Compass is rising in Chicago’s residential real estate market, with only a homegrown powerhouse in between the New York-based brokerage and the top ranking in the Windy City.

But it still has a long way to go to take the crown from @properties Christie’s International Real Estate. The Chicago-born brokerage is now making a stronger push into luxury home sales with the benefit of nearly two years of experiments to ride the Christie’s brand to stronger ties in the high end of the market.

In an analysis that captures deals closed in Cook County from July 2022 to July 2023, The Real Deal found that Compass has gained a significant market share since the pre-pandemic days of 2019, when it was only the sixth biggest brokerage in the area.

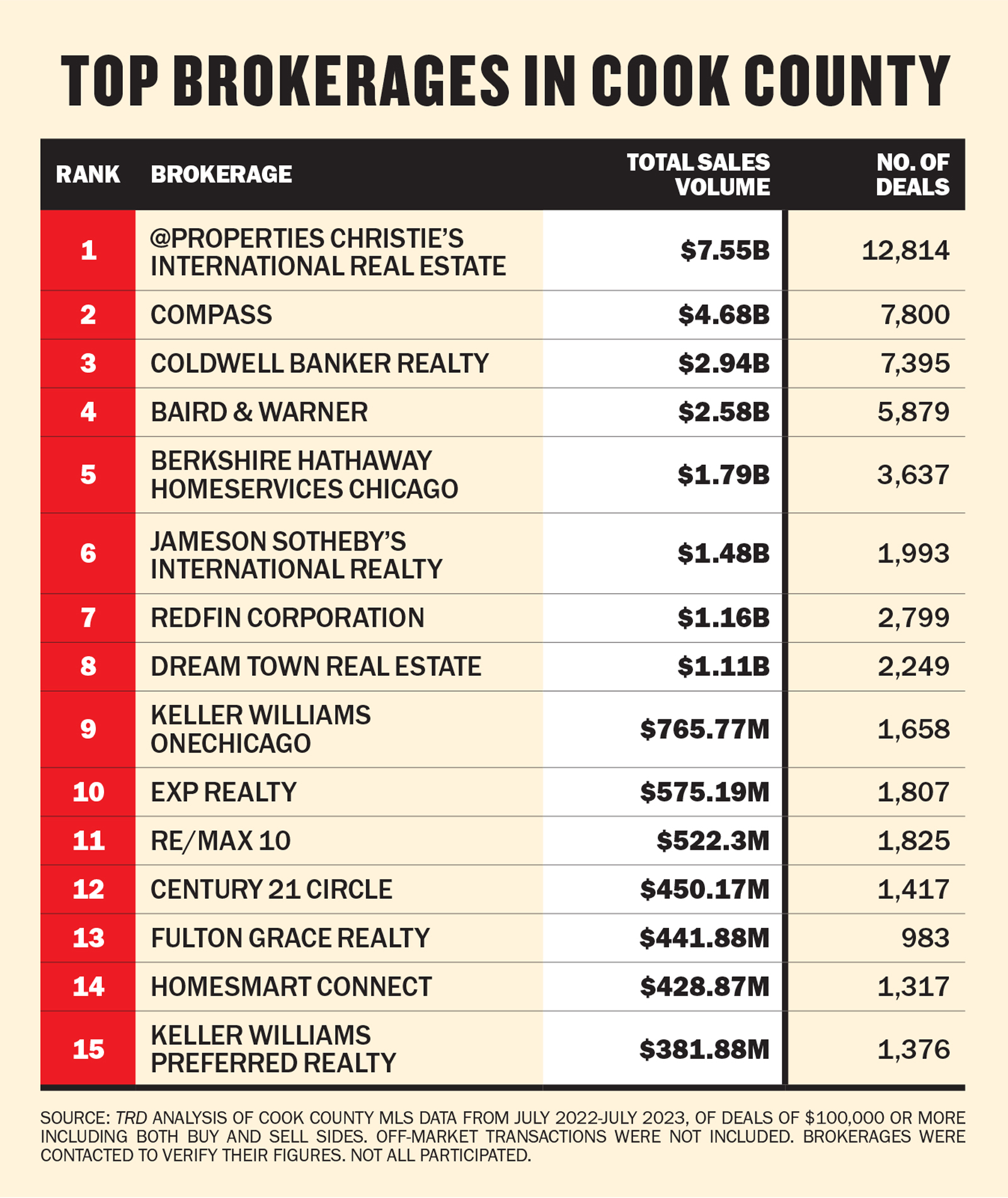

In a down year for residential real estate compared to the frenzy during the height of the health crisis, Compass came in second at nearly $4.7 billion in sales volume across 7,800 transactions, equating to 37 percent more volume than third-place Coldwell Banker, which previously ranked second.

