(Source: Streeteasy.com)

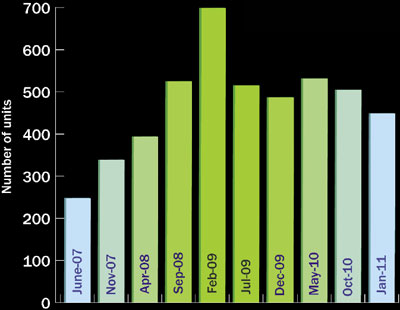

Two years ago, the Magic 8-Ball for Williamsburg condo developers would have read, “Try Again Later.” With condo inventory peaking at almost 700 units in February 2009 (according to StreetEasy), developers and brokers in the throes of the recession were grappling with a stock of residential units roughly three times the size of early 2007’s. It wasn’t a good time to open a building.

But now some brokers say the dust has settled, and inventory in the neighborhood, once the poster child for the condo glut, is actually tightening.

“I’m seeing my listings shrink; I’m seeing my inventory shrink,” said David Maundrell, president of aptsandlofts.com.

While waterfront buildings like the Edge by Douglaston Development and Northside Piers by Toll Brothers still have hundreds of units on the market, brokers say lower-priced units further inland are starting to burn off. “Right now, from what I see, there’s very little to buy other than waterfront product,” said Christine Blackburn, an associate broker with the Corcoran Group’s Williamsburg office.

“It’s really just the new inventory, which has dwindled down to Northside Piers and the Edge,” Blackburn said, noting that “they have tons of units … but a very different price point” from inland developments.

Inventory, while still elevated from 2007, when there was an average of about 200-some-odd units on the market in the neighborhood, dipped below 450 units in January 2011, a strong sign for the area.

But Jonathan Miller, head of appraisal firm Miller Samuel, said he’s not convinced of claims that the excess inventory problem is on its way out just yet in Williamsburg.

“The developer optimism is coming from the fact that sales [were] up 21.1 percent in fourth-quarter 2010, compared to the same period [the prior] year,” Miller said. “This suggests that inventory is declining, but we are still likely looking at several years to resolve excess supply. Drive through the [neighborhood] at night to get a sense of the amount of vacant units.”

Of course, the post-crash ballooning of inventory took its toll on new development sponsors and other sellers, many of which cut their prices significantly to move units. By the end of 2009, the average per-square-foot condo closing in Williamsburg was $548 — a steep discount from the average asking price in the area, which was at $757 per square foot at that time, according to a report by The Marketing Directors.

David Favale, a Citi Habitats vice president and Williamsburg resident, said that price cuts helped draw buyers in during the downturn, leading to today’s slightly tighter condo stock.

David Von Spreckelsen, a senior vice president with Toll Brothers, said that while his development “opened basically the week that Lehman tanked,” sales have been looking up at the massive 450-unit condo. “The market in Williamsburg is mature enough now that people wouldn’t see us as a shot in the dark,” Von Spreckelsen said, adding that the two-building development has sold 140 units in the last year and a half alone.

The first tower is completely sold out, while the second is more than 50 percent sold, he said. “We’re now selling at a faster pace than we have historically,” he said. “[But] if there was no Edge, I think I’d be sold out right now.”

Even as condo market conditions may be improving, many developers are still gun-shy when it comes to building and opening condos. “People walk around the streets and they see [formerly] stalled sites or jobs that are under construction … [but] those buildings could very well be rental, not condominium,” Maundrell said.