If not for 220 Central Park South, Vornado Realty Trust’s recent financials would have been a horror show.

Vornado, one of New York City’s biggest landlords, recorded a $107 million loss in the third quarter on its prime retail portfolio, once-prized Fifth Avenue and Times Square properties that have been paralyzed by the pandemic. It also took significant hits on the shuttered Hotel Pennsylvania and other investments.

But thanks to a flurry of closings at 220 Central Park South, its ultra-luxury condo at the foot of Central Park, the REIT closed out the quarter comfortably in the black.

“If you pardon the expression, we’re loaded,” Vornado Chair and CEO Steven Roth, who has never been accused of modesty, said during an August earnings call.

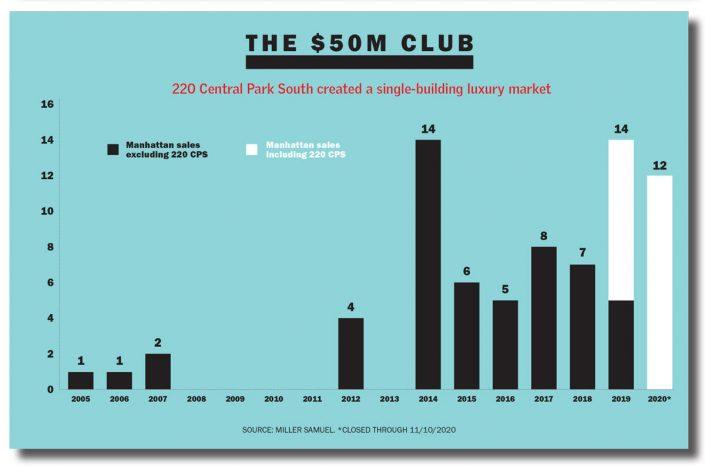

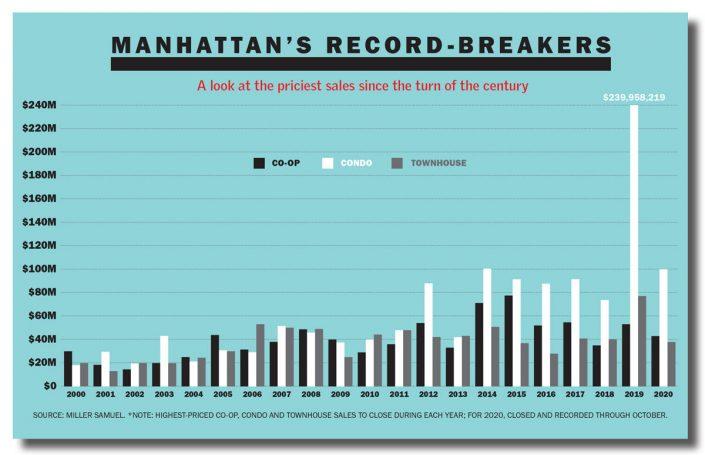

Even as the high-end condo market has been sunk by oversupply, a waning foreign buyer pool and a slowing economy, 220 Central Park South has floated above it all, closing high eight-figure deals, snagging boldface buyers and effectively creating its own single-project luxury market. It is the clear heir to 15 Central Park West as the city’s new alpha residence. It holds the record for the country’s priciest residential transaction. And with $1 billion of realized profits, it’s arguably the world’s most successful condo.

Roth said in his annual letter to shareholders in March that the project’s performance relative to its rivals was “sort of like winning the Kentucky Derby by 10 lengths.” But 220 Central Park South has been less horse race and more odyssey, a 15-year journey that encapsulates the best and worst of the blood sport that is New York real estate.

Buyout battles with tenants, siege warfare with rival developers, a lavish construction purse courtesy of a foreign lender, guerrilla marketing and record-breaking deals that highlighted the city’s extreme inequality and its status as a magnet for the global superrich: The tower has seen it all.

The get

Veronica “Ronne” Hackett’s first job was ideal, albeit unusual, training for a career in New York dealmaking: She tracked troop movements and rice shipments for the CIA during the Vietnam War.

