UPDATED, Sept. 9, 2019, 12:45 p.m: On Friday, Aug. 23, President Trump escalated his trade war with China in a series of tweets that labeled Chinese leader Xi Jinping an “enemy.” That same day, in Hong Kong, demonstrators formed a human chain across the territory in a show of solidarity with anti-government protests that had been raging for months. In Brazil, meanwhile, wildfires spread across the Amazon, wiping out millions of acres of forestland. And in the U.S., economists sounded alarms on an impending recession — warnings that continue.

As global instability hits new levels, both the New York and national residential markets are taking a hit.

According to the National Association of Realtors, the number of foreigners who purchased homes across the U.S. plummeted by 31 percent between April 2018 and March 2019. In that period, foreign buyers purchased 183,100 properties valued at about $77.9 billion, down from 266,800 properties valued at $121 billion in the previous 12-month stretch.

The decline in Chinese buyers — largely the result of capital controls instituted in late 2016 that restrict how much money citizens can take out of the country — is, not surprisingly, one of the biggest components of the fall in foreign capital. But it’s not just Chinese buyers taking a step back. Sources say they’ve seen a slump in buyers from multiple countries, including Russia, Italy and parts of the Middle East.

“There has been a substantial drop-off from the former Soviet Union, and more recently from Asia and the Middle East as well,” said Edward Mermelstein, a Russian-American attorney who advises wealthy clients on global investment opportunities.

Even more worrying for many in the real estate world is that, unlike in the past, there don’t seem to be any new groups emerging to fill the void.

“Foreign capital across the globe has slowed down,” said Manhattan real estate attorney Pierre Debbas, of Romer Debbas, adding that a strong U.S. dollar and a saturation of supply in the high-end condo market have also played a role.

Mermelstein said domestic buyers will need to fill the shortfall. “The emerging markets that were keeping the high-end real estate market on fire, especially in New York and other major U.S. markets — that is no longer the case,” he said.

Unprecedented incentives

Italian-born Corcoran broker Sofia Falleroni, who estimates that Italian clients make up about 25 percent of her business, said she’d seen a small decline in purchases from this group, which she attributed to the political crisis gripping Italy. (Last month, political leaders scrambled to form a new government after Prime Minister Giuseppe Conte resigned in the face of a no-confidence vote. At press time, Conte was still serving until new government leaders were sworn in.)

Despite the political shakeup in her home country, Falleroni said she is encouraging Italian buyers to take advantage of current market conditions in New York.

“I really do like this market for buyers,” she said, speaking on the phone from an area near Tuscany, where she was on a business trip. “Next week I have a lot of meetings in Milan, and I’ll be talking about how this is a great market to buy in.”

Related: NYC’s new global investment fix

The softening New York market has indeed led to price cuts and prompted some developers to offer financial incentives to unload condos.

In April, in an effort to spur sales at its 815-unit Lower Manhattan development, One Manhattan Square, Extell Development Company announced that it would waive common charges for up to 10 years for buyers who closed before July 4.

Extell declined to comment for this story, but the move revealed the challenges developers are facing selling condos in Manhattan.

“I’ve seen some pretty insane incentives before, but that tops it by far,” real estate attorney Petro Zinkovetsky told The Real Deal at the time. “Those incentives are going to cost them money; someone has to cover the operations of the building.”

Back in 2015, marketing for the project was launched exclusively in Asia. The building has recorded strong sales, according to a recent report from PropertyShark. However, it’s unclear how many of the colossal project’s units remain unsold.

Daniel Chang, a broker who works on Nikki Field’s team at Sotheby’s International Realty, said some foreign buyers view the softening conditions in New York as a deterrent to buying.

“Chinese clients have always bought on the way up,” he said. “They rarely buy on the way down.”

Furthermore, he said, the decline in Chinese buyers goes beyond just capital controls.

“I think the Trump trade war and anti-American sentiment impacted their future plans,” he said. “Investment in the U.S. is not as glamorous as it used to be.”

He also pointed to reports that Chinese students had faced difficulties accessing visas and securing spots in elite schools. (In December 2018, MIT offered early admission to more than 700 students from around the world; no Chinese students were among them.)

Despite this drop-off, Chinese buyers are still a major force in the real estate market.

