INVESTMENT SALES IN MANHATTAN AND BROOKLYN

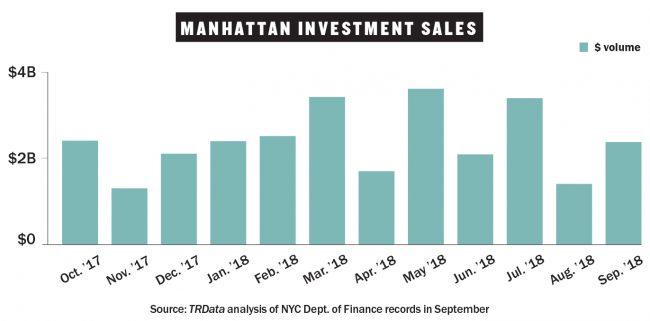

Manhattan investment sales bounced back in September with over $2.3 billion in deals recorded, up 68 percent from August and just under the average for the past 12 months. The top sale was the commercial space in the Marriott Marquis at 1535 Broadway, which Vornado bought from Host Hotels & Resorts for $442 million. Brooklyn saw its slowest month in the past year with just $438 million in sales recorded, none of which exceeded $40 million. The largest of those was the sale of a former orphanage by the Sisters of Mercy to Barone Management, which is planning a mixed-use project on the site. Meanwhile, Jonas Equities scooped up two properties in Sheepshead Bay for a total of $60 million.

Top manhattan investment sales recorded

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE | |

|---|---|---|---|---|

| 1535 Broadwayn(commercial condosnwithin hotel) | $442 million | Vornado Realty Trust/nHost Hotel & Resorts | N/A | |

| 101 West End Avenuen(residential) | $416 million | Dermot Company & PGGM/nEquity Residential | Cushman &nWakefield | |

| 183 Madison Avenuen(office) | $220 million | APF Properties/TishmannSpeyer & Cogswell-Lee Realty | CBRE | |

| 520 West 43rd Streetn(residential) | $193 million | Dermot Company, PGGM et al./nAEW Capital Management | Cushman &nWakefield |

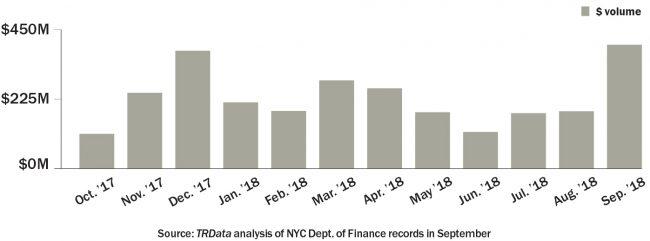

Brooklyn investment sales

Top Brooklyn investment sales recorded

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE | |

|---|---|---|---|---|

| 6301 12th Avenuen(development site) | $37.5 million | Barone Management/nSisters of Mercy | CBRE | |

| 2355 East 12th Streetn(residential) | $32 million | Jonas Equities/nR&C Management | N/A | |

| 1775 East 18th Streetn(residential) | $28 million | Jonas Equities/SusannSchoenfeld & Steven Breitman | Marcus &nMillichap | |

| 235 Park Avenuen(self-storage) | $27 million | Maddd Equities & Cayre Equities/nWarren Diamond & John del Monaco | N/A |

INVESTMENT SALES IN QUEENS AND THE BRONX

Queens investment sales hit a 12-month low in September with just $137 million in deals recorded, less than half the 12-month average. The top sale of the month was for a self-storage site in Jamaica, which Cayre Equities sold to Prime Group Holdings for $26.5 million,more than double any other sale recorded in the borough that month. The Bronx, on the otherhand, saw sales hit a 12-month high of $392 million in September, more than double any of the four months prior. Forty percent of that total came from two big South Bronx purchases by Brookfield, which kicked off its first Bronx development by acquiring 2401 Third Avenue and 101 Lincoln Avenue from Chetrit Group and Somerset Partners, for a total of $165 million.

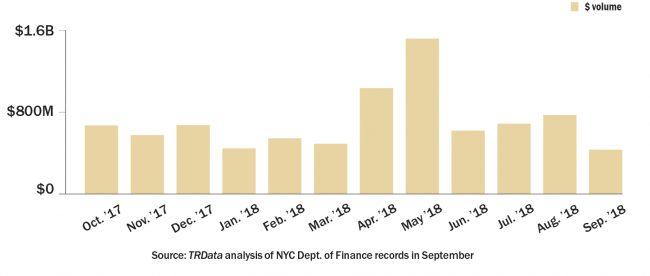

Queens investment sales

Top queens investment sales recorded

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE | |

|---|---|---|---|---|

| 109-09 180th Streetn& 180-05 110th Avenuen(self-storage) | $26.5 million | Prime Group Holdings/nCayre Equities | N/A | |

| 38-09 28th Street a.k.a.n28-08 38th Avenuen(industrial) | $10 million | Realty 38 LLC/nMunder Realty | Marcus &nMillichap | |

| 135-23 RooseveltnAvenue (commercial) | $9.5 million | Terrence Cheng/nTomilu Corp. | N/A | |

| 46-12 70th Street &n69-39 47th Avenuen(assemblage parcels) | $5 million | Madison Realty Capital/nAtlas Floral Decorators | N/A |

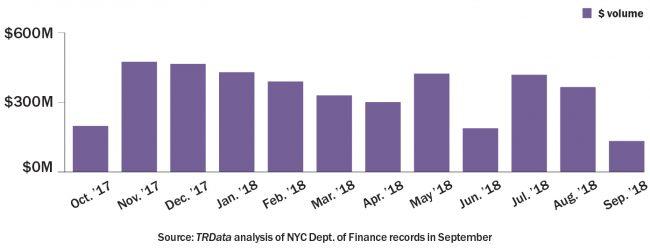

Bronx investment sales

Top Bronx investment sales recorded

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE | |

|---|---|---|---|---|

| 101 Lincoln Avenuen(residential) | $125 million | Brookfield Property Partners/nChetrit Group & Somerset Partners | Cushman &nWakefield | |

| 2401 Third Avenuen(residential) | $40 million | Brookfield Property Partners/nChetrit Group & Somerset Partners | Cushman &nWakefield | |

| 1150, 1166 andn1184 River Avenuen(development site) | $25 million | NYC Housing Partnership/nRiver Avenue Realty Corp. | N/A | |

| 2198 Cruger Avenuen(residential) | $22.5 million | Lightstone Group/nMartin Shapiro | Cushman &nWakefield |