South Florida’s residential brokerages don’t want you to read this ranking.

Their concerns: It measures Miami’s top firms by dollar volume, not the number of individual homes they sold; it looks at on-market resales; and it doesn’t factor pocket listings or new development deals.

And because it’s based on closed sales between April of last year and April of this year, it excludes their strongest quarter of 2022, before mortgage rates surged and sales slowed.

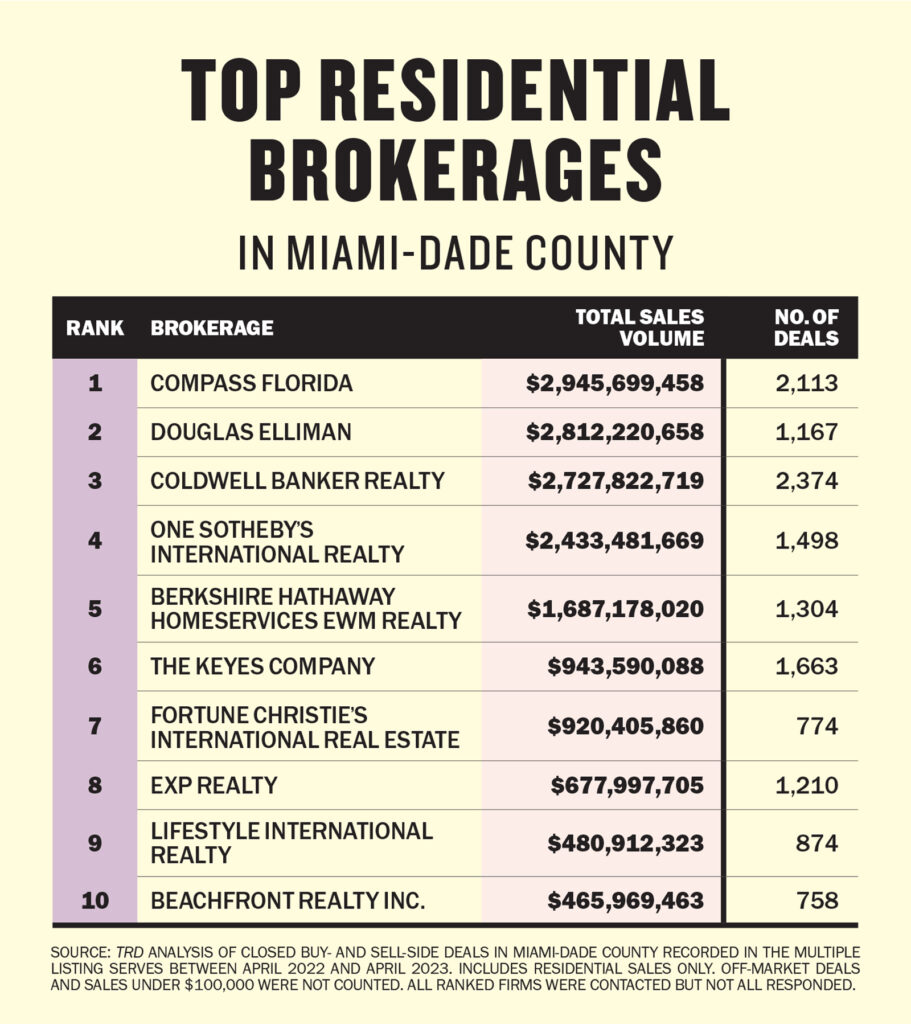

Still, the top 10 firms closed more than $16 billion in on-market dollar volume in Miami-Dade County over the past year. To determine which brokerages held on the strongest as the market turned, The Real Deal counted buy- and sell-side deals priced at $100,000 and up that closed in the 12 months ending April 11.

Compass took the top spot with nearly $3 billion in closed sales in Miami-Dade, beating out Douglas Elliman, Coldwell Banker, One Sotheby’s International Realty and Berkshire Hathaway HomeServices EWM Realty, which followed in the top five. All have footholds in the luxury market.

A slow market has increased competition to lure and retain top agents who expect higher commission splits that offset fewer transactions due to lean inventory.

