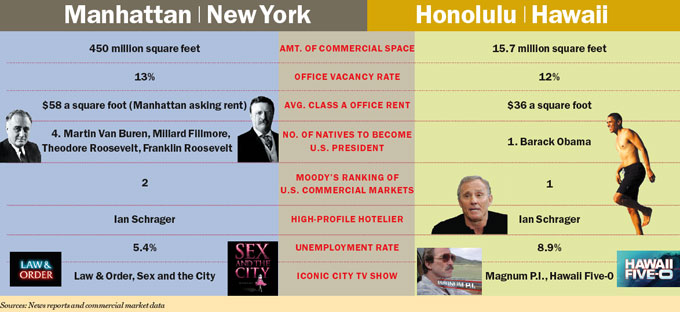

For those New York real estate professionals suffering from seasonal affective disorder, here is this month’s most unwanted news flash: The commercial market in Honolulu (yes, that Honolulu) has emerged as a rival to New York City — at least when it comes to a few key statistics.

According to Moody’s CMBS index released last month, the New York Metro area scored a 77, ranking it second-best among the 56 cities tracked, behind — you guessed it — Honolulu, which scored an 81.

“It is like the 90-pound weakling beating the world champ,” said Mike Hamasu, director of consulting and research for Colliers Monroe Friedlander in Honolulu and a native Hawaiian. (The index takes into account the current and projected supply-demand ratio, market “well-being” and market momentum.)

“Our prime selling point is the environment, the mentality of the people and the weather. In New York you have to deal with panhandlers and muggers, but here you can put on some sunscreen and enjoy your mai tais,” Hamasu said, only half-jokingly.

He has a point. These days, it seems reminders of Hawaii’s ongoing mini-renaissance are everywhere. In between well-publicized homecoming trips to the island made by President Obama and the first family, there are development announcements like the opening of Ian Schrager and Marriott’s new Waikiki Edition hotel, or reports that Honolulu is second only to New York in hotel occupancy and room rates nationwide. Even CBS’s remake of “Hawaii Five-0” is a hit.

Meanwhile, some New York-based real estate executives may be scratching their temples with frost-covered fingers with news from the National Association of Realtors that Honolulu and New York City are the only two office markets nationwide with vacancy rates below 10 percent. (Colliers and some other commercial firms put the vacancy rates for both cities higher, at around 12 and 13 percent, respectively, but that’s still low compared to a number of other U.S. cities.)

The reasons for the stability of the Honolulu market are myriad. The local economy has been buoyed by huge military expenditures, helped in part by the fact that U.S. Senator Daniel Inouye, a Democrat from Hawaii, is chairman of the Senate Appropriations Committee. An estimated $50 billion will be spent on military housing over the next 50 years. And in 2008, $15 billion was spent on federal programs and procurement contracts, according to Hamasu, who said those were the most recent figures he had.

In addition, tourism in Hawaii in general has benefited from favorable exchange rates with neighboring Asian countries like China, Japan and Korea, helping the local economy and the job market there. And, the state has a notoriously long zoning and entitlement process, which limited its exposure to overzealous developers who then got squeezed by the credit crunch — a fate a number of other American cities failed to avoid.

In addition, retail activity has been on the rise recently.

“Really the biggest movers in the market right now are the big-box national retailers,” said Brooks Borror, senior director of Grubb & Ellis’s commercial team in Honolulu. He said Safeway, Babies “R” Us, Walgreens and Whole Foods have all stepped up their presence of late. And, in some instances, they’re anchoring new retail development projects.

However, before ditching your job and stocking up on Reyn Spooner shirts, remember that any serious comparison between New York and Honolulu requires suspension of reality.

First of all, there is some bad news coming out of Hawaii. While Honolulu seems to have escaped defaults on large office complexes and shopping malls, its large hotels — a number of which traded hands at record prices during the last real estate boom — are now in default on their mortgages. Furthermore, a deeper inquiry into the methodology behind the Moody’s index demands a more nuanced interpretation. According to Moody’s analyst Keith Banhazl, the index is not a reflection of the relative assets of each city, but rather an evaluation spanning two years of the general supply and demand in the market across all types of real estate. He said that Honolulu’s score was also inflated because some of the variables that decreased New York’s score simply didn’t exist in Honolulu.

For starters, Honolulu has just 15.7 million square feet of office space available, a small fraction of the roughly 450 million square feet of office space that Manhattan offers. And, not a single Fortune 500 company is headquartered in Honolulu; New York City has over 40.

Honolulu Class A commercial space rents for about $36 per square foot in annual terms, according to Colliers. That is well off the $58-per-square-foot Class A asking rent that Cassidy Turley shows Manhattan logs in at (though net effective rents are generally lower than asking rents). And whereas Manhattan’s skyline is perpetually shifting, no large-scale office has been built on the Hawaiian Islands since 1996.

Hawaii has 1.2 million people, according to the latest U.S. Census figures. New York City has 8.2 million residents.

But as you read this, there may be only one statistic that really matters in this comparison: As this story goes to print, New York is 19 degrees; Honolulu is 80. Aloha.