When Kurt Rappaport closed the sale of a Malibu estate to Jay-Z and Beyoncé for $200 million in May, the Los Angeles real estate business cheered a new record for the priciest home in California history.

Much of the rest of the past 12 months has been quiet by comparison. Rising interest rates, a statewide property insurance crisis and the local issue of the recently imposed ULA wealth transfer tax haven’t stopped the music in the luxury market, but they have slowed the tempo significantly.

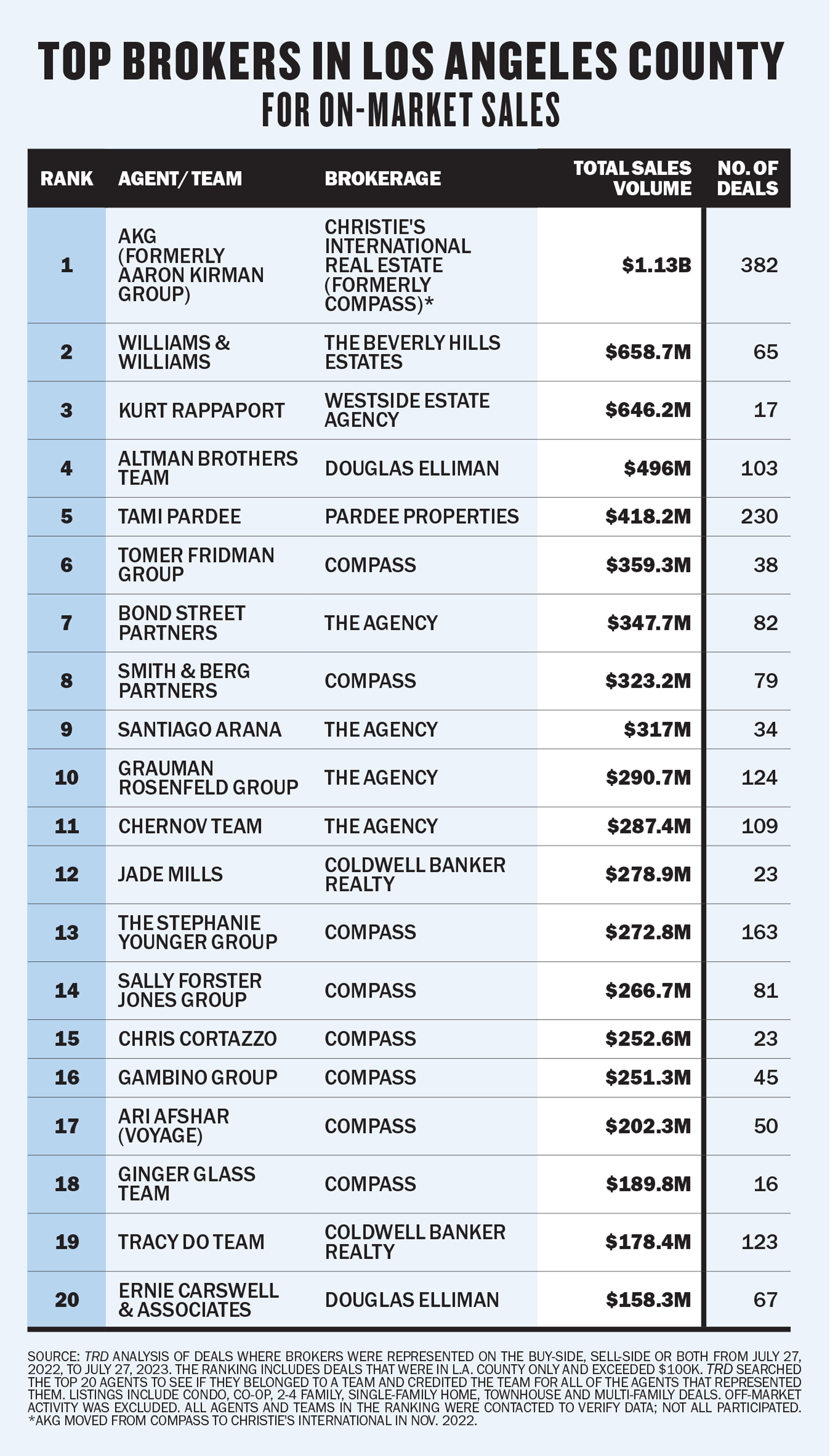

Even L.A.’s top agents couldn’t sidestep that trio of market pressures. Sales volume for the top 20 Los Angeles agents totaled $7.3 billion in the 12-month run from July 2022 to July 2023, according to a data analysis by The Real Deal. That’s down by more than 25 percent from the previous year.

