Everyone wants a piece of the millennial pie, and Westchester County is no exception.

Everyone wants a piece of the millennial pie, and Westchester County is no exception.

The coveted demographic of consumers — those born between 1981 and 1997 — is 75.4 million strong and growing, with reports estimating that the generation’s spending will hit $1.4 trillion annually by 2020. By all appearances, suburban Westchester — dubbed “hipsturbia” by the New York Times for its growing attractiveness to young hipster urbanites — is in a good position to cash in.

Some millennials in search of affordable rents within commuting distance to Manhattan have exhausted their options to the west, east and south and are now looking north — past the Bronx, to Westchester County. And developers have taken note.

A multifamily building boom that industry insiders say is driven by millennials has swept the county, with roughly 2,200 new rental units set to come on the market between now and 2018, according to John Barrett, vice president for sales at the brokerage Admiral Real Estate Services. That’s more than a seven-fold jump compared to the preceding three years, when just under 300 units were built, Barrett said.

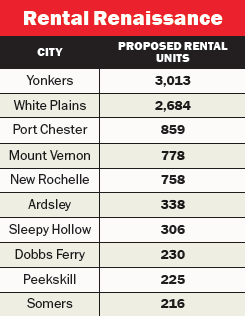

And that 2,200-unit estimate is based only on “shovel-ready” and approved projects. When all the proposed projects are accounted for — including those awaiting government approval — the number is close to a whopping 10,000 units, based on Admiral’s calculations.

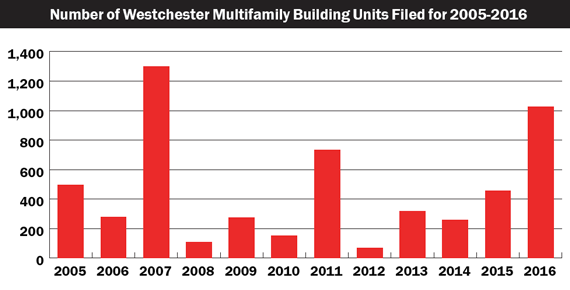

In 2016, there were 25 multifamily building permits filed by the end of October in Westchester, almost double the number filed in each of the four previous years. The total number of units filed for across these projects — 1,027 — is the most in any year since 2007.

New multifamily housing projects sprouting up: from left, New Rochelle’s planned 28-story tower, Tuckahoe’s Quarry Place and Ossining’s Harbor Square.

“Clearly, there’s a segment of the population that’s looking for alternative housing outside of Manhattan. They’ve gone traditionally to Brooklyn and to Jersey City for more affordable rental units that offer more space, certainly at a more affordable price point than Manhattan,” said Jonathan Stein, a managing partner with Diversified Realty Advisors who is one of the developers behind a new $1 billion multi-use project in Sleepy Hollow.

“But Brooklyn has started to get very expensive, Queens is very built up as well, and Jersey City is starting to get expensive. A lot of people want to be close to the suburbs but have ready access to the city,” Stein said, going on to summarize the appeal of Westchester as an area with more space at a lower cost in an often picturesque location.

Other industry experts agree that demand among prized millennials is the key driver of Westchester’s new multifamily projects, commonly referred to as “transit-oriented developments” due to their proximity to Metro-North train stations, with commutes ranging from 25 to 45 minutes to Grand Central.

Martin Ginsburg, the founder of Ginsburg Development Companies, said millennials would gladly pack up and move out of Manhattan and Brooklyn — where Douglas Elliman [TRDataCustom] reported the average rents in November were $4,095 and $2,993, respectively — for the opportunity to live in reasonably priced new developments with high-end amenities in an area where they could afford a nice lifestyle with access to a lively downtown.

Martin Ginsburg, the founder of Ginsburg Development Companies, said millennials would gladly pack up and move out of Manhattan and Brooklyn — where Douglas Elliman [TRDataCustom] reported the average rents in November were $4,095 and $2,993, respectively — for the opportunity to live in reasonably priced new developments with high-end amenities in an area where they could afford a nice lifestyle with access to a lively downtown.

In Manhattan, “you’re not going to have breathtaking river views and wall-to-wall glass,” Ginsburg said. “We have apartments that are 1,400 square feet and one that’s even 1,950 square feet. That’s a house-sized apartment.”

Wilson Kimball, the commissioner of planning and development in Yonkers, said a marketing campaign launched a few years ago called Generation Yonkers has contributed to the current buzz about the area among millennials. The campaign includes a website showcasing video testimonials from young people about Yonkers, as well as TV, radio and print advertisements.

“We’re finding that the new developments are attracting two groups of people. One are millennials, which we are advertising for and trying to attract, and on the other end of the scale are empty nesters,” Kimball said.

Indeed, in the eyes of developers, empty nesters looking to trade in the hassles and expense of owning a single-family house have much in common with millennials. They’re interested in amenities such as yoga studios and spas, as well as being within walking distance of restaurants and retail — not to mention having someone else to shovel the snow.

