New York is no stranger to reinvention. But the changes that have taken hold in Dumbo, even in just the last five years, have taken the neighborhood to a once-unimaginable place.

When artists began trickling into the post-industrial Brooklyn area in the 1970s, they found massive concrete warehouses and postcard views. But the stone-lined streets were desolate.

Today those same streets are teeming with tech workers, hotel guests, diners and shoppers spilling out from swanky hotels, restaurants and high-end retail. Meanwhile, the skyline is dotted with rooftop bars and pools.

Since the Empire Stores — a coffee warehouse-turned-food hall and mall — opened in 2016, everything has ballooned. That includes the debut of the exclusive members-only Dumbo House — a branch of Soho House tucked discreetly inside the Empire Stores building — and massive restaurants like the 8,500-square-foot Cecconi’s Dumbo and the even bigger 13,000-square-foot Sugarcane.

Down the street, meanwhile, is 1 Hotel Brooklyn Bridge, a nearly 200-room luxe eco-hotel that is also home to the trendy 150-seat restaurant the Osprey.

Down the street, meanwhile, is 1 Hotel Brooklyn Bridge, a nearly 200-room luxe eco-hotel that is also home to the trendy 150-seat restaurant the Osprey.

On Front Street, meanwhile, the first full-service grocery store, the 16,000-square-foot Dumbo Market, opened in April.

And that’s not even including all the residential projects. Developers and investors have funneled so much cash into to Dumbo that some say the neighborhood may be oversupplied, especially as the market softens.

Robin Schneiderman — head of business development for Halstead and Brown Harris Stevens Development Marketing, the first of which is active in the neighborhood — said rentals likely have a clearer path than condos in the area.

“The story really is, can Dumbo absorb all these new apartments?” he said.

Schneiderman noted there’s a sense that Dumbo is quickly approaching capacity.

“Everything is basically developed,” he said.

The Jehovah’s Witnesses, once among the largest property owners in the area, began selling off their holdings in the early 2000s, paving the way for some of the projects that began remaking the area, including the condo conversion One Brooklyn Bridge Park and the office mega-complex Dumbo Heights.

But the Witnesses sold off their final Dumbo parcels in 2018. And those sites are now set to bring another wave of condos, rentals and tech office space to the area.

The start of all of Dumbo’s development can be traced back to David Walentas, who famously pioneered the neighborhood in the late 1970s when he bought a 275,000-square-foot former box factory for $1.5 million, or $6 per square foot. Today, it’s the luxury condo dubbed the Clock Tower Building, where prices average $1,300 per square foot. Walentas’ firm Two Trees Management, now run by his son Jed, owns seven rental buildings and three office buildings plus retail in the neighborhood, which abuts Brooklyn Bridge Park — a public-private 85-acre mash of greenery and recreational facilities that attracts thousands of visitors each weekend.

Jared Della Valle, a co-founder of Alloy Development — a Dumbo-based firm behind a half dozen residential projects dating back a decade — said the changes in Dumbo speak to the larger transformation of Brooklyn.

“A lot of how Brooklyn culture is perceived in the world is because of what we have done here,” said Della Valle, who’s lived in Dumbo for 18 years.

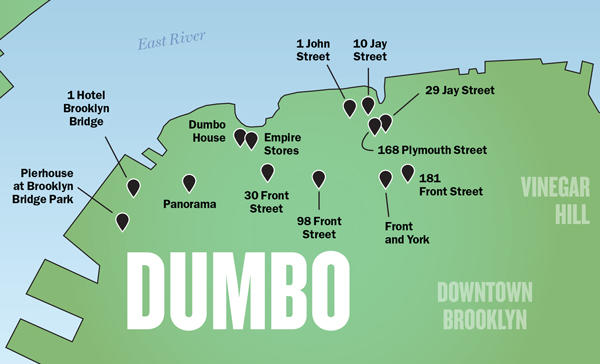

Here’s a look at some of the projects that have changed the game in Dumbo in the last five years — and some of the latest projects in the works.

