Brooklyn’s official motto may be “Fuggedaboutit,” but the borough’s real estate industry is not having an easy time shaking thoughts of double-digit price drops and troubled residential projects. Overall, the median closed sales price in Brooklyn has already fallen back to 2005 levels, dropping 19 percent over the past two years, according to StreetEasy. Rental listing prices dropped 12 percent over the past year, not including all of the concessions landlords are throwing in these days. Meanwhile, a city tally early last month found that Brooklyn had more stalled construction sites than any other borough with 214 — a stunning 47 percent of all 448 projects citywide.

What’s worse, most experts agree that the market has yet to reach bottom.

With that in mind, The Real Deal took a comprehensive look at Brooklyn’s prime areas, where the bulk of new construction occurred during the boom. The goal was to stack up Kings County’s neighborhoods to determine which ones are suffering the most and which ones are holding relatively steady.

Predictably, industry analysts like Jonathan Miller, president of the appraisal firm Miller Samuel, said the amount of new construction and the level of unresolved distress in each area were two major factors influencing a market’s vulnerability to future price declines.

“The area with the highest amount of new development concentration there, by definition, has the most exposure to the troubles with new development lending,” Miller explained.

In terms of the hundreds of troubled residential projects looming in the shadows, he said, “the more units you push into the market, the more impact you can have on values.”

Robert Knakal, chairman of Massey Knakal Realty Services, which is marketing several distressed assets in Brooklyn, predicted prices will bottom sometime next year, at the same time unemployment peaks, and then flatten for two or three years after that.

Ultimately, he said the firm expects prices to drop an additional 5 to 10 percent.

On the bright side, Dan Fasulo, managing director of Real Capital Analytics, noted that “it’s not going to be the end of the world if these [new condo developments] start selling at discounts.

“It’s going to provide much-needed affordable housing for the middle class, which doesn’t really exist right now.”

The Real Deal zeroed in on six sections of western Brooklyn stretching from Greenpoint to Sunset Park. The data was compiled using sales and rental figures from StreetEasy, the city Department of Buildings’ list of stalled construction sites, and Real Capital Analytics’ list of troubled assets.

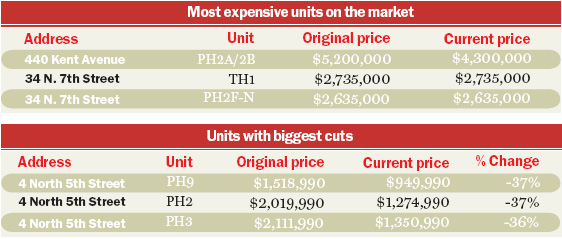

Williamsburg/Greenpoint/Bushwick

No area in the city epitomizes the boom and bust more than the neighborhoods of Williamsburg, Greenpoint and, to a lesser extent, Bushwick, former immigrant and industry havens that became the national epicenter of hipster culture. Thanks to a rezoning in 2005, scores of developers sought to capitalize on the area’s newfound cache, only for the music to stop mid-construction.

With 85 stalled construction sites and 16 residential projects officially classified as “distressed,” industry experts agree that this area is the one most vulnerable to steep price declines in the future.

Of all the districts The Real Deal researched, listing rents here have already fallen the furthest, 21.5 percent over the past year. More than 2,800 apartments are scheduled to come to market over the next year, according to aptsandlofts.com.

The median closed sale price fell 18.5 percent over the past two years, and the area has the most inventory of any market. In addition, the number of transactions declined the most, 58.2 percent, over the past year.

Since much of the area’s residential market was essentially created from scratch, the majority of the homes on the market are newly constructed apartments, the most tenuous sector of the housing industry.

Taken together, these factors give banks more trepidation when deciding whether to grant buyers mortgages, Miller said.

“The problem is that prices have to be depressed further than you’d think, given the fact that financing is so constrained; given the fact that lenders are looking at those [85] stalled projects and they’re gravely concerned, given the fact that they’re going to be lending into a market full of unknowns,” he said.

