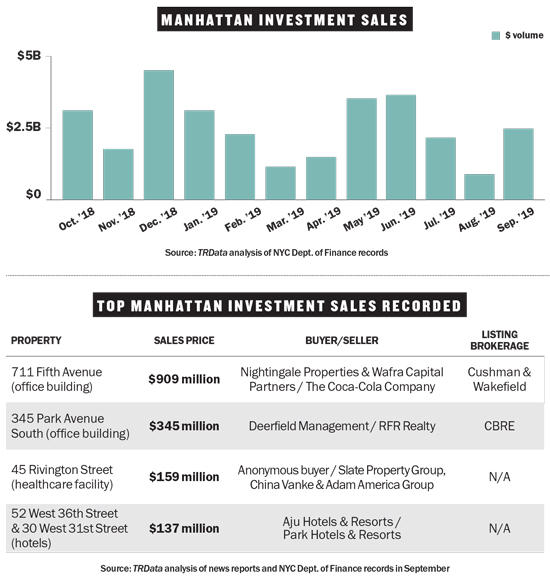

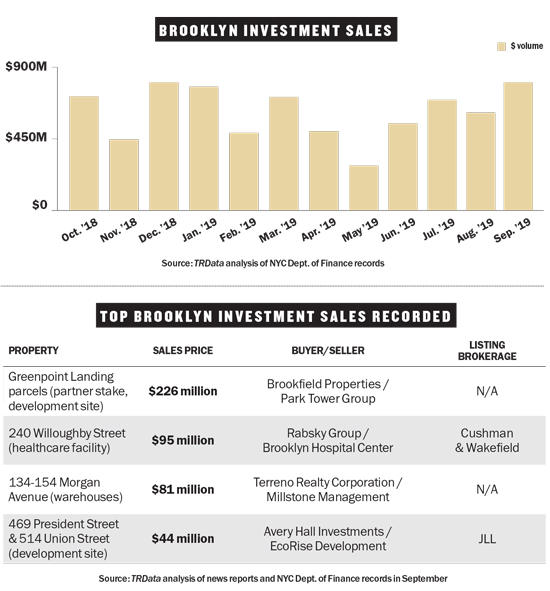

Investment sales in Manhattan and Brooklyn

Manhattan investment sales rebounded in September with $2.47 billion in deals recorded —more than double August’s total and slightly above the 12-month average. The borough’s largest deal was Nightingale Properties & Wafra Capital Partners’ $909 million buy of the Coca-Cola Building (which they flipped to Michael Shvo and Serdar Bilgili last month). Brooklyn’s investment sales market, meanwhile, hit an all-year high in September with $779 million in deals recorded, 42 percent up from the prior month and 31 percent above the 12-month average. The borough’s top deal was Brookfield Properties’ takeover of two sites at the Greenpoint Landing development, where it bought out partner Park Tower Group in a deal that valued the properties at $226 million.

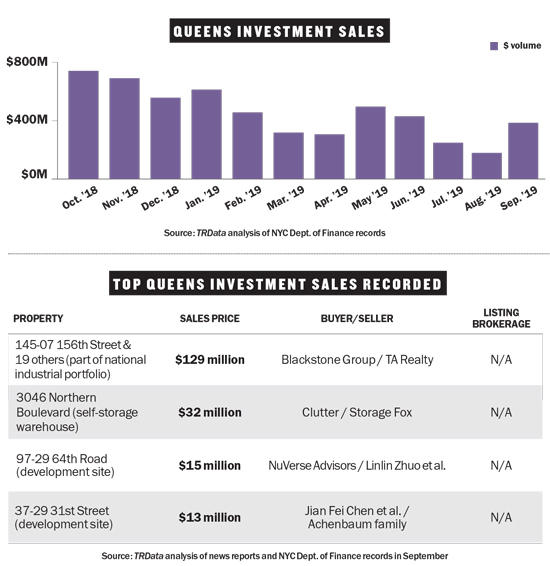

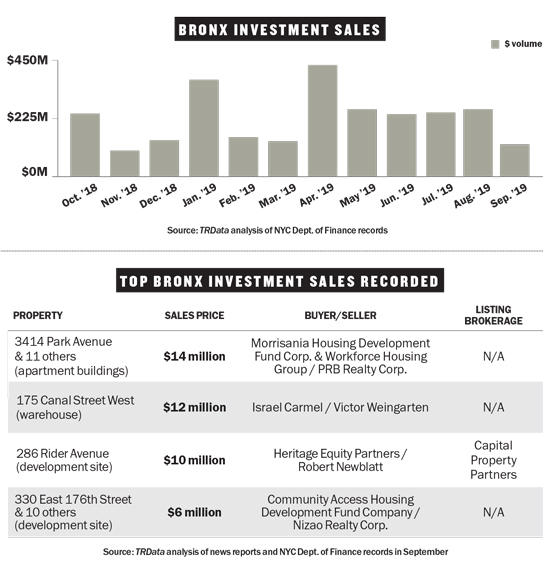

Investment sales in Queens and the Bronx

Queens’ investment sales market recovered from a four-month slide in September with $362 million in deals recorded — more than double the previous month but 17 percent below the 12-month average. The borough’s top sale was Blackstone Group’s $129 million purchase of the Queens portion of a national portfolio owned by TA Realty. In the Bronx, however, investment sales drop dramatically in September with just $109 million in deals recorded, less than half the month prior and roughly half the 12-month average. The borough’s top deal went to the Morrisania Housing Development Fund Corporation, which bought 12 apartment buildings in the Morrisania neighborhood from PRB Realty Corp. for $14 million.