Those worried about chronically stalled luxury property sales at the high end of the Westchester residential market finally have a reason to exhale, thanks to Douglas Elliman’s second-quarter report.

In the single-family luxury market — made up of the top 10 percent of home sales — the median sale price increased 6.7 percent over the same quarter last year to $2.2 million, the report states. Luxury properties have seen three consecutive quarters of price gains, the report found.

The improvement at the high end reflects the overall health of the Westchester residential market, insiders say. The county saw the greatest number of second-quarter sales recorded since 1982, with 2,654 in total. The average sales price went up 2.1 percent year over year to $675,509, Elliman found. With the lowest second-quarter inventory in 14 years — 4,431 homes — listing discounts dipped to 2.1 percent, down from 2.9 percent in the same quarter last year.

While these numbers bode well for the market, those selling the homes haven’t had time to sit back and enjoy the sunnier conditions. Whether they’re courting potential sellers in low-inventory submarkets or chopping prices to land luxury buyers, brokers are pulling out all the stops to ensure that properties continue to move.

And it seems to be working. In the The Real Deal’s ranking of the most expensive Westchester sales in the 12-month period ending in May, prices are robust. The highest-priced home was 12 Parsonage Point Place in Rye, sold by Julia B. Fee Sotheby’s International Realty in June 2016 for $21.15 million.

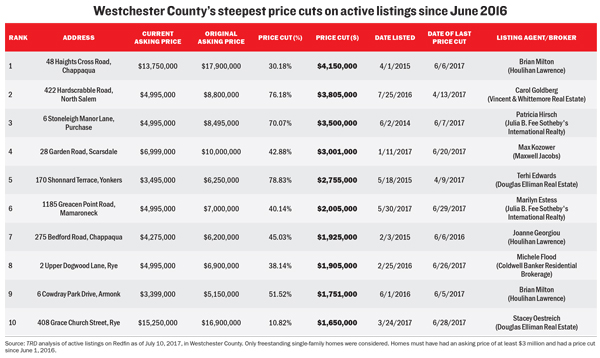

Of course, all this movement does come at a price. TRD’s ranking of active listings with the biggest price cuts indicates that brokers are slashing asking amounts by as much as nearly 80 percent in the hopes of luring luxury buyers.

Because many millennial families set their sights on homes priced at under $1 million in the communities closest to New York City, brokers who cater to the high end have to stay on their toes, investing heavily in advertising to catch the eyes of deep-pocketed buyers, who are harder to find.

“Buyers are looking for good value, particularly at the upper end of the luxury market, where we have a larger proportion of inventory,” said Jim Gricar, general sales manager for Houlihan Lawrence, headquartered in Rye Brook. “That proportion of inventory has increased relatively dramatically in the last couple of years.”

As of mid-July, there were 145 active listings priced at $4 million and above in the county, according to the MLS; 22 homes in that price point had sold in the year to date, with 17 in the “down county” area, with the easiest commute to Manhattan.

“[Brokers] are working very hard nowadays,” said Ghylaine Manning, owner and principal broker at Vincent & Whittemore Real Estate in Bedford. “It costs a lot of money for advertising. I don’t think the public recognizes or realizes what it costs both the agencies and the agents to run this business.”

Buyers who can afford to go after the priciest properties in Westchester are taking a “less is more” approach these days, posing a challenge to brokers hoping to sell bigger homes, said Louise Colonna, executive manager of sales for the Scarsdale office of Douglas Elliman, which also serves areas including Larchmont, Rye, Ardsley, Sleepy Hollow and Irvington.

“The McMansions are not what the millennials are looking for,” Colonna added. “They used to look for really huge mansions. I think they are really scaling down. [Even] if they can afford a $5 million or $6 million house, they may go for $3 million or $4 million. It still suits their needs. They have the mindset of being liquid and keeping the cash, because of where the market had been before and wanting to have that security.”