“She had a background of not trusting anybody,” said David Perry, who for 11 years was director of sales at Hackett’s firm, the Clarett Group. “And she was usually right.”

Veronica Hackett

After the CIA stint, the native Floridian moved to New York and worked as an assistant at a small investment brokerage while taking night classes toward an MBA at NYU. She then became one of the first female employees in Citibank’s real estate division.

“I didn’t know what a mortgage was,” she recalled in a 2006 appearance on the real estate talk show “The Stoler Report.”

She learned, moving to Chemical Bank in the thick of the 1970s mortgage REIT crisis. She then jumped into development, running marketing and finance at George Klein’s Park Tower Realty. In 1999, Hackett formed the Clarett Group with Neil Klarfeld, a Park Tower colleague who died in 2004. Backed by financial giant Prudential, the firm went shopping.

“Prudential gave us a blank check to do development deals,” said Perry.

In 2005, a potential deal came along: a 20-story rental building at 220 Central Park South.

The white-brick building was drab, the location anything but. Nestled right on the park between Seventh Avenue and Columbus Circle, a new tower there would offer the best views in the city — even better than those from Zeckendorf Development’s much-anticipated 15 Central Park West.

“The view out the front was over Central Park,” said Joel Diamond, a music producer who rented the penthouse for $1,200 per month in 1971 and lived there for two decades. “It was absolutely magnificent.”

The property was owned by the estate of Sarah Korein, a Hebrew teacher-turned-notoriously tough investor with “bare-knuckle tactics cloaked by grandmotherly charm,” as the New York Times put it in her obituary.

The 124-unit building was home to 47 rent-stabilized tenants and 40 percent vacant. Clarett wanted to tear it down and replace it with a 41-story luxury condo, but it had a chicken-and-egg problem.

To get the state’s blessing to demolish a building with rent-stabilized tenants, Clarett had to show it had the funds to immediately kick off the redevelopment. But without a legal green light, the funds would be impossible to get.

“We couldn’t do it with a loan,” Perry recalled. “We needed to have a financial partner that could write a check off of their line.”

The rental property at 220 CPS. Vornado and Clarett bought it for $136.6 million in 2005

Clarett’s chief investment officer, Warren Fink, was a connected industry veteran who knew Michael Fascitelli and Steven Roth, the Vornado bosses dubbed “the Gangstas of Brick” by the New York Post. By then, Vornado had a market capitalization north of $10 billion and had developed the luxury condo One Beacon Court atop its Bloomberg Tower in Midtown East.

Fink brought Vornado to 220 Central Park South as a 90-percent equity partner, and the joint venture was christened Madave Properties. In August 2005, it closed on the acquisition for $136.6 million. Then came the hard part.

Clarett began buying up air rights from neighboring properties, including from Ian Reisner at 230 Central Park South, and pursuing buyouts of the building’s tenants. Many had lived there for decades and were aghast at the idea of leaving.

“Why should they tear up a beautiful building like this?” Marjorie Cantor, a retired Fordham University professor who lived at 220 Central Park South for 27 years, told the Times.

“It’s a scorched-earth policy,” added tenant lawyer William Gibben. “If this gets done, it is open season on every building in the city.”

Hackett, however, saw it differently. “The bigger issue,” she countered, “is how to deal with obsolete buildings in the city.”

Vornado deployed its huge war chest in the battle against the building’s residents. “There was so much money involved,” recalled Jack Lester, who represented a group of tenants who sued in 2007 to block demolition. “The tenants were put under a great deal of pressure.”

In 2008, Justice Paul Feinman said the state might need to conduct an environmental review to assess how wealthy buyers would impact the “existing community character,” but the ruling was overturned on appeal.

The legal battle dragged through the financial crisis. Finally, in December 2010, the developers agreed to pay each of the remaining tenants between $1.3 million and $1.6 million. Among them was Corcoran Group agent Leighton Candler, who in 2012 would broker Michael Dell’s record-breaking $100.5 million purchase at One57.

Lester recalled tense negotiating sessions with Hackett. “In person, she was pleasant enough,” he said. “Behind the pleasant façade was a sword ready to strike at the heart of the tenants.”

