What a difference a year makes.

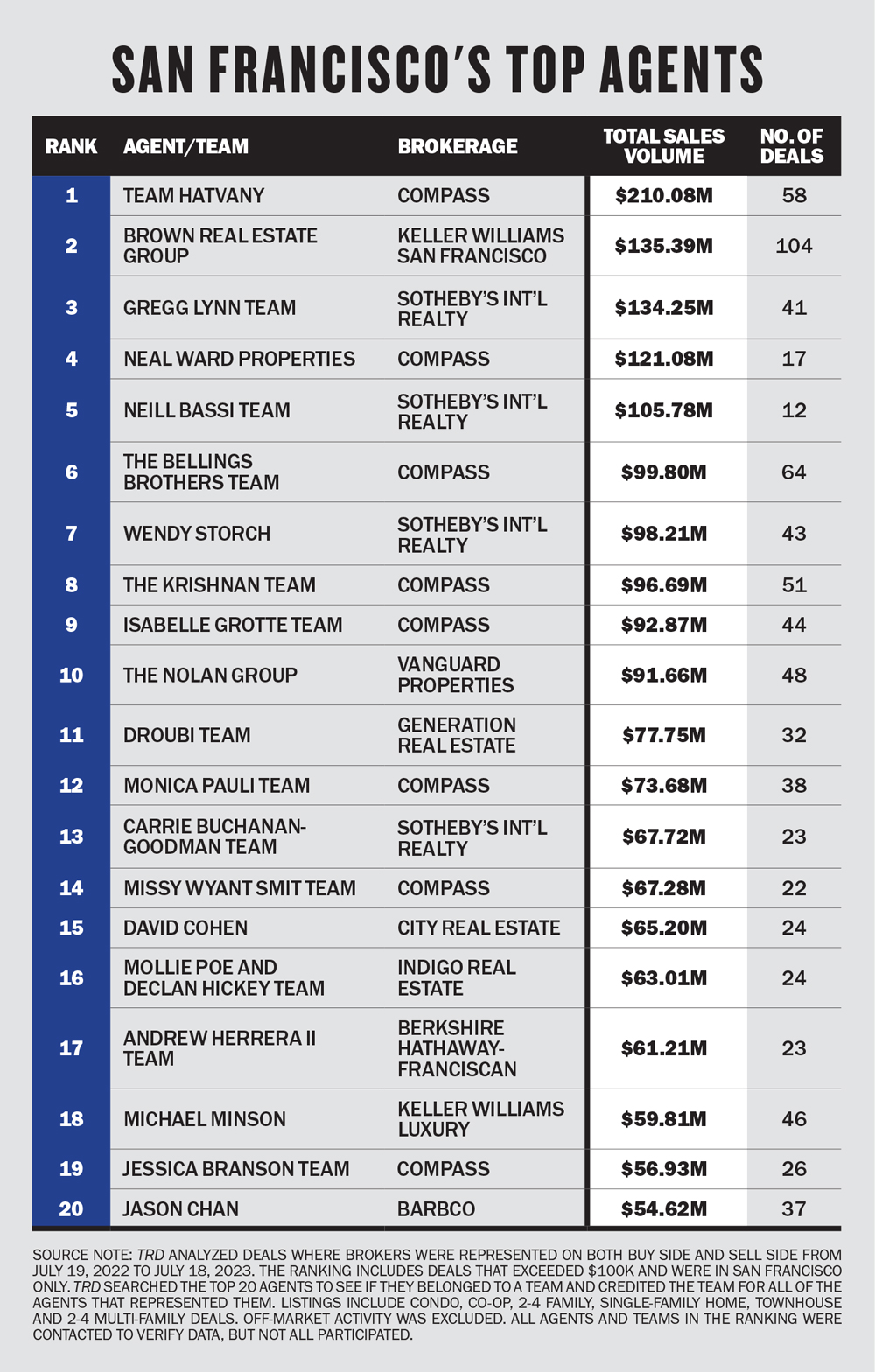

The top five San Francisco residential agents represented buyers and sellers on a combined $700 million in transactions between July 19, 2022, and July 18, 2023, less than half the $1.5 billion take from last year’s top five.

The steep drop off — little surprise given the past year of limited inventory, rising interest rates and San Francisco’s struggles with public order as well as public relations — is reflected in MLS data analysis by TRD.

