Adam Hochfelder pulled up to The Real Deal’s New York office in his Bentley on a mission.

Prior to that Friday morning in June, the real estate investor and developer had been calling TRD’s publisher multiple times a day from a rotating cast of phone numbers, worried about reporting on his latest project.

Hochfelder — who went to prison in 2010 for bilking investors and lenders and was back in court on another fraud charge this March — was wearing a tailored suit with his hair slicked back. From his chauffeured car, he phoned again to ask whether the publisher could meet him immediately.

That day, Hochfelder claimed to have dirt on an editorial staffer: unsubstantiated allegations he said were provided by his sources. His threat: If TRD published “false claims” about him and one of his latest projects, an unnamed publication would run a story about the staffer.

Over a period of several weeks, Hochfelder sought to kill this story by threatening legal action and other consequences.

Since his release from prison in 2012, Hochfelder’s career has been marked by lawsuits, a criminal court appearance and multiple efforts to rebuild his reputation with real estate and nightclub ventures in the city.

Hochfelder’s threats came as TRD was investigating his latest hotel and entertainment project, involving the Playboy Club New York. When the pricey, members-only club opened last fall, it was the first time in years that Playboy Enterprises had licensed its iconic brand to a venue in the U.S.

But the timing was sensitive, as Playboy has been struggling for years to identify a business strategy that resonates with Americans following its heyday. Its New York location on West 42nd Street proved not to be the answer: Playboy cut ties with the club last month after a slew of issues with Hochfelder and his partners.

“What transpired with the New York club — both in concept and execution — was not what we had originally agreed upon,” Playboy’s CEO, Ben Kohn, said in a statement after his company terminated its licensing deal.

The Playboy Club’s debut in New York drew a decidedly mixed reception, coming on the heels of the #MeToo movement. But bad timing was far from the only problem.

Property and court records — including three lawsuits tied to the project — show a trail of unpaid bills that ran for two years and allegations of misused funds, “unconscionable fraud” and sexual harassment. Those claims, which have since been settled, were largely aimed at Hochfelder, the lead representative for one of the project’s owners, Merchants Hospitality.

The documents and interviews with many of the people involved provide an inside look at how the deal fell apart after Playboy lent its name to a precarious partnership that controls the club’s operations and underlying real estate.

Of the more than 30 people interviewed for this article over the past 10 months, many spoke on the condition of anonymity, citing confidentiality agreements or fear of being targeted by Hochfelder.

“I don’t want him fixating on me,” said one person with ties to the project about why anonymity seemed best.

Hochfelder, a 48-year-old father of two, later said his behavior in June was spurred on by TRD’s “crazy” questions about the project. “I was so nuts for that whole week,” he said, adding that he believes people were trying to damage his reputation under the cover of anonymity.

“Look, I made mistakes in the past. I’ll have to live with those mistakes,” Hochfelder said. “But unfortunately, sometimes people will use the past against me and there’s nothing I can do about it.”

A risky venture

Within the Playboy Club’s red, black and gold interior, vintage photos of the brand’s glory days were prominently displayed throughout the low-lit, windowless venue. The only other sights to speak of were women dressed in the classic bunny outfit and a massive, luminescent fish tank.

For Hochfelder and his firm, the project presented a chance to bring glory back to a fading gentlemen’s club scene and profit from a well-known brand.

Illustrations by Chris Koehler

The original vision for the site had been a chic restaurant and cocktail lounge patronized by an exclusive roster of members, according to Playboy executives. The company agreed to lend its trademark to what it believed would be a sophisticated dining concept — and its first club in the U.S. since its Palms Casino Resort nightclub in Paradise, Nevada, ended a six-year run in 2012.

When the Manhattan venue opened in September 2018, Playboy promised that it would not be “the sort of place where investment bankers hurl bottles of liquor at each other,” the New York Times reported.

One year later, however, police responded to an incident involving a large group of patrons throwing bottles during a fight in the back of the club. Two people sustained head wounds and one required stitches, according to the NYPD report. No arrests were made.

But behind the scenes, another struggle was unfolding — one that ended with Playboy’s exit. The club is now to become a steakhouse that hosts events booked by Live Nation, which has a month-to-month arrangement.

Merchants Hospitality, which owns and manages a handful of New York City restaurants and bars including Industry Kitchen and Treadwell Park, laid the groundwork for the project in 2016. And Hochfelder was running the show, he and other sources say.

