INVESTMENT SALES IN MANHATTAN AND BROOKLYN

Manhattan investment sales rebounded in May with $3.46 billion in deals recorded, making it the busiest month of the year so far and 40 percent above the 12-month average. The top sale of the month went to Google, which picked up the Milk Building across the street from Chelsea Market for $592 million from Jamestown Properties. Meanwhile, Brooklyn’s investment sales market slowed down to a two-year low in May, with recorded deals totaling just $282 million — half the previous month’s dollar volume. The borough’s top deal was for a self-storage development site in East Williamsburg, which Storage Deluxe picked up from Ingraham Street Development and other sellers for $46 million.

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 450 West 15th Streetn(office building) | $592 million | Google /nJamestown Properties | Cushman &nWakefield |

| 521 Fifth Avenuen(office building) | $379 million | Savanna /nSL Green Realty | CBRE |

| 460 West 34th Streetn(office building,nmajority stake) | $292 million | L Green Realty /nKaufman Organization | N/A |

| 235 West 48th Streetn(rental building,nmajority stake) | $251 million | Carlyle Property Investors /nIvanhoe Cambridge &nSL Green Realty | N/A |

MANHATTAN INVESTMENT SALES BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 74 Bogart Streetn(development site) | $46 million | Storage Deluxe / Ingraham StreetnDevelopment LLC et al. | Kassin SabbaghnRealty |

| 6301 12th Avenuen(parcel withinndevelopment site) | $18 million | New York School ConstructionnAuthority / Barone Management | N/A |

| 200 Nassau Streetn(apartment building) | $11 million | Watermark Capital Group /nRoman Catholic Diocese of Brooklyn | N/A |

| 645 Gates Avenuen(apartment building) | $9 million | NYC Housing Partnership /nProto Property Services | N/A |

INVESTMENT SALES I N QUEENS AND THE BRONX

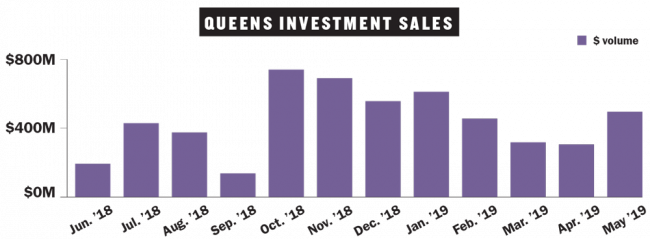

Queens’ investment sales market rebounded from a four-month decline in May with $488 million in deals recorded, 62 percent above the previous month and 12 percent above the 12-month average. More than half of the total came TF Cornerstone’s purchase of a Long Island City development site for $285 million — a deal the developer signed a contract for days before Amazon said it would be coming to the neighborhood. Meanwhile, the Bronx’s investment sales market fell from April’s high, with $256 million in deals recorded in May — a 40 percent decline, but still 15 percent above the 12-month average. About half of that total came from two warehouse deals, one for $89 million and the other for $39 million.

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 55-01 Second Streetn(development site) | $285 million | TF Cornerstone /nHolterbosch family | NewmarknKnight Frank |

| 35-46 & 35-66nJunction Boulevardn(retail buildings) | $25 million | Food Bazaar Supermarket /nMAN-Dell Food Stores | N/A |

| 87-40 165th Streetn(rental building) | $16 million | Rajmattie Persaud /nEric Silverstein | N/A |

| 96-33 Queens Boulevardn(retail building) | $13 million | Richard Harris /nCarlyle Management | Marcus &nMillichap |

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 1601 BronxdalenAvenue (warehouse) | $89 million | Himmel + Meringoff Properties & SquarenMile Capital / Sackman Enterprises | PinnaclenRealty |

| 1080 LeggettnAvenue (warehouse) | $39 million | Goldman Sachs Asset Managementn& Blumenfeld Development Group /nAdvantage Wholesale Supply | PinnaclenRealty |

| 953 SouthernnBoulevard (officenbuilding, 25% stake) | $11 million | Urban Health Plan /nAshkenazy Acquisition | N/A |

| 1331 JeromenAvenuen(development site,naffordable housing) | $10 million | The Doe Fund /nPeter Fine | N/A |