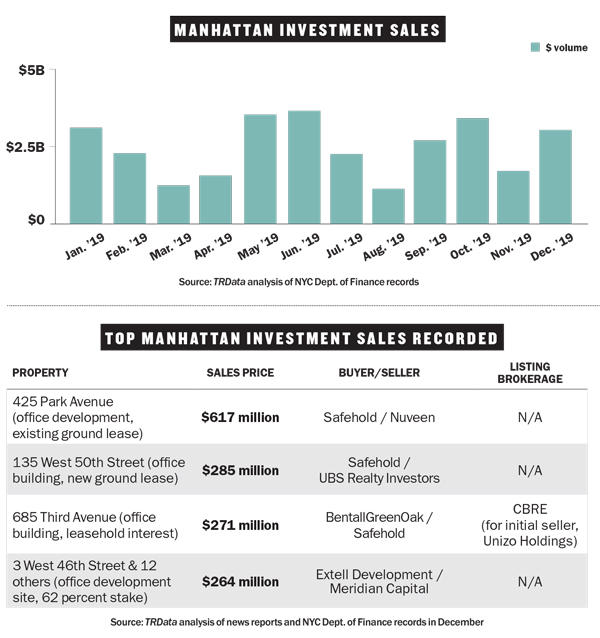

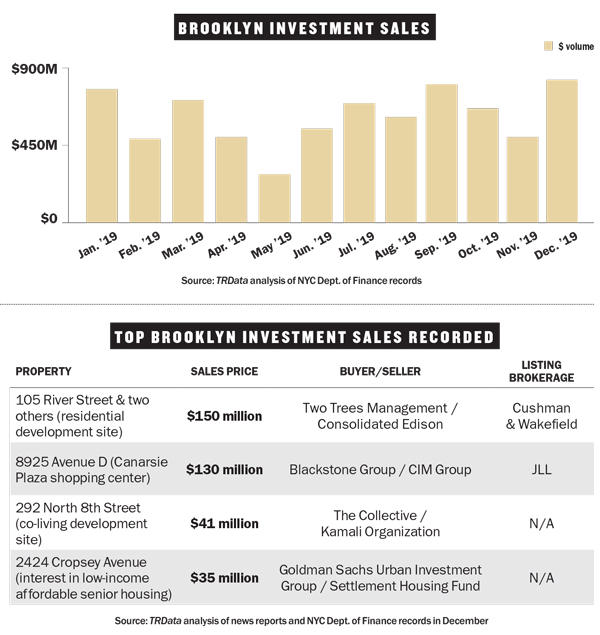

Investment sales in Manhattan and Brooklyn

Manhattan investment sales ended the year strong with $2.94 billion in deals recorded in December, nearly double the month before and 28 percent above the 12-month average. The borough’s largest deal went to iStar-managed ground lease REIT Safehold, which bought the land beneath L&L Holding’s 425 Park Avenue office development from Nuveen for $617 million and closed on two other big ground lease deals in the same month. Brooklyn’s investment hit an all-year high with $793 million in deals recorded in December, 58 percent up from the month prior and 35 percent above the 12-month average. The borough’s top deal was for a development site on the Williamsburg waterfront that Two Trees Management bought from Con Edison for $150 million.

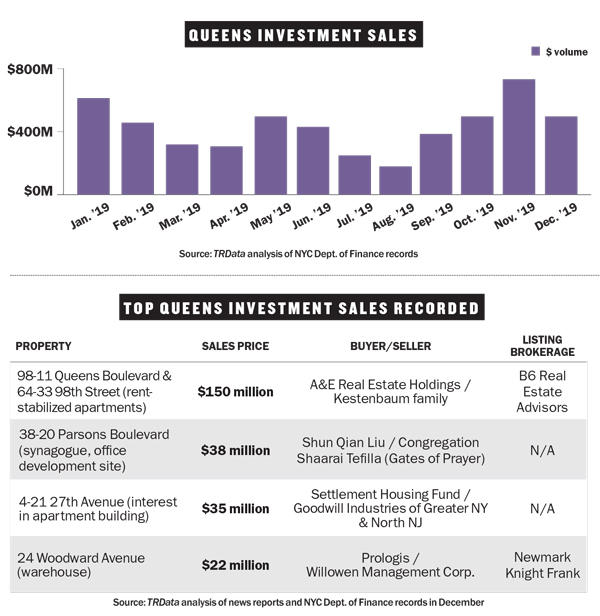

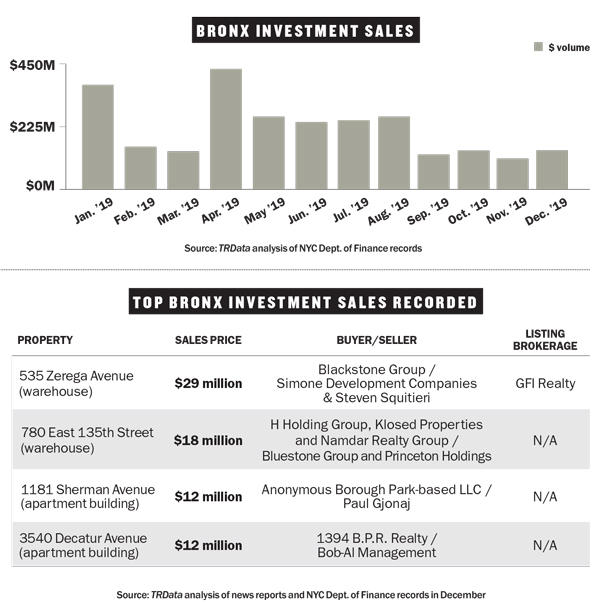

Investment sales in Queens and the Bronx

Queens’ investment sales market dropped back from an all-year high in December, with $480 million in deals recorded — 25 percent less than the previous month’s total but still 17 percent above the 12-month average. The borough’s largest deal saw A&E Real Estate Holdings pay $150 million for the 539-unit rent-stabilized Kestenbaum family portfolio in Rego Park. The Bronx saw a fourth straight quarter of slow activity in December with just $124 million in deals recorded, up 25 percent from the month prior but still 40 percent below the 12-month average. The borough’s top deal went to the Blackstone Group, which bought a warehouse at 535 Zerega Avenue from Simone Development Companies and an entity managed by Steven Squitieri for $28.5 million.