Projects in the pipeline

On the last day of November, RXR Realty and Rising Development broke ground on a 28-story project in New Rochelle. The mixed-use 28-story building will rise on the site of the former Loews theater on Main Street and calls for 280 rental units, 17,000 square feet of commercial space and 10,000 square feet for arts and culture. City officials said the $120 million project is part of a broader $4 billion redevelopment plan for downtown New Rochelle.

RXR has also just started a 440-unit project that includes a 17-story and 25-story tower in downtown Yonkers. The $190 million complex will have 40,000 square feet of retail space and be within walking distance of the train station.

Yonkers is also seeing action from other developers. Ginsburg, who has been in the business for 50 years, said he has about 600 apartments total in Westchester that are under construction or recently opened, with many of them in Yonkers.

In November, Ginsburg announced the topping off of River Tides at Greystone, a $100 million, 10-story building in Yonkers with 330 luxury units set to open for leasing in March. In August, the company also broke ground at 1177@Greystone, a 55-unit building located just a block away from River Tides that is expected to start leasing next summer, Ginsburg said.

As of late 2016, the value of new developments in Yonkers was about $1.5 billion, a 50 percent increase over 2015, according to Kimball. Two-thirds of that went toward residential projects. As of press time, local officials had given the green light to build 2,500 units in Yonkers.

“We’re seeing a building boom that will persist for some time,” Kimball said. “Most of the developers that we talk to tell us they’re thrilled because their projects are in the 90 percent occupancy range and it’s a fast turnover and it’s a solid investment for them.”

A similar building boom is on the way in White Plains. A 2016 state government report said that while 822 residential units were built between 2005 and 2015, there were now 2,500 or so in the pipeline, including a $250 million, 561-unit building at 55 Bank Street being developed by LCOR.

Farther north, Stein’s Sleepy Hollow project will sit on the former General Motors site along the Hudson River. The development, known as Edge-on-Hudson, will feature 1,177 condo flats, townhomes and apartments, he said. The GM site closed 20 years ago and was vacant until this year, when construction crews began tearing up the concrete foundation.

And up in Ossining, Ginsburg opened a $65 million mixed-use luxury rental complex near the waterfront called Harbor Square. Prices listed on the project’s website range from $2,395 for a 683-square-foot unit to $3,295 for a 1,114-square-foot one-bedroom with two baths. The 188-unit building has a 24-hour concierge, fitness center, yoga room, rooftop pool and deck with barbecue stations.

Other Ginsburg projects include the Lofts on Saw Mill River, a $34 million luxury rental project in Hastings-on-Hudson that features 66 loft-style apartments. The developer said proximity to the water as well as amenities like sundecks help to make the units marketable to millennials.

Also planned for Ossining is River Knoll, a project developed by Glenco Residential that is also a 188-unit building. Glen Vetromile, managing partner at Glenco, said the firm has about $500 million in projects underway in Westchester. A second project is a proposed three-phase, 750-unit upscale project adjacent to the Mount Vernon West train station, a 23-minute commute to Midtown. Glenco Residential is also the developer of Quarry Place, a high-end apartment building in Tuckahoe.

Market watch

While the list of projects in the planning stages continues to grow, those in the industry don’t seem worried about oversupply, insisting that there is sufficient demand from millennials and empty nesters as well as current county residents. And news from New York City of listings inventory rising sharply, rents leveling and landlords increasingly offering concessions did not seem to faze many.

Stein said the reports showing a cooling off in the New York City rental market did not inspire any concerns about his firm’s Edge-on-Hudson project, calling the Sleepy Hollow development “close to being as recession-proof as possible.” He said the project would be a draw because it has everything millennials want: proximity to Metro-North, restaurants, shops and a waterfront location — all for the right price. “It’s got all the elements to survive any downturn,” Stein claimed.

Seth Pinksy, vice president at RXR Realty, also said the leveling off of rents in the city won’t make a difference to Westchester. His reasoning was that the gap between rents in the suburbs and rents in the city is so large that any fluctuations “won’t change the fact that the city remains unaffordable to large segments of the population.” He added that he believes many potential tenants for the new projects already live in Westchester but are eager to move into modern apartments.

Asked to offer his analysis of the Westchester market, Gary Malin, president of the New York City rental brokerage Citi Habitats, said that the “developers are smart, savvy people who have done all their research, that have done all their analyses, they understand what the market can bear, they understand what the current housing stock is.”

Ginsburg, however, said he is offering some temporary rent concessions during initial lease-up on selected apartments that are not moving as fast as he’d like.

Other developers TRD spoke to were reluctant to discuss vacancy rates or concessions at their developments but insisted they’re highly optimistic about the Westchester market. In the third quarter of 2016, the vacancy rate was 3.2 percent, almost flat with the 3.1 percent rate a year earlier, according to Barbara Denham, an economist at the market research firm Reis. Denham referenced the 108-unit luxury development Quarry Place as a sign of how hot the market is. Less than a month after the units went on the market, some 70 percent were rented, Denham said.

“We’re way ahead of expectations,” said Glenco’s Vetromile, adding that he has not considered concessions at this property. “It’s a typically quiet time of the year when you come into Thanksgiving and year-end holidays, but we’re still very, very active.”