UPDATED, Nov. 19, 10:10 a.m.: Smoke billowed across northern Colorado in late October, during what is typically the end of the wildfire season. The Cameron Peak Fire had torn through nearly 500 structures, most of which were homes.

UPDATED, Nov. 19, 10:10 a.m.: Smoke billowed across northern Colorado in late October, during what is typically the end of the wildfire season. The Cameron Peak Fire had torn through nearly 500 structures, most of which were homes.

In late September, California’s wildfires reached the Meadowood resort, a Napa Valley institution that was home to the award-winning Restaurant at Meadowood. The Glass Fire engulfed the eatery and other parts of the resort. It also scorched the Calistoga Ranch resort and the Glass Mountain Inn, a bed and breakfast, as it burned through nearly 67,000 acres and 300 properties.

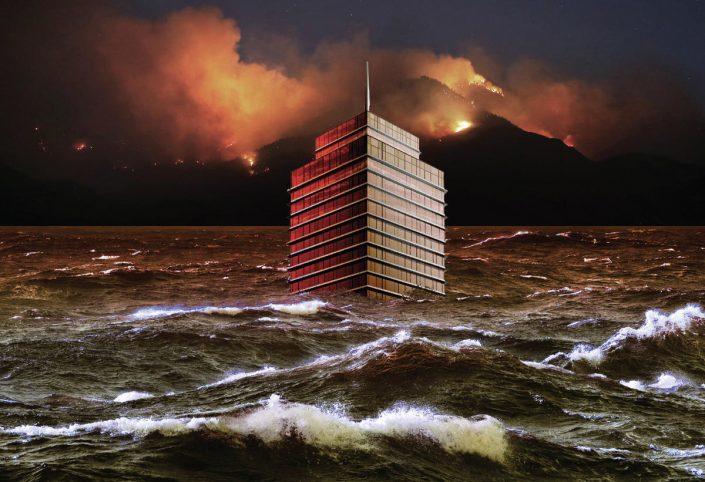

For states along the Gulf Coast and up the East Coast, the growing threat is not wildfires but storms. Of the 29 named storms this year, 11 have become hurricanes.

And this Atlantic hurricane season has been the busiest in recorded history. In late August, Hurricane Laura destroyed parts of Louisiana and Texas. In early November, the final month of hurricane season, Hurricane Eta pummeled parts of Central America and then, as a tropical storm, knocked out power to tens of thousands and flooded the streets of South Florida and the Caribbean. There has also been a rise in tornadoes in states such as Tennessee.

“Out of all the various topics we consider, [climate change] is the most complex and the most important one,” said Aleksandra “Sasha” Njagulj, who leads environmental, social and corporate governance for the real estate investment management firm CBRE Global Investors.

The increasing frequency of climate disasters has a direct impact on commercial property investment around the world, with major asset managers and debt and equity providers now pulling back from markets that are most vulnerable to climate disasters and extreme temperature changes.

In the U.S. alone, roughly $1.3 trillion worth of real estate is at high or extremely high risk from wildfires alone, according to a recent Urban Land Institute report.

“Investors are mitigating risk at the [geographic] market level,” said Billy Grayson, executive director of the nonprofit’s Center for Sustainability and Economic Performance. “Assets can’t be taken in isolation.”

Across the country, more developers and owners are adapting their strategies by investing in design and infrastructure to make properties more resilient and reassessing their portfolios — including avoiding entire regions altogether.

Terra’s Canopy Park project

“There’s a lot of discussion going on right now,” said Kevin Fagan, a vice president and senior analyst with Moody’s ratings group on commercial mortgage-backed securities.

“The scrutiny of climate change risk has increased substantially in recent years. If there’s a perceived issue in an area, that can have as much impact on values as the storms do themselves.”

Risky business

The increase in disasters has caused insurance rates to soar, raising costs for property owners around the world. The elevated risk makes buildings more expensive to buy as well.

“In South Florida, hurricanes are a part of our life, so it’s very easy if you live here to constantly think locally,” said Doug Jones, managing partner of South Florida-based JAG Insurance Group.

