With global supply chains, an inherent need for on-site workers and a client base that depends on optimism, construction firms faced challenges on several fronts when the pandemic shook the world economy last spring.

Suppliers scrambled to secure materials, rapidly shifting regulations shut down projects for months, and economic uncertainty led to a plunge in new starts as many developers opted to wait things out.

But a year on from the initial shock, general contractors are getting a handle on the new normal.

“I feel that the construction industry as a whole handled the pandemic extremely well,” said Lance Franklin, co-CEO of New York-based Triton Construction, which made the top 10 in The Real Deal’s annual ranking of the city’s biggest general contractors. “We all adjusted to it quite quickly in terms of mask-wearing, in terms of taking everyone’s temperature as they entered the sites and in terms of doing contract tracing if there was an exposure.”

A handful of workers on Triton’s projects in the city were exposed to the virus, Franklin said, and some projects faced delays early on in the pandemic. But the firm is still moving forward.

A handful of workers on Triton’s projects in the city were exposed to the virus, Franklin said, and some projects faced delays early on in the pandemic. But the firm is still moving forward.

In March, Triton broke ground on the 950,000-square-foot residential complex at 101 Lincoln Avenue, the second phase of Brookfield Properties’ Bankside megaproject on the Bronx waterfront.

Even as the industry looks forward to a post-pandemic recovery, general contractors will still have to grapple with many of the same challenges they were facing before the crisis, like rising material costs and a chronic shortage of skilled workers. But at the same time, the Biden administration’s ambitious infrastructure plan has raised hopes of a construction boom in the coming years.

“It’s really a very important inflection point for the construction industry,” said construction lawyer Barry LePatner, founder of LePatner & Associates, which represents the Related Companies and Starwood Hotels and Resorts.

By the numbers

After peaking in 2016, construction activity in the five boroughs has been on the decline for four straight years, according to an analysis by the Real Estate Board of New York.

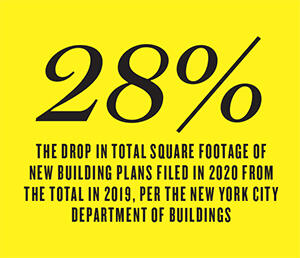

In 2020, just 1,760 new building plans were filed with the city’s Department of Buildings, the lowest tally since 2012 and almost a 10 percent drop from 2019. The total square footage of new filings fell 28 percent to 42.67 million square feet, while the number of residential units dropped 18 percent to 27,402.

TRD examined all new and renewed building permits issued across the city between April 1, 2020, and March 31, 2021, to rank the firms that have managed to stay the busiest, taking into account changes in the DOB’s reporting as it transitions from its DOB BIS database to the new DOB Now system.

According to TRD’s analysis, AECOM Tishman was the most active general contractor in the city in terms of ground-up new construction, with more than 11 million square feet in active projects. Lendlease, New Line Structures & Development, Lettire Construction and Gilbane Building rounded out the top five.

For alteration work, TRD tallied companies on the basis of initial estimated project costs. By that measure, Turner Construction was the busiest firm by far, with active projects totaling more than $2 billion — more than twice as much as the second-ranked firm, Structure Tone, whose figures also include its Pavarini McGovern subsidiary. Other big players in the alteration space included J.T. Magen & Company and AECOM Tishman.

“One of our biggest challenges in 2021 will be adapting to new ways of delivering projects safely, and possibly being able to ramp down and ramp back up quickly depending on other events,” said Jay Badame, president of AECOM Tishman, which made headlines last year for its completion of SL Green’s One Vanderbilt, the 1.7 million-square-foot office tower beside Grand Central Terminal.

“One of our biggest challenges in 2021 will be adapting to new ways of delivering projects safely, and possibly being able to ramp down and ramp back up quickly depending on other events,” said Jay Badame, president of AECOM Tishman, which made headlines last year for its completion of SL Green’s One Vanderbilt, the 1.7 million-square-foot office tower beside Grand Central Terminal.

