The Manhattan office leasing market began the year on a tear, leading executives as recently as four months ago to predict that volume could top 30 million square feet in relocation and expansion deals. Now, however, professionals — who have seen demand wane in the second half of the year — expect activity will fall far short of that.

Indeed, the fourth quarter — often a bright seasonal spot as firms try to wrap up leases before the end of the year — won’t deliver, sources say.

Leasing for 2011 is expected to reach only 25 million or 26 million square feet, barely ahead of last year’s 24 million square feet, figures from commercial firm CBRE show. The last three months of the year are not expected to help.

“We are anticipating it being a slightly softer quarter than we have seen in the last three or four quarters,” Matthew Van Buren, president of CBRE’s Tri-State region, said last month at a media briefing.

That’s a comedown from July, when the strong 15.7 million square feet completed in the first six months of the year led Van Buren to predict, “If you just do a rough two-times [estimate], you are up there with well over 30 million square feet of leasing anticipated.”

Even still, some tenants looking to grow are taking advantage of the slowdown and are snapping up extra space even if it’s not needed right away.

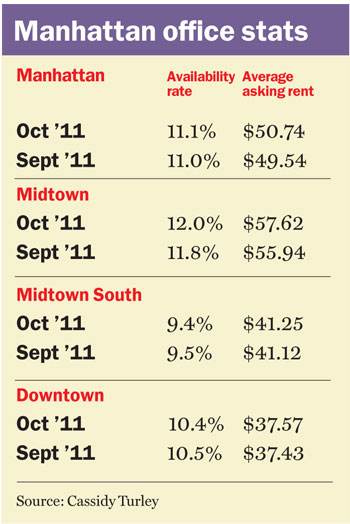

Average asking rents for Manhattan overall rose by $1.20 per foot, driven mostly by a large increase in Midtown asking rents, to $50.74 per foot, preliminary figures for October from commercial firm Cassidy Turley showed. At the same time, the availability rate — which measures space available for rent now or in the next 12 months — remained mostly flat, rising by .1 points to 11.1 percent, the firm reported.

Midtown

Following a trend of tenants moving Downtown — often chasing lower rents — operational and financial advisory firm Huron Consulting Group last month put the entire eighth floor at 1120 Sixth Avenue on the market, data from the CoStar Group showed.

The 58,150-square-foot space is being marketed by Jones Lang LaSalle’s Douglas Neye and Lisa Kiell, who declined to comment. While the asking rent was not published, rents on neighboring floors are between $57 per foot and $70 per foot.

Huron declined to comment, other than to confirm it was moving to 40 Wall Street (where it will open an office in January) and it had placed its current Sixth Avenue space on the sublease market.

It seems that the move is, in fact, cutting the firm’s rent costs. CoStar shows the asking rent for the 28,812 square feet on the 20th floor of 40 Wall was $31 per square foot.

Richard Bernstein, vice chairman at Cassidy Turley, said the market activity has been steady, if not robust.

“Leasing velocity remains healthy, but I do see some hesitation. There are many people out there who are going to be cautious heading into 2012,” he said.

Last month, Bernstein represented publisher Random House in the sublease of a portion of its space at 1745 Broadway to hedge fund PDT and accounting firm Spielman Koenigsberg & Parker.

Average asking rents in Midtown rose by a steep $1.68 per foot last month to $57.62 per foot, but the availability rate rose by .2 points to 12 percent, the Cassidy Turley data showed.

Midtown South

Yet another high-tech firm may take space at the building that Apple and Yelp call home, now that the global public health and development nonprofit FHI 360, which currently occupies two full floors of 100-104 Fifth Avenue, is moving out.

Last month, the landlord Kaufman Organization put the 32,000 square feet, on the eighth and ninth floors in the 305,000-square-foot building, on the market.

Grant Greenspan, a principal with Kaufman, said the asking rent was $55 per foot. He expected tech firms “that are experiencing growth” to take the space. He noted that the space might get leased by two firms, each taking a floor.

Asked when he thought it would be leased up, he said, “My best guess is March of 2012.”

The asking rent at the Kaufman building was higher than the average for the Mid town South market, which was $41.25 per square foot, just $0.13 per foot above last month’s figure. The availability rate fell modestly last month, by .1 points to 9.4 percent, the Cassidy Turley statistics revealed.

Downtown

The big managed healthcare company Healthfirst, which inked last year’s largest relocation lease Downtown, at SL Green Realty’s 100 Church Street, is now taking more space in the building.

In August 2010, the nonprofit signed a 20-year deal for 172,600 square feet on the 16th through 19th floors. Then, last month, it signed for another 57,817 square feet with an asking rent of $36 per foot, on the 14th floor, CoStar data showed.

Jones Lang LaSalle brokers Bill Peters and Derek Trulson represented the tenant. The building was represented by a team of Newmark Knight Frank brokers led by James Kuhn, as well as SL Green agents.

SL Green took full ownership of the 21-story office building from the Sapir Organization in January 2010. At the time, 58 percent of the 1 million-square-foot building was vacant.

“Tenants are moving into [mostly] empty buildings; you are seeing that in Midtown and Downtown,” Peters said. At such properties, ironically, existing tenants are getting boxed in as newer tenants take long-term leases around them. Therefore, companies such as Healthfirst are looking to sign for more space than they currently need, “to control their destiny.”

Asking rents Downtown followed the pattern seen in Manhattan overall, with the market remaining stable, with a slight improvement. Asking rents rose by $0.14 per foot to $37.57 per square foot from the prior month, but are down by $0.41 per foot from the same month a year ago. But while average asking rents have remained in a thin margin for the last 12 months, the vacancy rate has fallen steadily. Last month it was 10.4 percent, down .1 points from the prior month, and down from 13.5 percent one year ago.