(Source: Newmark Knight Frank)

(Source: Newmark Knight Frank)New York City may have some of the priciest housing in the world, but the London and Hong Kong residential markets are bouncing back faster from the downturn.

“In the second half of 2009, prices started to pick up again in New York,” said Liam Bailey, head of residential research at London-based brokerage Knight Frank. “But it’s a slower recovery.”

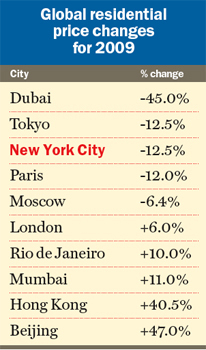

A recent report by Knight Frank found that residential prices in Hong Kong, which fell 25 percent during 2008, rebounded by 40.5 percent in 2009. London, also initially hard-hit, saw prices grow 6 percent last year, while Manhattan experienced a drop of 12.5 percent.

Meanwhile, on Global Property Guide — a Manila-based Web site aimed at investors looking to purchase real estate outside their home countries — New York City ranks third in home prices, behind London and Moscow. The average sales price of a London apartment advertised on the site in 2009 was $2.43 million; in Moscow, it was $1.98 million, followed by $1.95 million in New York. (It should be noted, however, that the site focuses on prime areas within each city that are attractive to investors.)

Sky-high prices in London are partially a result of strict building regulations and “endless planning approvals” that make new housing difficult to build, preventing a New York-style construction boom, said Matthew Montagu-Pollock, the publisher of Global Property Guide.

That doesn’t mean there hasn’t been any new residential construction. “If you go up and down the river Thames, you see nothing but new buildings,” he said.

(Source: Global Property Guide)

(Source: Global Property Guide)But as the global financial crisis drove prices down, many London homeowners took their homes off the market, constraining the already limited supply, while the weak pound increased interest from international buyers. As a result, prices have begun to rise again.

“We’ve seen examples of peak prices being achieved again in central London,” Bailey said.

In Hong Kong, space for housing is limited by a very small geographic area and a large proportion of parkland. Montagu-Pollock said it’s not uncommon for foreigners to spend the equivalent of $10,000 a month on housing there.

While Hong Kong’s housing market — much of it in high-rise buildings — was weak in 2008, it exploded in 2009, thanks to low interest rates and an influx of capital and lending from the banks, according to Knight Frank.

Hong Kong is a “volatile” market and a frequent target for speculators, Bailey said, but it has nonetheless shown “a very strong recovery.”

Moscow also remains one of the most expensive housing markets in the world, despite a year-over-year decrease of 6.4 percent, according to Knight Frank. In recent years, a rush of oil wealth has resulted in a high concentration of expensive homes in a small area in the center of the city.

“Housing is extremely expensive in Moscow,” noted Rebecca Powers, a principal at the global consulting firm Mercer.

Tokyo, meanwhile, faced difficulty in 2009, when home prices decreased by 12.5 percent, according to the report. While the city is also space-constrained, it’s seen prices spiral downward since the bursting of Japan’s real estate bubble in the early 1990s.

In India, Mumbai is seeing some recovery, with price increases estimated at 11 percent in 2009, according to Knight Frank. (Montagu-Pollock noted that record-keeping in India is spotty.)

“Much of the land is covered by slums, so the middle- and upper-middle classes live in high-rise housing,” he said. He added that the city also has rent controls in place that discourage some residents from moving, pushing up prices for others.

Latin America, particularly Brazil, is also holding its own. Prices in Rio de Janeiro increased 10 percent in 2009, Knight Frank reported.

Brazil has seen reforms to its banking system in recent years, and the rapidly growing economy has led to increased demand for housing. “Everywhere was impacted by the downturn, but [India and Brazil] weren’t impacted to the same extent that we were,” Bailey said.

(Source: Global Property Guide)

(Source: Global Property Guide)On the domestic front, Manhattan is still the most expensive city in the country, despite the beating it’s taken in the downturn.

The median price of a listing for Manhattan in the fourth quarter of 2009 was $810,000, according to Miller Samuel. San Francisco was a distant second at $610,000, according to the real estate Web site Trulia.

Where to rent?

When it comes to rentals, New York saw some of the steepest price declines in the U.S.

According to Reis, the New York research company that tracks commercial real estate data, the average asking rent of a market-rate New York City apartment in 2009 was $2,739 per month — 5.1 percent less than the previous year. (Reis tracked buildings with more than 40 units in Manhattan, the Bronx, Brooklyn and Queens. While it doesn’t give a full picture of New York City rentals, it offers a useful comparison to other cities.)

At first glance, that may not seem like much of a drop. But because landlords often offer tenants incentives before officially lowering the rent, a decline of 5 percent is considered substantial, said Ryan Severino, an economist at Reis.

“To see New York pull back 5 percent — that’s a significant decline,” he said. By contrast, asking rents in New York increased between 4 and 8 percent every year between 2004 and 2007, he said.

San Francisco saw a similarly dramatic decrease, with rents dropping 6.2 percent year-over-year to $1,812 per month, according to Reis.

Dallas, Chicago, and Washington, D.C., saw more moderate changes.

When the economy is healthy in Manhattan and San Francisco — both situated on small landmasses — landowners can raise rents dramatically, knowing there will be enough demand to support high prices. Not only are there hordes of would-be tenants wanting to live in hip areas, but purchasing a home can be so costly that many have no choice but to rent.

In cities like Dallas and Atlanta, where land is cheap and there’s plenty of housing available, rents don’t rise nearly as fast. “Landlords don’t have the leverage to raise the rents in good times,” Severino said.

But when the economy turned, New York landlords found they had to drop their prices significantly to keep tenants, he said. That differed from the cities where rents hadn’t risen as fast.

Other factors come in to play as well. In Washington, D.C., for example, the Metro train serves Northern Virginia and Maryland along with the city itself, so city rentals face competition from the suburbs. “I don’t think living in D.C. proper is as compelling as living in NYC proper,” Severino said.

Miami also faces unique challenges because of its massive overhang of new condos, many of which will be rented out now that the sales market has stalled. “They’re working through the excess inventory,” he said.