Some of those affluent buyers are gravitating to smart homes and green homes. “You’ll see younger buyers come in with the intention of harnessing the sun and converting to solar,” said Philip Faranda, broker and owner of J. Philip Real Estate in Briarcliff Manor.

To close more deals, brokers who have found potential buyers for higher-priced properties in hot communities like Rye — where eight homes on TRD’s list of priciest sales are located — are actively reaching out to find more sellers.

“Several of my agents have been very successful in sending postcards or mailers,” said Colonna. “A letter works perfectly if you have a specific buyer looking for an area.” Typically, such a letter might say, “We do have a buyer. If you’re interested and know someone interested in selling, please let us know,” said Colonna.

For all their hustle, brokers continue to be rewarded well. Commission splits remain healthy, by all accounts. Though brokerages can lower brokers’ commission splits at year end if they don’t hit their gross sales targets, both brokerage owners and brokers said this rarely happens in Westchester. Brokers’ commissions for multimillion-dollar sales can be substantial — generally 5 percent in Westchester, according to industry sources, but 4 percent in the most posh communities, like Rye.

“Our splits are quite competitive,” said Gricar. “That has remained steady.”

At Vincent & Whittemore, the picture is similar. “The agents have been very good about keeping their commissions where they are,” said Manning.

“Sometimes something happens and you see different cuts,” she said, but added, “On the whole, we have kept our commission splits where they are for a long time.”

“Sometimes something happens and you see different cuts,” she said, but added, “On the whole, we have kept our commission splits where they are for a long time.”

Meanwhile, area brokerages are stepping up other efforts to help their teams stay competitive. Houlihan Lawrence, for instance, recently expanded its executive team by promoting Anne Marie Gianutsos, who ran its digital and public-relations divisions, to chief marketing officer. Gianutsos will be developing the brokerage’s creative initiatives and making sure its messaging is aligned across all channels. The brokerage also hired former Coldwell Banker Chief Financial Officer Nicholas Fears as its CFO to enhance its financial reporting. These moves came in the wake of the firm’s acquisition by Warren Buffett’s Berkshire Hathaway HomeServices of America in January 2017.

Hot spots

Not surprisingly, the towns in Southern Westchester that offer a combination of well-regarded schools and an easy commute to New York City area are in demand.

“Larchmont is very hot,” with homes priced under $1 million getting multiple bids consistently, said Colonna of Douglas Elliman. “Pelham is right on the border of the Bronx and has an easy commute. Many people want that express train to New York versus a local stop.”

But once prices rise above $2.5 million in the river towns, she added, “you’re seeing more supply, and movement is not as quick.”

One town that is perennially in demand is Rye. “Rye has always been high-volume and high-activity,” said Nancy Neuman, senior managing director of the Rye office of Coldwell Banker.

With views of Long Island Sound and its own 2,000-square-foot guest house, the 12-room colonial at 2 Sackett Landing in Rye (No. 6 on The Real Deal’s list of priciest sales) underwent some price cuts in order to sell. At 6,736 square feet, the home was originally listed at $9.25 million in February 2016. Three months later, it was reduced to $8.95 million, and it finally sold for $7.75 million on March 15, 2017.

“When you have very high-priced houses, it takes much longer to sell,” Neuman said, adding that brokers often end up having to make price cuts.

And that is evident in The Real Deal’s ranking of active listings with the biggest price cuts, ranked by the largest dollar-amount reduction. The ranking includes only listings that were active on Redfin as of July 10 and had gotten a price cut since June 1, 2016.

At the top of the list is 48 Haights Cross Road in Chappaqua, listed by Brian Milton at Houlihan Lawrence. The 19,306-square-foot, six-bedroom home sitting on 86 acres was originally priced at $17.9 million on April 1, 2015 and got a 30 percent price chop down to $13.75 million by June 6, 2017.

The property with the second-biggest price cut was the 10,168-square-foot home on nearly 84 acres at 422 Hardscrabble Road in North Salem, represented by Carol Goldberg at Vincent & Whittemore Real Estate. First listed for $8.8 million on July 25, 2016, the property got a whopping 76 percent price cut, down to just over $4.99 million by April 13, 2017, and remained on the market as of press time.

