Ben Mandell is stalking South Florida’s commercial real estate market, looking to swoop in on a distressed asset as debt maturities loom amid high refinancing costs.

Ben Mandell is stalking South Florida’s commercial real estate market, looking to swoop in on a distressed asset as debt maturities loom amid high refinancing costs.

“It’s just part of the conversation these days in commercial real estate. Where is the distress? When is it going to hit? How can you take advantage of the opportunity?” said Mandell, CEO of Miami-based Tricera Capital. “The writing is on the wall.”

South Florida boasts a reputation as a real estate haven, insulated from recession fears and rising foreclosures in markets such as New York, Chicago and San Francisco. Even as the Federal Reserve is poised to continue rate hikes, the buzz in South Florida surrounds the surge in population and companies, and ensuing record rents across asset classes.

Yet the tri-county region won’t be unscathed by distressed commercial real estate sales, experts say.

Owners with maturing loans will run into much more expensive refinancings at higher rates than when they originally took out their debt. Not only will some landlords fall short of meeting debt-service coverage ratio requirements, they will find that banks are stepping back on refinancings altogether, according to experts.

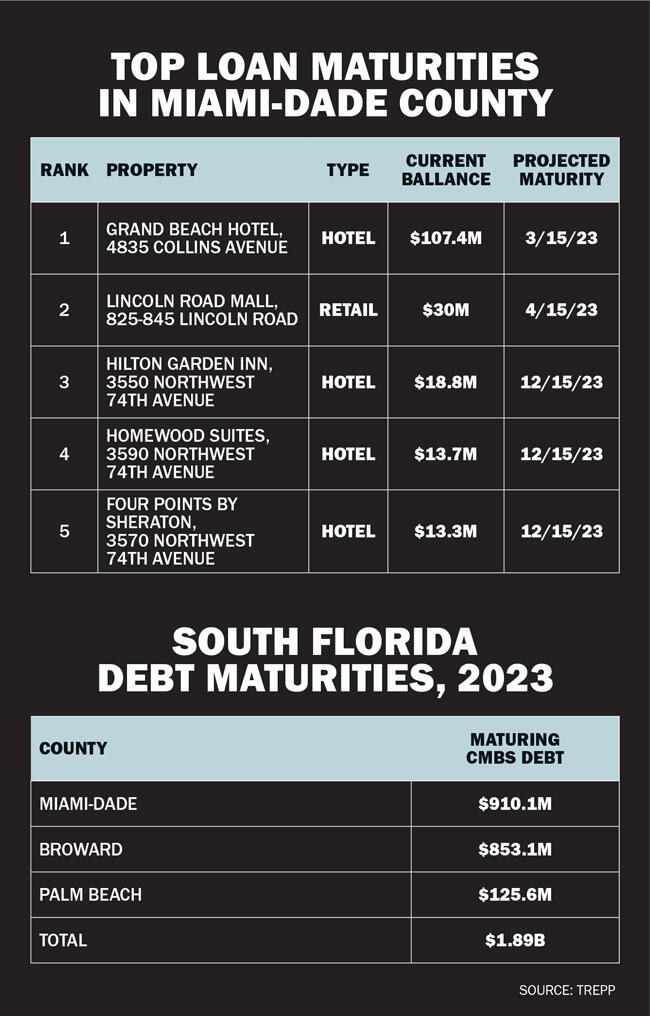

Across the tri-county region, nearly $1.9 billion of commercial mortgage-backed securities debt is maturing this year, according to Trepp. Miami-Dade County has the largest chunk of that at $910.1 million. In Broward County, it’s $853.1 million, and in Palm Beach County, the figure is $125.6 million.

“South Florida has absolutely fared better, and will continue to,” said Alex Horn, founder of Miami-based bridge lender BridgeInvest. “It does not mean that it’s impervious to what is happening in the market right now.”

Scavenger hunt

Distressed real estate investor David Gordon’s phone has been buzzing. Calls are coming in from lenders that are in the process of foreclosing, already have foreclosed or simply fear their borrowers won’t make looming maturity deadlines.

“We expect to be very busy this year,” said Gordon, managing partner at Miami Beach-based ARC PE.

The firm is betting on a $200 million distress shopping spree nationwide this year, with 20 percent to 30 percent of that expected in South Florida.

“This isn’t going to be like 2008, where values are going to drop 40 or 30 percent,” Gordon said. “There might be some slight discounts. I think the number is going to be 5 to 20 percent across the board, including South Florida.”

Hospitality bears a good portion of the total volume of debt maturing.

Hospitality bears a good portion of the total volume of debt maturing.

The biggest loan due this year is $107.4 million on the 430-key oceanfront Grand Beach Hotel at 49th Street and Collins Avenue in Miami Beach, according to Trepp. Property records show that the owner is British billionaire Jacques Gaston “Tony” Murray, a 102-year-old World War II veteran who made his fortune in fire protection systems and air conditioning as well as real estate.

Three hotels west of Miami International Airport have a combined $45.8 million of maturing debt. Family-owned Economos Properties, which is based in Boca Raton, owns the Hilton Garden Inn, Four Points by Sheraton and Homewood Suites by Hilton at 3550, 3570 and 3590 Northwest 74th Avenue.

