As 2011 draws to a close, real estate executives and brokers say it’s now clear that office tenants made faster leasing decisions this year than last. The coming off the fence was driven, professionals say, by the realization that the economy was not likely to experience any major changes — for better or worse — anytime soon.

Peter Braus, managing principal at commercial firm Lee & Associates, which last month announced an affiliation with Midtown-based Sierra Realty, said the mood in 2011 was a recognition that the economy was not going to turn around right away.

“[This year] has been more of a realization that the recessionary economy is here to stay — at least for the foreseeable future,” he said.

Peter Riguardi, president of the New York region for commercial firm Jones Lang LaSalle, said that translated into faster leasing this year.

“Tenants [seemed] to make decisions more quickly in 2011, with fewer hesitations, and were comfortable that the market was at a point where they could feel good about committing,” Riguardi said. He added that he did not expect much change before the elections next fall.

But those same challenging economic times led global commercial firm Cushman & Wakefield to cut back its expectations on rental growth for prime Midtown Class A office space, revealing that the international slowdown is expected to have an impact on leasing in the city.

Cushman figures from the third quarter — released in late October but not reported on until now — revealed that its analysts scaled back expectations for actual rental rates in Class A office space in Midtown.

In the optimism of the first months of the year, the firm’s researchers forecast that in 2015, the average taking rent in Midtown Class A properties would be $97.81 per square foot — far eclipsing the 2007 peak of about $80 per foot. But the firm has toned down its optimism dramatically, and now predicts a net effective rent in 2015 of $82.79 per foot.

Still, that forecast does represent an increase of 60 percent from the Class A taking rent in the third quarter (the most recent figures available) of $52.06 per square foot, Cushman figures show.

Despite the tempered optimism, the overall Manhattan leasing picture continued to improve, at least as seen in the monthly leasing statistics.

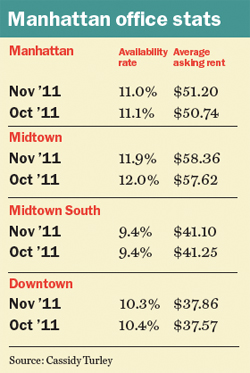

The availability rate — which measures space available for rent now or in the next 12 months — fell in November by 0.1 point, to 11 percent (down from 12.3 percent in November 2010), and the asking rent rose last month by $0.46 per square foot to $51.20 per foot, data from Cassidy Turley showed.

But not all tenants had the financial wherewithal to make a deal.

In fact, the current economic situation helped some and harmed others, depending on their financial footing, said Paul Wolf, copresident of the Manhattan-based firm Denham Wolf Real Estate Services, which focuses on nonprofits.

Those on solid footing took advantage of the relatively affordable rents.

“They were actually moving into new space and expanding,” Wolf said. Other firms, meanwhile, just struggled to hold on.

Midtown

The availability rate dropped in Midtown, but it may not stay that way for long. Indeed, several large projects are in the works that will deliver millions of square feet of office space in the coming years.

The Related Companies announced early last month that luxury leather company Coach will be the anchor office tenant, with 600,000 square feet, in a new 1.7 million-square-foot tower at the northwest corner of 10th Avenue and 30th Street, in the Hudson Yards area.

The supply of commercial space from such new buildings could push down asking rents in the city’s nearby modern but aging buildings, Braus said.

“This will put downward pressure in rents for older Class A properties that can’t compete with the bells and whistles of the new buildings,” he said.

Riguardi said that throughout 2011, tenants were seeking higher-quality space in greater volume than they were in 2010, and looking to take space on higher floors. He also noticed a change in the mix of tenants who were on the hunt, with a noticeable drop in financial services firms.

“The media, entertainment, legal and tech companies are leading the way and have led the way in 2011,” he said, speaking of the overall Manhattan market.

The availability rate in Midtown, meanwhile, barely budged — tightening by only 0.1 point to 11.9 percent in November, Cassidy Turley statistics showed. However, the average asking rent rose by $0.74 per foot to $58.36 per square foot, the figures revealed.

Robert Sammons, a vice president of research at Cassidy Turley, said much of the leasing activity this year appeared to be swapping space and right-sizing, instead of big moves.

“Rather than new deals or expansions, [it was] renewals, relocations and consolidations [that] have characterized deal flow,” Sammons said.

Midtown South

The story was a little different in Midtown South, the tightest of the city’s markets — which, unlike Midtown and Downtown, did not show any improvement over the prior month.

In Midtown South, the availability rate was flat in November at 9.4 percent, and asking rents fell slightly, by $0.15 per foot to $41.10 per foot, according to Cassidy Turley numbers.

But the market did tighten through 2011 and that was reflected, Sammons said, by the decline in the number of large blocks of space greater than 100,000 square feet in Midtown South (as was seen in Midtown, as well).

But smaller spaces continued to come on the market. For example, a pre-built space on the ninth floor of 599 Broadway, at the corner of Houston Street, better known as the home to retailer American Eagle Outfitters, was put on the market last month.

The 4,620-square-foot space, listed by Joseph Del Vecchio of ABC Properties, has an asking rent of $52 per square foot, information from the CoStar Group shows.

Downtown

There were few large leases inked last month in Downtown, a review of deals in the CoStar database revealed, even as the market continued to show signs of improvement.

Cassidy Turley figures showed the availability rate declining by 0.1 point to 10.3 percent and the average asking rent rising by $0.29 per foot to $37.86 per square foot.

Yet even as vacancy rates in the city are trending down, the weakness of the financial sector could spell trouble ahead. Lower Manhattan and Midtown are home to many of the city’s large financial firms.

“You can see some cracks opening up — significant layoffs in the banking sector that will inevitably lead to higher vacancy and sublet space coming to market,” Lee & Associates’ Braus said.

In addition, the largest deal last month was a relatively small one, for just over 50,000 square feet at 33 Whitehall Street. The tenant was an online advertising sales firm called Adprime Media, which was represented by the CBRE Group. The second largest deal was tenant Artnet Worldwide, a global art sales and research firm, taking 28,098 square feet at the Woolworth Building at 233 Broadway, data from CoStar shows.

The building’s owner, a partnership of Cammeby’s International and the Witkoff Group, was represented by the brokerage the Lawrence Group.

David Ofman, executive managing director of the Lawrence Group, said Downtown is attracting more creative tenants because “You can lease space in a nice building and still pay in the mid-$30s [per square foot],” he said.