If hindsight is 20/20, forecasting the future might be 20/200. Yes, there have been some right-on-target predictions in the last few years — among them, mathematician Nassim Nicholas Taleb’s warnings that a meltdown of the world’s financial systems was imminent in the mid-2000s. But nailing down with certainty what tomorrow’s economy may bring, experts say, is at best a crapshoot.

The difficulty of crystal-ball gazing was, in fact, the heart of Taleb’s 2007 book, “The Black Swan: The Impact of the Highly Improbable,” in which he says that knowing with certainty when the next big calamity will hit is as tough as finding an actual black swan.

However, Taleb goes on to say that one should try to prepare for life’s black-swan events — like Hurricane Katrina, say, or the Sept. 11 attacks — by having safeguards in place for a multitude of worst-case scenarios.

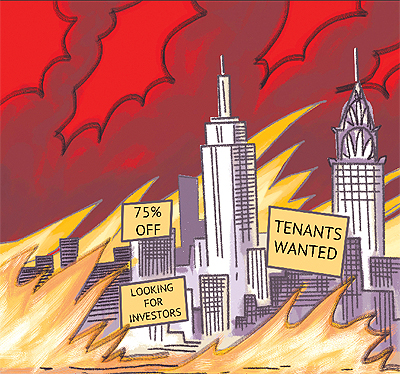

Similarly, it makes sense to follow blue-sky predictions to catch the upturn when it comes. Here, The Real Deal boils down some doomsday (and some rosy) scenarios and has experts, from economists to brokers, weigh in on their merits, to find out what they could mean for New York real estate.

Dissecting real estate’s upside if…

There’s a second round of stimulus

President Barack Obama’s first stimulus bill, which had an $835 billion price tag and passed in February 2009, was pilloried by many Republicans as an act of overreach that didn’t lower the unemployment rate.

President Barack Obama’s first stimulus bill, which had an $835 billion price tag and passed in February 2009, was pilloried by many Republicans as an act of overreach that didn’t lower the unemployment rate.

But most economists say that the stimulus, which funded thousands of shovel-ready projects nationwide, did create construction jobs, and that the economic climate might have been far worse without it.

That said, another massive program, if focused on long-term fundamentals like adjusting the tax code to help businesses, giving business more incentives to hire or helping to alleviate consumer credit card debt, could “help to repair balance sheets,” said Noah Rosenblatt, the founder of Urban Digs, a real estate analytical website, and a broker. That, in turn, could significantly brighten the mood of the housing market.

Any stimulus “needs to be longer term in nature,” Rosenblatt said. “It can’t be, ‘How do we get volume up today?'”

Many buyers, he said, are hesitant to pull the trigger on purchases because of anxiety about the nation’s health. But a sustained government effort to get people working in, say, Queens and Brooklyn, “where guys are hurting really bad,” would boost overall consumer confidence, Rosenblatt said.

While New York’s 8.7 percent unemployment rate is lower than the national rate of 9.1 percent, shaving a couple more points off of it would do wonders for real estate activity, he added.

Hiring picks up

Not all the help can come from the public sector. Private businesses would ideally start boosting their payrolls. The good news is that there are signs they are starting to do so.

For example, accounting firms like Deloitte, KPMG and Ernst & Young have recently been hiring — possibly to help banks comply with new regulations mandated under the Dodd-Frank Act.

That trend, experts say, could have an immediate (and very positive) impact on the office-leasing market in the city because more workers, of course, means greater demand for space.

Commercial brokerage Cushman & Wakefield put the Manhattan office vacancy rate at 9.4 percent at the end of June and at 6.4 percent in Midtown South in August — the lowest since February 2009. And Cushman researchers are predicting that the lower rate will stay in place going forward, according to a June report. “While there has been some indication recently that financial firms may reduce payrolls, that is not expected to have a major impact on the city,” the report said (see story here for a differing take).

Plus, rents have climbed 11.3 percent in Class A offices in Manhattan since the start of 2010, a trend that Cushman predicts will continue.

A market that’s tightened that much so quickly suggests bidding wars between tenants can’t be far behind, McCarthy said. When occupancy rates fall into the low single digits like they did in 2007, landlords “could play tenants off each other,” McCarthy said. “It does happen.”

Washington goes to one-party rule in 2012

The next presidential election is just around the political corner, and experts say that it could have serious implications for the economy and the real estate market as a whole.

One school of thought is that if either political party wins control of all of the key levers of government, the political gridlock that is now paralyzing Washington could begin to ease.