Empire Stores

Empire Stores

The mammoth Civil War-era coffee warehouse at 55 Water Street has been owned by the state since the 1970s and sat mostly vacant for decades. Then in 2013, a team made up of Joseph Cayre’s Midtown Equities, HK Organization and Rockwood Capital beat out more than a half a dozen firms for the lease.

The starting rent was about $1.5 million a year, which is partly used to pay for upkeep of Brooklyn Bridge Park.

After a $150 million gut renovation, the brick complex is now a hive of activity, with retailers like J. Crew, watchmaker Shinola, West Elm (which also has its headquarters in the building) and the Time Out Market, a 21,000-square-foot, two-floor food hall that opened in May and includes outposts from restaurateur David Burke and others. (It should be noted, however, that in July, 14 of its 21 eateries were shut down for two weeks for health violations involving food being stored improperly.)

Midtown Equities did not return a call about the property, but in February, the firm, along with HK, bought out Rockwood’s majority stake for $420 million.

Dumbo House, meanwhile, includes a 3,300-square-foot outdoor terrace with a pool, overlooking the East River. In addition to West Elm, office tenants include the conglomerate United Technologies, ad agency 72andSunny and marketing firm Laundry Service. The office space, which is fully occupied, rents for about $85 per square foot, said JLL’s Howard Hersch, who handles the leasing.

But tax credits through the city’s Relocation and Employment Assistance Program, designed as an incentive for companies to relocate to Brooklyn from Manhattan, along with other sweeteners, bring down the effective rent to around $65 per square foot, brokers said.

That’s a steep discount over Manhattan’s Flatiron — a tech hub — where rents can be $125 per square foot, according to Hersch.

“This building is one of the most important expressions of a creative office building in New York,” Hersch said. “It’s a case study.”

98 Front Street

Resembling a stack of children’s blocks, this condo from Hope Street Capital includes 165 units and amenities such as an indoor saltwater pool and a rooftop bocce court.

Resembling a stack of children’s blocks, this condo from Hope Street Capital includes 165 units and amenities such as an indoor saltwater pool and a rooftop bocce court.

The under-construction building launched sales in July and was on track to be 20 percent sold by Labor Day weekend, said Sha Dinour, the president of Triumph Property Group, Hope Street’s in-house marketing arm.

Apartments start at $595,000. That’s well below the $1.6 million average for northwestern Brooklyn, according to data from Douglas Elliman.

But Dinour said the sub-$1 million market is attractive to the tech and creative employees now flooding into Dumbo. “People thought we were crazy because we went with small apartments,” Dinour said. “But we view it as an underserved segment of the market. Up until now, our buyers have been priced out of Dumbo.”

Hope bought the site — once home to a low-slung garage — from the Witnesses for $60 million as the religious group began its second major push to sell off its holdings in the area.

Front and York

Front and York

This full-block, two-towered condo-and-rental complex — formerly known as 85 Jay Street — is being developed by CIM Group and LIVWRK. The project was several floors out of the ground in early August.

In 2016, the duo, along with Kushner Companies, paid $345 million for the sloping, fence-enclosed former parking lot. (Kushner sold its 2.5 percent stake to CIM last summer.)

According to public records, the 21-story project includes 408 condos and 320 rentals. The condos have a projected sellout of $833 million; rental prices have not yet been set.

LIVWRK declined an interview request through Yael Gewant, a project spokesperson, who noted that the complex, designed by architect Morris Adjmi, will include a sprawling private park.

10 Jay Street

This 10-story, 250,000-square-foot office building with red brick walls and a crinkly glass façade opened this year.

This 10-story, 250,000-square-foot office building with red brick walls and a crinkly glass façade opened this year.

The developers — New York-based landlord Glacier Global Partners and investment firm Triangle Assets — had originally planned a condo but pivoted in 2015.

Brokers say the duo may have been hedging against a softening condo market. But the strength of Dumbo’s office market — which, according to CBRE, includes 4.7 million square feet at 21 buildings — may also have been a factor.

The project was 95 percent leased in July to office tenants, including co-working firm Soho Works and ad agency Translation, said JLL’s Hersch, who is repping the property and put the development cost at “north of $80 million.” (Rent the Runway has also signed on for space and will relocate in 2020 from Manhattan.)

