In February, Midtown suffered its slowest month of office leasing in nine months, prompting brokers to wonder whether the poor performance was the result of a pause before another rush of leasing, or a harbinger of anemic activity that will remain for months.

James Frederick, executive managing director at commercial services firm Cassidy Turley, predicted that activity would pick up in the coming months.

“Now, there is a little lull in closings. But there are lots of significant deals in negotiations. Expect this month and next month [to] pick up,” Frederick said.

However, Howard Nottingham, executive managing director at tenant representative firm Studley, sees the weak leasing results differently. Barring a rapid increase in employment in the city, he said he does not expect an uptick in the coming months to match the high levels seen at the end of last year.

Nottingham said the slow activity that the Manhattan leasing market saw in February and last month are going to continue for at least a few more months.

In Midtown, just 860,000 square feet of new leases were signed in February, the lowest number since May 2009, when 620,000 square feet were leased, CB Richard Ellis figures showed.

And for Manhattan overall, leasing activity was 1.5 million square feet, the lowest since October, when it was just over 1.4 million feet.

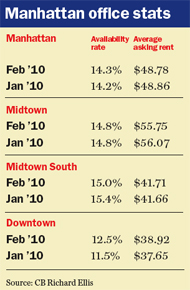

Average asking rents slipped by $0.08 to $48.78 in February from the prior month, and are off 32 percent from the high in July 2008 of $71.92 per square foot. The availability rate for Manhattan, which tracks space that is vacant or available within 12 months, rose by .1 point in February to 14.3 percent.

Cushman & Wakefield executive director David Rosenbloom said the dip in February was to be expected because leasing is traditionally slower that month. In fact, he said, the level of leasing in Manhattan for the month was on par with average activity over the past several years.

While brokers may disagree on the direction of the market, they generally still consider the landscape favorable for tenants. In fact, some landlords are still dangling extra giveaways to snag high-profile tenants — whom they hope will, in turn, lure in other tenants.

Michael Kaufman, a partner at the Kaufman Organization, which owns or manages about 5 million square feet of property in the metro area, said landlords are looking for tenants that can improve the cachet of a building.

“If you have a really, for lack of a [better word], ‘sexy’ tenant, someone that is very attractive to put in a building, you can use that almost as an advertising piece,” Kaufman said. “In this market, that is a big thing to get that type of tenant. It is exciting.”

Midtown

Market conditions weakened in Midtown as leasing velocity fell, and asking rents declined at their steepest rate in three months. The vacancy rate, however, remained stable.

The amount of new space leased in Manhattan’s largest market was only 860,000 square feet, 29 percent below the monthly average of 1.2 million square feet, CBRE reported.

The average asking rent in the market fell by $0.32, to $55.75 per square foot, down 36 percent from the June 2008 peak of $86.57 per square foot. The large asking rent decline in February was not attributed to a broad-based cut in pricing, but was instead attributed to several low-priced, large blocks of space coming on the market, including 184,000 square feet at the Empire State Building, CBRE said.

Average asking rents rose in some submarkets, including Sixth Avenue/Rockefeller Center, Park Avenue and Times Square/West Side.

Nottingham said some of the landlords who were raising prices would lose out on deals. There were two or three major landlords who have interpreted the rise in activity late last year as evidence they can raise prices and cut concessions, he said, though he declined to name them. He noted that he was working on behalf of a tenant who was seeking about 40,000 square feet in Midtown, and that one landlord he was negotiating against recently gave a final price that was 5 to 10 percent above the competition’s in a taking rent.

“A landlord raised prices, and we are just going on to the next [building],” he said. “They haven’t shown the flexibility to be competitive in the market.”

Midtown South

Midtown South showed the strongest fundamentals of the three Manhattan markets in February. The district had its highest level of leasing since November 2007, which helped push down the availability rate and nudge up average asking rents.

There was 410,000 square feet of new space leased, beating by 46 percent the five-year monthly average for the market of 280,000 square feet, CBRE reported.

The leasing gains were not broad-based, however. More than half of the new leasing came from just two deals — the City University of New York taking 137,000 square feet at 395 Hudson Street, and Horizon Media inking a deal for 115,000 square feet at 1 Hudson Square, CBRE said.

The high leasing numbers reduced the availability rate by .4 points to 15 percent in February, with the largest drop in Hudson Square, where it fell by 1.3 points to 20.6 percent, still the highest in the city. The average asking rent rose slightly, by $0.05 per foot to $41.71 per square foot, CBRE data showed.

Downtown

Conditions in the Downtown market weakened in February as it experienced its lowest level of leasing in five months and additional large blocks of space came on the market.

Even a strong rise in average asking rents, often seen as a signal of a recovering industry, was not described by market analysts as positive news.

Just 210,000 square feet of new office space was leased Downtown, which was 46 percent below the five-year moving average of 390,000 square feet, CBRE statistics showed.

The availability rate in the area rose by 1 point to 12.5 percent in part due to large new blocks of space put on the market by financial firms, including one space CBRE chairman of global brokerage Stephen Siegel had held out hope during a media briefing in January that the tenant might continue to occupy.

Siegel had said at the time, “I also believe with the exception of 85 Broad, Goldman Sachs will probably retain a lot more space than they were anticipated to — maybe One New York Plaza, etc.”

But in February, 733,000 square feet of former Goldman Sachs space at One New York Plaza and 30,000 square feet of American Express space at 3 World Financial Center were returned to the market, CBRE data showed. The Goldman move was part of its relocation to its new headquarter building at 200 West Street.

Although average asking rents jumped by $1.27 per square foot to $38.92 per foot, CBRE analysts cautioned that the increase was due to the addition of the One New York Plaza space, which was priced at $55 per foot, well above the average.