Two projects in particular are expected to have a disproportionate impact on the market.

One is Northside Piers, the first project in the area to aggressively slash prices back in February. The move by the 180-unit Tower 1 building effectively re-priced much of its competition (besides its even larger neighbor, the Edge).

The project, with a combined 450 units in both towers, is one to watch both because of its sheer size and because of developer Toll Brothers’ willingness “to do whatever they need to do to move product as long as they don’t completely lose their shirt,” said Michael Falsetta, executive vice president of commercial real estate advisor Miller Cicero, a sister company of Miller Samuel whose specialties include new development.

The first Northside tower, which is already occupied, claims the top 10 listings with the biggest price cuts in the district at up to 37 percent for one of its penthouses. Sixty-nine apartments have been sold there since February, according to project manager Scott Avram, making it the best selling project in Brooklyn in terms of total number of units.

But Avram said there are no plans to slash prices at the second tower, which has 270 apartments.

The second project expected to have significant impact on the market here is Warehouse 11, a 120-unit building on North 11th Street designed by Karl Fischer. One of the area’s largest distressed projects, Warehouse 11 was reportedly caught in a bidding war between some 50 investors.

Originally planned as condos, the rents it fetches will serve as an indicator for similarly fated projects. Massey Knakal, the firm marketing it, predicts units could fetch between $30 to $40 per square foot in rent, compared to Williamsburg’s median listing price of $36 per square foot.

Stalled and distressed construction sites dot this district. In addition to Warehouse 11, on the eight blocks surrounding Union Avenue and North 10th Street, there are 11 bulldozed lots and four construction sites where the Daily News reported it found drug-addicted squatters.

The most expensive property in the district is a five-bedroom, 3,540-square-foot penthouse at Schaeffer Landing listed for $4.3 million, 17 percent less than its original listing price. Combined from two penthouse units purchased for a total of $3.7 million, the home was listed just days after the second unit closed in October 2008. Sotheby’s broker Karen Heyman said there are interested buyers, but declined to divulge more detail.

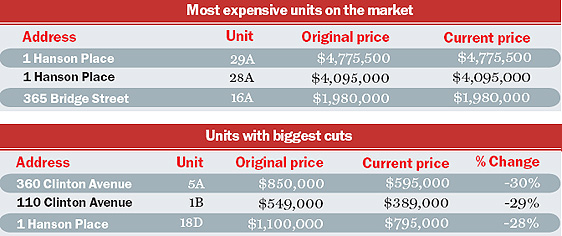

Downtown Brooklyn/Fort Greene/Clinton Hill

The neighborhoods of Downtown Brooklyn, Clinton Hill and Fort Greene were among the most rapidly gentrified during the real estate boom. Now, the district has also experienced the most rapid fall in median sales price, 29 percent over the past two years.

“Downtown Brooklyn has done worse than just about any other neighborhood, even worse than Williamsburg, for two reasons,” said Miller Cicero’s Falsetta. “The bulk of the developers in Downtown Brooklyn have been generally unwilling to cut pricing.

“And the other reason is, Downtown Brooklyn never really finished gelling as a neighborhood.”

In fact, the Downtown Brooklyn and Williamsburg areas were the only two that had a significant gap between the median listing price and the median closed sale price, indicating a deep divide between buyers and sellers that translates into dismal transactions.

The median closed sale price for transactions in the district between June and August was $405,000, while the median listing price on Sept. 1 was $598,930 — 48 percent higher. (Williamsburg’s median listing price was 31 percent higher than its most recent median closed sale price.)

Falsetta pointed out that, with the exception of Toren, many towers in this district sold slowly even during flush times.

He estimated that projects like Toren, be@Schermerhorn and Forté should slash their prices by up to a quarter to sell.

The Clarett Group, Forté’s developer, ceded control of the building’s remaining 72 apartments to lender EuroHypo Bank in August (see “Resenting the renters”).