With the residents finally out, Vornado and Clarett were eager to raze the building. But they had to deal with one final nuisance: a savvy and preternaturally patient developer named Gary Barnett.

The Trojan Horse

Champion Parking, a third-generation family business founded by Sam Rosenblatt in 1949, operates 39 locations across New York. In 2005, one of them was a 44-space basement garage at 220 Central Park South.

That summer, Champion’s principals, Kenneth and Gary Rosenblatt, were approached by representatives from Barnett’s firm, Extell Development.

Barnett, a diamond dealer-turned-developer, had a lot at stake. He had recently bought the first parcel in an assemblage for a potential supertall condo between West 57th and 58th streets, hoping the park views would command bumper prices. When his rivals made their play for 220 Central Park South, he feared their upcoming tower would block the views from his.

He made his move, buying a 49 percent stake in the Rosenblatts’ garage lease, which ran until 2018. He paid the Rosenblatts many multiples of what the lease was worth, but to him, it was an invaluable bargaining chip.

Gary Barnett

Barnett gave a different rationale in an affidavit from a lawsuit Extell brought against Vornado. “I wanted to have parking available for my nearby projects,” he said. He also bought a small development parcel on 58th Street (“nothing but a little sliver of land,” as one source put it) that was in the middle of Vornado’s development site.

According to a person familiar with the events, Barnett hired an executive from Clarett, Pamela Samuels, giving him valuable insight into 220 Central Park South.

Then he waited.

By 2011, the recession had left Clarett unable to secure financing for its projects. Vornado indicated to the firm that given the additional delays and costs, Clarett’s promote, or the premium paid to the sponsor in a development project, was essentially wiped out. Vornado wrote the firm a check for its troubles and took full control of 220 Central Park South.

“The golden rule is: He who has the gold makes the rules,” said a source familiar with the partnership. “[Vornado] had the money, so they could keep going.”

But a final obstacle remained: the garage. If it stayed put, the redevelopment would be more complicated and expensive, and Barnett knew it. Vornado began negotiating with Extell to close the garage, and began preparing to tear down the building above it.

“We think it would show very poor judgment to attempt to demolish an occupied building, especially when there is no possibility of construction for a number of years,” an Extell spokesperson told the Wall Street Journal in April 2012, implying that a tower could not be built until the garage’s lease expired in 2018. “God forbid something bad happens for no purpose.”

Vornado informed the Rosenblatts that they were in default on the garage lease, setting the stage for an eviction. It cited a Department of Buildings violation it received that stated the garage was not being primarily used as parking for the building’s residents.

In fact, the violation was engineered by Vornado, court papers show. The company first informed DOB of the transgression in the summer of 2011 and even followed up later.

“The history of this DOB violation is curious in that its recipient, Madave, asked for it,” Judge Donna Mills wrote in an opinion on the eviction case.

Extell sued Vornado in 2012, alleging the developer was using sham tactics to force it out.

“They take away our clients, they empty out the building, and then say, ‘You’re in violation because you have an empty building,’” Barnett said to the Journal after the suit was filed. He asked the court for a Yellowstone injunction, a proceeding by which a tenant being threatened with termination is allowed to stay, provided it addresses the alleged breach of lease. It was a stalling tactic, and it worked: In July 2013, the court granted the injunction.

That October, Vornado blinked. It agreed to pay Extell $194 million for its tiny West 58th Street parcel and additional air rights. The deal came to a staggering $1,400 per square foot, more than twice the going rate for air rights in the area.

The developers also agreed to unusual design adjustments for their competing towers: Vornado would shift its project slightly to the west, while Extell would move its planned luxury condo on West 57th Street — what would eventually become Central Park Tower, the city’s tallest residential building — to the east. Extell would also cantilever its skyscraper 28 feet to the east over the landmarked Art Students League building, a move the Times’ architecture critic Michael Kimmelman likened to “a giant with one foot raised, poised to squash a poodle.”

“I could just see [Vornado] trying to browbeat Gary, and Gary just being immovable,” said Charles Bagli, a veteran real estate reporter who covered the saga for the Times.

