The global economic downturn hurt shopping districts all over the world last year, with retail rents in many countries falling for the first time in decades.

But New York City’s prime retail destinations — especially Fifth Avenue and 57th Street — held their own against many other premier international shopping strips, from Rodeo Drive in Beverly Hills to Causeway Bay in Hong Kong.

“New York did benefit from a healthier economy and better tourism than we expected,” said Kenneth McCarthy, managing director of New York metropolitan area research at Cushman & Wakefield. “If you look at many other cities, you saw really substantial rent declines.”

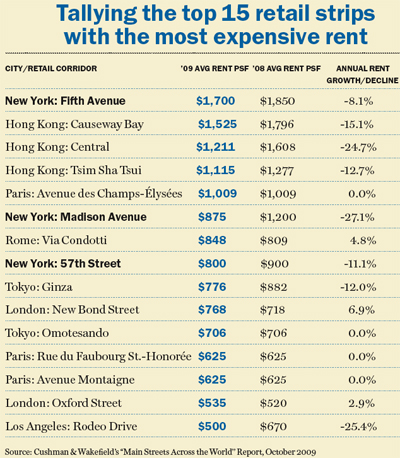

According to Cushman’s “Main Streets Across the World” report, the average retail rent on Fifth Avenue in mid-2009 was $1,700 per square foot — down just 8.1 percent from $1,850 at the same time in 2008.

By contrast, Rodeo Drive saw average rents sink 25.4 percent to $500, down from $670 in 2008, while rents in Tokyo’s prime Ginza district dropped 12 percent. Hong Kong’s three most expensive shopping areas — Causeway Bay, Central and Tsim Sha Tsui — each saw double-digit declines in retail rents, amid rising unemployment and reduced consumer spending.

Central, which has targeted big spenders from mainland China as well as local finance-sector workers, has been hit particularly hard as the luxury shopping market has struggled, the report says.

In New York, layoffs haven’t been as prevalent as economists once feared, and bonuses haven’t disappeared. Meanwhile, the city continued to see strong interest from tourists, especially “last year, when the dollar was very weak against the euro,” McCarthy said.

“A lot of European tourists come to New York, and a lot of them shop on Fifth Avenue,” he added.

The importance of tourist dollars for New York stores is evidenced by a slump on the Madison Avenue retail corridor. The key Madison shopping area, in the 60s and 70s, draws fewer tourists than prime Fifth Avenue. As a result, many Madison Avenue retailers have moved or closed shop, and average rents dropped 27 percent, to $875 per square foot.

“Retailers made a decision that Fifth Avenue is much more attractive in terms of people walking by than Madison Avenue,” McCarthy said.

Several European cities fared even better than New York. Paris’ premier shopping districts — the “Golden Triangle” (including the Avenue des Champs-Élysées) and fashion-focused Rue du Faubourg Saint-Honoré (home of the historic flagship of Hermès) — saw steady rents. Meanwhile, up-and-coming Boulevard Saint-Germain on the Left Bank, where a new Ralph Lauren flagship is opening soon, saw a 14 percent jump in rents from 2008.

According to Darren Yates of the European research group at Cushman, the top retail locations in prominent cities in the developed world have suffered less than shopping centers in outlying locations.

“With the top two or three key streets in the capital cities, there is always a list of retailers wanting to get in there,” he said. “If retail is going to be anywhere in the French market, it’s going to be in Paris and it’s probably going to be on the Champs-Élysées or Rue du Faubourg Saint-Honoré.”

As in the hotel market, London retail got a boost from the pound’s weakness.

“[It’s] pulling in all these European tourists,” Yates said. Particularly strong were New Bond Street, with luxury retailers like Armani Casa and Louis Vuitton, and bustling Oxford Street, which has hundreds of small shops and department stores like Selfridges.

Ireland, on the other hand, has seen sharp drops in retail rents after a severe recession and an “explosion of development of shopping centers and big-box stores,” Yates said.

In Latin America, an expanding middle class coupled with limited retail space helped push rents up last year, especially in São Paulo and Rio de Janeiro, Brazil.