Elan Padeh, a partner at TDG/TREGNY, which is handling sales at Forté, said the new sponsor does not plan to re-price the building, but there is room for negotiation and even bulk sales. “We’re just asking people to come in and make offers,” said Padeh.

Meanwhile, listings were recently pulled at be@Schermerhorn, which held its opening party two days after the collapse of Lehman Brothers.

At the time, Brownstoner.com noted that its listings were priced roughly $100 more per square foot than the competition, at $857. Now, developer Mario Procida said he is in the process of working out an agreement with the lender so apartments could be re-released “at $600 to $625 per square foot on average.”

On the rental front, the district has seen a decline of 6.6 percent in the past year. But experts expect that to change when two massive buildings come to market — the Brooklyner, at 111 Lawrence Street, which has 491 studios and one-bedrooms, another project by the Clarett Group; and Avalon Fort Greene, with 650 apartments that developer Avalon Bay has listed, starting at $1,984 for a studio to $5,064 for a three-bedroom.

The Isabella at 541 Washington and the Collection at 525 Clinton Avenue are among the 17 stalled or distressed projects in the district. Both are in Clinton Hill and nearly complete.

Marlon Vargas, one of the guards, said there have been two break-ins at the Collection: In the most recent, the vandals tried to make off with the air-conditioning units.

Assemblyman Hakeem Jeffries is pushing to turn projects like these into affordable housing, Crain’s reported. If that were to happen, “I don’t think it would do that much [to market prices], because it would just be nibbling around the edges,” said Falsetta.

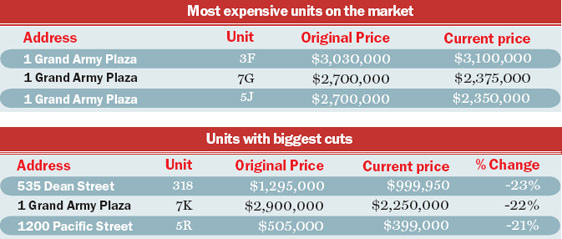

Bed-Stuy/Crown Heights/Prospect Heights

Of all six areas The Real Deal examined, median sales price fell the least over the past year in the neighborhoods of Bed-Stuy, Crown Heights and Prospect Heights, at a combined 5.7 percent.

Unlike the other districts, the bulk of price declines here occurred between 2007 and 2008, when the median sale price plunged from $605,000 to $477,000.

Falsetta said the luxury market in these neighborhoods fell first, probably in early 2008, “because they were fringe neighborhoods that only had recently begun appealing to the higher end of the market.” But unlike the other districts, the area was also affected directly by the impact of subprime mortgages, which took its toll in 2007.

Listing prices saw the most aggressive decline over the past year, at 20.9 percent, and the median listed rent fell by 11.7 percent.

Richard Meier’s On Prospect Park, the architect’s glassy tower at 1 Grand Army Plaza, contains the top seven priciest homes in the district — and, overall, is one of the most expensive projects in the entire borough.

“At an average of $1,013 per square foot, [that compares to prices in Manhattan neighborhoods] like Battery Park City, Chinatown, the East Village, Beekman, Sutton Place and Kips Bay,” said Sofia Kim, StreetEasy’s vice president of research.

Marketing on the project by SDS Procida began in late 2006, and still only 51 percent of its 96 apartments have either closed or are in contract, said sales director Cheryl Nielsen-Saaf of Corcoran.

Nielsen-Saaf said there are no plans to lower prices.

“We [cut prices] a couple months back in order to get to 50 percent sold, but we’re not finding that we’re needing to do any special concession right now,” she said.

“In the last three months things have changed significantly; we closed nine apartments in August.” She added, “I think it’s the highest-caliber product in Brooklyn right now, so I don’t doubt that it’s the most expensive.”

The district also has the second-highest number of stalled construction sites, 24, mostly clustered in Bed-Stuy and Prospect Heights, which make the area vulnerable to steep price cuts in the future.

One of the largest stalled construction sites in the district, 840 Bergen Street, is not yet on the Department of Buildings’ list –as The Real Deal and others have reported, the list is still incomplete.