Barnett downplayed the ransom he received.

“You think [the price] is high,” he told The Real Deal in 2014. “But it’s not high at all.”

The build

“I’m in the suck-up business to the Bank of China.”

That’s how Roth characterized his relationship to his favorite lender on a panel hosted by the China General Chamber of Commerce in 2015. The previous year, after flirting with a Qatari sovereign-wealth fund, Vornado had scored a $600 million loan from the Bank of China, giving it the funds to finally begin erecting its tower. The overall cost of capital on the $1.5 billion project, Roth said, was just 1.4 percent, far lower than his rivals paid.

“We had the ability to over-improve it, make it great, make it so that it really was at the tippy-top of the luxury market, and we did that,” Roth said. When Barnett, who was also on the panel, suggested that his upcoming Central Park Tower might be the better building, Roth said, “Don’t be jerky — it’s not even close.”

A few months after the event, Bank of China topped up the loan with a further $350 million.

Although 220 Central Park South was initially conceived as a glassy tower designed by Pelli Clarke Pelli, by late 2013 the developer had decided to go with Robert A.M. Stern, designer of the record-breaking 15 Central Park West, which the real estate blog Curbed immortalized as “the Limestone Jesus.”

Stern’s firm hewed closely to a proven formula that combined silvery Alabama limestone, set-back terraces and a fluted crown with ornamental cornices. With just 118 units, the development would comprise two structures: a 70-story tower and an 18-story “villa” annex facing Central Park.

Even by Billionaires’ Row standards, 220 Central Park South was a study in opulence. In late 2015, with the shell of the building rising nine stories, Roth disclosed that Vornado was spending an unheard-of $5,000 per square foot on construction: $1,500 for the land and $3,500 for hard, soft and financial costs.

“The building has the largest loss factor of any building of its type, intentionally,” Roth said, touting interiors by Thierry Despont and an amenity package that included multiple lobbies and a porte-cochère. When completed, the building would also have a wine cellar, juice bar, 82-foot saltwater pool, basketball court and golf simulator, as well as a private 54-seat restaurant operated by Jean-Georges Vongerichten.

“Leaving taste aside, you really can’t spend more,” said one rival luxury condo developer.

Even the building’s construction signage — with elegant silver lettering set on lush boxwood — replaced the industrial signs favored by rivals.

View this post on Instagram

Architecture nerds and skyscraper enthusiasts breathlessly chronicled every stage of development. In 2014, Curbed and New York YIMBY published unauthorized renderings of the building. “They were the most tight-lipped of any development site I’ve covered,” said Nikolai Fedak, founder of New York YIMBY.

The first official depiction of the building was revealed in the developer’s own full-page advertisement for the property in the 2016 Real Estate Board of New York gala handbook. That same year, a New Jersey teen broke into the construction site and captured footage of himself hanging from the scaffolding. It went viral.

But the allure was mostly lost on the workers toiling away at 220 Central Park South and its counterparts.

“I don’t give a rat’s ass,” one told TRD in 2015. “I’m glad they’re building stuff and I have a job,” said another.

The sell

In May 2015, Roth dropped a bombshell on an earnings call: Vornado had sold $1.1 billion worth of condos at 220 Central Park South — or one-third of the building — just six weeks after launching sales.

“Acceptance by brokers and buyers has been extraordinary and unprecedented,” he said.

One could be forgiven for asking: What launch? What brokers? What buyers?

Sales kickoffs for luxury condos are usually part debutante ball, part bar mitzvah, accompanied by PR blitzes that include a teaser website and videos, rendering reveals and parties with top-shelf Scotch, champagne and canapés. Developers often spend millions on the sales offices alone.

Vornado’s sales office was a simple room inside the REIT’s headquarters at 888 Seventh Avenue, complete with trappings such as a couch, table and computer screen.

“There’s never been something sold without being sold before,” said Anna Zarro, a new development consultant who was Extell’s sales director from 2016 to 2018.

