Listings, particularly on the high end, are not easy to unload.

Nonetheless, landing a listing when the seller has yet to come to terms with a realistic price is often a necessary evil in the residential real estate world.

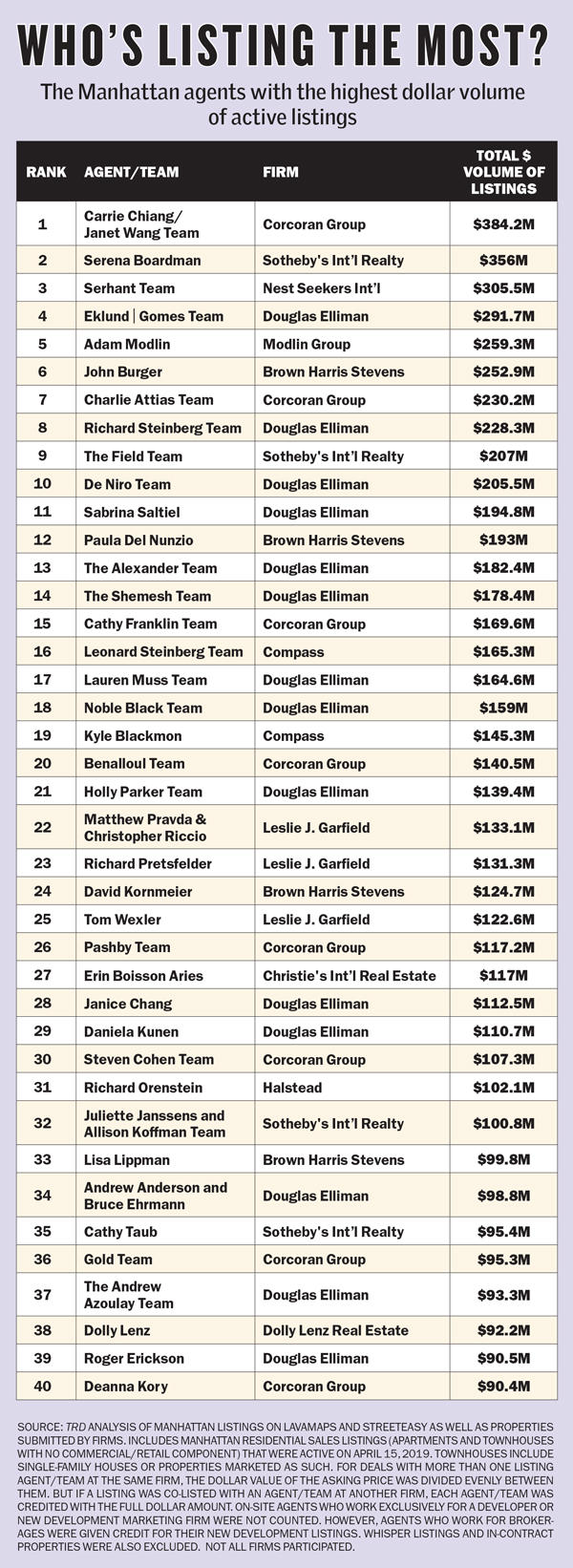

This month, with help from real estate data firm LavaMap, which pulled thousands of active for-sale properties, The Real Deal ranked Manhattan’s top agents by their total dollar volume of listings in the borough. While the ranking excludes closed transactions (that will be published in an upcoming issue), it offers an important glimpse into which brokers have a pipeline of potential deals teed up in the city’s priciest borough.

As it is every year, the top of the ranking is filled with faces from the upper echelon of the residential food chain, but there has been some reshuffling since last year.

This time around, the Corcoran Group’s Carrie Chiang/Janet Wang Team landed the No. 1 spot with $384.2 million in for-sale Manhattan properties on TRD’s one day snapshot of April 15.

The other agents on the top five included Sotheby’s International Serena Boardman (with $356 million in Manhattan listings), Nest Seekers International’s Ryan Serhant (with $305.5 million), Douglas Elliman’s Eklund | Gomes Team (with $291.7 million) and the Modlin Group’s Adam Modlin (with $259.3 million).

But some say that those listings don’t fully capture what’s for sale.

In the ultra-high-end market, nearly half of the homes that sold in the city last year for more than $20 million were listed off market, according to data from Compass.

