From Malibu to Long Beach — and virtually everywhere in between — there’s no question as to which brokerage rules Los Angeles County.

National giant Compass, which arrived on the West Coast less than a decade ago, brokered more than $18 billion worth of home sales in the nation’s most populous county over the past year — almost triple the output of its closest rival.

The Robert Reffkin-led firm took the top spot after an aggressive expansion in the market, which saw Compass go from outsider to L.A. County’s top brokerage by agent headcount in just a few years.

“When I started in 2017 there were 600 agents,” said Parker Beatty, Compass’ regional vice president for California and Hawaii. “Now there’s around 2,800.”

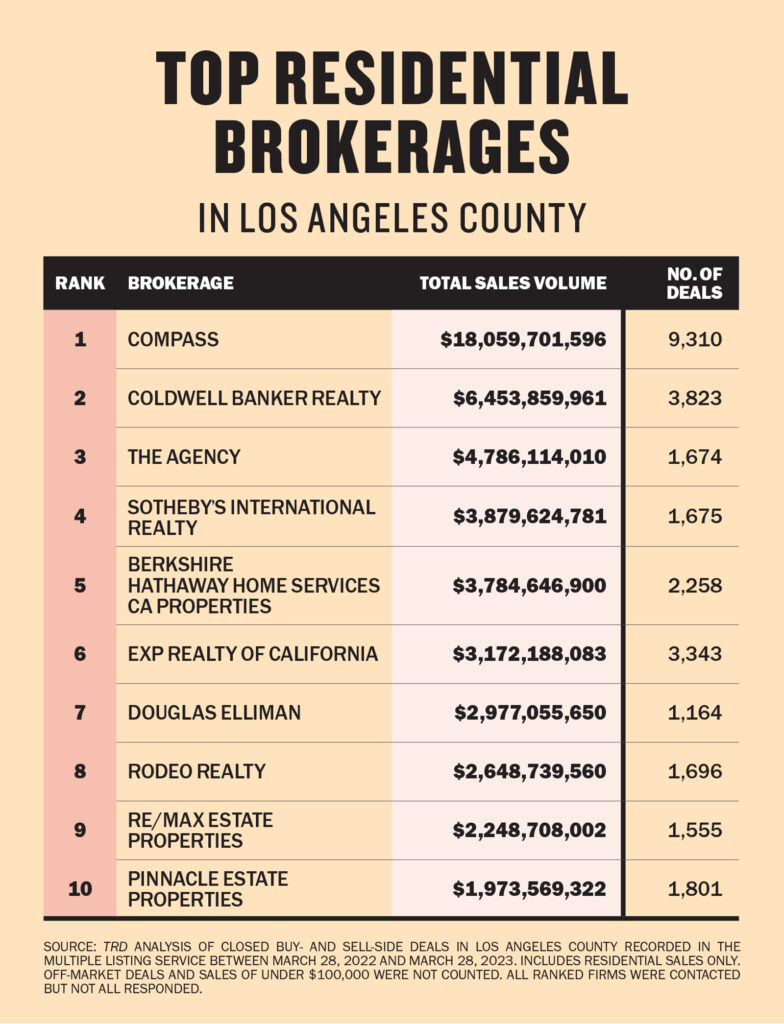

To get a clearer picture of the area’s top-selling brokerages, The Real Deal analyzed both buy- and sell-side transactions for residential properties in L.A. County recorded on the Multiple Listing Service over the 12-month period ending March 28, 2023. Off-market deals and homes that sold for less than $100,000 were not included in the analysis.

With $18.1 billion across 9,310 closed sales, Compass far outpaced second-ranked Coldwell Banker Realty, which recorded $6.4 billion in transaction volume on 3,823 deals in the county.

But Compass’ dominant year was not without some setbacks. The firm — which lost another $150 million in the first quarter — has been aggressive in its cost-cutting as it seeks a path to profitability, curbing its use of incentives to recruit new agents and shedding back-office staff in multiple rounds of layoffs.

It lost some star power in L.A. too, when top agent Aaron Kirman decamped for luxury specialist Christie’s International Real Estate. Kirman’s team at Compass handled $1.3 billion worth of home sales in L.A. County between April 2021 and April 2022, according to a previous TRD ranking, the most of any individual team.

Beatty brushed off the departure.

“We have an amalgamation of incredible agents. It’s not a one-person operation,” he said. “We have Sally Forster Jones. We have Tomer Fridman. We have Chris Cortazzo. All of these people are name brands.”

Hills and valleys

All segments of the L.A. brokerage scene from boutique or startup firms to long-established players are represented in the top 10 ranking, which comes after a tough period for the market characterized by skyrocketing interest rates and tight inventory. Home sales in the greater L.A. area declined 32 percent year-over-year in the first quarter, according to a Douglas Elliman report. It was the fifth consecutive quarter to post an annual decrease in transactions.

Jamie Duran, Coldwell Banker’s Southern California president, agreed with Compass’ Beatty that an army of boots on the ground provided an edge during a market slowdown.

“It’s like Starbucks. The more coffees you sell, the more business you have,” she said. “But we have never been a company who had agents just to have agents. They have to be productive.”

Duran defined a productive agent as one who makes at least $50,000 in gross commissions. About 80 percent of Coldwell Banker Realty’s L.A. business last year came from single-family homes priced above $1 million, she said.

Luxury boutique firm The Agency placed third with nearly $4.8 billion in volume across 1,674 transactions, comfortably ahead of Sotheby’s International Realty, which took fourth place with a similar number of deals but approaching $3.9 billion in volume. Berkshire Hathaway HomeServices rounded out the top five, just behind Sotheby’s with nearly $3.8 billion in transaction volume on 2,258 deals.

More than 500 agents work for The Agency in L.A. County. Founder and CEO Mauricio Umansky credited the decade-old firms’ star teams, including Bond Street Partners, the Chernov Team, Grauman & Rosenfeld and the Santiago Arana team, with helping The Agency stay competitive. Being nimble is a plus, he said.

“We’re driving a small speedboat. Everybody else is driving a mega cruise liner,” Umansky said. “It gives us the opportunity to pivot, practice things, try things. If they work, great. If they don’t, adjust fast. That is our competitive advantage.”

Flexibility was also key for fourth-ranked Sotheby’s, said Michael Williamson, the firm’s Southern California regional manager.

“Our company is all over the region. That’s important when a market shifts,” he said. “When the Westside slows down, the Valley is busy. When the Valley slows down, Pasadena is busy.”

Williamson said Sotheby’s is still seeing homes get multiple offers in some markets, including Northeast L.A., Pasadena and parts of the San Fernando Valley.

“There’s still high demand, and the under $3 million price category is still very active,” he added.

Stephen Kotler, CEO of brokerage for seventh-ranked Douglas Elliman’s Western region, said attracting new brokers is vital in a market where it has just 450 of them. But its agent roster — which already includes star brokers like Josh Flagg and brothers Josh and Matthew Altman — picked up some more prominent producers in the past year, such as Lisa Optican in Beverly Hills, formerly with Hilton & Hyland, and the Calabasas and Hidden Hills-based Shevin Team, which joined from Berkshire Hathaway.

Coldwell Banker’s Duran noted that there will be more market share for the taking in Los Angeles this year. But with inventory still well below pre-pandemic levels, it won’t be easy.

“We’re going to have 30 percent of agents leave in a shifting market,” she predicted. “But there is less out there on the table.”