Merchants’ founding partners, CEO Abraham Merchant and general counsel Richard Cohn, had hired Hochfelder during his prison stint to spearhead acquisitions and development for the firm.

Hochfelder was incarcerated after pleading guilty to 15 counts of grand larceny and three counts of scheming to defraud his uncle and in-laws, among others. He was charged with stealing more than $18 million and agreed to pay $9.5 million in restitution. When he was released from prison two years later, he went to work at Merchants’ office in Manhattan.

On the West 42nd Street project, Hochfelder brought in many of the parties and was an active presence at the club early on, according to several sources. Merchants and its partner Cachet Hotels & Resorts, which runs the project’s hotel, claimed in a press release this summer that they had put in $45 million in equity as of June 2019.

But accounts from people involved and several people who used to work at the club described a struggling business plagued by mismanagement and misconduct.

And a lawsuit by Cachet’s former CEO in October 2017 claimed three female Cachet employees accused Hochfelder of sexual harassment and gender discrimination. One of the women alleged that he made sexual overtures and grabbed her, according to a related document provided to TRD. Hochfelder, however, was not a party to the suit —which was later dismissed — and the claims in the suit went no further.

A group of Playboy Bunnies (Alamy Images)

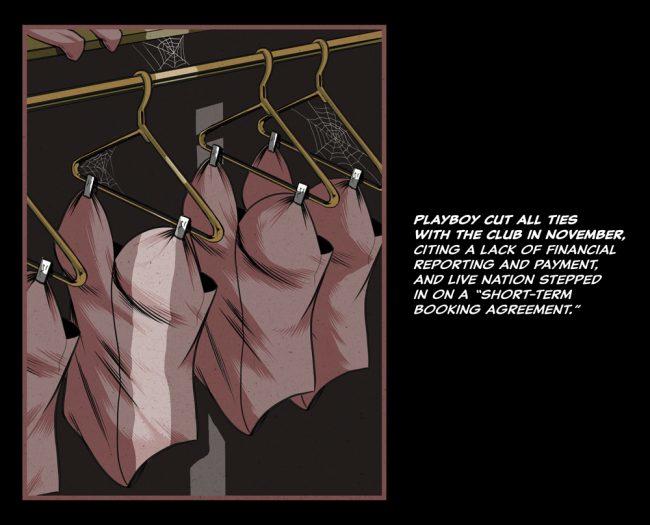

Separately, Playboy contends that Merchants failed to provide required financial reporting and payment for use of the company’s assets, resulting in breaches of contract.

A Merchants spokesperson denied any financial troubles and maintained the firm “needed” to end its relationship with Playboy to make way for its deal with Live Nation. “The club was successful, but Merchants expects the new programming to be more so,” the spokesperson said.

A spokesperson for Live Nation called the partnership a “short-term booking agreement.”

Tangled ties

Hochfelder’s behavior and criminal record were sources of tension for the project from the start, according to several people with direct ties to it. As the Playboy Club struggled to gain traction, Hochfelder was accused of overspending and fraud in court filings.

Mikhail Gurevich, a minority investor in the club and hotel, said that while his firm, Dominion Capital, was running its due diligence, “Adam’s history came up,” prompting pause.

But Hochfelder’s name was “not anywhere on the documents,” Gurevich claimed, so Dominion proceeded with the deal.

“What gave us comfort was the other two partners that were involved,” Gurevich said in an interview this March. He later got into a legal spat with Merchants and Cachet over what he alleged was the dilution of Dominion’s stake and a lack of financial reporting.

In court filings, Merchants denied sidelining Dominion and claimed it gave its partner necessary access to the project’s records. Merchants’ Cohn contended in a sworn affidavit that Gurevich had “adamantly refused” to invest $1 million more when the project faced a “shortfall” in the lead-up to the maturity date of a $30 million construction loan from hard-money lender Silver Arch Capital Partners.

Cohn attributed the shortfall to “various problems in construction, operation and management.” The club’s owners fronted $18 million, but it wasn’t enough.

“As expected, the Silver Arch Loan matured, and the Project defaulted on the loan,” Cohn wrote in the affidavit, noting that Merchants signed a forbearance agreement with the lender to stave off foreclosure while it sought to refinance.