Chiang — whose listings include a $67 million townhouse at 12 East 63rd Street and a $31 million townhouse at 7 Sutton Square — said those quiet deals happen organically for her team after 30 years in the industry.

“We are like a matchmaker in a way,” she said. “We put our thinking cap on [and say] ‘Let’s make a phone call, and maybe they will sell.’”

She said she did two off-market deals last year — one was selling Steve Madden’s Upper East Side townhouse at 175 East 73rd Street to Joe Moinian. “Joe called me up and said, ‘Carrie, can you get the neighbor?’” she recalled, noting that the real estate mogul first bought the garage next door and then purchased the Madden townhouse.

Collectively, the top 40 agents on the ranking were publicly marketing $6.6 billion worth of Manhattan properties. That was 30.5 percent down from $9.5 billion last year at this time.

And those drops were seen by agents from the top of the list to the bottom. Both the ceiling and the floor this year were lower than last year.

Chiang’s $384.2 million, for example, was able to land her the top spot even though it was a drop from her $490 million last year.

Despite those dollar-volume drops, inventory has continued to rise as developers have spit out more units that were envisioned in headier days.

Active listing inventory in Manhattan rose by nearly 9 percent to 6,673 properties in 2019’s first quarter compared to the same time last year, according to appraisal firm Miller Samuel. Meanwhile, listing discounts also inched up.

Active listing inventory in Manhattan rose by nearly 9 percent to 6,673 properties in 2019’s first quarter compared to the same time last year, according to appraisal firm Miller Samuel. Meanwhile, listing discounts also inched up.

Faced with the unpleasant reality that selling often means eating losses, many Manhattan owners are increasingly swapping out brokers, sources say.

“Do you know how many owners call me and say, ‘I’m really not happy with my broker right now?’” said Elliman’s Holly Parker, whose team ranked No. 21 with $139.4 million in Manhattan listings.

Her most common response to those statements is, “Are you sure it’s not the market that you don’t like?”

Compass’ Leonard Steinberg — who ranked No. 16 this year with $165.3 million in listings, a dramatic drop from his No. 1 spot last year with a powder keg of $535.8 million listings — said he’s become “a lot more selective this year.”

“We don’t work with any sellers right now that are not realistic about price,” he said, adding that he’s had to drop clients who either refuse to negotiate on their asking price or expect the property to sell quickly.

“I don’t take on exclusives now where the seller thinks it will sell in three months,” he said, explaining that “it just eats up too much of your time and your resources.”

“I don’t need listings to prove a point,” added Steinberg, who also claimed to have about $100 million in properties under contract, which are not counted in TRD’s tally.

Many brokers prefer to swoop in after a seller’s been hardened by the market

“If [a seller’s] already been one year on the market, he’s been through a lot,” said Corcoran’s Charlie Attias, who ranked No. 7 with $230.2 million in Manhattan listings.

Elliman’s Noble Black — whose team clocked in at No. 18 with $159 million in listings — cited a mantra that a slew of other brokers also invoked this year (as they have in year’s past): “It’s best to be the first son, the second wife and the third broker.”

Black had a roughly $40 million penthouse listing at the Baccarat Hotel & Residences at 20 West 53rd Street, among his 34 total listings on the day of TRD’s snapshot. (His blockbuster deal was vacuum-cleaner mogul James Dyson’s $73.8 million purchase of a penthouse at 520 Park Avenue, but that transaction was not included in this ranking because it closed in November.)

But as Black suggested, winning listings is a mixed bag for those who come in too early. And convincing sellers to drop their prices is not for the faint of heart.

The quality and age of finishes — or even the curve of a bannister — are all factors that could either demand a premium or justify a discount in this market, according to multiple sources.

Several agents also said they’ve had to provide clients with detailed explanations of why a neighbor’s listing price wasn’t a valid comp, despite a similar size or layout.

“This is not a forgiving market,” said Parker, describing how oversized furniture, kids toys or even the lingering odor of a cat can kill a deal.

Turning tricks

Turning a listing into a sale can feel like it requires a magic trick in today’s Manhattan market.

Nest Seekers’ Serhant went so far as to pull a new neighborhood out of a hat.

On a blustery January day, with cameras rolling from his Bravo reality show “Sell it like Serhant,” the celebrity broker donned a black cape and tophat and proclaimed, “We invented a neighborhood!”