TRD’s analysis is based on deals registered with the Multiple Listing Service in L.A. County, and excludes off-market deals.

The downward trend saw dips in both deals and prices.

Some managed better than others and kept the party going.

Aaron Kirman, founder of the new AKG team at Christie’s International Real Estate, led the rankings for a second year in a row.

One of his big deals during the past 12 months was the August sale of 1575 Capri Drive in Pacific Palisades for $27.5 million. While lucrative, there’s a big difference between that and his headline-making deals of 2022, such as the $141 million deal for the Bel Air megamansion dubbed The One, where he served as a co-listing agent.

“We as L.A. luxury agents have the biggest headwinds in the country,” Kirman said of navigating high interest rates and the ULA tax, which tacks a 4 percent tariff on deals between $5 million and $10 million and 5.5 percent on anything bigger.

“At the end of the day, nobody is really happy — agents are unhappy, principals are unhappy,” said Kirman, who doesn’t forecast a rebound until 2025. He believes eventually interest rates will come down and Measure ULA will be overturned by either the courts or the voters.

Husband-and-wife partners Branden and Rayni Williams, who ranked second, launched their brokerage The Beverly Hills Estates in 2020.

But the pickings were slimmer this year. One of their top deals over the past 12 months came on the sale of a $70 million house at 9137 Cordell Drive in Hollywood’s Bird Streets.

Rayni Williams conceded that 2023 has been a tougher year but called the market resilient.

“ULA put a damper on some deals. However, in keeping everything in perspective, we realized Los Angeles pays hefty taxes but it’s less than some other amazing places to live, like Europe,” she said.

Rappaport, co-founder of Westside Estate Agency, ranked third this year.

He said the Los Angeles real estate market is standing tall despite its clear challenges.

“It would be unfair to say that [the market] hasn’t changed,” he said. “The activity has changed, [but] it’s like when you go from a hurricane to a tropical storm. There’s still a lot of activity.”

Still, the slower market has forced top agents, such as Jon Grauman of the Grauman Rosenfeld Group at The Agency, to reevaluate the way they do business.

“You can’t force deals, especially in this market,” Grauman said. “I’m not trying to force deals or chase deals. I’m chasing relationships. I’m going back to the basics, and doing all things that I didn’t have time to do during the frenzied market during 2020 and 2021. I’m getting back in front of my clients.”

One of the Grauman Rosenfeld Group’s top trades of 2023 was a $14 million deal for 315 South Hudson Avenue in Hancock Park.

The co-founders of the Altman Brothers, who ranked fourth on this year’s rankings, took issue with rankings based solely on deal registered with the MLS.

“Relying solely on MLS-based data not only fails to adequately represent our business performance, it also demonstrates a very narrow perspective of the industry you cover,” Josh and Matt Altman said.

F. Ron Smith and David Berg of Smith & Berg Partners, affiliated with Compass, made a return to TRD’s top LA brokers list after finishing ninth in 2022. About 35 to 40 percent of their business involves homes priced under $5 million. Inventory is low, and well-priced homes in good condition sell quickly, according to Smith. “There’s more buyers — it’s still a sellers market,” he said.

The larger problem is the lack of listings leading to a dearth of deals.

“You got fewer properties — there are fewer transactions for the agent community as a whole,” Smith said.

Two new names made their way into the top 20 — Gambino Group and Ari Afshar of Voyage — both affiliated with Compass.

Perennial local powerhouse Jade Mills ranked 12th. When she started in real estate during the 1980s, interest rates were higher than they are now, and inventory was low.

“I’ve seen markets like this come and go,” Mills said. “People got used to high interest rates and continued to buy.”