Compass agent Nina Hatvany held onto her number-one spot with a sales volume of $210 million over 58 sales. That’s less than half of the $445 million and 128 sales that put her on the top of the 2021-2022 list.

If San Francisco’s biggest agent is seeing that kind of drop, what does it mean for the rest of the field?

“It tells me that every agent in San Francisco is experiencing low inventory, nervous buyers and reluctant sellers,” Hatvany said via email.

She’s had several sellers take their homes off the market in the past year rather than accept an offer below what they’d expected, she said, while others are holding off on listing altogether until perceptions turn after several years of cable outlets and social media casting San Francisco as the poster child of big-city problems.

“[Sellers] all consistently feel that things will get better, rates will go down, that the national press is unfairly targeting San Francisco and that if they wait a couple of years, they will not have to take the kind of discount they would have to take this year,” she said.

Hatvany’s four-person team, which consists of herself and her three children, handles both luxury properties and more entry-level clients. She said that the latter have been more active “by far,” in part because luxury clients’ purchases are typically more discretionary while “people in lower price ranges just want to find a nice place to live and are committed to living here for one reason or another,” be it schools, family or work.

The emphasis on entry-level sales may have given the Brown Real Estate group at Keller Williams its big lift in the rankings, which do not reflect off-market deals, transactions outside of the city, or residential building sales with more than four units. The team did not appear in last year’s top 20 but this year scored the second-highest on the list with $135 million in sales volume over 104 sales—an average price of about $1.3 million for the team led by tenancy-in-common specialist Tim Brown. Brown did not reply to a request for comment.

Gregg Lynn of Sotheby’s International Realty held on to the number-three position, with more than $134 million in sales volume and 41 sales. Neill Bassi, also of Sotheby’s, moved up from 16th last year to fifth this year, with $105 million in sales volume over just 12 deals — an average of nearly $9 million per sale. Both declined to comment.

Most of the other top teams also had a spot on last year’s list and, like Hatvany, appeared to be about half off last year’s figures, which covered sales between April 2021 and April 2022.

The latest rankings continue a roller-coaster ride for San Francisco’s agents. Last year’s data stopped just before a quick rise in interest rates led to a drop in volume and a price drop of about 20 percent below peak spring pricing. Prices, if not sales volume, have been heading back up again more recently, thanks to ultralow inventory, according to Compass data. All of that has made for some countervailing trends, with the lower sales volume accompanied by bidding wars sparked by a dearth of inventory (see related story, “Bidding Wars,” page 20).

Read more

Luxe in flux

Neal Ward of Compass, who was 12th on the list last year, jumped up to fourth place this year. He had only 17 sales, yet still managed to transact more than $121 million in sales volume between July 2022 and July 2023.

“2023 has been one of the most challenging of my career in that the luxury buyer, to a large extent, has been on the sidelines,” he said.

Ward called the lack of motivated luxury buyers “difficult to understand” because they are usually “very well-heeled financially” and therefore not as impacted by rising interest rates. They are also typically committed to living in their homes for five-plus years, often as their primary residence, and willing to take a long-term view that should look past the current downturn. But the lack of inventory that has helped to keep prices from sinking further may also be contributing to buyer malaise because there’s nothing new and exciting on the market, he said.

For buyers who are ready to move forward, there are some “extraordinarily good values out there right now,” Ward said. They have put forth offers so low that they might have been deemed insulting in the past, but it’s up to listing agents to “absorb offers in different ways,” he said.

“You have to remove the emotional element from the decision and help them look at the financial elements,” he said. “Do I sell this house now and bank X amount of money? Is that better for me to move on with my life right now versus holding out?”

He said that buyers’ restraint over the past year could lead to an uptick in interest in the fall, especially as “the vocabulary about what is going on here in our city is starting to ease up,” he said.

“Obviously, there are elements in the Bay Area that we wish the optics were better on, but we are a boom-and-bust city, and IT is going to fuel our city again in an extraordinary way,” he said.

Hatvany said that downtown is just one part of San Francisco, and that the north side — where most luxury listings are located — “continues to be a very favored part of town, while the condominium market South of Market continues to languish really significantly.”

Retail and restaurants outside the downtown core have largely recovered from the pandemic, she said, calling the ongoing “Doom Loop” narrative a “salacious media story promoted by those who are jealous” of San Francisco’s natural beauty and amenities.

“San Francisco certainly has its issues, but the fact remains that this is still a very nice place to live,” she said.