Merchants told TRD that it paid off the Silver Arch loan in May, and Silver Arch confirmed it was no longer involved in the project. Merchants and Dominion settled in June.

Leon Katselnik of Katselnik & Katselnik Group, the project’s first general contractor, also had initial concerns about Hochfelder’s past. But he said he was touched by Hochfelder’s contrition and decided to take the job.

“He seemed like the biggest sweetheart,” said Katselnik, who had met Hochfelder through their kids’ activities.

Still, Katselnik took precautions. His contract with Merchants included a rider noting that only Merchant or Cohn could make financial decisions for the project. Hochfelder “wasn’t financially capable of hurting us,” Katselnik said. “He was the guy who was going to grow their hotel branch.”

The contractor ultimately sued, however, accusing Merchants of misusing its construction funds and “falsely representing” Hochfelder’s role in the project. K&K alleged that Hochfelder had been put in charge of approving spending and had “dramatically” increased costs. K&K and 15 of its subcontractors filed mechanic’s liens against the project, and the general contractor claimed it was owed $1.1 million.

Robert Roche (Alamy Images)

Merchants claimed construction payments stopped because of shoddy and untimely work and, in court filings, denied owing K&K money. That case also was settled in June.

As Hochfelder was battling the suits this year, he appeared in Manhattan Criminal Court on an unrelated charge of scheming to defraud people in three separate incidents, TRD reported at the time.

Hochfelder was charged with collecting money for Knicks season tickets that he never purchased, getting paid for a distressed Manhattan property that was never for sale and receiving money for a “pending order from a large fashion retailer” by his now-wife that was never made, court records show.

His attorney at the time, Marc Agnifilo, told the Daily News in late February that Hochfelder had borrowed money from acquaintances “under circumstances that were less than honest and then paid them back.”

Hochfelder pleaded guilty in March to a misdemeanor and was sentenced to a one-year conditional discharge. As part of the deal, he paid $1 million in restitution.

A familiar face

Hochfelder, a University of Pennsylvania Wharton School graduate, is one of just a few New York real estate players to serve prison time.

The Long Island native began his career in his 20s as a commercial broker at Newmark Knight Frank before teaming up with N. Richard Kalikow, chair and CEO of Gamma Real Estate, to launch their own company, Max Capital. Together, they traded Midtown properties, including the Helmsley Building.

Real estate attorney Robert Ivanhoe, of Greenberg Traurig, recalled that Hochfelder “came out of nowhere” and was suddenly “doing billion-dollar deals with major counterparties.”

But after Hochfelder bought Kalikow out of Max Capital, things went off the rails. In court, Hochfelder’s attorneys claimed a combination of financial strain and rampant cocaine addiction led him to forge documents and steal money from banks, investors, family and friends, according to reports at the time. TRD and DNAinfo stories from 2010 also cite a bipolar disorder that led Hochfelder to defraud. A spokesperson for Merchants disputed the accuracy of those accounts.

After serving two years in Manhattan’s Lincoln Correctional Facility, Hochfelder walked out in late 2012 with a job offer in hand and a Downtown corner office awaiting him, courtesy of Merchants.

As news of Hochfelder’s return traveled, “a lot of people commented to me at the time that it seemed like a risk,” Ivanhoe recalled.

“Some people love a redemption story and some people don’t care,” said Ivanhoe, who along with several others had asked the judge in writing to give Hochfelder a lenient sentence, calling him “a changed person.”

The veteran attorney said he’s only spoken to Hochfelder once since his release, when Hochfelder called him for help retaining counsel from Greenberg Traurig. “He was very nice and very friendly,” the attorney recalled, noting that “hopefully he’s learned his lesson and he’ll stay more in the straight and narrow.”

Hochfelder told TRD that many of his professional connections predating his felony endure to this day.

“The mistakes I made were personal in nature,” he said.

A battered brand

Hochfelder isn’t the only one trying to move beyond a troubled past.

Playboy is looking to recast itself as a modern lifestyle brand for a wider audience. This spring, the company relaunched its magazine under editors with burnished feminist credentials and rolled out an events series with such speakers as Roxane Gay, author of the bestseller “Bad Feminist.”

Playboy has been aiming to regain its clout from decades ago — minus the misogyny and other problems that came to define it. At its peak in the 1970s, its magazine was read by millions and membership in its clubs were a status symbol. In 1971, the company went public at $23.50 a share.

