After a strong first half of the year, Manhattan leasing activity declined in the third quarter. But despite the slowdown, which stemmed from a dearth of mega deals, the availability rate and asking rents for the overall market continued to strengthen.

Manhattan leasing volume fell from nearly 10.6 million square feet in the second quarter to 6.7 million square feet in the third quarter, preliminary figures from commercial firm Cassidy Turley showed late last month. (Those numbers exclude deals from the last few days of the month.)

The lower volume came after a strong beginning of the year, in which major tenants like Japanese financial giant Nomura Holding America and publishing powerhouse Condé Nast inked deals for 900,000 square feet and up. The third quarter saw no blockbuster deals: Oppenheimer & Co.’s deal for 270,000 square feet at 85 Broad Street was the largest of the quarter, CoStar Group figures show.

Some said the weakness in the national and global economy appeared to be taking a toll on Manhattan leasing activity, while others said the steep increase in asking rents in Midtown was driving down demand.

Some said the weakness in the national and global economy appeared to be taking a toll on Manhattan leasing activity, while others said the steep increase in asking rents in Midtown was driving down demand.

Robert Goodman, executive managing director at commercial firm Colliers International, predicted that larger deals will be put off until tenants get a better sense of whether the market is heading up or down.

He said the spike in activity earlier this year was a result of pent-up demand combined with a firming market that encouraged companies to sign before prices rose further.

“What’s happened now is that the marketplace [is beginning] to have a lot of uncertainty, and no one wants to look in the rearview mirror and be punished for having made a bad long-term decision, ” he said. “I think there are some big deals to be had, but they will be done at a point when people are convinced that they are securing value pricing, and it is not necessarily where we are right now. ”

Midtown

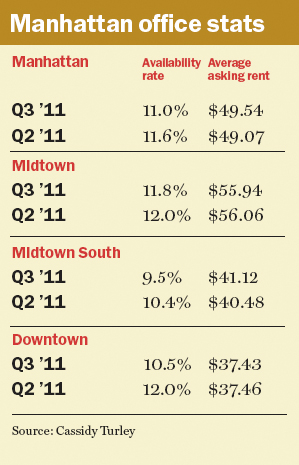

Like the rest of Manhattan, leasing activity in Midtown offered up mixed signals in the third quarter: Both the amount of space leased and asking rents fell, but availability rates — which measure space available for rent now or in the next 12 months — tightened, the Cassidy Turley stats showed.

In some buildings, landlords continued to remain bullish. For example, in the 22-story Class A property at 645 Madison Avenue, landlord TF Cornerstone put the entire 17th floor, a 7,000-square-foot space, on the market last month with an asking price of $110 a square foot. That was the most expensive space listed with an asking price in CoStar last month for all of Manhattan.

The price was far above the average asking rent for Midtown, which was $55.94 per square foot — a decline of $0.12 per foot from the second quarter, Cassidy Turley numbers show.

William Cohen, executive vice president at Newmark Knight Frank — who along with Newmark’s Matthew Leon and Ryan Kass is representing the landlord — said it’s the first space to become available in the building in two years.

“We got in excess of $100 per foot in the past, and the value is in excess of $100 per foot, ” said Cohen, who noted that the Central Park views are attractive to hedge funds, private equity firms and money management offices for wealthy New York families.

Farther Downtown, the Michael J. Fox Foundation for Parkinson’s Research, a nonprofit founded by the actor, signed a lease last month to move to George Comfort & Sons’ 498 Seventh Avenue, at 37th Street.

The foundation signed a deal for 29,468 square feet on the 18th floor of the 25-story, 795,669-square-foot building, data from CoStar Group shows.

The terms of the deal were not available. The agents for the sublet space, Joseph Mangiacotti and Molly Concannon of CB Richard Ellis, did not respond to a request for comment. Holly Barkhymer, a spokesperson for the foundation, declined to comment, citing a policy to not publicize the address, because celebrity seekers come hoping to find Fox.

Despite those deals, leasing activity fell by 32 percent to 3.8 million square feet in Midtown. The availability rate tightened, though, by .2 points to 11.8 percent.

Goodman said he expected tenants to hold back because of the general increase in pricing. “[Landlords] are not going to see nearly the amount of activity as was the case earlier in the year, ” he said.

Midtown South

Midtown South — the market growing the most diverse tenant base in the city — showed the strongest improvement in asking rents in the third quarter. And, it claimed the lowest availability rate in all of Manhattan to boot.

Still, leasing activity declined, falling by 31 percent to 1.7 million square feet.

Goodman said media, public relations and other creative firms were still expanding in the area.

“Midtown South is a different animal, ” he said. “[The creative companies] are still maintaining that entrepreneurial spirit. They are continuing to grow. They may not be experiencing explosive growth, but they are still growing. ”

One recent example is Iris Public Relations, which signed a deal for about 10,000 square feet of space on the entire fifth floor of 632 Broadway. The deal, which was signed in July, first appeared in CoStar last month, showing an asking rent of $40 per foot.

Iris, which already has space in the building, is roughly tripling its footprint with the move. The leasing agent for the building is Nora Stats, president of landlord agency firm Tarter Stats O’Toole.

For Midtown South as a whole, asking rents rose $0.64 per foot to $41.12 per foot, Cassidy Turley data revealed. The availability rate declined by .9 points to 9.5 percent.

Downtown

While Midtown South is gaining recognition as Manhattan’s main hub for Internet firms, some of those companies still prefer to lease space Downtown.

One Downtown-based software firm specializing in mobile-phone applications went office-space hunting in Midtown South, but ended up finding a short lease in Lower Manhattan, said the company’s representative, Bradley Gerla, an executive vice president at CBRE.

The company, Oberon Media, which only three years ago signed a lease in One World Financial Center, is moving to 16,103 square feet at 100 Broadway. The firm is leasing about the same amount of space in the new location, but the rent is far less.

The asking rent at the former location was $48 per square foot, while the new deal, a three-year sublet, is in the mid-$20s, Gerla said.

Gerla took the company to look at spaces in Midtown South and the Flatiron District.

“[But] they felt Downtown was just as appropriate, if not more so, ” Gerla said. “The economics are compelling. And they feel there is a techie mentality as well Downtown. ”

The availability rate tightened the most Downtown last quarter among the three submarkets, despite the largest decrease in the amount of office space leased.

The availability rate fell by 1.5 points to 10.5 percent in the third quarter, in part because a large block of 586,622 square feet at 70 Pine Street was taken off the market, with the expectation that it will be converted to condominiums.

Even as the availability rate declined, Downtown leasing activity fell. It dropped by 51 percent to 1.2 million square feet in the third quarter, the Cassidy Turley figures showed. But the numbers are slightly skewed because Condé Nast signed its 1 million-square-foot lease at One World Trade Center in June.

The Downtown asking rent, just as in Midtown, declined. But it only dropped by three pennies to $37.43 per square foot.