189 Bridge is now partly rentalLike many other development firms, the Clarett Group rode the wave of the real estate boom expertly, building successful condos in Manhattan and other markets across the country. Like a host of other developers, however, the company hit a damaging riptide in Downtown Brooklyn.

A few months ago, Clarett’s condo, the Forté, went back to its lender, Eurohypo AG.

The move was the most boldface example thus far of the difficulties developers have encountered selling condos in Downtown Brooklyn, generally defined as the section of the borough bounded by Nassau Street to the north, Ashland Place to the east, Schermerhorn Street to the south and Court Street to the west. That catch zone encompasses several micro-neighborhoods, including the western edge of Fort Greene.

Several big developers are feeling pain in the saturated area, which has been generating a lot of attention lately because three new luxury rental towers are preparing to launch.

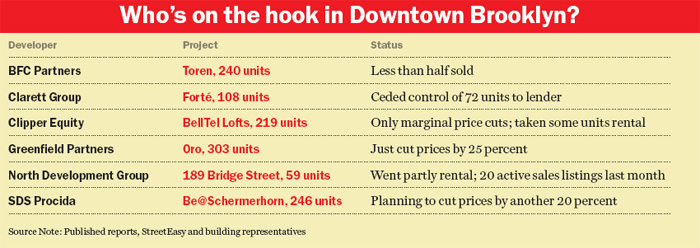

This month, The Real Deal looked at some of the most exposed developers in Downtown Brooklyn. In addition to the Clarett Group, developers SDS Procida, Greenfield Partners, Clipper Equity, BFC Partners and North Development Group all have struggling Downtown Brooklyn projects.

While those affiliated with the projects say they’re confident that rentals will succeed where condos failed, the competition is stiff.

Since December 2006, construction has either begun or been completed on 2,780 rental units, according to data from the Downtown Brooklyn Partnership.

Meanwhile, with a crush of condo inventory still unsold, it’s clear that it will take longer than expected to transform Downtown Brooklyn from a district defined by government buildings and a smattering of office towers into a vibrant residential neighborhood.

The Downtown Brooklyn Partnership — a nonprofit development corporation whose mission, in part, is to bolster the goals of the city’s redevelopment plan for the area — touts in a video on its Web site that by 2012, Downtown Brooklyn will attract “35,000 new residents.”

However, given the tepid sales of the condos that have hit the market since a 2004 rezoning of the area, those estimates about the coming influx of residents seem more than a little hyperbolic.

Clarett’s crossroads

The Clarett Group’s 108-unit Forté condo, at the intersection of Ashland Place and Fulton Street, began presales in early 2007.

By the middle of this year, around 60 percent of the units in the building were still unsold, and Clarett ceded control of 72 condos to its lender, Eurohypo AG.

“Clarett had big successes elsewhere but bad luck in Brooklyn,” said Chris Havens, chief executive of Brooklyn-based commercial brokerage Creative Real Estate Group.

A source involved in the Forté’s development, who asked not to be named, said the condo did not succeed because negotiations with Eurohypo to lower prices in the building got nowhere. “We were trying to meet the market,” the source said. “We tried to convince the bank that the market was slipping, but they gave us a minimum price that we had to sell out. It was a long battle. Finally, they lost the opportunity [to cut prices] before the market slipped.”

Still, the firm’s other Downtown Brooklyn project — the 490-unit Brooklyner tower, which will begin leasing next month — will succeed, in large part because “it’s more of a renter’s economy,” said David Perry, the Clarett Group’s director of sales and leasing.

As of last month, rents at the Brooklyner, at 111 Lawrence Street, were scheduled to start at around $1,500 for studios and $1,700 for one-bedrooms.

Meanwhile, the Clarett Group’s third project in Brooklyn, a condo not in Downtown but on Court Street in Carroll Gardens, is currently stalled.

Perry said his firm is trying to get financing for it.

Who else is on the hook?

