Despite an uncertain political climate and a challenging real estate market — in which office leasing has slowed and condominium sales turned sluggish — scores of New York developers are plowing ahead with tens of millions of square feet of new developments, including tens of thousands of residential units.

The Real Deal analyzed thousands of projects to determine how many were active but not yet completed, as defined by receiving their temporary certificate of occupancy or declared effective by the New York State Attorney General’s office.

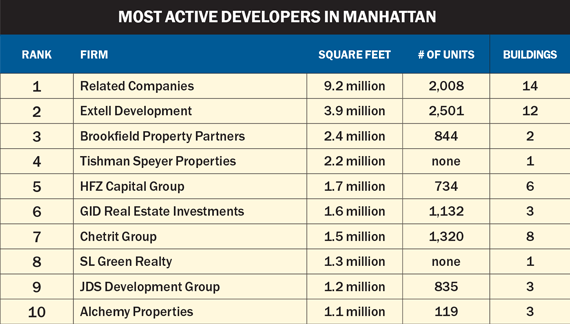

In Manhattan alone, the top 10 most active builders are constructing 26 million square feet of commercial and residential space. But that’s not to say that those developers are oblivious to an ongoing slowdown. While some of those developers have expressed confidence in their projects as they were originally planned, others are shifting gears to be more in tune with today’s buyers. Buyers who, experts say, are demanding better value and snubbing the trophy units they snapped up just a few years ago.

Architects said that one way developers are responding to an altered market is pivoting on condo configurations — for example, some under-construction condos that were designed with a range of bedroom units are now being altered.

The new mindset among developers is “We’ve got to make them all 2s,” said architect Thomas O’Hara, of HTO Architect. One-bedroom units were most popular with foreign investors, insiders said, and that buyer pool is drying up. Two-bedrooms, on the other hand, are favored by Manhattan buyers, as a year-end report from Halstead Property Development Marketing showed.

Related Companies, the Midtown-based development and investment firm led by Stephen Ross, is the most active builder in Manhattan, with 14 projects totaling more than 9 million square feet and 2,000 residential units under development. Executives at the firm have said they don’t feel the need to change strategy either, in part because of Related’s success attracting office tenants to its Hudson Yards campus. The firm is also confident about its condo projects, sources said, because they’re not shooting to break records with trophy towers on West 57th Street.

That’s in contrast to Gary Barnett of Extell Development. Extell is the second-most active developer in the city, with 12 projects accounting for just under 4 million square feet and more than 2,500 residential units. Among those projects is Central Park Tower on Billionaire’s Row, which is slated for completion in 2019.

Other major developers are also staying active. Brookfield Property Partners, the third busiest in Manhattan, has two projects totaling 2.4 million square feet and 844 residential units. Tishman Speyer, which came in fourth, meanwhile, is building a 2.2 million-square-foot tower in Hudson Yards, dubbed the Spiral. HFZ Capital Group, which rounds out the top five, is working on six projects totaling 1.7 million feet that will have more than 700 residential units.

Not all activity can be chalked up to market bullishness, of course. Developers are continuing to build, in part, because their projects are already underway.

“If you’ve got the shovel in the ground, the brick and mortar rising, there is no stopping you,” said Paul Purcell, managing director at residential firm William Raveis NYC.

He added, however, that builders and buyers have a tendency to ignore the lessons of the past. “We are not elephants,” he noted. “We have a short-term memory.”

—Additional research by Derek Smith