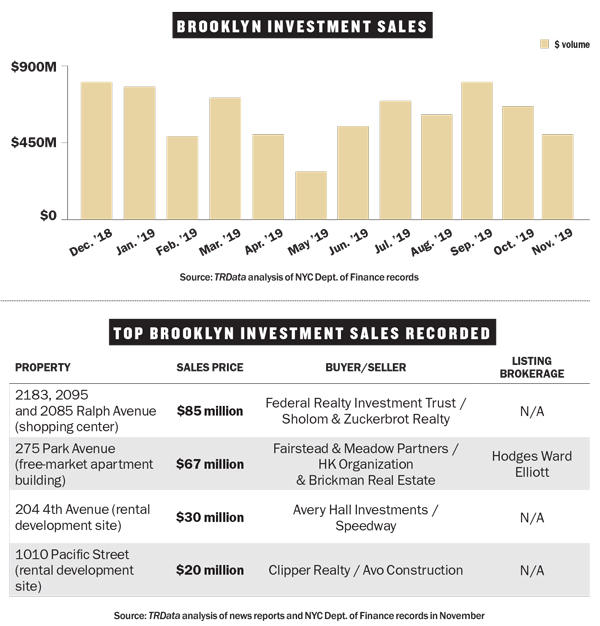

Investment sales in Manhattan and Brooklyn

Manhattan investment sales had a slow November with just $1.54 billion in deals recorded, a 46% drop from the month before and 37% below the 12-month average. The borough’s largest deal went to the Qatar Investment Authority, which bought the hotel and commercial portions of the St. Regis Hotel building from Marriott International for $310 million. Brooklyn’s investment sales also slowed down somewhat, with $503 million in deals recorded in November, 11% down from the month prior and 15% below the 12-month average. The borough’s top deal was for the Fairway-anchored Georgetowne Shopping Center in Bergen Beach, which Federal Realty Investment Trust acquired from Sholom & Zuckerbrot Realty for $85 million.

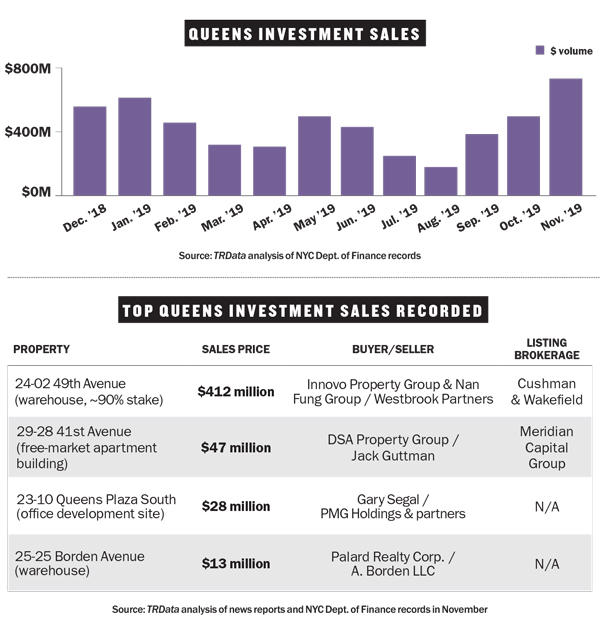

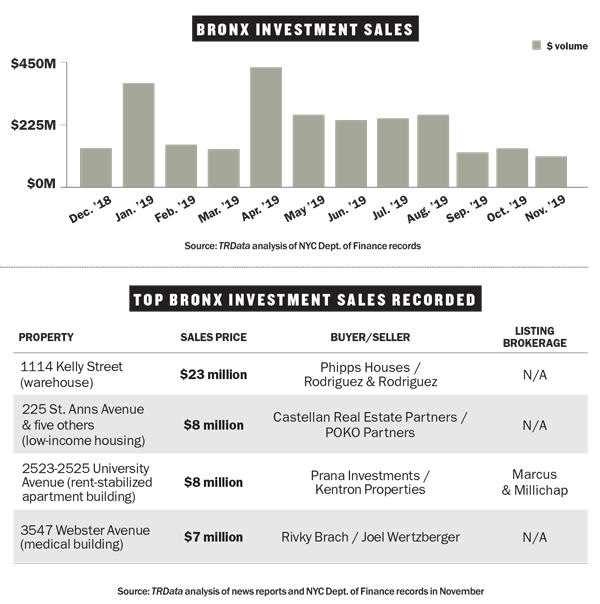

Investment sales in Queens and The Bronx

Queens’ investment sales market took off in November, hitting an all-year high of $643 million in deals recorded, 36% more than the previous month’s total and 55% above the 12-month average. Most of that sum came from the borough’s — and the city’s — top deal of the month, which saw Innovo Property Group buy out Westbrook Partners’ stake in a massive LIC warehouse for $412 million. Investment sales in the Bronx remained tepid in November with just under $100 million in deals recorded for the first time in a year, down 18% from the month prior and 52% below the 12-month average. The borough’s top deal was for a warehouse in Morrisania, which Phipps Houses bought from Rodriguez & Rodriguez for $23 million.