The years of delays Vornado endured with tenants and Barnett proved serendipitous, as other projects with Central Park views worked the ultra-luxury market into a frenzy. Extell had launched One57 in 2011, with Macklowe Properties and CIM Group’s 432 Park Avenue debuting the following year. Billionaire Michael Dell inked a $100.5 million deal at One57, and when he closed on it at the end of 2014, the market took notice.

Vornado’s building was the next big thing, launching at the top of the market. It was quickly becoming the new nexus of wealth and power. For a time, though, that wasn’t clear.

By early 2016, Vornado stopped updating Wall Street on sales at the project for “competitive reasons,” leaving brokers and their buyers in the dark about what was available.

Savvy brokers and lawyers obtained floor plans and prices from the building’s offering plan, a kind of prospectus filed with the state’s attorney general. Real estate reporters, hunting for crumbs of information about the building, obtained the plan via the Freedom of Information Act. They trekked to the attorney general’s office at 120 Broadway and photocopied sections from the tome.

Initially, the plan listed 112 units ranging in price from $12 million to $60 million. Later, Vornado released the six priciest units for $100 million to $250 million.

“Given how hard it is to assemble that kind of real estate, these buildings are worth the money that’s being charged,” said JDS Development Group’s Michael Stern, who is finalizing a supertall condo nearby at 111 West 57th Street. “I get what goes into it.”

To sell the building, Roth turned to Corcoran Sunshine Marketing Group, Corcoran’s new development arm and successor to the eponymous marketing firm started by Louise Sunshine. The actual business of selling fell to Deborah Kern, a Brit who previously led sales at Harry Macklowe’s 737 Park Avenue. Her brand of outreach was akin to a discreet tap on the shoulder, mostly high-level phone calls placed to the kind of buyers Roth wanted.

Most brokers never saw the building’s sales office, where Roth would drop in to meet prospective buyers. Douglas Elliman’s Jacky Teplitzky said the Vornado chair grilled two of her clients, a couple, not just about their finances, but also their background and personalities.

“He [was] basically hand-picking the buyers in his building,” she said in 2016.

“The marketing strategy was Steve’s Rolodex,” noted a competing developer. “The bet was that he could curate a country club of like-minded people.”

The vetting process, part of the lore of New York’s toniest co-ops, was a first for a condo, but it made the building more desirable.

“Even if you had the money, it wasn’t guaranteed you could get a visit,” said Elliman’s Richard Steinberg.

Soon, the names of possible buyers trickled out, including Sting and his wife, Trudie Styler, and hedge funder Ken Griffin, who was rumored to be buying the top penthouse.

The vibe of Central Park South, with its horse carriages and hot dog vendors, wasn’t for everyone. R New York’s Jeffrey Fields had one client back out of his contract in favor of Zeckendorf’s 520 Park Avenue, a 35-unit building where prices started at $18 million.

“When you’re spending $60 to $70 million and you walk out on Central Park and it smells like horse shit, you wonder if it’s where you want to be,” Fields said.

Read more

Roth could afford a few naysayers. Demand was so intense that Vornado raised prices six times in the first year of sales, and a dozen times between 2015 and 2018.

A luxury broker put it this way: “You didn’t go there because of the deal you were getting. You went because you wanted to be part of the club.”

In October 2018, five years after breaking ground and 13 years after acquiring the site, Vornado sent out the first closing notices to buyers. Great Lawn Holdings, an anonymous LLC that paid $14.6 million for a three-bedroom, three-bathroom unit on the 24th floor, was the tower’s first closing.

The gravy

Rival developers kept close tabs on the building’s sales, hoping it would give a boost to their projects.

“Any success 220 had was a rising tide,” said Zarro, who led sales for Extell’s Central Park Tower, which has 20 condos priced at or above $60 million. “When you get into such a small market sector, you want to see wins even if they’re not directly yours, because they bode well.”

Once closings began, Roth’s hand-picked purchasers came to light. Many were wealthy domestic buyers, such as car dealer Michael Cantanucci, who shelled out $38.2 million for a duplex, and Harbor Freight Tools CEO Eric Smidt, who paid $61 million for a five-bedroom.