Compass joined the Chicago market in 2017, and the firm has grown rapidly in the years since.

The analysis illustrates how quickly Compass has become a formidable challenger in Chicago, as well as the fact that @properties has an iron grip on the top spot, with its significant lead still remaining at more than $7.5 billion in sales volume and more than 5,000 additional transactions compared to its closest local competitor.

“We were on a very aggressive expansion plan in Chicago and to make sure we had the right footprint for Chicago, Chicago proper and the surrounding suburbs,” Compass regional vice president Fran Broude said. “And I think we accomplished that in a short period of time… We’ve been here less than six years, [and] going from the lowest, lowest brokerage and market share to number two is pretty remarkable.”

Altogether, the top 10 brokerage firms in Chicago did a total of more than $24 billion in sales volume during the yearlong period ending in July. The rankings measure both buy and sell side deals within the Cook County MLS and omit off-market transactions and non-residential deals.

Despite the down year, the market collectively outperformed the top 10 firms that made the cut for a 2019 TRD brokerage ranking of Cook County, when they pulled off a cumulative $22.7 billion in deals in the area. The fact that this year’s top 10 firms closed 8 percent more in volume within the county compared to four years ago — even though prices have surged at higher clips since then — illustrates the market slowdown caused by rising interest rates. Shifts in the lending markets have created mismatches between buyers and sellers as owners hold onto their homes and listing inventory remains muted, cutting into sales.

@properties co-founders Mike Golden and Thad Wong said that although the market has had its challenges, the brokerage was focused on growth, both in Chicago and of its Christie’s affiliates nationally and internationally.

“While the markets haven’t been great, we’ve continued to see market share growth in all the primary markets that we work in. We’re just continuing to focus, to help our core agents grow and continuing to look to add great new agents,” Golden said.

The company purchased the Christie’s brand in December 2021, and it’s been implementing its Pl@tform software across Christie’s affiliates. Much of the company’s growth has focused on improving its average home sale price — a target that requires beefing up its luxury market share.

“We’ve really focused a lot on pushing and growing into the luxury markets and using the strength of @properties brands throughout Chicago, the Chicagoland area, along with the strength of Christie’s to kind of put ourselves at a different level,” Golden said.

The company was concentrated on recruiting over the past year. In March, it implemented a 1 percent commission fee that went into effect in April. Golden said the fee wasn’t even a “speed bump” in the company’s recruiting efforts and that agents seemed to understand the need for more revenue to invest in technology.

“In a slowing market, the benefit of that is that you capture agents’ attention,” Wong said. “When you have a robust market, agents are so busy trying and working to thrive and generate the greatest outcome from an upward market. When the market slows, they can take a breath and they can focus on your business and how they service their clients.”

Compass’ Broude said the brokerage faced many of the same headwinds as other Chicago brokerages, but that it also zeroed in on recruiting as an opportunity of the slowing market.

“Challenges are challenges, but they will always bring opportunities to light for those who can embrace them,” she said. “We had a pretty good recruiting year. I don’t think I could ever say it’s enough recruiting, but we focus on good culture fits first and foremost and certainly productive agents, teams and or solo principals.”

The two brokerages were joined by Coldwell Banker Realty, Chicago-based Baird & Warner and Berkshire Hathaway HomeServices Chicago to round out the top five spots.

Both Compass and @properties said the firms’ plans for 2024 include boosting market share in and around Chicago.

“People are now becoming more selective when they’re looking for an agent, and a brokerage begins to play a significantly greater role in a slowing market,” Wong said. “That’s when we look to increase our market share, knowing that customers want to be aligned with the number one brokerage firm in a market.”