Homes aren’t just homes anymore.

During Covid, they’ve become offices, schools, gyms, places of worship and date spots, combining shelter, work and social fulfillment in a way that hasn’t been seen in decades. So if owning hundreds of apartments was an emotional and political minefield prior to the pandemic, you can imagine what David Schwartz is dealing with now.

Schwartz is the chair of the National Multifamily Housing Council, the most influential national trade group for large multifamily landlords. The NMHC has been in the thick of the battle against the national rent control movement and is a key industry voice in Washington. Schwartz is also the CEO and co-founder of Waterton, a Chicago-based multifamily investor launched in 1995 that has $6 billion in assets under management and is finalizing a $1.25 billion investment fund, its largest ever.

The Real Deal caught up with Schwartz to discuss his organization’s latest efforts to counter the rent control movement, its strategy around securing federal assistance for landlords at a time when renters may be as much as $70 billion behind on payments, and his plans for Waterton.

This interview has been condensed and edited for clarity.

The mandate going into the NMHC role was probably dramatically different from what you’re looking at now. What did you expect when you took this on?

It’s funny. I talked about disruption on a lot of different levels: regulatory disruption [and how] our industry happens to get picked on by government; technological disruption; climate change disruption. I didn’t talk about biological disruption, so that was a surprise.

We had been hit head on with all of the above. The inability for our residents to pay rent came very fast because unemployment hit so quickly and so dramatically when the shutdowns began in March. Our first line of attack is: What is the right thing to do with the households that live in our communities? We represent the largest owners and operators in the United States. What is our messaging for them? We were expecting a lot of our residents to be unable to pay rent. What do we tell them?

What we came up with was: We’re not going to put anyone in the street. We want to keep people in their homes. It’s critical, with the home turned into an office and school.

That strategy works when there is an end line in sight. One of the challenges your industry has faced is that things have gone on for longer than we expected. Some say the true pain in multifamily hasn’t even been quite felt yet.

Government has to get involved and support people so they can stay in their homes. We can’t put that on the backs of the landlords, the owners of America, and that’s what’s happened. There are eviction moratoriums and local moratoriums, statewide moratoriums, national moratoriums. Ultimately, that falls on the backs of the owners of these properties who still have to pay bills. They still have property taxes — no one’s waiving the property tax. They still have employees and maintenance that is critical.

We’ve spent the last eight or nine months saying to Congress that we need emergency renters’ assistance. We got $25 billion of it.

We’ve heard estimates [for rent shortfalls] as high as $70 billion. That’s quite a significant gap.

We’ve heard estimates [for rent shortfalls] as high as $70 billion. That’s quite a significant gap.

We don’t know the true number — $25 billion is for sure a start. We’ll need more stimulus checks, we’ll need more continued enhanced unemployment. These are all tools that provide households essential shelter, which is our business.

How willing are lenders to work with you at the moment?

As a food group within real estate, we’re not as impacted [as the lodging industry or regional malls] as far as forbearance and working with our lenders goes. The banks have bigger fish to fry right now with their hotel loans and other delinquent real estate classes.

I would expect there could be problems with construction loans as they mature, particularly in some of the hard-hit urban areas.