“Exciting young companies need low rents,” said Hersch, noting that rents in the building range from $72 to $85 per square foot.

30 Front Street

The final property in the Witnesses’ Dumbo portfolio was a 52,000-square-foot site next to the Brooklyn Bridge that had long been used as a parking lot. The triangular parcel attracted several bidders when it came to market last year, said Jonathan Landau, the CEO of Fortis Property Group, which ended up paying $91 million for it.

The final property in the Witnesses’ Dumbo portfolio was a 52,000-square-foot site next to the Brooklyn Bridge that had long been used as a parking lot. The triangular parcel attracted several bidders when it came to market last year, said Jonathan Landau, the CEO of Fortis Property Group, which ended up paying $91 million for it.

The developer is now planning a 78-unit condo that will include two swimming pools — one indoor and one out.

Tentatively named the Olympia, the tower will have 360-degree views from units located above the 15th floor, Landau said.

The offering plan has not yet been submitted for the $300 million project, but the building is expected to hit the market early next year and open in 2021, at prices “north of $2,000 a square foot,” according to Landau. “This will be a new experience for luxury living in Brooklyn,” he said.

Those prices are not unprecedented in the borough. Buildings like 1 John Street, the Pierhouse and a number of others have all charted into that territory. And in October, a condo at Quay Tower in nearby Brooklyn Heights went into contract for $20 million, which will break the record for the borough’s priciest residential sale if it closes at that price.

Still, the average price for new Brooklyn condos in 2019’s second quarter was $955 per square foot, according to Elliman.

Fortis has never built in the neighborhood. It lost out on developing 85 Jay Street, where it envisioned big-box stores, Landau said.

“We have witnessed the gentrification, the explosion of the Dumbo’s street life, from when we first moved,” said Landau, noting that the firm has been headquartered in Dumbo since 2007. “It was a super-compelling picture for us to get involved in.”

29 Jay Street

This squat, two-story brick structure served as a temporary home for the Saint Ann’s Warehouse performing arts space from 2012 to 2015. More recently, it has been home to a classical ballet school.

This squat, two-story brick structure served as a temporary home for the Saint Ann’s Warehouse performing arts space from 2012 to 2015. More recently, it has been home to a classical ballet school.

The building’s next act is up in the air. The property is located in a historic district, but the Landmarks Preservation Commission green-lit landlord Peter Forman’s proposal to raze it and erect a glassy 11-story office building. But Forman, who did not return a call for comment, needs a zoning change for the manufacturing site in order to proceed.

He can, however, build residential as of right and has said he’ll construct a 141-unit apartment building if he doesn’t win approval for the office building.

181 Front Street

This 12-story, 105-unit rental was developed by Urban Realty Partners and Megalith Capital Management and opened in 2018.

As of mid-July it was 85 percent leased, according to Halstead’s Schneiderman, who is marketing the project.

Rents at the doorman building, which has a gym, playroom and roof deck, start at about $5,000 a month for one-bedrooms, he said. The building is offering one free month of rent and shouldering the cost of any broker fees.

The property — which partly sits on an assemblage bought from the Witnesses for $30.6 million in 2013 — also counts the Carlyle Group among its owners. A development arm of the Washington, D.C.-based firm bought a stake in 181 Front and 200 Water, another of the developers’ nearby rentals, for about $21 million in 2014.

Schneiderman said that as Dumbo increasingly attracts young tech workers, the area’s rental inventory should be easily absorbed. The roughly 700 condos in the pipeline are a different story, he added. “It’s the big question, really,” he said. “But I am cautiously optimistic.”

1 John Street

Brokers point to the 2016 arrival of the 12-story tower as the beginning of Dumbo 2.0.

Brokers point to the 2016 arrival of the 12-story tower as the beginning of Dumbo 2.0.

Developed by Alloy and Monadnock Development, the 42-unit project took amenities and pricing up a notch.

The doorman building, on leased land inside Brooklyn Bridge Park, sold out in 2016. But today resales trade for about $1,800 per square foot. A four-bedroom, three-and-a-half-bath apartment was listed there this summer for $5.1 million.