“Covid has forced us to rethink the entire construction process in significant and lasting ways,” Badame said.

Labor lurch

As construction projects ramp up across the city, a lack of workers in specialized trades continues to bottleneck the industry.

In the early days of the pandemic, the unemployment rate in the U.S. construction industry spiked to 16.6 percent in April before falling back to less than 10 percent, according to U.S. Bureau of Labor Statistics. But before then, the sector’s unemployment had fallen to 3.2 percent in late 2019 — the lowest point this century.

Not only have fewer young people entered the construction field in recent years, more experienced workers have been going elsewhere.

“We witnessed subcontractor labor choosing early retirement and relocating out of the tri-state area, resulting in a decline of local skilled labor,” said Maurice Regan, CEO of J.T. Magen & Company, which has won several new interior projects, including Facebook’s new offices at the Farley Building, BlackRock’s space at 50 Hudson Yards and TikTok’s headquarters at One Five One (formerly 4 Times Square) in Midtown.

Many subcontractors under financial stress let workers go in the past year, exacerbating the problem, said Regan, whose firm placed third in the alteration-work ranking.

At the same time, contractors’ efforts to keep workers busy through the lean times last year could have negative consequences in the long term, according to LePatner.

“Contractors large and small are bidding lower than they would ordinarily, just to keep their manpower going until normal times come around,” he said. “That’s a risky strategy because there’s minimal to no profit, and in some cases losses.”

Onshoring

Onshoring

Construction costs continued to rise during the pandemic, and New York City is still one of the most expensive cities in the world to build in.

Trump-era trade wars had already caused problems, but the Covid crisis wrought even greater disruptions in the global network of construction suppliers, driving up costs still further.

Several firms said that they continue to see spikes in the prices of various commodities more than a year into the pandemic — from lumber and steel to gypsum, copper and concrete — as well as delays in fabrication and delivery.

“We will continue to see this rise until facilities can get back to normal production schedules,” said Dan Fine, general manager at Turner Construction, whose projects include Tishman Speyer’s Spiral at Hudson Yards, which topped out last year.

Going forward, LePatner said, more companies may seek to shorten their supply chains and move sourcing back to the U.S. — in part as a response to vulnerabilities revealed by the pandemic, and in part due to incentives provided by the Biden administration to bring back manufacturing jobs.

“It’s going to make our domestic supply chain more reliable, although we’re going to see product costs in many situations rise at least 20 percent,” he said. “But that may be the price to pay.”

The infrastructure decade

While sectors like hospitality and retail have taken a serious beating, others are well positioned to keep growing, and construction firms are eager for the work.

“We expect the residential market to continue to grow, especially in the outer boroughs, with more focus on the environment, amenities and work-live-play complexes,” said Lisa Hickerson, manager of business development at Turner. The markets for life sciences, industrial facilities and data centers also accelerated in the past year, she added.

Many firms say they are also paying close attention to the Biden administration’s infrastructure plan, as well as the billions in federal stimulus dollars slated for New York City.

Many firms say they are also paying close attention to the Biden administration’s infrastructure plan, as well as the billions in federal stimulus dollars slated for New York City.

“Investing in schools and hospitals and libraries and transit locally creates thousands of good-paying jobs,” AECOM Tishman’s Badame said.

A trillion-dollar overhaul of the nation’s aging infrastructure would mean “well-paying jobs for tens of thousands of specialty trades, such as certified welders, concrete strength test technicians, highway construction managers, all of whom will need the proper backup and support,” said LePatner.

And while much of the nation’s population growth and new construction in the coming decades will be in the Sun Belt, plenty of work needs to be done in New York as well — for the renovation of aging buildings, as well as retrofits to meet looming emissions caps.

“We’re going to see New York have its own building boom,” LePatner said, “because so many of our buildings are 40, 80 and 150 years old.”