In a less partisan environment, one could argue, this summer’s bruising battle over the debt ceiling, which seems to have pushed Standard & Poor’s to downgrade the U.S.’s credit rating, might have been avoided. And that would have likely meant a more stable stock market and a greater willingness on behalf of investors to, well, invest.

“I think that gridlock is one of the contributing variables to the general … lack of confidence in the future,” said Terrence Martell, a finance professor at Baruch College who also worked for years on Wall Street. “People aren’t stupid. They can read the tea leaves.”

In addition, having the GOP in charge would likely mean a looser regulatory environment, which might prompt banks to hire more people and take more space.

On the other hand, a sweep by Democrats could lead to tough rules for banks and the hiring of more compliance officers, but could create a sounder footing for the next round of economic growth, some say.

“It’s clarity about what to expect that really helps,” McCarthy said.

Greece’s debt problem is fixed

If France and Germany come to the rescue of their beleaguered, debt-ridden neighbor, Greece, and help the financially strapped country avert a debt default, they would be removing a major thorn from the side of the global economy.

Such a rescue could also be important to New York’s residential market. That’s because foreign investors are so crucial here.

While overseas buyers are increasingly coming from Asia and South America, Europeans — who would be more seriously impacted if Greece actually defaulted — are still a sizable piece of the residential sales market, sources say.

A bailout or restructuring could avert a default and a Lehman Brothers-style European collapse, and thus stave off panic among investors in ailing countries like Ireland and Portugal, said Ted Truman, a senior fellow with the Peterson Institute for International Economics, a Washington, D.C.-based think tank.

With confidence restored, banks might extend more credit to homebuyers here in New York, where the market is relatively better than it is in other parts of the country. Plus, buyers here would feel more comfortable spending if Greece’s debt problem was resolved, because it would help boost the stock markets here and increase investors’ overall net worth.

New York’s population grows

In the 1970s and 1980s, New Yorkers fled the city, but in more recent years, that migration pattern has reversed itself.

Indeed, the population in the five boroughs grew by about 2 percent from 2000 to 2010, according to the U.S. Census. City officials have forecasted an increase of 1 million residents by 2030 — a number at the heart of Mayor Michael Bloomberg’s PlaNYC initiative, a sweeping effort to make the city more livable.

If the projections are borne out, that pattern would continue to create healthy demands for housing, while putting upward pressure on home prices and rents — all good news for developers.

Indeed, using the standard measurement of three people per household (in New York that may be three roommates) the city would need roughly 330,000 new units of housing in the next two decades.

If the population continues to grow as predicted, inventory could be absorbed at a more typical rate, unlike what has happened in the last few years, when much of it lingered on the market. That rising tide could lift the entire industry, according to analysts.

Rosenblatt said assuming that New York will be a desirable place to work and live in the future is a smart bet.

“I don’t think we will revert back to the 1980s, when crime was rising and the quality of life in the city was nowhere near where it is today,” Rosenblatt said. “The leadership that we have will continue to maintain the quality of life that we’ve gotten accustomed to.”

Along similar lines in terms of long-term generational thinking and planning for the future, Taleb has also said that the 2008 bank bailout was a mistake because it unfairly burdened the taxpayer. “The Romans had a saying,” he said at a Washington, D.C., forum last year. “The grandchildren should not bear the debt of the grandparents.”

Taleb also predicted that the Federal Reserve will likely be eliminated within decades because of its ineffectualness. While that may seem far-fetched, there are many (mostly in the conservative camp) who want the Fed gone and for private banks to set interest rates.

Home values barely budge

Tepid demand for real estate, both in New York and nationally, may not just be a problem of the moment — it could persist for years no matter how many tax credits and interest-rate breaks and other buyer incentives the government manages to throw at the problem.

That could perpetuate a wait-and-see cycle for buyers, who may think, “What’s the rush? Prices will be soft for years.”

This fall, a panel convened by Macro Markets — the financial firm founded by Yale professor Robert Shiller, who correctly predicted the housing bubble — found that home prices nationally will gain just 1.1 percent a year through 2016. To put that in perspective, some prices leaped by double digits in New York during the boom.

How real estate could suffer if…

Inflation kicks in

The low interest rates that now make borrowing so attractive could cause bucketloads of money to wind up in circulation.

The low interest rates that now make borrowing so attractive could cause bucketloads of money to wind up in circulation.

Government efforts to boost spending through stimulus measures could do the same, which in turn might drive down the value of the dollar. In the worst-case scenario, the dollar could tumble so far below the yuan that the Chinese could be less interested in purchasing U.S. Treasury bills.