Four decades later, its founder, Hugh Hefner, and the private equity firm Rizvi Traverse Management took Playboy private in a buyout deal that diminished Hefner’s personal fortune. He paid $6.15 a share to minority shareholders in 2011, and the company sought to reinvent itself. Hefner died at his Los Angeles home in September 2017 at age 91.

Playboy briefly stopped publishing nude photos, and licensing became its main business. It also dropped U.S. club branding deals in favor of more lucrative overseas projects. Asia emerged as its biggest market.

But in 2016, Playboy was reportedly looking to sell for $500 million and, though no deal was reached, a series of other changes occurred: Kohn, Rizvi’s managing partner, took over as CEO, and Hefner’s then 24-year-old son, Cooper, became chief creative officer.

Later that year, the company inked a licensing agreement for what would become the Playboy Club New York. Its opening event featured singer Robin Thicke performing “Blurred Lines.” Critics called it tone-deaf.

Six months later, programming had been transformed. Nights at the club included spoken-word performances, magic shows, a fundraiser for a dog-rescue nonprofit and panel discussions about blockchain. One chilly evening in February, Cooper even hosted an “exclusive backgammon night” that was also open to the public and coincided with a summit of Playboy’s global licensees.

But several insiders said the change was too little, too late and didn’t address the real problem — lack of cash. (Hefner’s son, who could not be reached, left Playboy a few months later to launch a news and adult-content website.)

Illustrations by Chris Koehler

“Cooper Hefner hosting a backgammon night on a Tuesday … What are they going to do, play Clue on Wednesday?” said one person who was previously involved in the project. “You can’t make money in this industry doing things like that.”

Several people with access to the club’s records said complimentary memberships far outweighed paid ones. One insider counted 41 paying members out of 267 on a July 2019 list provided to TRD and corroborated by two other sources. Merchants declined to comment on membership numbers.

Two former Playboy Bunnies and other club employees said scant tips and wages routinely came up at staff meetings, as the venue was sparsely attended and patrons who did show were often not charged.

The exclusive, members-only concept soon faded as the club’s management upped the mix of events and eventually opened a more traditional nightclub in one part of the venue, according to sources who previously worked there.

Playboy said its involvement had been limited to ensuring its brand standards were adhered to and, in rare cases, recommending collaborations.

“This situation was an anomaly,” said Jared Dougherty, head of Playboy Licensing. The company — which claims its licensed products and services do $3 billion in consumer sales — has hundreds of partnerships globally, and branded hospitality projects will be “a big part of our future,” he added.

Ambitious plans

For Merchants, the Playboy Club was a key part of a bigger play.

In July 2016, the company signed a $40 million contract to buy the leasehold of Ian Reisner’s gay-themed OUT Hotel and reposition the property, according to reports. Hotelier Richard Born, who owns the land, said Merchants and its partners pay their rent, but declined to comment further.

Chicago-born entrepreneur Robert Roche, who runs Asia-based hotel management company Cachet, became an equity partner in the project. The owners landed the $30 million construction loan from Silver Arch in spring 2017.

Accounts differ on how Playboy got involved. Hochfelder attributed it to his personal connections. Playboy said it had signed a licensing agreement with Cachet for a Shanghai club and had no knowledge of Merchants or Hochfelder until Cachet asked to move the club to New York.

“We only met Adam well after the licensing agreement was signed,” said Kohn.

The location change would allow Cachet to promote the U.S. venue in Asia, according to several sources. Playboy agreed to play along, so Roche introduced the entertainment company to Merchants, the sources said.

Playboy executives visited the real estate firm’s other New York restaurants and decided to move forward, but soon had misgivings about the project.

With Playboy on board, Merchants began to tout the West 42nd Street venue’s ties to the famed brand. Sources said their target was at least $12 million in annual revenue.

By comparison, chef Daniel Rose and restaurateur Stephen Starr’s French restaurant and lounge Le Coucou reported $13 million in revenue last year, while Mario Batali’s now-shuttered La Sirena reported $16 million, according to Restaurant Business’ annual survey.

Reisner joked that his former asset went “from dicks to chicks,” but expressed confidence in Merchants. “They’re good people,” he told TRD in July. “They get stuff done.”

Others, however, thought the idea was flawed from the outset. Hospitality consultant Stanley Turkel called it “old-fashioned and antiquated,” and several former employees said the venue was frequently mistaken for a strip club.

