OFFICE LEASING IN MANHATTAN

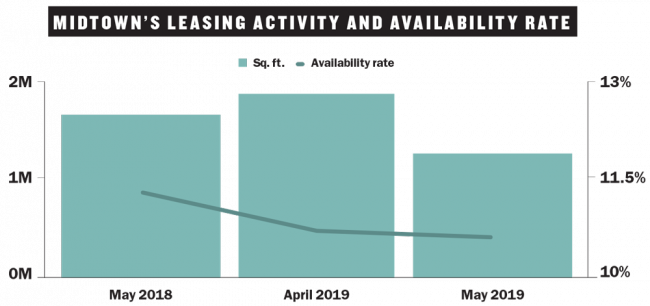

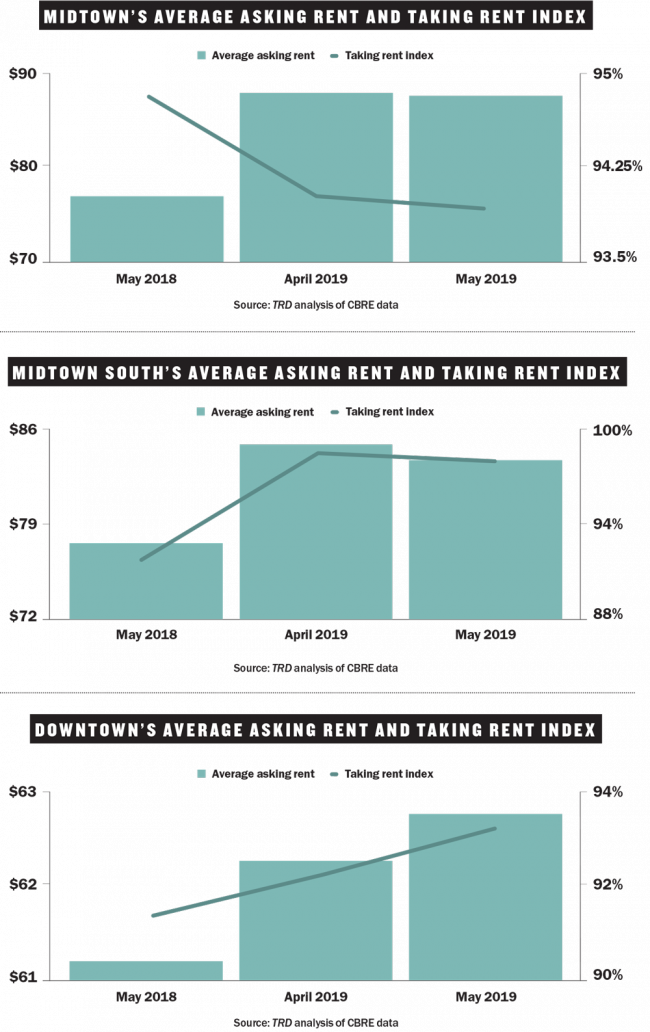

• Midtown office leasing slowed down in May, totaling 1.25 million square feet, a 32 percent decrease from the month before. The availability rate dropped slightly to 10.6 percent, while

the average asking rent fell from the previous month’s high, reaching $87.89. The largest deal in Midtown went to Time Warner Cable, which renewed 106,176 square feet at 1633 Broadway.

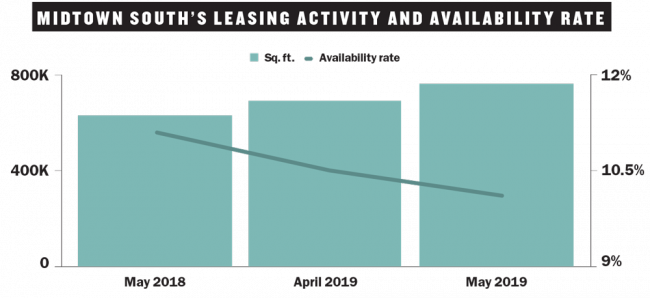

• Leasing activity in Midtown South continued to climb in May with 750,000 square feet in leases inked, a 10 percent increase from April. The availability rate dropped to 10.1 percent, and the average asking rent fell to $83.56 per square foot. The largest deal in the submarket — and all of Manhattan — was at RXR Realty’s 620 Sixth Avenue, where WeWork picked up 212,937 square feet previously occupied by Spotify and Mediaocean.

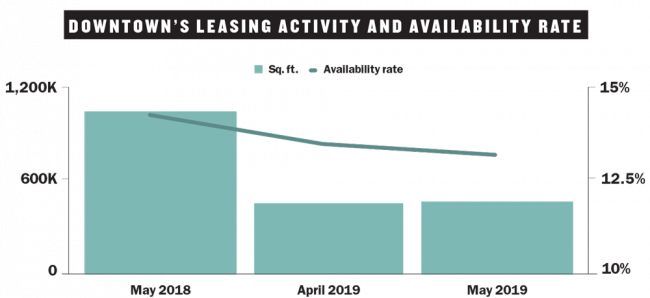

• Lower Manhattan office leasing totaled 460,000 square feet in May, a slight increase from the month prior. The availability rate dipped to 13.2 percent and the average asking rent continued to climb, reaching $62.74 per square foot. The largest deal in the submarket went to Knotel, which tripled its square footage at KBS Capital Partners and Savanna’s 110 William Street with a 79,285-square-foot expansion.

Source: TRD analysis of CBRE data

Source: TRD analysis of CBRE data

Source: TRD analysis of CBRE data

TOP DEALS

MANHATTA N ’ S TO P RECENT TRANSACTIONS

| SQ. FT. | TENANT | ADDRESS |

|---|---|---|

| 212,937 | WeWork | 620 Sixth Avenue |

| 106,176 | Time Warner Cable (renewal) | 1633 Broadway |

| 79,285 | Knotel (expansion) | 110 William Street |

| 77,622 | Greenhill & Company | 1271 Sixth Avenue |

Source: CBRE and TRD

MANHATTAN ’ S LARGEST NEW AVAILABLE SPACES

| SQ. FT. | TENANT | ADDRESS |

|---|---|---|

| 99,000 | 601 West 26th Street | Midtown South |

| 83,000 | 1400 Broadway (OnDeck Capital sublet) | Midtown |

| 82,000 | 1345 Sixth Avenue* | Midtown |

| 72,000 | 28 Liberty Street | Downtown |

*Space was previously on the market, but was included because it’s now within the 12-month window for tenant occupancy.

Source: CBRE and TRD