For law firms executing real estate deals in New York City, there’s no escaping what’s turned into the most difficult market for investment and residential sales since the Great Recession.

The challenge real estate attorneys face is reflected in the data on different corners of real estate. Multifamily transaction volume in the city is down 48 percent. Manhattan office sales are on pace for $1.7 billion in 2023, which would be the lowest dollar amount in the sector since 2009. Depending on the borough and type of housing, residential sales are down anywhere from 9 percent to 63 percent.

And yet, scrappy law firms that have adjusted their business models — or were fortunate enough to have the right one in place already — have found a way to not only survive, but in some cases thrive in an environment where transaction volume is down across the board.

“If you look at the beginning of the year, there was a lot of shock,” said Stephen Rabinowitz of Greenberg Traurig, which finished 24th this year after finishing second last year. “We’re now past a shock. What we’re seeing now is a growing consensus on values. What keeps real estate in neutral is when there’s no consensus on values, when you have sellers who have an idea about what an asset is worth, and buyers who have a completely different idea.”

It’s not hard to pinpoint the sources of the trouble. Rapidly rising interest rates over the past year have chased banks and buyers out of the market. Alternative lenders have tried to fill the void left by retreating banks, but they simply don’t have pockets that deep.

“The overwhelming majority of our buyers right now are domestic. The reasons are myriad, including geopolitics.”

In the office sector, companies are reducing their footprint, causing occupancy rates to plummet, particularly in lower-class office buildings. Because it’s so difficult to sell these buildings or refinance them, many landlords are handing the keys back to their lenders.

Despite the office malaise, it was business as usual for some law firms. And business was … OK.

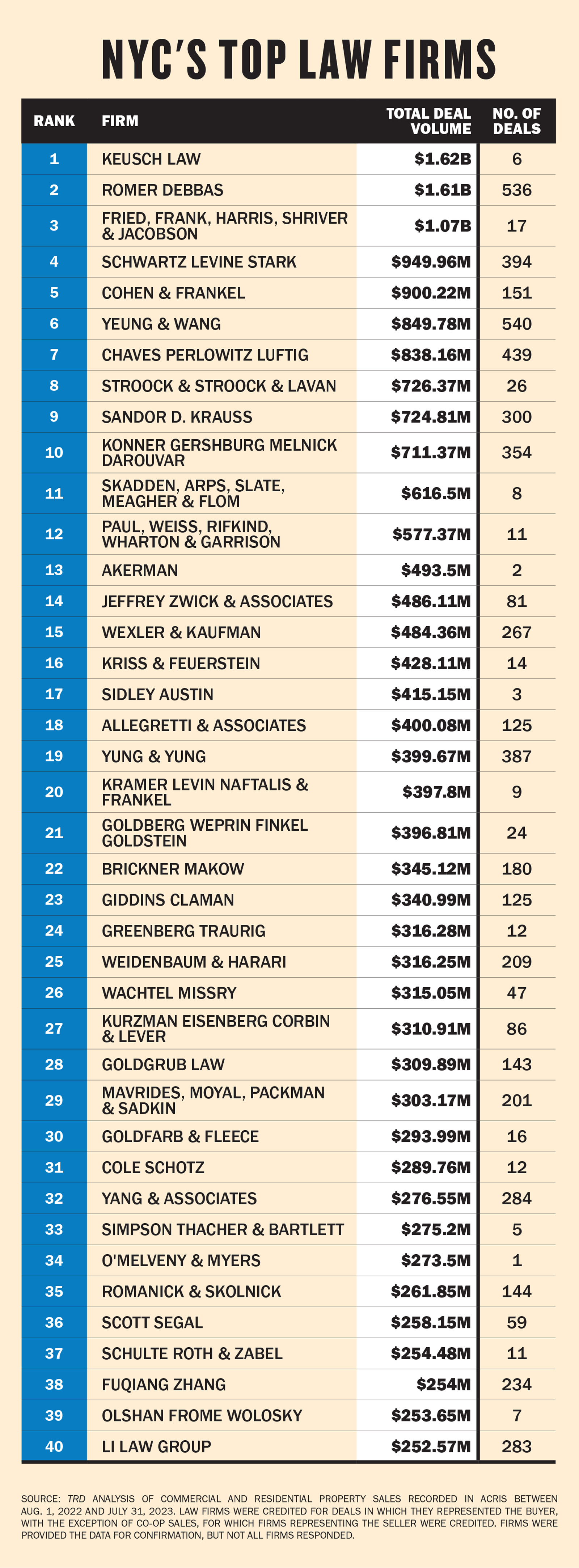

To put a number on it, TRD analyzed more than 42,000 transactions for commercial and residential properties in Manhattan, Brooklyn and Queens that were recorded in the city register between Aug. 1, 2022, and July 31, 2023. We then ranked the law firms in terms of dollar amount.

Going home

The data show that some of the money has stopped flowing. The top 20 law firms in the 2023 rankings tallied $14.7 billion over 3,670 transactions. While that’s by no means a small figure, it is a far cry from the tally in 2022, when the top 20 firms recorded $26 billion over 3,499 transactions.

The number of law firms that topped $1 billion in transaction volume has also dropped considerably. In 2022, nine firms generated more than $1 billion, including three that came in at more than $3 billion. This time around, only three law firms generated more than $1 billion, and top-ranked Keusch Law transacted just $1.6 billion.

There is one common thread among the law firms that were able to succeed: residential sales.

Romer Debbas, which ranks second after finishing fifth last year, estimates that 80 percent of its transactions were residential. Jeremy Wang of Yeung and Wang, which ranked sixth after finishing 14th last year, estimates a nearly identical figure.

While residential sales are also hampered by high interest rates, the sector has been propped up by cash buyers.

“We’ve seen an uptick in cash buyers that began around June and has consistently increased and reached a plateau in the past few weeks,” said Daniel Gershburg of Konner Gershburg Melnick and Darouvar, which ranks 10th this year after finishing 25th last year. “The overwhelming majority of our buyers right now are domestic. The reasons are myriad, including geopolitics.”

Going big

If Keusch Law seems like a curious firm to top the rankings, it might be because Keusch didn’t even rank in 2022. Even more curious is that the firm took the top spot on just six transactions. Five of the six were for $200 million or more.

The largest of those was the $220 million sale of a commercial property at 523 East 72nd Street and an apartment building at 530 East 73rd Street. Black Spruce paid $410 million to seller Solow Realty.

Romer Debbas, which executed 536 transactions for $1.6 billion, moved up three places in the rankings after finishing fifth last year. Fried, Frank, Harris, Shriver & Jacobson finished third with $1.07 billion on just 17 transactions. Schwartz Levine Stark ($950 million) finished fourth after finishing 11th last year. Cohen and Frankel ($900 million) finished fifth after finishing sixth last year.

The largest transaction of the year, meanwhile, went to Skadden, Arps, Slate, Meagher and Flom, which executed a $598 million swap of 125 Greenwich Street, a 273-unit, 88-story condo tower in the Financial District that is still under construction. Fortress Investment Group was the buyer. Construction resumed on the building in July after Fortress secured a $313 million construction loan from Northwind Group.

The outlook for law firms over the next year is the same as for everyone else in real estate. Not many law firms expect the Federal Reserve to cut rates in the near term, and if anything they expect rates to keep rising. Some speculated that the Fed could start cutting rates in the second half of 2024 at the earliest.

“New York City residential real estate has its highs and it has its leveling-out periods,” said Michael Romer of Romer Debbas. “But it’s very rare that the New York City residential market falls off a cliff.”