New York wasn’t the only city in the world to find itself in a tenant’s market last year.

In fact, global office rents fell by 10 percent in 2009 compared to the previous year, according to Cushman & Wakefield.

In particular, New York and other major banking centers, like Hong Kong and London, saw rents plummet as the economic crisis dealt a severe blow to the financial services industry.

“Overall, the recession hit the industrial countries extremely hard,” said Kenneth McCarthy, managing director of New York metropolitan area research at Cushman.

Still, vacancy rates in these major global cities generally stayed lower than in other areas.

“Vacancy in New York is still relatively low compared to other major cities,” said Ben Breslau, a senior vice president at Jones Lang LaSalle and director of research for the Americas.

On the rental front, New York has seen some of the largest drops in the country.

Compared to the rest of the U.S., “New York [rents] went up the furthest and came down the furthest,” said McCarthy, noting that landlords aggressively lowered prices to retain tenants.

Washington, D.C., is recovering faster than New York, because even as the private sector contracts, the federal government expands, explained Breslau. “D.C. is at the head of the pack in terms of stabilizing,” he said.

By contrast, “New York is starting to stabilize, but hasn’t necessarily come back yet,” he said.

Midtown Manhattan saw higher vacancy rates than Downtown, as companies like the now-defunct Lehman Brothers and Bear Stearns, as well as others like Citibank, dumped space on the market.

Still, there was less available office space in both Midtown and Downtown than in Los Angeles, Miami, Chicago and San Francisco, as well as in Beijing, Moscow and Brussels, according to Cushman.

That’s likely because companies are focusing resources on international financial centers like New York, Tokyo and London, rather than secondary locations, said Barrie David, a senior research analyst for Europe, the Middle East and Africa at Cushman.

“Companies always need to be in global cities,” he said. Still, firms in these locations “have negotiated hard with their landlords,” he noted, one reason for the large rent drops.

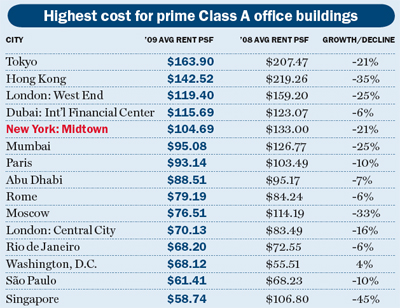

Though it’s sometimes difficult to compare rent drops in different countries because of currency fluctuations, New York has seen significant rent declines. The most prime, high-end Class A office space in Midtown dropped 22 percent from $133 to $104.69. Other cities have, however, fared much worse. For example, Singapore saw its most prime Class A office rents drop by a stunning 45 percent between 2008 and 2009. “Companies aren’t looking to locate there as much,” David said.

Like New York, London was also hard hit, with Class A rents sinking 25 percent year-over-year in the West End — the city’s most expensive office area, which is known for an abundance of hedge funds. Central London, meanwhile, saw a 16 percent rent drop. Still, the vacancy rate remains low in central London, where there is a scarcity of available high-end office space and continuing demand.

The market has begun to bounce back a bit as a result, David said.

“There hasn’t been much Grade A supply coming on the market,” he said. “These buildings are highly sought-after, so when they do come on the market, there’s competition. That’s led the recovery in the office market.”

Tokyo has also suffered, with office vacancy nearly doubling year-over-year, and more landlords offering incentive packages. And, of the world’s other major financial centers, Hong Kong saw the steepest rent drops.

“Hong Kong is a volatile market,” McCarthy said. “It goes up a lot and goes down a lot. You get a lot of speculation when times are good, boosting rents rapidly.”

Hong Kong office space has always been expensive because it’s a “small market” where it’s difficult to build, he said, and yet there’s traditionally been a large amount of demand due to its proximity to China.

“It really has been China’s door to the rest of the world,” McCarthy said. “Many Chinese companies locate there, [along with] Western companies that want to get into China.”

In contrast, Dubai saw a massive building boom during the mid-2000s and has plenty of office space, Cushman’s David said. But when the financial crisis hit, many companies cancelled or postponed their plans to expand to the Middle East.

“Dubai is going to have a lot of empty buildings,” David said.

Cushman estimates that some 80 percent of the space in the newly built Dubai International Financial Center is currently vacant.

“It’s a lovely office center, but nobody can afford, or wants, to go there at the moment,” he said.