While no other developers in the area have had to return projects to the bank yet, Clarett is hardly alone in its struggles.

Other nearby developments that have posted weak sales numbers include Greenfield Partners’ Oro, at 306 Gold Street; SDS Procida’s Be@Schermerhorn, at 189 Schermerhorn Street; Clipper Equity’s BellTel Lofts, at 365 Bridge Street; BFC Partners’ Toren, at 150 Myrtle Avenue; and North Development Group’s 189 Bridge Street.

Last month, Crain’s reported that the 303-unit Oro — which hit the market more than two years ago and as of last month was only about one-third sold — has relaunched its sales effort for the building and cut prices by up to 25 percent. With the cuts, prices at the condo were ranging from around $300,000 for studios to more than $1 million for three-bedrooms.

Meanwhile, Louis Greco Jr., a principal of SDS Procida, which developed the 246-unit Be@Schermerhorn, told The Real Deal he and his partners are also planning to relaunch their condo in the coming months with prices reduced around 20 percent. Sales at the condo — which is not yet totally complete — began last September, “the worst time in the history of the republic to try to sell a building,” according to Greco.

The developers dropped prices about 20 percent off their initial asks shortly after hitting the market, but still put only about 40 units into contract over the course of a year, according to Greco. This September, contract holders were given the option of getting out of their agreements. Greco estimates that about 20 buyers will take that offer.

“Our capital structure is different from most [developers’],” he said, “because we have no mezzanine debt.” Greco said condo sales in the area “are going to come down to pricing.”

Be that as it may, other developers in Downtown Brooklyn have yet to implement big price cuts.

At the 219-unit BellTel Lofts, which hit the market more than three years ago, Clipper Equity has managed to sell only slightly over half the units, according to data from Property Shark. While some units are now being offered as rentals, there have been only marginal cuts on asking prices for the unsold condos.

A spokesperson for BFC Partners, the developer of the 240-unit Toren (which went on sale last April and where closings were “imminent” as of the middle of last month), said that 114 condos in the building are in contract.

Despite the fact that the building is less than half sold, the spokesperson said listings are still going into contract at full price; the developer is “happy” with its sales progress, and price cuts have not been implemented.

North Development Group’s 189 Bridge Street, a 59-unit condo that went on sale three years ago and went partially rental last year, had 20 active listings last month on StreetEasy, the real estate data site.

Prices on some of the condos had been cut: For example, a one-bedroom that had been listed for $610,000 in November 2007 was asking $539,000.

Although Greco and his partners considered taking Be@Schermerhorn rental, he said they ultimately decided against it “because we felt there were also decreases in the rental market.”

Playing rental roulette

Still, those associated with the three rental towers that will open in Downtown in coming months — aside from Clarett’s Brooklyner tower, Forest City Ratner’s 365-unit building at 80 DeKalb Avenue, and the 650-unit Avalon Fort Greene at 343 Gold Street are all nearing completion — are betting that their buildings will find success where condos did not.

“I don’t anticipate that rentals are going to struggle as much as condos,” said Clifford Finn, managing director of new development at Citi Habitats, which is marketing 80 DeKalb. “Right now, there are a lot more people renting than purchasing, and there isn’t that much high-end rental inventory in the area. It’s not like in a Manhattan neighborhood, where you have 50 different rental buildings to choose from.”

Finn said gross rents — before concessions — at 80 DeKalb are set to start at $1,895 for studios, $2,250 for one-bedrooms and $3,400 for two-bedrooms.

At Avalon Fort Greene, the development’s Web site last month said that studios start at $1,730, one-bedrooms at $2,223 and two-bedrooms at $3,137. Advertised concessions at the building included two months’ free rent.

The rentals’ developers said the buildings will help Downtown turn a corner into a more desirable residential area, thus eventually luring buyers to the many condos.

“The condos are going to be successful once these rentals draw people into the area,” said Clarett’s Perry.