The scene came during a party after his team took over marketing at Cary Tamarkin’s 550 West 29th Street from CORE. Serhant dubbed the location of the West Chelsea property as “SoHY” — South of Hudson Yards.

More than four months later, Serhant claimed to have put at least five units in the 19-unit condo into contract.

“People gave me a lot of shit for calling the neighborhood ‘SoHY’ but it worked,” he told TRD. “CORE had this building on the market for a really long time with zero, zilch, nothing.”

CORE’s Emily Beare, who served as the director of sales on the project, said Tamarkin “was too slow” to adjust his prices.

“We understand that the developer is currently in a position where, having turned down higher prior offers brought to it by CORE, it’s now marketing the same or comparable apartments at much lower prices, loaded with incentives and tax breaks,” she wrote in a statement. “We wish Ryan the best of luck.”

For Elliman’s Tal and Oren Alexander, hobnobbing with the ultra-wealthy — and posting their every move online — is part and parcel of showcasing their exclusive listings. And they credit the strategy with getting them results.

“In great markets, anyone can sell,” Oren Alexander said in an email. “We’ve been able to separate ourselves from the pack because of our unique way of doing business.”

Late last month their team — which clocked in at No. 13 with $182.4 million in Manhattan listings — posted a slick Instagram video with 360-degree views showcasing a new listing: the four-story penthouse at 240 Centre Street, asking $19.5 million.

Modlin is sharing that listing at the so-called Police Building with the Alexanders. (TRD divided credit for agents who shared listings if they worked at the same firm but gave full credits to brokers if they worked at different brokerages.)

Modlin is sharing that listing at the so-called Police Building with the Alexanders. (TRD divided credit for agents who shared listings if they worked at the same firm but gave full credits to brokers if they worked at different brokerages.)

Like the Alexanders, Modlin also jet-sets with clients and potential clients. “I fly overseas for dinner. I fly overseas for lunch,” he said. “My strategy is go for the best and forget the rest.”

Teamwork makes the dream work

Actually selling a unit often boils down to throwing in some extras to sweeten deals, like offering to pay common charges for a year or parting with some furniture, sources said.

Compass’ Steinberg noted, however, that he draws the line at over-the-top offers like complimentary helicopter rides, which make sellers look “desperate.”

Halstead’s Richard Orenstein — No. 31 with $102.1 million in Manhattan listings — said he’s taken to waking up at 4 a.m. to analyze comps and prepare for five to seven pitches a week. In the current market, he said the most prudent advice for sellers is to “price things tight.”

Elliman’s Lauren Muss, meanwhile, said many sellers think the key to moving a property is to have more open houses, often in the form of cocktail parties.

“We have become event planners. But parties don’t work. They are really used just to quiet the seller,” said Muss, who racked up $164.6 million in listings.

In the old days, she said she could often score listings based on her reputation in the industry. Now she totes elaborate pitch packages to client meetings to give sellers a reality check.

For years, Muss resisted having a team but, as of December, now works alongside nine other agents. And she is not an anomaly. Fewer agents are going it alone.

Even the industry’s biggest teams are spreading their wings to capture more business.

In October, Eklund and Gomes opened an outpost in Los Angeles with four agents — on top of the 23 they have in New York.

Serhant — who also has an office in L.A. — has been beefing up his New York team. In April, he brought on four new agents for a total of 64. And after being tapped to market two condos in Long Island City, he said he plans to open a physical office in Queens by the end of the year.

Sotheby’s Nikki Field, whose 19-member team ranked No. 9 with $207 million in active listings, said she’s strategically hired agents with sub-specialties — whether it’s working with millennials, ultra-high-net-worth individuals or foreign buyers. (For example, she has designated agents who work with Chinese and Indian buyers, and in January she hired an agent fluent in Russian who works part time in Moscow.)

“I will do the listing presentation and say, ‘I’m an integral part of this, but we’ll have one or two others who are in this partnership,’” Field told TRD.

Hushed marketing

Some of the biggest listings out there are not being blasted out over influencers’ social feeds.

“The dirty little secret is we’re all sitting around with a healthy amount of ghost listings,” said Field, noting that buyers see more value in properties that are kept offline.

“It hasn’t been on the supermarket shelf for 197 days,” she said, adding that she currently has $81 million worth of whisper listings.

