have a leg up compared with “land with plans.” Some developers finance their spec homes with construction loans. And with high mortgage rates, that pushes costs up even further. Many buyers “don’t want to enter that journey,” she said.

“Finished homes are getting bought. Nobody wants to wait. You need to be a primary homeowner living six months and a day in Florida to have the tax advantage,” Puig said.

Still, land listings with approved plans are more desirable than those without, because the approval process in a city like Miami Beach can take so long. Approved plans translate to time and money saved, she explained.

Puig has the listing for a $36.5 million mansion that just went into contract at The Links Estates on Fisher Island, an exclusive island off Miami Beach that’s home to one of the wealthiest ZIP codes in the country.

She is also listing the under-construction waterfront spec mansion at 4736 North Bay Road for $80 million. The seller, revealed by property records as developer Niklas de la Motte, has been working on the home for four years and will complete it next year. Puig believes that type of property will sell.

She is also listing the under-construction waterfront spec mansion at 4736 North Bay Road for $80 million. The seller, revealed by property records as developer Niklas de la Motte, has been working on the home for four years and will complete it next year. Puig believes that type of property will sell.

But anyone who is not in a rush may stick to their aspirational price until — or if — it becomes a reality.

Glaser said he offered the seller of a lot nearby, at 5930 North Bay Road, $45 million. It was listed for $70 million with Corcoran agent Julian Johnston. The seller turned the offer down because “he didn’t need to sell,” Glaser said.

“Two years from now, the lots are going to be priced properly when things start selling for $70 [million] or $80 million. If you sit on land for the next two years, you’re going to do really well,” Glaser said. “It’s better to buy something finished if you can find it.”

Some sellers have started adjusting their prices. The waterfront compound at 16, 18, 22 and 24 La Gorce Circle, which includes three homes and a park, is now asking $150 million, down from $170 million it listed for in May. The Jills Zeder Group also has that listing.

A “circus sideshow”

The top end of the luxury market — $50 million and higher in top Miami-Dade markets, or closer to $100 million and up in Palm Beach — is a different animal playing by different rules.

In South Florida and across the country, home sales and dollar volume fell dramatically this year, especially compared to the “rocket ship” that was 2021, said housing market analyst and appraiser Jonathan Miller.

While demand still exists, the frenzy is over, Puig said. And though many in the market are cash buyers, their stock portfolios have been affected by rising rates, giving some sellers pause.

“With these properties, just like the rest of the market, people are taking longer to make decisions,” Miller said. But “it’s hard to say whether we’re seeing prices weaken or decrease, because each one of these properties is so unique.”

Take Griffin’s purchase of Arsht’s bayfront Miami estate. The deal set the record for single-family home sales in Miami-Dade County. But it sold for 30 percent below the $150 million ask.

“The reason why luxury — versus the balance of the market — tends to have higher days on market and discounts is they’re harder to price accurately,” Miller said. “Super-luxury properties are even more difficult.”

Miller said sellers and their listing agents use what he calls PFA pricing, or “pull from air.”

“I’ve long described this market as a circus sideshow that has very little to do with the local market,” he added. “It could be New York, L.A., Palm Beach or Miami. It’s the same thing.”