Pierhouse at Brooklyn Bridge Park, 1 Hotel Brooklyn Bridge

The 106-unit condo known as Pierhouse — which is spread between two buildings on the border with Brooklyn Heights — was the first ground-up condo to be built inside the park, back in 2015.

The 106-unit condo known as Pierhouse — which is spread between two buildings on the border with Brooklyn Heights — was the first ground-up condo to be built inside the park, back in 2015.

The project is part of the same structure as the 194-room 1 Hotel.

Developed by Toll Brothers City Living and Starwood Capital Group on land leased from the Brooklyn Bridge Park Corporation, the complex was controversial, to say the least.

Many longtime residents in the low-rise area took issue with its height, which the developer argued was needed for mechanical equipment. Neighbors sued the over that in 2015, but ultimately lost.

And buyers came without hesitation. The priciest apartment to sell, in 2017, was a three-bedroom with Manhattan views for $10.2 million, according to StreetEasy. That same unit appears to have traded again in August; its last list price was $11.2 million.

Meanwhile, rooms at the hotel, which is run by Starwood, were starting at around $500 a night in July, far more than most other luxury Brooklyn hotels.

But if the crowds on the rooftop are any indication, those rates also don’t seem to be turning off guests.

“It’s certainly one of the best views in the city,” Hersch said. And because there really wasn’t a high-end hotel in Dumbo till it arrived, he added. “it’s been a huge value-add for the neighborhood.”

Panorama

Panorama

For years, passersby knew it from the large Watchtower sign on its roof. Now the complex, once owned by the Witnesses, is about to be reborn as Panorama, a five-building, two-block office project.

The 1920s buildings — which sit at 25, 29 and 30 Columbia Heights as well as 51 and 67 Furman Street — were bought in a high-profile deal by CIM, LIVWRK and Kushner Companies for $340 million back in 2016. (Kushner recently cashed out.)

The massive collection of buildings — some of which are joined by skybridges and sport new glass staircases — is undergoing an $80 million renovation and will undoubtedly be a neighborhood game changer when it opens.

When finished, Panorama will include 55,000 square feet of outdoor space and 35,000 square feet of retail. All five buildings are set to open this fall, according to the spokesperson.

And its signature yellow will be painted gray. Asking rents average $75 to $85 per square foot, a spokesman said.

The complex resembles Dumbo Heights, also a multi-building complex and also a warehouse-to-office conversion that sits at the opposite end of the neighborhood in the shadow of the Brooklyn Bridge and houses tenants including WeWork, Etsy and Frog Design. That 1.2-million-square-foot complex, which the Witnesses sold in 2013, was a partnership of LIVWRK, Kushner and Aby Rosen’s RFR Holding.

168 Plymouth Street

This 46-unit project — two adjacent industrial buildings once used as paint factories — is being redeveloped by Alloy on the corner of Plymouth and Jay streets.

This 46-unit project — two adjacent industrial buildings once used as paint factories — is being redeveloped by Alloy on the corner of Plymouth and Jay streets.

The $100 million project, which is largely made up of condos but also includes three townhouses, will launch sales this month and has an opening date of 2020.

According to filings with the state attorney general’s office, the condos and townhouses (essentially duplex condos) have a projected sellout of $132 million. Unit prices average $1,600 per square foot.

In addition to usual luxury amenities, the landscaped roof deck will also include three for-sale cabanas, according to Alloy, which acts as the developer, architect and contractor on its projects.

In a telling sign for the neighborhood, Alloy bought the project this spring from Phoenix House, the nonprofit drug and alcohol rehab organization that had controlled it since 1973, for $52.3 million.

Della Valle, who will relocate to the building himself, dismissed concerns about oversupply in Dumbo. “Good product always gets sold,” he said, adding that Dumbo is “kind of an irreplaceable neighborhood at this point.”

CORRECTION: An earlier version of this story stated that Front and York will include 408 condos and 324 rentals. After publication, representatives for the developer said there will, in fact, be 320 rentals.