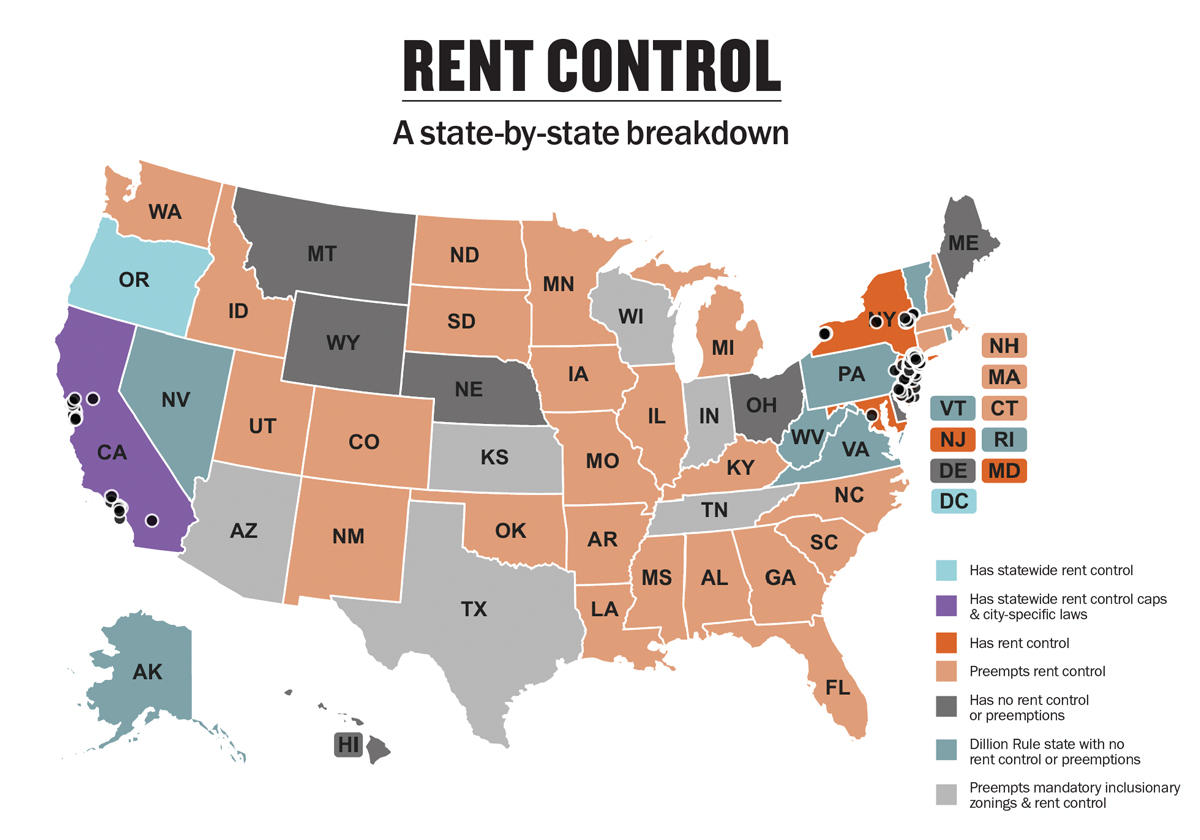

Stepping away from the pandemic, you’ve talked about rent control as something that could derail the industry’s plan to provide more housing. How have you countered that movement?

It certainly hasn’t gone away. We saw it on the ballot in California [Proposition 21]. And there are other states that have various risk levels of rent control being put on the legislative agenda. You’d think the heat on rent control would be going away because these less affordable markets are seeing massive rent decline. So the natural market forces are working quite well. A lot of that is due to supply that had been built before the pandemic and is entering the market in a very low-demand environment.

Is it just about supply and demand, or is it also about political momentum and rhetoric?

There is kind of a progressive social justice side to it all. But I think we can’t ignore the housing affordability problem. People should not be spending 50 percent of their income on housing, and that’s what’s happening in these expensive markets.

So we do need to attack the housing affordability problem. Rent control is a methodology to do that. It’s great for politicians because it doesn’t cost the taxpayer anything. It’s a good story, but there is no economist that we know of who thinks it’s a good idea. The cities where we have rent control, whether it’s New York or San Francisco, have the most expensive housing in the country.

Are you taking these advocates head on?

There’s a defense approach: That’s helping our members raise money and paid media campaigns to deal with the statewide ballot initiative, which is extremely expensive. We’ve had to do that in Illinois and deal with legislative initiatives. We’ve had to do it in Colorado, Oregon. So that’s the defense, it’s reactionary.

The offense is more important. That’s figuring out how to create more affordable housing options in markets across the country, and working with the legislature and state and local folks on solutions. We can’t just magically build real cheap housing that people can afford. And so we try to offer solutions. We continue to push for more Section 8 vouchers, real basic things to make housing more affordable.

We were successful in helping the Section 42 tax credit [for affordable housing development] in the stimulus bill. We got that 4 percent credit fixed in there, which is pretty critical. Our industry is extremely responsive to financial incentives. So if you remove property tax from the equation, we’ll do a lot of things for affordability.

What are you most optimistic about with the shift from the Trump administration to the Biden administration? What are you less thrilled about?

The Trump administration [had] really been trying to get Fannie and Freddie out of conservatorship and make them stand on their own. We think the Biden administration will likely reverse that course. They will behave more like the agencies did under the Obama administration. The affordability will be a bigger part of that mission. And so that’s probably good for our industry, and it’ll keep the financing affordable.

The Biden housing plan is kind of mixed, but rental housing is a big priority for them and so that’s good. There are proposals such as renter tax credits that we’re not asking for. It’s all baked into their tax reform proposal, which is obviously negative to the real estate industry in general.

One of the most dramatic pandemic-driven changes to me is the ability for talent to disperse. What opportunities have opened up, particularly in Tier 2 and Tier 3 cities?

We’re not jumping into the theory that all the employees who worked at JPMorgan in Midtown Manhattan now are going to move to Lake Placid or the Adirondacks and change their lifestyle and work remotely. This pandemic has for sure benefited suburban Sunbelt areas. We think that some of that is permanent; some is temporary. Our in-house view at Waterton is that the urban areas will come back, that people will come back to work. The majority of the time, we’ll still be coming to the office.

And then the nightlife and other elements of urban living, we think, will come roaring back. There will probably be quite a bit of pent-up demand for it.