“What most consumers fail to realize is insurance companies are national if not global,” he added. “As we’ve seen these catastrophes happen around the world, they’re going to affect the overall pricing worldwide.”

In the past decade, extreme weather caused losses of more than $3 trillion globally. And just last year, 40 climate disasters each resulted in at least $1 billion in direct losses, according to a report from insurance giant Aon.

Insurance firms typically buy coverage from other insurers, in case they get more claims than they can cover. But even with reinsurance, some are still wiped out.

In late 2018, following California’s deadly Camp Fire, Merced Property & Casualty Company was liquidated after a state judge ruled it could not meet more than $60 million in outstanding liabilities in Paradise — a town of 26,000 people in the foothills of the Sierra Nevada Mountains. About 90 percent of the town’s 11,500 homes burned.

In Japan, prone to a variety of disasters, two typhoons last year accounted for $10 billion of insured losses, the Insurance Journal reported.

“How many insurance providers are going to continue to provide insurance? When you don’t have a diverse set of insurers, it can cause a looming concern,” Fagan said.

Moody’s recently began to include climate risk data in its ratings reports for CMBS deals. And the research firm Trepp, which is integrating data from the catastrophe risk company RMS into its platforms, has started to create risk scores for properties with securitized commercial loans.

Major asset managers have also taken note. In his annual letter to chief executives, BlackRock’s founder and CEO, Larry Fink, pledged to put sustainability at the center of his firm’s investment strategy globally. Portfolios that take a climate-integrated approach will create better returns for investors in the long run, he asserted.

“With the impact of sustainability on investment returns increasing,” Fink wrote, “we believe that sustainable investing is the strongest foundation for client portfolios going forward.”

Njagulj said CBRE Global Investors, which has roughly $110 billion in assets under management, audited its risk management process early last year with the goal of making climate change a bigger priority than before.

A number of factors play a role in whether the company pulls the trigger on a deal, she noted, including a city’s air quality, infrastructure, economy and transportation system. Njagulj declined to say which markets her firm prioritizes or avoids, but its recent acquisitions could shed light on that.

In September, CBRE Global Investors purchased an office building near Munich’s central business district and public transportation, and in March it bought a Netherlands rental portfolio in which all 916 units have a green energy label.

Mapping out the future

When the Urban Land Institute published an earlier report on climate change in 2018, institutional investors said they did not know how to price global warming and rising sea levels into their real estate portfolios, according to Grayson.

Fast-forward two years, and nearly all of a similar group of firms have started to make “asset-level decisions” using climate change analytics to score their portfolios. The global investors most recently surveyed by the nonprofit organization have pledged net-zero carbon emissions targets as early as 2030 and as late as 2050.

Local governments will need to keep up, too, or risk losing out on private investment.

Climate change and its effects are tied to a number of factors that investors take into account, including proximity to transportation, energy efficiency, elevation, government investment in infrastructure and other trends affecting property owners.

Municipalities throughout South Florida have been issuing hundreds of millions of dollars in bonds to deal with sea level rise by taking measures such as raising roads. Values of properties at higher elevations in Miami-Dade County appreciated faster than those at lower elevations, according to a Harvard University analysis.

In Key Biscayne, a barrier island south of downtown Miami, residents recently voted for a $100 million general obligation bond to mitigate the effects of rising sea levels and flooding. Some of the money will go to protecting the beaches and shoreline from erosion and installing and reinforcing underground infrastructure to withstand hurricanes.

Halfway around the world, Japan has already lost out on investment. Thirty-seven of the country’s real estate investment trusts — representing nearly $265 billion in commercial real estate assets — are exposed to the highest risk for typhoons, according to Four Twenty Seven, a climate risk data firm owned by Moody’s. That doesn’t include the risk of earthquakes and other disasters.

And across Europe, cities have been dealing with extreme temperature swings, floods, droughts and landslides.

The pandemic has clouded investors’ priorities and the impact of climate change on property values. In pockets of South Florida, for example, the demand for coastal single-family homes has skyrocketed since March, propping up residential real estate.

