Trending

Deciphering the census

A flood of numbers, but what do they mean for real estate?

New York City never stops changing, and the newest census proves it. Two months ago, the Census Bureau released a batch of data from the American Community Survey. Later this year, more data from the 2010 census will be released, covering everything from population density to demographic shifts. Public officials regularly talk about the political repercussions of census numbers, but what about real estate? After all, statistics covering 2006 to 2009 reflect not only the changing population, but also the effects of the recession, the housing boom and even the baby boom.

Here is what the census says about the future of New York real estate.

Women run this city

Women, who are said to make the majority of housing decisions, still outnumber men in New York. In 2009, women made up 52 percent of the city’s population. Robert Jacobson, senior innovation consultant at GEMBA Innovation A/S, a Denmark-based consulting company, found in his research that women make 80 percent of purchasing decisions. “Given that the ratio of women to men is even larger, sellers have no choice but to pitch to women — and they’d better be ready for piercing questions and shrewd bargaining,” Jacobson said.

Here come the boomers

New York City is getting older. Each year between 2006 and 2009, people from ages 60 to 64 made up an even greater share of the population, growing from 4.3 percent in 2006 to 5 percent in 2009. According to Jonathan Miller, president and CEO of appraisal firm Miller Samuel, the aging baby boomers are deciding to move to the city after retirement instead of the traditional spots in Florida or Arizona. For the first time in decades, he said, there was a decrease in relocation from the Northeast area to Florida. “We’ll most likely be seeing developers adapt more to the demographic shift that is already happening,” Miller said. “The direction it seems to be going is more pragmatism in the amenities, and whatever form that takes will definitely be tapping into the aging baby-boomer population.”

Brokers, learn about the arts!

Education and the arts grabbed a bigger share of the job market in recent years. While education increased its share by almost 2 percent between 2006 and 2009, the finance industry had an overall decrease of 0.4 percent. Frances Katzen, managing director at Prudential Douglas Elliman, said the shifting employment from finance and technology to arts and education will have a big impact on real estate. New York City residents who are in the arts and education industries and not necessarily wealthy, she said, were priced out of homeownership in the past. “But with the current market, they can manage 35 percent down and pay an interest rate that is affordable.”

Kids, sure, but not everywhere

The number of households with children under the age of 18 has decreased slightly as a percentage. Katzen, though, said she doesn’t see this as a negative for real estate. The market in Williamsburg, on the other hand, reflects the opposite of the census results, according to Lior Barak, senior vice president and associate broker at the Corcoran Group. Barak, who works primarily in Williamsburg, said he mostly sells to new families who have children or are expecting children. “A few years ago nobody had kids there — it was very single-minded young people — and now they all grew up, and started having kids,” he said.

The race for boom-era homes

Could “boom-time new construction” be the next prewar? According to the Department of City Planning, 96,807 new dwelling units were completed in New York City from 2006 to 2009. In the first 11 months of last year, first-time filings for new building permits totaled 1,357, according to PropertyShark, a 78 percent decrease compared to the same period in 2005. The sharp decline in new developments will likely increase demand for those boom-era units, particularly given the city’s growing population. “While demand for new construction declined along with the rest of the market after the collapse of Lehman Brothers, it has been recovering nicely over the past several months,” said Gregory Heym, the chief economist for Halstead Property and Brown Harris Stevens. “With very little new construction planned over the next few years, demand for these units should remain strong.”

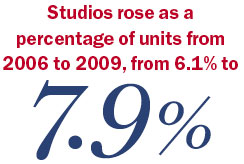

Don’t count out studios just yet

Census figures show that studios rose as a percentage of city homes from 2006 to 2009, increasing from 6.1 to 7.9 percent. While studios are not as common as one-, two- or three-bedroom apartments, they saw the biggest growth over the four years, and the number of one- and two-bedroom units actually decreased as a percentage of homes over that length of time. “Studios are the first home purchase for many in the city, and they benefited greatly from the first-time homebuyers’ credit,” Heym said. “As employment in the city continues to rise gradually, we should see continued demand for smaller apartments.”

All-cash homes

The number of housing units without a mortgage went up and then down slightly in the five boroughs, yet still increased as a whole over the four-year data span. In 2009, owner-occupied housing totaled just over 1 million in New York City, and 36 percent of those units did not have a mortgage. Heym attributed the high percentage of no-mortgage apartments in New York City, and particularly Manhattan, to the large number of co-ops. “This type of apartment, which you really don’t find anywhere else in the U.S., usually requires a larger down payment due to co-op board requirements,” Heym said. “Some co-ops in Manhattan even require that buyers use all cash when purchasing an apartment.”

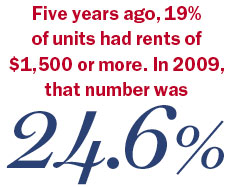

The rent is indeed ‘too damn high’

Rents declined during the recession, but the cost of housing steadily increased from 2006 to 2009, census numbers show. Five years ago, 19 percent of units had a gross rent of $1,500 or more, and the number climbed to 24.6 percent in 2009. Ryan Severino, a senior economist at Reis, said these increases are a familiar function of supply and demand. “How much are people willing to pay relative to what is available to rent, given income levels, inflation, etc.?” he said. “In New York, clearly over time, people are willing to pay quite a bit of money to rent an apartment.” The residential rental vacancy rate went down and then back up between 2006 and 2009, ending at 3.8 percent. It then dropped significantly in 2010, according to Severino. “What we are seeing is a trend of increasing demand, relatively limited supply, vacancy declines and rental increases. That dynamic should persist in 2011,” he said.