Last month, New York Magazine surprised Manhattanites when it named Park Slope “The Most Livable Neighborhood in New York.” But the ranking came as no surprise to major city real estate firms, who have been busily setting up shop in “Brownstone Brooklyn” for more than a few years.

In fact, Brown Harris Stevens recently expanded its office at 100 Seventh Avenue in Park Slope. The Corcoran Group, meanwhile, is also increasing its Park Slope footprint and taking over a space once occupied by a Thai restaurant above its office at 125 Seventh Avenue. The move will make room for about 20 additional agents, according to Frank Percesepe, Corcoran’s regional senior vice president for Brooklyn. (The company may close another small Park Slope space once the bigger office is up and running.)

Corcoran has also been doing more deals in Kensington, Windsor Terrace, Greenpoint and Bushwick, Percesepe said.

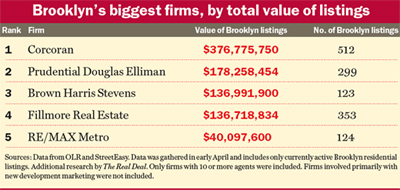

In 1998, Corcoran became the first major Manhattan firm to venture into Brooklyn. It was a prescient move: Brooklyn home prices have since soared, and Corcoran’s early entry into the market has paid off handsomely in terms of market share. With offices in Williamsburg, Fort Greene and Brooklyn Heights in addition to Park Slope, Corcoran has the highest dollar value of listings of any firm in Brooklyn, according to The Real Deal‘s first annual ranking of Brooklyn firms.

With roughly 230 agents, Corcoran is the second-largest firm in the borough, behind 44-year-old Fillmore Real Estate, which has nearly 290 agents and is based in Sheepshead Bay.

Corcoran has more than twice as many Brooklyn agents as third-ranked Elliman, which came to Brooklyn in 2004. Brown Harris Stevens, which also moved into Brooklyn in 2004, is ranked No. 4 in the borough, with 71 agents. Halstead has three Brooklyn offices and 34 Brooklyn agents, coming in at No. 14.

In the past few years, the Manhattan firms have impacted the Brooklyn market by encouraging other agents to “co-broke,” or show other companies’ exclusive listings.

When the Manhattan firms first came to Brooklyn, “there was no co-broking,” recalled Hall Willkie, president of Brown Harris Stevens. “They were used to dealing with their own listings only.”

The Manhattan firms that moved into Brooklyn are members of the Real Estate Board of New York, which requires them to co-broke. That’s helped prompt many smaller firms to do the same.

“It’s always better to share,” said Paul Link, a manager and associate broker at Marine Park-based Tracey Real Estate, which ranked ninth in size with 42 agents. “You’re going to look good in the client’s eyes.”

Co-broking is one factor that’s helped increase Brooklyn real estate prices in recent years, said Michael Guerra, director of sales for Elliman’s Brooklyn Division. “It drives more traffic, and more traffic will ultimately drive up prices,” he said.

But Brooklyn firms are only taking co-broking so far. A few have joined REBNY, but many refuse because they feel that paying dues to the Manhattan-based trade organization has little benefit for their agents, explained John Reinhardt, the CEO of Fillmore, which is not a REBNY member.

And, understandably, many Brooklyn firms are not pleased about the arrival of the Manhattan-based companies.

Because of the additional competition, “my people have to work harder,” said Marc Garstein, the president of Warren Lewis Realty in Park Slope, adding that his 20-agent firm “got killed” in the recession, though things are now picking up.

But intense pressure from Manhattan firms is still limited to Northwest Brooklyn neighborhoods like Brooklyn Heights, Carroll Gardens and Park Slope.

“There’s the Downtown Brooklyn brokers, and the rest of Brooklyn,” said Reinhardt, noting that the big Manhattan firms have few listings in southern Brooklyn, where price points are lower.

Indeed, based on the value and number of listings each firm has, the average price of a Fillmore listing is around $387,000. Corcoran’s average listing, meanwhile, is around $735,000, while Elliman’s is nearly $600,000.

Reinhardt — whose firm ranked fourth in terms of listing value, with $136.7 million worth of properties on the market — said he’s not worried about losing market share to the Manhattan firms. In part, that’s because many of Brooklyn’s neighborhoods are so diverse that it’s difficult for outside real estate brokers to gain a foothold there, he said.

“There are so many different nuances to Brooklyn,” he said. “One side of the street is different from the other side of the street. There’s so much to know, and it’s not something [brokers] can learn about in a textbook or read about.”

Be that as it may, many local mom-and-pop firms are becoming franchises of national brands. Jaroslaw Kaszuba, who co-founded All Seasons Realty in Canarsie in 1998, said he was concerned by the number of small brokerages closing. To help avoid that fate, they became a franchise of Exit Realty in 2007. Exit’s business model, which offers agents 70 percent commissions, has helped lure agents from other firms, allowing All Seasons to grow from three agents to 59 in just two years.

Many small Brooklyn firms have had a difficult time in the recession, said Reinhardt, who noted that his company has allowed several “walk-overs,” where all of the agents of a smaller company become Fillmore agents (though he wouldn’t name the companies).

Still, even Fillmore has dropped in overall size, he said. Many agents — especially part-timers — left the business when the economy turned south.

“You can’t be mediocre anymore,” Reinhardt said. “You have to be a great agent.”