“It’s almost too competitive,” said Edgardo Defortuna, CEO of Miami-based Fortune International Group. “If you don’t provide the splits and services and attention to the agents, it’s really difficult to retain them.”

Duff Rubin, president of Coldwell Banker in Florida, agreed.

“Agents tend to go for a higher split when their business is down because they’re looking at the paycheck,” Rubin said. “There’s a lot of pressure on us.”

That means that for most companies, brokering sales isn’t enough. Many also offer title, insurance and/or mortgage services, and some have large divisions dedicated to new development sales.

Defortuna, whose firm affiliated with the @properties-owned Christie’s International Real Estate in the fall, said that the resale business “creates the momentum” for Fortune’s development sales arm. (Fortune is also a developer.) Fortune Christie’s ranked seventh on TRD’s list with more than $920 million in closed sales.

Fortune has recruited 75 agents since announcing its affiliation with Christie’s, and it plans to add more agents in Broward County and in Boca Raton.

“It’s hard to make significant money on the general brokerage. But it is what it is,” Defortuna said. “For our company, it’s a very important piece of the equation.”

Expansion mode

As the slowdown persists, South Florida’s largest firms continue to expand geographically and by agent count. Even that has brought its challenges.

“Normally, we recruit like 100, 150 agents a month,” said George CancioBello, broker of Lifestyle International Realty, which ranked ninth with about $481 million in sales. Now, that’s down to about 75 agents a month, CancioBello said, calling it an indicator of the market.

The drop in business has led some agents to look for second jobs or forgo paying their trade group memberships, said Rubin of Coldwell Banker in Florida. And some have left national brokerage giants to launch boutique firms of their own.

Ron Shuffield, CEO of fifth-ranked Berkshire Hathaway HomeServices EWM Realty, said that agents are “constantly looking for better opportunities.” He said he’s speaking with agents from other brokerages every week.

Most of the top firms emphasized their focus on agents and keeping them happy. The Keyes Company, which ranked sixth, recently relaunched a boot camp for agents. The program is geared toward making them more productive and helping them close their first deals faster. It also started a wealth builder program, which allows agents to invest in real estate alongside Keyes executives, said company president Christina Pappas.

Top brokers have jumped around over the past year.

Oren and Tal Alexander left Douglas Elliman last summer to launch Official, a brokerage backed by the white label firm Side. Riley Smith and his team left BHHS EWM after 17 years to join Compass, working out of the firm’s Coconut Grove office alongside Chad Carroll, Liz Hogan, Ben Moss and others.

Recruiting has paid off for some brokerages, including Coldwell Banker, even as firms try to cut costs nationwide. Anywhere Real Estate, the parent company of Coldwell Banker, Corcoran Group, Sotheby’s International Realty and other large national brands, is looking to slash $70 million in expenses by the end of this year.

Still, Coldwell Banker brought on 2,500 agents statewide last year, Rubin said. But it’s adding fewer agents per month so far this year, he added.

Compass also began to slash costs last year. It stopped offering equity and cash incentives to new agents, but it’s continued recruiting.

Compass recently opened offices in Weston and Palm Beach Gardens to house more than 200 agents as it joins a number of Miami brokerages expanding to other parts of South Florida and the state. Jeff Polashuk, a regional executive with Compass, said the goal is to go “super deep” in Florida and boost agent count across the state.

Keyes, with more than $940 million in closed deals over the past year, recently opened offices in West Palm Beach and Fort Myers. Keyes is looking at Sarasota, Jacksonville, Orlando, Tampa and up the Space Coast, Pappas said.

Douglas Elliman, which ranked just behind Compass at about $2.8 billion in closed sales, is expanding along Florida’s west coast as well, where it opened offices in Tampa and St. Petersburg four years ago, said Elliman Florida’s CEO Jay Parker. To aid with recruiting, Parker said he’s working with Courted, which uses AI to research agents and track who may be more likely to jump to a new firm.

The west coast is “still in its infancy,” he added.

Many of the other top firms are also looking for untapped markets for potential growth, despite the rapid appreciation that cities across the state experienced in 2021 and part of 2022.

“The frenzied pandemic period has moved behind us,” Parker said. “But there are still opportunities.”