Some came from New York’s finance and real estate worlds, including Ofer Yardeni, CEO of Stonehenge NYC; Albert Behler, the CEO of Paramount Group, who paid $33.5 million for a 35th-floor unit; and Richard Leibovitch, founder of Arel Capital, who paid $26.2 million four floors down.

But the vast majority of buyers used LLCs that shielded their identity from the public, among them the acquirer of a $99.9 million duplex that sold for a stunning $12,164 per square foot.

Other big-ticket deals included Sting and Styler’s Villa penthouse, for which they paid $65.7 million, or $11,313 per square foot. Daniel Och, founder of Och-Ziff Capital Management, snapped up a 9,800-square-foot penthouse for $92.7 million, or $9,446 per square foot. Sting and Och previously bought condos at 15 Central Park West, which was “the first building that captured the imagination of the helicopter people,” said Michael Gross, whose “House of Outrageous Fortune” chronicled the record-breaking building. Vornado’s project continued the tradition, he said.

“These people don’t want to be on the board of the Met,” Gross said. “They want their own museums.”

The pièce de résistance came in January 2019, when Griffin closed on a 23,000-square-foot quadplex for nearly $240 million, shattering the record for America’s priciest residence. Though the price was untethered from the rest of the market, brokers were elated to see the long-rumored deal culminate.

Photo illustration of Ken Griffin (Getty, iStock)

The sale also stirred up class warfare in a city already marked by extreme wealth disparity.

State Sen. Brad Hoylman, a Manhattan Democrat, used the event to reintroduce a bill for a pied-à-terre tax on second homes.

“A $238 million purchase puts things in perspective,” Hoylman told the Times in February 2019. Mayor Bill de Blasio, who ascended to City Hall on a “tale of two cities” message, sided with Hoylman, as did City Council Speaker Corey Johnson. City Comptroller Scott Stringer estimated the second-home tax could generate $650 million annually to repair the city’s crumbling subways.

“It’s a rounding error for the people who own these expensive part-time apartments,” Stringer said at the time.

Developers and brokers saw the tax as an existential threat. In March 2019, William Zeckendorf headed to Albany with Patrick Jenkins, a lobbyist who was a college roommate of Assembly Speaker Carl Heastie. Zeckendorf cited his own analysis, which found that while a pied-à-terre tax might generate up to $370 million, that windfall could be dwarfed by the losses from wealthy out-of-towners leaving New York.

Roth, who had described New York’s loss of Amazon’s proposed HQ2 campus last year as “one of the stupidest damn things I’ve ever seen,” said the proposed pied-à-terre tax was almost as bad.

“Those who fan the fire of class warfare and those who tear down should be put on double secret probation,” he wrote in his 2019 letter to shareholders.

Meanwhile, his company kept cashing in. By July 2019, the developer said it had closed 38 units valued at $1.03 billion. That allowed it to repay Bank of China, so proceeds from remaining sales would flow directly “into our treasury,” Michael Franco, Vornado’s president, said during an earnings call.

By September of this year, Vornado had sold 95 units for $2.8 billion, and its net gain ticked past $1 billion.

That kind of success would normally breed several copycats. But there’s reason to believe that won’t happen.

For starters, Manhattan’s ultra-luxury market has withered since 2015 thanks to a supply glut and dearth of top-drawer buyers. There were just 139 luxury sales during the third quarter of 2020 compared to 366 in the same period in 2015, according to data from real estate appraisers Miller Samuel. The average discount, just 2.7 percent in 2015, rose to 12.1 percent this year.

And then there’s the matter of changing tastes at the top of the market, particularly given the pandemic.

“In the post-Covid world, the next supertall, uber-luxe condo is going to look like a suit with big shoulder pads,” said Gross.

JDS’ Stern noted another impediment: Land for towers adjacent to Central Park is all spoken for. Billionaires’ Row is all built up.

“We just lived through an era,” he said. “Make no mistake — these aren’t happening anytime soon. It was a small window.”

Write to Hiten Samtani at hs@therealdeal.com and E.B. Solomont at eb@therealdeal.com

Matthew Elo and Mary Diduch contributed research.