INVESTMENT SALES IN MANHATTAN AND BROOKLYN

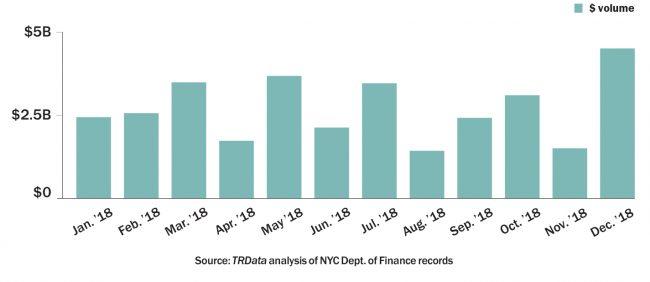

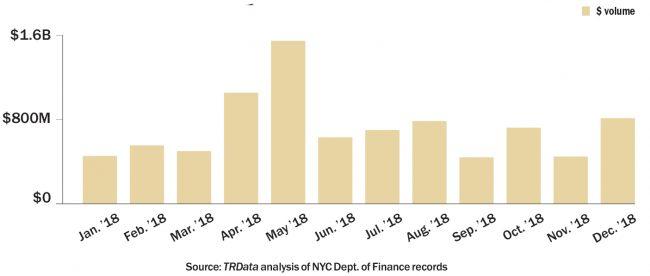

Manhattan investment sales ended 2018 on a high note, exceeding $4.4 billion in deals recorded in December, nearly double the 12-month average. The top sale was for an 80 percent stake in five Manhattan properties, including 1 Morningside Drive, that AvalonBay Communities sold to Invesco for $607 million. Brooklyn saw $801 million in sales recorded in December, somewhat above average for the year and an 80 percent increase from November. The largest deal in the borough was UPS’ acquisition of six waterfront development sites in Red Hook, which Sitex Group sold for $303 million.

MANHATTAN INVESTMENT SALES

TOP MANHATTAN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 1 Morningside Drive and 4 othersn(residential, 80% stake) | $607 million | Invesco Real Estate /nAvalonBay Communities | N/A |

| Park Centralnat 870 Seventh Avenuen(hotel-condominium) | $366 million | Highgate Hotels /nPebblebrook Hotel Trust | N/A |

| 271 West 47th Streetn(residential) | $290 million | GreenOak Real Estate,nSlate Property Group /nJack Parker Corporation | NewmarknKnight Frank |

| 114 West 41st Streetn(office and retail) | $282 million | Clarion Partners /nBlackstone | NewmarknKnight Frank |

Source: TRData analysis of news reports and NYC Dept. of Finance records in December

BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 44 Ferris Streetnand 5 othersn(development sites) | $303 million | UPS / Sitex Group | N/A |

| 30 Front Streetn(development site) | $91 million | Fortis Property Group /nJehovahu2019s Witnesses | N/A |

| 500 DeKalb Avenuen(office) | $23 million | Joseph Heimann /nJonas Equities | N/A |

| 545 Broadwayn(office) | $22 million | Acuity Capital Partners /nBlesso Properties | JLL |

Source: TRData analysis of news reports and NYC Dept. of Finance records in December

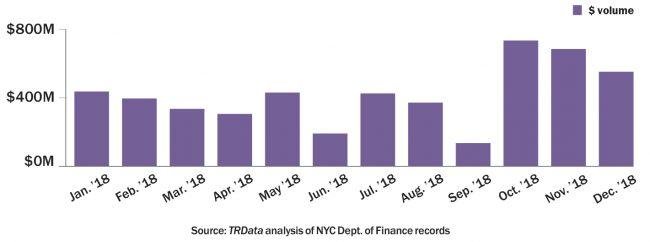

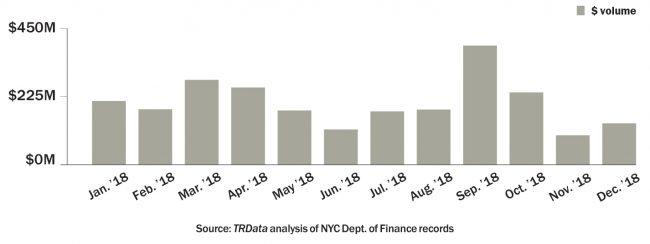

INVESTMENT SALES IN QUEENS AND THE BRONX

Queens investment sales declined again in December, but stayed well above average for the year with $548 million in sales recorded. More than half of that sum came from Carlyle Group’s $284 million purchase of the 1 QPS rental tower in Long Island City, which was previously co-owned by Property Markets Group, the Hakim Organization and Howard Lorber’s New Valley. The Bronx saw almost 40 percent more sales volume in December than the month before with $137 million recorded, but remained well below its annual average. The borough’s largest deal was the $15 million sale of a 57-unit rental building at 2304 Sedgwick Avenue by Prana Investments to Desai Real Estate.

QUEENS INVESTMENT SALES

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 1 QPS Towernat 42-20 24th Streetn(residential) | $284 million | Carlyle Group /nProperty Markets Group,nHakim Organization, New Valley | N/A |

| 124-16 31st Avenuen(self-storage) | $37 million | CubeSmart /nStorage Deluxe | N/A |

| 56-72 49th Placen(warehouse) | $17 million | Ping Yeung /nKi Tai Yeung | N/A |

| 72-35 Broadwayn(bank) | $14 million | Da Bronx LLC /nSterling National Bank | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in December

BRONX INVESTMENT SALES

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 2304 Sedgwick Avenuen(residential) | $15 million | Desai Real Estate /nPrana Investments | N/A |

| 188 East 135th Streetn(office) | $11 million | Jacob Sofer /nG.A.D. Holding Corp. | N/A |

| 2350 Cambreleng Avenuen(residential) | $10 million | Amit Doshi /nJoseph Locascio | N/A |

| 1535 Taylor Avenuen(residential) | $9 million | Joel Werzberger /nBluestone Group | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in December