That could mean that the prices for goods, including real estate, could climb faster than incomes do, suddenly putting homes out of the reach of buyers.

Sources say if that happens, there would be some concern about “zombie” office towers — if not in New York, elsewhere in the country. Those are towers that are intentionally kept empty by landlords because they are worried about locking in rents that are too low to cover the quickly escalating costs of maintaining the building.

Taleb has publicly expressed concern that hyperinflation will be the next big problem besetting the U.S. economy.

In fact, Universa Investments, the Santa Monica, Calif.-based hedge fund he works at, is now investing in options on securities that respond to inflation (meaning they’re betting on products believed to be most vulnerable to inflation).

“Expectations for home-price performance in 2011 have become somewhat less negative,” economist Robert Shiller said in a news release. “Unfortunately, the average projection is somewhat more negative for each of the following four years.”

That softening spells trouble for Wall Street. While the struggles of the housing market in a city like, say, Toledo, Ohio, may seem far removed from Manhattan, consider that the subprime crisis that brought down the economy had its roots in cities and towns throughout the country.

Layoffs continue, and another recession hits

Almost all of the major investment banks have said that they will significantly trim their workforces in the weeks ahead, as weakness in the stock market, evident by the sharp drops and climbs of the past few months, continues to cause them pain.

When people are out of work, they spend less, which crimps retailers and other businesses, lowering their revenues and putting them on the ropes. That downward spiral has some, like famed economist Nouriel Roubini, who also predicted the last crash and has been dubbed “Dr. Doom,” worried about another full-blown recession. This summer, Roubini put the chances of another recession at 60 percent.

If that happens, experts say, the office vacancy rate in Midtown, which was hit hardest in the last recession, could shoot up to 13 percent, residential prices in Manhattan could drop by 20 percent, and new construction could completely freeze — again.

Barry Gosin, chief executive of Newmark Knight Frank, the commercial brokerage, said any corporate layoffs are cause for concern, especially in New York’s office market.

“We would be keeping our heads in the sand if we didn’t think [layoffs] would have some kind of impact,” he said. He added that contractions in the workforce are unfortunately happening as One and Four World Trade Center, the pair of under-construction high-rises in Lower Manhattan, are about to be added to the office supply.

Greek woes become catastrophic

If European countries rush to the aid of Greece, they could wipe out their own reserves. Plus, investors who hold Greek debt might find it to be worthless.

In a worst-case scenario, some predict that the European Union — which was formed in the early 1990s and is currently comprised of 27 countries — could be broken up.

In this case, the euro, the EU’s currency, would be scrapped and each nation would go back to its old currency, a move that could create harmful trade barriers. Acting individually, those countries could ban certain types of investments by their banks — no Italian debt, for instance — which could destabilize European credit markets, economists say.

“It would be hard to contain the centrifugal forces that would be in play” in the dissolution of the EU, said Truman, of the Peterson Institute, projecting that the break-up “is more possible than it was a year ago.”

Newmark’s Gosin also believes an EU breakup is not out of the question. He also pointed out that in today’s world, most major global events — whether it’s an earthquake in Japan or a debt default in Greece — have a direct effect on the U.S. economy. “It is all connected,” he said. “And none of the news seems good.”

For his part, Truman said the effects of a broken-up EU on New York’s real estate market could be that banks “might get burned, which would in turn cause them to pull back” on everything from bundling commercial mortgage-backed securities to issuing jumbo home loans.

An earthquake hits NYC

The 5.3 quake that hit central Virginia on Aug. 23 did only minor damage in the city. But it did rekindle some fears that New York — which hasn’t been hit by a major tremblor since 1884, when a 5.3 quake hit Brooklyn — is vulnerable.

Though new high-rises do have to follow seismic construction codes, established in the 1990s, and the city’s skyscrapers, which can wiggle a bit to withstand hurricanes, are probably sturdy enough, tens of thousands of brick, wood and masonry structures put up in the 19th and early 20th centuries could possibly be felled by tremors.

In quake-prone California, landlords in these types of buildings often reinforce their floors with rods to make them safer. But the chances of convincing property owners here to spend money to do a thing like that may be a lost cause.

“The chances of that happening in New York seem very slim,” said Andrew Smyth, a professor of civil engineering at Columbia University. Like an ultimate black-swan event, “earthquakes are rarer here than on the West Coast,” he added.

“But when they do happen, the effects are felt quite far,” he said.