In some cases, buyers want to quietly shop their listing to see how the market responds to the asking price before taking it full bore. “If you get beyond 90 days, that directly relates to the entry offer,” she said.

Corcoran’s Chiang said that within the past year she had a broker approach her looking for a Gold Coast Soho townhouse. Chiang, who said she’s sold “95 townhouses,” hunted down a seller who was about to move to California, and “right away we did the deal.”

In September, Compass went so far as to roll out a feature dubbed “Compass Coming Soon,” which allows its agents to post their listings to the firm’s website days before sharing them with local multiple-listing systems and portals like Zillow, StreetEasy and Realtor.com.

But as TRD has reported, critics argue that the feature — like whisper listings — creates an unfair advantage because it rewards agents with direct deals and limits listing exposure.

On the new development front, Miller Samuel found in the first quarter that “active new development listing continued to be pulled from the market.” The report noted that the category of inventory fell 5.5 percent year-over-year — despite a “steady flow of new projects entering the housing stock.”

Developers, of course, always strategically hold back shadow inventory. That’s particularly true in this crowded market where discounts and incentives are the norm.

Robert Dankner, co-founder of the boutique brokerage Prime Manhattan Residential, said publicly listing a property leaves the price open to being “misunderstood.”

Dankner — who did not make TRD’s ranking but said off-market listings have been a boon for him — cited 220 Central Park South as the “the Grand Pumba” on this front.

In that case, Vornado and Corcoran Sunshine Marketing Group, which has the coveted assignment to handle the $3.4 billion sellout, have opted to hold units off the market and sell them to hand-picked buyers as so-called shadow inventory.

Vornado Chairman Steven Roth is said to have personally vetted buyers.

“[The building] achieved above-market prices, [and] the buyers are a who’s who because they were invited,” Dankner said.

The cherry on top of that star-studded list of buyers is hedge funder Ken Griffin, who purchased a record-shattering $238 million penthouse. (The Alexander Team represented Griffin in the deal, but didn’t get credit on TRD‘s ranking because it was a buy-side transaction that closed in January.)

It should also be noted that Corcoran Sunshine is not included on this ranking because, despite its dominance, it’s a new development marketing firm where the company — rather than the agent — is the one reeling in the listings. (At other firms, like Douglas Elliman, star resale brokers are assigned to new developments.)

Still, Corcoran Sunshine says it’s currently marketing $23.5 billion worth of units in Manhattan alone. Its projects include buildings like Waterline Square, 70 Vestry, 15 Hudson Yards and a slew of others.

The sound of silence

While listing brokers can aggressively lobby sellers to reduce their prices, in many cases they just have to wait for those clients to come to terms with reality.

Serhant recalled getting inundated with calls from other brokers about a unit at the Park Millennium at 111 West 67th Street that went into contract for $11 million — despite being listed for $14 million. He said he was surprised by the number of agents who were waiting for a price chop, rather than just having their buyers make a below-ask offer.

“‘Oh, this sold?… How did this go into contract without a price reduction?’” he recalled brokers asking.

Compass’ Steinberg said he had one listing where a buyer didn’t believe there was a second bidder on the property and ended up losing out.

CORE’s Beare, meanwhile, noted that some of her buyers have refused to make offers below the listing price because they don’t want to be “that bottom-feeder.”

“They’ll just wait and wait and wait,” she said, explaining that a price reduction serves as a signal that the seller is willing to negotiate. “[It] puts it on everyone’s radar again.”

Ironically, a lack of offers can work in a broker’s favor — providing fuel for them to convince their seller to drop their price.

Modlin argued that waiting for the market to improve is a poor strategy because it delays freeing up investment dollars: “The only smart thing to do is to make a deal now” and walk away with the cash, he said. “You don’t always make money in real estate.”

—C.J. Hughes contributed reporting

Correction: The listings chart was updated to add three Corcoran Group agents who had been listed individually to already ranked teams. Alexis Bodenheimer and Marion Smith are on the Cathy Franklin Team and Connor Ramage is on the Charles Attias Team. As result of the mergers, three additional agents/teams (Dolly Lenz, Roger Erickson and Deanna Kory) were added to the chart. In addition, John Burger’s total was undercounted. His new total of $252.9 million moved him from No. 13 to No. 6 and shifted several other agents’ ranking. Finally, the story was updated to remove a clause about Adam Modlin’s social media activity.