I know you’re in the process of finalizing Fund 14 — my Latin numerals aren’t very good — a $1.25 billion fund, [Waterton’s] largest. What are you looking to target?

Even in a healthy market like Atlanta, your growth is still lackluster because we’re in a recession, we’re not creating a ton of jobs. We’re recovering. Across the U.S., we’re going to be at these trough levels of net operating income. We’ve already acquired some assets, a small portfolio in Hawaii and Honolulu. It’s a little bit of a contrarian play, but it’s the ultimate barrier-to-entry market — very high unemployment. We think this pandemic will slow down the supply pipelines across the country to varying degrees.

Were you always ready to take on the political challenges of the business? I know you worked with Sam Zell, so there’s probably scrap in you somewhere.

The great thing about the apartment business is people always need a place to live and you can always fill an apartment. That’s really the foundation of investing in this. I don’t think that goes away. Yes, you have political risk, and that’s probably more significant than I’ve seen in my career. These are people’s homes, and we just can’t forget that. If that’s not in your culture as a business, you’re probably not in the right business. And you certainly see owners who really ignore that.

That’s not the case with us. Our mission is one, to provide a great place to live. Two, to provide a great place to work. And then the third part of our mission is to provide great results to our investors, which happens automatically if you do the first two things.

Right now you can do one and two perfectly, but you may not get three for a while. And that’s why I think it’s a fascinating time to talk with you.

Yeah. But this is a year in time, and maybe it’s 18 months in time. It’s a blip. The great financial crisis, we had an 18-month blip. That was pretty rough. I think this one is still a relatively short blip. We’ll come out of it with all sorts of lingering progressive issues we’ll have to deal with. I think our industry needs to do a better job communicating to the media. On evictions, if you look at the real statistics, an infinitesimal percentage of residents at professionally managed apartment communities get evicted. But if you read [Matthew] Desmond’s book “Evicted,” you’d think everyone’s getting evicted. It’s just not true.

The NMHC rent tracker [which looks at 12 million units nationally to analyze rent collections] has gotten a lot of attention.

The tracker is pretty historic in our industry because we got the big property software companies — Yardi, RealPage, etc. — to contribute their data and work together. In March, we feared the worst, we feared Armageddon. The conclusion over eight months is we’re 2 percentage points on average off of what it would have been in 2019 in those same months. So, Armageddon did not happen.

Is that taking into account partial rent as well?

There is some nuance with that. But what I would tell you is it’s not meaningful in the overall numbers. If I’m collecting 2 percent less rent, that’s meaningful to our P&L. But it’s not Armageddon, it’s reasonable in this type of environment. And it proved that most households stepped up and were able to pay — they use their government assistance, they use the enhanced unemployment, maybe they use stimulus checks.

We as owners and operators had to step up. We had more trash to collect. We had hygiene protocols at a higher level than ever. Our employees are frontline workers. One of the other things we did is make sure they were treated like frontline workers and could go to work every day because it was pretty necessary, and the government and CDC agreed with that.

The rent-tracking numbers have sometimes been used against you.

There were some people in Congress who said, “You’re not hurt by this.” Or, “Hey, this eviction moratorium isn’t hurting you. Because the rent tracker says you’re collecting 97 percent.” But the 12 million units it tracks are generally professionally managed. If you dissect the data, you can see certain geographies are hurt much worse than others. An example would be Southern California, because L.A. County has probably the worst moratorium in the country. Basically gives residents a year to pay their rent with no penalty or no late fees. You can’t report to the credit bureaus, and so people take advantage of that. So you have very poor collection data in certain parts of the country. You take the smaller landlords, they’re more impacted for various reasons.

You made an interesting point about needing to be better at telling your story. There’s been some arrogance on the part of the real estate industry that’s now come back to bite them.

Look, we’re an essential business. When you look at the grocery stores, no one was ever suggesting, “Hey, look, if you don’t have the money, when you’re at checkout, just take the groceries, you don’t have to pay it.” That’s kind of what they’re saying to our industry. We have to do a better job articulating that the vast majority of the rent goes to pay critical expenses like property tax and extermination and cleaning. It doesn’t all go to the owner’s pocket. There’s this misconception, and we’ve had great difficulty in conveying that.

Rent control is a tough one. Because, in a sound bite, it’s hard to explain to people who don’t understand why that’s a bad policy, why it’s actually destructive to housing. And so, we’ve tried to do different things. There are great ads that were produced in the Prop 21 fight about the impact to all sorts of people when you implement rent regulation, including minorities, low-income families and households and unions. All the people who you’d think would support it, it actually impacts them. It impacts jobs, it impacts wages, it impacts the quality of the housing, maintenance and so on. So we have to continue to tell that story

— Georgia Kromrei contributed reporting.