Manhattan’s commercial market bounced along the bottom for much of the last 12 months. But the start of the New Year brings fresh signs that landlords, even in the lagging Downtown market, are gaining back some of the leverage they lost over the past two years.

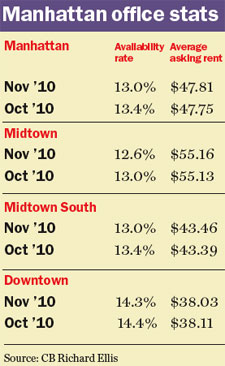

Both Midtown and Midtown South are beginning 2011 with good news — the availability rate has declined by over 2 points in the last year and the average asking rents have risen. And in Lower Manhattan, the only district of the three where the availability rate remains higher than it was one year ago, brokers reported signs that landlords are winning back some leverage.

Adam Foster, a senior vice president in the Downtown office of commercial services firm CB Richard Ellis, said tenants are starting to put in more of their own money to build out spaces. That’s a change from the transactions he was working on 18 months ago.

“A majority of the deals are including additional capital, which is a positive sign, as well as expansion,” he said. “Before, you had a lot of Band-Aid transactions that were shorter-term in nature.”

Gordon Ogden, a broker and principal with brokerage Byrnam Wood, said he anticipated leasing would remain at healthy levels in the New Year.

“There will probably be a little more product becoming available based on landlords who were traded out of buildings or removed from buildings where their cost basis did not make much sense in this market,” he said.

Midtown

Brash divorce lawyer Robert Wallack, who has represented clients like supermodel Christie Brinkley and hip-hop clothing impresario Damon Dash, is looking for more space in Midtown.

Wallack, now located in about 1,500 square feet of sublease space at 444 Madison Avenue, wants to take about 2,500 square feet in a new location. While it’s clearly not a blockbuster transaction that will sway the market, deals under 10,000 square feet made up 36 percent of all office lease transactions in Manhattan — as well as in Midtown –in the third quarter, according to Cushman & Wakefield.

Wallack is looking at spaces in Third Avenue office towers, his broker, Bertram Rosenblatt, a principal with brokerage firm Vicus Partners, said. Rosenblatt and company senior director Waite Buckley are managing the search, which began in October with visits to Madison Avenue locations. Wallack did not respond to a request for comment.

But Rosenblatt said his client could get more space for less a bit further east. Premier buildings along Madison charge $75 per foot to $85 per foot, while landlords are offering similar spaces on Third Avenue in the low $60s and landlords are accepting deals in the high $50s, Rosenblatt said.

But even with cheaper prices further east, landlords in all submarkets of Midtown are becoming less flexible, Rosenblatt said. About a year ago, a $62-per-foot asking rent meant a $52 taking rent, but that taking has now been bumped up to $60 per foot. And landlords are telling him that if he doesn’t want the space, someone else will take it.

“They’ve become a lot less anxious about deals. They tell you they have a lot more activity and then they just have less flexibility,” Rosenblatt said.

In Midtown, there was 2.37 million square feet of new office space leased in November, according to the most recent data available, up from 1.2 million in the same month a year prior. That is more than twice the five-year monthly average of 1.2 million square feet, CBRE figures showed.

Asking rents in Midtown, which hit a recent low of $54.63 in May 2010, rose slightly in the second half of last year to $55.16 per square foot in November, CBRE data indicated.

Midtown South

The Midtown South market saw its volume of new leasing double in the first 11 months of 2010 compared with the same period in 2009, although old space is still not as desirable.

The entire second floor of the Village Voice building at 36 Cooper Square — vacated about a year ago as the venerable weekly consolidated space — has been rehabbed and is being returned to market this month.

Broker Nora Stats, president of commercial leasing firm Tarter Stats O’Toole, which is representing the landlord, Hartz Mountain Industries, said the floors were prebuilt with new lighting and glass offices, because the space in its previous condition was not getting leased up.

“The market picked up, and to keep up with the new glamour of Cooper Square we needed to do something to attract tenants,” she said. She expected interest from media, software and publishing companies for the space, with an asking rent of $33 per square foot.

The amount of new space leased up in Midtown South through November was 3.9 million square feet, double the 1.9 million square feet leased in the same period in 2009, figures from CBRE showed. Asking rents in November for the district were $43.46 per square foot, up 7.2 percent from the low point of $40.53 per foot in December 2009.

Downtown

Leasing activity Downtown was just 190,000 square feet in November, compared with 320,000 square feet in the same month a year earlier, CBRE figures showed.

The average asking rent, meanwhile, was $38.03, down by $0.60 per foot from the same month in 2009, the brokerage firm reported.

One firm looking to increase its Downtown footprint is Reputation Institute, now located at 62 William Street. The company — a private advisory and research firm that specializes in corporate reputation management — is moving a few blocks, to the 400,000-square-foot 55 Broad Street, said CBRE’s Foster, the company’s broker.

Reputation Institute, which signed a 10-year lease, expects to relocate in the first quarter to a 10,105-square-foot space in the 30-story tower owned by Rudin Management. The building, known as New York Information Technology Center, has a focus on tech companies. Reputation Institute declined to comment on the deal.

The landlord provided a full build-out of the full-floor space, an improvement from the approximately 6,000 square feet on two floors the firm occupied at 62 William Street, Foster said.

During the search, he and the tenant visited about 10 Downtown locations over a five- or six- month period. The firm was attracted to the building, which has asking rents of $36 per square foot, in part because of all the technology tenants.

“They were looking to align themselves with a building that is more fitting with their business,” Foster said.