Within Rye, the Indian Village neighborhood is popular with New York City transplants, according to Elizabeth Berg, a real estate salesperson in the Rye office of Houlihan Lawrence, who grew up in the area. “Clients coming from the city will want to remain close to town and Metro-North for their commute,” said Berg.

But many buyers prefer streets near the waterfront so that it’s easy to get to private clubs, said Berg. These clubs include American Yacht Club; Coveleigh Club, which has a private beach, swimming and tennis; and Shenorock Shore Club, which has a private beach, yachting and tennis. They’re on Stuyvesant Avenue, “a very prestigious road on the way to the clubs in Rye,” Berg said.

One recent sale in the neighborhood by a broker in Berg’s office at Houlihan Lawrence was 14 Phillips Lane, which is located near Stuyvesant in the coveted neighborhood near the country club scene. It was sold for $5.7 million in January in a deal that had it tied at No. 13 on TRD’s list of priciest sales.

With many millennial buyers looking for starter homes, places like Bronxville, Chappaqua and Mamaroneck, which offer single-family houses at a variety of price points, are also in demand.

Some buyers in such communities like the fact that they have a chance of avoiding the state’s 1 percent mansion tax, imposed at closings for homes above $1 million, Berg said.

But those areas are attracting buyers with deeper pockets, too. In Chappaqua, 47 Lawrence Farms Crossway, which sold in August 2016 for $5.7 million, tied with 14 Phillips Lane for 13th place on TRD’s list of priciest sales.

Faranda, whose base in Briarcliff Manor is west of Chappaqua, has found that relatively affordable parts of his area have a shortage of inventory. These include Hastings-on-Hudson, Dobbs Ferry and Irvington.

“It’s a frustrating experience when you have a buyer and two and three times in a row they find out that either something they were interested in is no longer available or something they placed a bid on has been outbid,” Faranda said.

Some buyers in Westchester want new construction, but it can be hard to find at the high end of the market and usually is available only when there is a teardown. “You don’t see too much new construction,” said James Renwick, president and principal broker at Renwick Sotheby’s International Realty in Bedford. “Land is expensive. There is not a lot of free land around.”

That’s not to mention the asking prices for new homes erected after teardowns, which are often beyond what buyers want to pay. “We have a lot of houses being torn down and rebuilt. The builders are pricing them a little too aggressively,” said Neuman.

As a result, most buyers are gravitating to older homes in pristine, move-in condition. “If they are coming with children, they can’t live through a total renovation,” said Colonna.

Dawn Dresher Knief, a licensed real estate salesperson at Julia B. Fee Sotheby’s International Realty in Scarsdale, closed the sale for 31 Whig Road in Scarsdale in June 2017 for more than $4 million. She credits the restoration job.

“It was a beautiful stone Tudor,” said Knief. “The inside was like a brand-new house. The buyers were people who really appreciated older homes and love what the client did. They were move-up buyers in Scarsdale.”

While Faranda is seeing some foreign investment — “There is a lot of wealth coming over from the Pacific Rim and China,” he notes — many purchasers of Westchester’s priciest homes already live in the area. Often, buyers who moved to the county from New York City trade up after four or five years, said Berg.

Currently, Berg has a listing at 555 Milton Road in Rye, close to the waterfront, for $1.35 million. The sellers are a couple who have been in the house for four years, and, with a growing family, want a roomier home within the community. “They’ve decided they want more amenities than they initially had,” she said.

Some buyers are looking to expand their real estate footprint in the county. That was the case when 750 Old Milton Road in Rye sold in June. The six-bedroom, nine-bath home, at 9,174 square feet, went for $6.93 million. The property was not included in TRD’s ranking, as it closed after the cut-off date.

“It was purchased by a neighbor,” said Colonna of Douglas Elliman. “She wanted the unobstructed view of the water. She bought it for extra land.”

—Harunobu Coryne provided research for this article