According to Corcoran broker Gregory Todd, the 67 apartments at Bergen Street were supposed to come to market as luxury condos in spring of last year. Instead, the incomplete building is still shrouded in scaffolding and netting, and Todd said the project’s future is also being kept tightly under wraps.

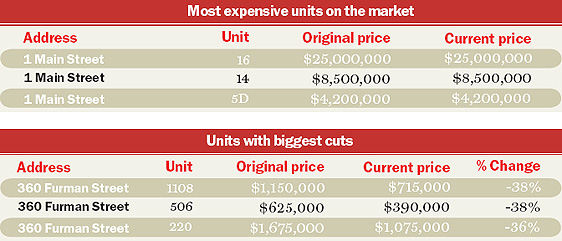

Dumbo/Brooklyn Heights/BoCoCa

The largely landmarked district comprised of Dumbo, Brooklyn Heights, Boerum Hill, Carroll Gardens and Cobble Hill had the smallest median sales price decline over the past two years, at 7.5 percent. The area also saw one of the smallest declines in rental listing prices over the past year — 4.7 percent.

“New development didn’t dominate the market, so as a result you didn’t have as large of a drop,” Miller explained.

While the area saw relatively few cranes during the building boom, retail districts flourished, like Smith Street’s “restaurant row” and Dumbo’s arty mash-up of bars, bookstores, furniture stores and more recently, two Brooklyn Flea outposts.

Several area brokers pointed out that, with the simultaneous mall-ification of Manhattan, these quaint neighborhoods have become preferred alternatives for many buyers: “what the West Village was like 20 years ago,” said Janet Gigi Zimmerman of Brownstone Real Estate.

Unfettered by the recession, developer David Walentas, credited with converting Dumbo from a seedy industrial enclave to one of Brooklyn’s most exclusive neighborhoods, brought the borough’s priciest property to market in August for $25 million at One Main Street.

The towering mansion in the sky features four glass-faced clocks 14 feet in diameter; a private glass-enclosed elevator, and an observation deck on the fourth floor from which the entire city appears almost toy-like.

“It supersedes real estate; it’s a work of art,” said Asher Abehsera, president of Two Trees Real Estate, the brokerage arm of Walentas’ Two Trees Management.

With no comparable properties, experts say its sale will affect little in the Brooklyn market.

“It’s hard to put a price on a property that’s so unique and iconic,” said Kim of StreetEasy. “However, looking at comparable properties in Manhattan like the listings at Palazzo Chupi and the Police Building, it will be very difficult to find a buyer at its current pricing.”

Abehsera said the developer is in no hurry to sell, but has already had “two guys who fell in love with it” and one offer “above $15 million.”

Much of the shadow inventory in this district is concentrated in One Brooklyn Bridge Park — only 17 percent of the building’s 438 apartments have sold.

The meager sales have prompted developer RAL Companies to begin offering some units for rent and free cars to buyers. The company received a two-year loan extension from its lender in May.

However, industry experts still worry about the future of this project because of the sheer number of apartments, and its peripheral location (it bookends one side of the under-construction Brooklyn Bridge Park, but is cut off from the rest of the neighborhood by the desolate road that runs under the Brooklyn-Queens Expressway).

Some say another major problem is its price point of $654 per square foot, already a 32 percent reduction from its original average, according to StreetEasy.

“They’re living in a fantasyland if they think that they’re going to sell out at the prices they are offering,” said Fasulo.

Park Slope

The blue-chip neighborhood of Park Slope, set to be immortalized in an upcoming television show about its stroller culture (based on the book “Prospect Park West”), is the only neighborhood that has its own category because there are 529 homes on the market here — the third highest of any combined district.

The largely landmarked brownstone neighborhood has seen most of its new development concentrated along Fourth Avenue, which the city upzoned in 2003.

The district has the lowest exposure to distressed development of any that The Real Deal looked at. Only five construction sites were listed as “stalled,” and no properties were officially deemed “troubled.”