Back in Miami Beach, the retail property at 825-845 Lincoln Road has $30 million coming due this year, Trepp data shows. New York-based Jenel Real Estate owns the building.

It’s unclear if plans are in the works for these loans. The owners declined to comment.

A looming loan maturity and the prospect of a high-interest refinancing or short-term bridge loan don’t necessarily spell doom. Owners have options, said Mabelle Perez, who heads Berkadia’s hotels and hospitality division.

“It could be a combination of maybe a new partner who is going to come in and save the day, and maybe do a loan workout with that lender before it gets to a short sale or a foreclosure,” she said. “I think creativity is going to win.”

As a result, the extent of pain South Florida property owners will experience is unknown, as is the potential volume of distressed asset deals.

Gordon isn’t exactly betting on a Brickell bonanza, but on smaller assets such as multifamily properties under $10 million, he said.

In a recent deal, ARC PE scooped up a three-story South Beach mixed-use building for $5 million, or 41 percent less than the seller’s purchase price a decade ago.

Though the discount on the property, at 826 Collins Avenue, didn’t stem from an inability to refinance — records show no outstanding loan on the property — the building’s characteristics speak to how distress could arise. The retail and office spaces are vacant, and only the apartment unit on the third level is leased.

Portions of Collins Avenue, including the area between Ninth and Fifth streets, have largely struggled as retailers have vacated spaces in recent years. And in other parts of South Florida, landlords haven’t benefited from the surge in leasing demand because they are locked into leases that haven’t renewed at much higher rents.

That may provide pickings for investors in their scavenger hunts this year.

For prices to drop, said Jalal “Jay” Shehadeh, EVP of U.S. Century Bank in Doral, “it would likely be in an area where occupancy is lower, or where rents are not really increasing.”

Dark omens

Even though the Fed began aggressively hiking interest rates last spring, it didn’t result in deep price discounts on commercial properties in 2022. But the market’s reaction to the changing debt climate foreshadows distress, experts say.

Investment sales declined as the high cost of financing prevented buyers from meeting sellers’ asking prices. At the very least, it showed the South Florida market isn’t immune to interest rate increases.

“I think that this has been brewing for the last year, and that is evidenced in the decline in the volume of sales,” said Shannon Rex of Colliers’ South Florida debt and equity finance group.

“I think that this has been brewing for the last year, and that is evidenced in the decline in the volume of sales,” said Shannon Rex of Colliers’ South Florida debt and equity finance group.

The office market was most affected. It took a beating in the second half of last year with a total sale volume of $776.9 million, down 70 percent year-over-year, according to Colliers data.

Office leasing has remained healthy, thanks to out-of-state financial and tech companies’ penchant for neighborhoods like Miami’s Brickell and Wynwood, and downtown West Palm Beach. But lenders aren’t as enamored.

“Office is also the least desirable property to refinance, so there may be a lack of liquidity in the office sector,” Rex said.

In another sign of what is to come, BridgeInvest has experienced a pickup in inquiries this year for its bridge loans. The firm is hearing from borrowers who can’t secure a refinancing from traditional lenders, or don’t meet banks’ debt-service coverage ratio requirements, according to Horn.

Industrial real estate is another darling of the market. In the fourth quarter of last year, South Florida landlords ticked up asking rents to $13.16 a square foot, from $10.11 a square foot in the same period of 2021, even though vacancies declined slightly, according to Newmark.

Still, BridgeInvest is working on a bridge loan for an industrial landlord that found traditional financing options “closed to them,” Horn said. “No asset class is safe,” he said. “All deals are going to have to sharpen their pencil.”

Wynwood pipe dreams

The influx of capital to South Florida will counteract the distress expected elsewhere in the U.S., sources agreed. Skyrocketing tri-county rents across property types will provide cash flow to offset high borrowing costs.

In “Florida, we have other dynamics that are keeping valuations elevated relative to interest rates, because you have companies moving here, in-migration,” Rex said. “I think Florida would be one of the last markets you would see” distress in.

Yet others warned not to count on high rents as a cushion.

“There are a lot of markets I think are overvalued,” Gordon said. “Wynwood would be the biggest example of that.

“People are asking $150 per square foot [for retail],” he added. “I don’t see how, unless you are an A-rated tenant, you can afford those rents long-term, and there’s not enough walking traffic to really make that make sense. … Wynwood is one of the core areas where I think there would be a downtick in values.”

In that, Wynwood just might follow the path set by Miami Beach’s Lincoln Road, which has lost foot traffic and tenants in recent years to up-and-coming neighborhoods.

During the pedestrian promenade’s heyday a few years ago, asking rents reached $300 per square foot. But as retailers left, actual rates ended up at $150 per square foot, Gordon said.

“They sold everybody on a pipe dream of … what things are worth, and then reality set in,” he said.

Mandell, of Tricera, is counting on opportunities in the market.

“There will be distress in the next six-plus months in certain sectors of the industry, especially if [interest] rates continue to stay stagnant and stay high,” he said. “Where debt is coming due, and a debtor did not execute in the retail, office sector, we can help the debt servicers take it off their plate.”