But over a two-year period, coastal Florida areas at high risk from climate change have underperformed the market, a National Bureau of Economic Research paper found.

“Covid complicates things because it creates some noise in the system,” Grayson said.

Florida as a model

When developer David Martin founded his Miami-based company Terra alongside his father, Pedro, in 2001, climate change was not top of mind. But now, resiliency is a key factor in the company’s strategy.

Martin, a former member of the city of Miami’s Sea Level Rise Committee, isn’t shying away from the waterfront.

Jonathan Rose Companies’ Sendero Verde project

The developer, who was raised in South Florida, has proposed a mixed-use redevelopment of the Miami Beach marina, with plans to invest $40 million in flood-risk mitigation, floating docks, sea wall enhancements, a public park with natural infrastructure and irrigation systems and a “blue” roof that collects water and gradually releases it.

Though the future of that project is now in question, as voters just rejected a ballot item that would have allowed the city to sell air rights to Terra for $55 million so the firm could build a luxury residential tower, Martin plans to work with the city to move forward.

Terra is also working with Crescent Heights developer Russell Galbut and partner New Valley on a nearby mixed-use project that includes a 3-acre green space along Miami Beach’s Alton Road. Canopy Park’s sustainability features will include a maritime hammock and a weather-based irrigation, water conservation and rainwater management system, as well as habitats for birds, bats, native bees and native plants.

Martin says he wants to “hack capitalism to solve society’s challenges.” As some developers decide against investing in South Florida, he is doubling down on the belief that the region will be an example for others dealing with climate change.

But for the investment to pay off, local governments and developers have to share the cost. Studies have predicted that every dollar invested in resilience will return $2 to $4 over the next five decades.

Walter Meyer, principal of Brooklyn-based Local Office Landscape and Urban Design, echoed Martin’s statements. Florida’s building codes are far stronger than those in other parts of the country and are a model for coping with climate volatility, he said.

“Miami has some of the highest urban winds, most intense flooding and rain of some of the cities on the planet,” said Meyer, who works with Terra. “If it works in Miami, it works anywhere else. Those rains, if they hit New York City, would cause billions of dollars of damage.”

Developer Jonathan Rose, founder of Jonathan Rose Companies, said his company has been climate-focused for two decades. The affordable housing developer and investor has properties in more than a dozen cities, from New York to San Diego to Seattle.

Rose said he hopes to grow in all of those markets, but declined to say which cities he avoids. (He has no projects in Florida.) Over the next five years, his company plans to build 2,500 new units and acquire another 7,500.

In Harlem, the firm is a co-developer of the Sendero Verde project, which will mark the nation’s largest certified “passive house” development. Passive building calls for high energy efficiency, indoor air quality and resiliency. Sendero Verde, which will include about 700 mixed-income apartments and 90,000 square feet of community space, will be much better insulated than the existing housing stock, including properties that have been upgraded to today’s standards, Rose noted.

“If the power goes out in the middle of the winter,” he said, “the temperature may just go down to the 60s.”

But Rose acknowledged that it’s getting “harder and harder” to insure properties and that his company is reexamining how it assesses climate risk. “There are more issues than just flooding,” he said. “There are a lot more vulnerabilities. The times are calling for a more rigorous assessment.”

Skyrocketing premiums

Rising insurance rates are one of the issues that California-based Ideal Capital Group is grappling with, said Kevin Conway, its director of acquisitions. The company owns more than 1,000 apartments in Southern California and has about $150 million of ground-up development in the pipeline.

“Insurance prices have gone through the roof in California due to the wildfires,” Conway noted. “Whether or not there are going to be more wildfires in California due to climate change, they have a direct and immediate impact on us.”

Some property owners decided not to rebuild in Paradise after the Camp Fire — the deadliest and most destructive in California history — tore through the small town in 2018.

But locating in more urban areas does not guarantee safety. Wildfires are creeping closer to cities.

Because of the scale and intensity of wildfires, companies are “more careful about where they develop,” Conway said. “When it comes to these massive infernos engulfing these towns, the only way to mitigate a risk is to not build in those areas.”