“Originally it was supposed to be this very high-end, private club,” said Scott Gerber of Gerber Group, which owns and operates restaurants and cocktail bars in several cities. “I don’t think they got very many takers on that.”

Gerber wasn’t involved in the deal and hasn’t visited the Playboy Club, but said he knew several people who worked there when it opened. “I never understood it from the beginning — why they were doing it or who thought it was going to have legs,” he said. The idea of dressing women in Bunny costumes, he added, “just doesn’t feel right.”

Even Reisner, who said he liked the concept, conceded that “the #MeToo movement hit them in the head.”

“It’s on Adam”

Behind closed doors, more than a half dozen people involved in the project said trouble was brewing nearly a year before the club’s debut.

The first legal fight came in late 2017 when Cachet’s former CEO, Alexander Mirza, sued his former employer. Mirza claimed he was wrongfully fired for trying to investigate the accusations of sexual harassment and gender discrimination made against Hochfelder that summer. Cachet counterclaimed, alleging Mirza was let go for breaching his fiduciary and contractual duties. The parties later settled and there are no outstanding claims of misconduct or breach of fiduciary duties against Mirza.

Mirza said in his complaint that he learned of the women’s accusations that summer and informed a human resources adviser, who began an investigation. Mirza claimed Roche attempted to intervene. The adviser protested and ultimately resigned over the alleged interference, according to emails included in the court filing.

An external workplace investigator hired by Cachet later “exonerated” Hochfelder and reported that one woman’s claims were falsified to “direct attention away from her own incompetence,” according to a confidential document prepared by the company. The claims from the other two women were not addressed in that document, and the suit in which those allegations were made was dismissed in February.

Mirza declined to comment. A lawyer for Cachet said in an email that the company highly values its relationship with Hochfelder and Merchants, but would not comment further.

Other disputes quickly piled up, including the legal actions from minority partner Dominion and general contractor K&K and a handful of liens filed by other contractors citing lack of payment.

Then in June, seemingly out of the blue, Merchants settled all pending litigation and closed on a $42 million loan from hedge fund Taconic Capital Advisors to refinance the project. At the same time, Merchants announced it would construct a giant billboard and observation deck at the property.

In an effort to show that his firm’s legal problems were over, Hochfelder arranged a three-way call in June with Leon Katselnik’s father, Arkadi, and this reporter.

“Everything is under the bridge,” the senior Katselnik maintained during the call. “Leave Adam Hochfelder alone. He’s a nice man … All right? Thank you.”

Several people familiar with the matter, however, say Cachet’s Roche has taken a more dominant role in the club’s day-to-day operations. On the Taconic loan documents, a company tied to Roche, rather than Merchants, is listed as the point of contact.

One contractor who said he had prior payment issues with Merchants recalled a running joke about Hochfelder on the jobsite. Once the club opened, he said, construction workers would come in to order drinks and food, rack up a bill and say, “It’s on Adam.”

Merchants denied that its role has been reduced and claimed to be “even more active at the property now than it was last year.”

Illustration by Chris Koehler

Standard fare?

For Playboy, the two-year saga has been a harsh lesson about control. And it’s not over. As of Nov. 21, a source familiar with the matter said Merchants was still using the company’s branding at the club.

Playboy said in a statement that it’s monitoring the situation and “looking at all our options, including legal action.”

As for the relationship between Roche and Merchants, Hochfelder denied the project’s legal tangles caused any strain, suggesting it was not unusual in his industry.

“Hotels average five to seven disputes,” he said. “That’s just what happens when you develop something. It doesn’t have to mean that it’s a fight … you’re just working through things.”

Real estate attorney Todd Soloway, who runs the hospitality group at Pryor Cashman, called that portrayal “somewhat far-fetched,” and Dominion’s Gurevich said the problem was Hochfelder — not the industry in general.

“He gets involved with people and, for one reason or another, lawyers get involved and the court system gets involved,” the investor said. “That’s the byproduct of being in business with Adam.”

Correction: An earlier version of the story incorrectly stated that Cachet Hotels & Resorts was an equity partner in the project. In fact, Robert Roche, who owns Cachet, became an equity partner, not his hotel management company. The terms of a settlement between Cachet and its former CEO Alexander Mirza was also clarified to note that there are no outstanding claims of misconduct or breach of fiduciary duties against Mirza.