Still, over the past year the number of transactions saw the second-highest drop at 48 percent. Median listing prices over the past two years fell 25 percent, and rental listing prices fell 7.4 percent.

Zimmerman of Brownstone Real Estate said Park Slope’s brownstone market is faring better than the condo market because there is a finite supply of these historic properties and “the buyer of a brownstone tends to be more mature, versus condo buyers who are younger and have less savings.”

She said, “Banks now require more savings; [young buyers] don’t always have it.”

But not everybody likes old homes. Last month, actress Jennifer Connelly told Conan O’Brien on “The Tonight Show” that she and her family sold their mansion at 17 Prospect Park West late last year partly because “it was big, and frankly it was a little Scooby Doo creepy … the kids would be, like, sleeping on the floor in sleeping bags because they were afraid to go to their own rooms.” The home was reportedly sold to a Google engineer for $8.45 million in November 2008.

Two of the most expensive listings in the district are at 35 Prospect Park West, built in 1928 and designed by architect Emery Roth. One 4,400-square-foot, five-bedroom co-op there is listed for $3.9 million, and another similarly sized duplex co-op is on the market for $3.75 million — a 24 percent decrease from the original asking price in June 2008.

Brown Harris Stevens, the listing brokerage, declined to discuss the property.

Meanwhile, much of the area’s new housing is concentrated in 500 Fourth Avenue, which has 116 listings priced at an average of $715 per square foot.

Having just launched sales in the spring, a spokesperson for developer Matri Holdings said 20 percent of the building’s units have gone into contract.

As the single largest project along Fourth Avenue, where four of the district’s five stalled construction sites are centered, the project is being closely watched for price cuts. “You’ll do for the Fourth Avenue corridor what Northside Piers did for the Williamsburg luxury segment; you’ll re-price the market,” said Falsetta, adding that the heart of Park Slope wouldn’t be affected.

Developer Baruch Singer, who owns a stalled construction site a few blocks away on Fourth Avenue where 51 condos were planned, said he’s “waiting for those other units to be sold before I would start construction.”

When his project was originally conceived during the boom years, Singer conservatively predicted the project could sell out at $650 per square foot. Now, his projections are closer to $550.

Red Hook/Gowanus/Sunset Park/Greenwood/Windsor Terrace

This hodgepodge district, which spans Red Hook, Gowanus, Sunset Park, Greenwood and Windsor Terrace, has seen the second largest overall decline in median closed sales prices over the past year, at 24 percent.

Conversely, its median rental listing prices have declined the least during the same time period, by only $50, to $1,900.

“In terms of closings, there are typically too few closings in Red Hook to make any conclusions — only five so far in all of 2009,” said StreetEasy’s Kim.

However, she said, median closing prices on the other end of the district in Windsor Terrace have declined roughly 10 percent from a year ago, and have declined 28 percent in Sunset Park.

The district’s most heavily discounted properties are the five “King Richard Townhouses” on a dilapidated block in Red Hook across from a public housing complex.

The new townhouses, which resemble carriage houses, were built with reclaimed brick. They have private garages and ample roof decks, and were all priced in August 2008 at $1.3 million.

The smallest one, a 1,000-square-foot two-bedroom, was reduced 46 percent to $699,000 and is in contract. Another one twice the size entered contract after it was reduced 31 percent to $899,000.

“We shot for the moon when we came to market last year priced at $1.3 million,” said Prudential Douglas Elliman broker Nicole Galluccio.

She said two of the units were in contract at the listing price but the contracts fell through because of financing difficulties.

It may be indicative of the changing market that activity picked up only after the most recent discounts.

The city lists nine stalled construction sites in this district — all in Sunset Park and Greenwood. The projects were all relatively small, so they are unlikely to have a major impact on the prices in the vicinity.

Still, neighbors called the city to complain of falling debris at one four-story cinderblock shell on 34th Street in Sunset Park where construction has been stalled since an accident there in January.

The developer, Louis Salemaj, said he would resume building once he’s financially able.