It’s been an unusual year for Miami real estate.

If the pandemic-era boom South Florida experienced was an all-night rager, this past year and a half has been one long hangover — with some bright spots. Major sales, including a slew of record-setters, meant a few top players had a good year.

Among the most notable: Jeff Bezos, the latest billionaire to come to town, paid $68 million for a teardown on Indian Creek this summer. Sohely Van Woerkom of Golden Ocean Luxury Real Estate, the only agent publicly involved in that sale, is an outsider to the usual cast of characters orbiting Miami’s ultra-luxury market, and it was her only on-market residential deal closed this year (she just missed the cutoff for the top 25).

Months later, Bezos paid $79 million for the adjacent home in a deal involving luxury broker Dina Goldentayer of Douglas Elliman and her colleague Danilo Tavares.

But the slowdown continues, forcing top brokers to hustle harder to maintain their status.

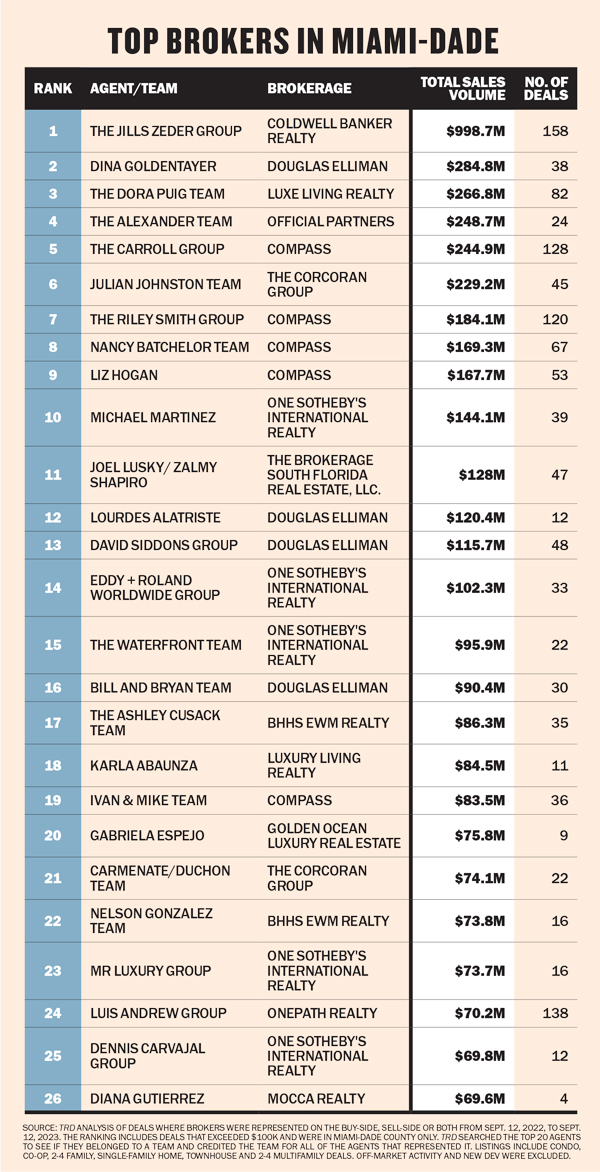

The top 25 agent teams in Miami-Dade County closed $4.3 billion in on-market sales in the 12-month period ending in mid-September, according to The Real Deal’s analysis. That number pales in comparison to the $6.7 billion in deals closed in a similar time frame last year. The series of interest rate hikes that started in 2022 has kept deal volume down.

Agents still speak of the pandemic peak with reverence.

“I’m really grateful that I was able to experience and live it,” said Luxe Living Realty broker Dora Puig. She is less rosy about the current market. “To get deals done now, it’s a journey. It’s a fight.”

Closed sales didn’t pick up until the summer, agents say.

“The type of action that we hoped to have last January, February, March didn’t come to fruition until June, July, August,” said Goldentayer, who came in second in TRD’s ranking of top agents with nearly $285 million in on-market sales for the 12 months.

Goldentayer said the past year’s market was “backwards.”

“It’s like a reverse season,” she added.

Oren Alexander, co-founder of the Side-backed firm Official and the Alexander Team, said buyer confidence picked up in the summer as buyers accepted that higher interest rates are here to stay.

“People had a better grasp on where they felt value is,” said Alexander, whose team was fourth in TRD’s ranking with nearly $250 million in closed on-market sales.

Puig, who ranked third with nearly $267 million in sales volume over the past year, pointed to the paradox of record sales closing against the backdrop of declining sales volume.

“The market’s a little nutty,” she said.

Buyer demands

Luxury buyers have more negotiating power, agents say. But most are only looking for new or renovated homes.

“I had a roster of like 36 buyers at one point,” said Compass agent Liz Hogan, ninth in this year’s ranking with nearly $168 million in closed on-market sales. “Right now, the buyers want [homes] that are absolutely, perfectly finished. Nobody wants to do work.”

Agents are encouraging sellers to make their properties more appealing, including staging homes.

“If it’s minor work that’s needed, go in and do that work, because they will get a premium if they do it,” Hogan said.

Coldwell Banker agent Judy Zeder, of the top-ranked Jills Zeder Group which had almost $1 billion in sales volume, said one challenge is that some sellers still believe in pandemic pricing.

But asking prices are coming down. Zeder represented the buyer who paid $36 million for a waterfront teardown in Coral Gables in August, which hit the market in 2022 for $45 million. Hogan had the listing.

“I always encourage sellers to be competitive,” said One Sotheby’s International Realty agent Michael Martinez, who closed $144 million in sales volume last year and landed in the 10th spot in TRD’s ranking. “I’ve turned away a good amount of listings when people are unrealistic.”

Agents are being more selective and having to work harder to close deals. Buyers with financing, once dismissed, are back in the mix.

“During the pandemic, if you came with a deal with conditional financing you got laughed at,” said Puig. “Today, everyone takes a deal with financing really seriously. It’s not a joke. It’s just a person buying a home with financing.”

Because demand, especially for single-family homes, is still high, agents are still working off-market as well. Alexander estimated off-market sales represent half of his business. Puig said she regularly goes off-market to find inventory.

Brokers are optimistic that the winter will be busy, given the uptick in sales this summer. Goldentayer said she has closed lease deals totaling more than $5 million over the past two months. Still, she said agents need to get realistic with pricing.

“To my colleagues: Stop taking overpriced listings with high days on market,” she said.