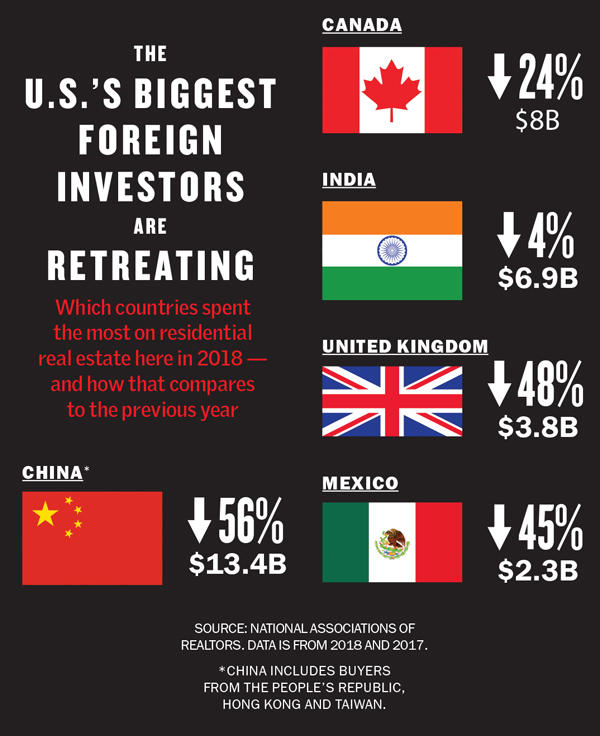

In 2018, they purchased an estimated $13.4 billion worth of residential property in the U.S. — more than any other international group, according to NAR. However, that number was down a massive 56 percent on the previous 12 months. After China, buyers from Canada, India, the United Kingdom and Mexico poured the most money into the U.S. market with $8 billion, $6.9 billion, $3.8 billion and $2.3 billion, respectively. However, those numbers were also down compared to the previous year (see chart).

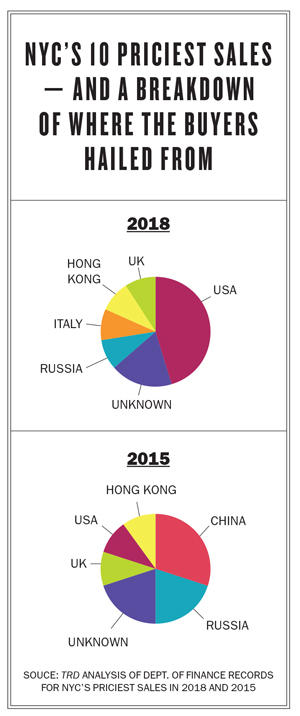

An analysis by TRD found a similar decline at the very top of the Manhattan market for Chinese buyers. In 2015, buyers from the People’s Republic were behind three of the 10 priciest sales, while in 2018 there were no Chinese buyers in the top 10. American buyers, meanwhile, made five of the 10 priciest purchases in 2018, compared to only three in 2015.

The climate has many brokers altering their approach.

This May, Warburg Realty’s Jason Haber led a delegation of 18 Chinese buyers around a number of properties on Billionaires’ Row. When he was initially approached about setting up the tour, Haber said, he vetted the situation more rigorously than he would have a few years ago. It wasn’t until he was assured that the buyers’ money was in Hong Kong — rather than in mainland China, where it would be hard to move — that he agreed to work with the group.

Haber said the buyers ultimately decided to hold off until the first quarter of 2020 in the hope that trade tensions between the U.S. and China would ease. “Their primary concern was that by buying here now, it could create problems for them at home,” he said, adding that they also wanted to watch what happened with the currency markets.

Sotheby’s Chang also predicted that Chinese clients would return to the U.S. in greater numbers once political conditions improved. “They’re taking a pause and seeing where it goes,” he said.

Who’s hit the hardest?

Not all sectors of the New York residential market are created equally when it comes to foreign investment.

“Most foreign buyers are strictly interested in the condo market, so this has affected condos more than anything,” said Hall Willkie, president of Brown Harris Stevens, which handles a high volume of resales. “We certainly don’t like to see any decline, but there’s really no measurable effect.”

Nancy Packes — who runs an eponymous new development marketing consultancy — said that before the 2008 financial crisis, the New York condo market was largely geared toward U.S. buyers. But, she said, during the recovery that followed, developers became increasingly focused on foreign investors. “The market has become a much more sentiment-driven market,” she said.

BHS’ Paula Del Nunzio, a powerbroker in the townhouse space, noted that Chinese buyers who already have money in the U.S. can still buy — often through LLCs or other structures that conceal their identity.

“For what we’re doing, if they’re trying to buy it, they’ve already figured out how to do it,” she said. Furthermore, she said, there will always demand. “New York is such an international destination for investment. We find that as one group diminishes, another steps up.”

Historically, that’s been true. In 2012, Russian billionaires were making splashy purchases in New York. But in 2014, the U.S. imposed sanctions on Russia for annexing Crimea from Ukraine, and many of those buyers disappeared. Chinese buyers then took the mantle and ended up pumping far more into the market. Unlike the small cadre of Russian oligarchs buying trophy penthouses, Chinese buyers penetrated the market at all price points.

Historically, that’s been true. In 2012, Russian billionaires were making splashy purchases in New York. But in 2014, the U.S. imposed sanctions on Russia for annexing Crimea from Ukraine, and many of those buyers disappeared. Chinese buyers then took the mantle and ended up pumping far more into the market. Unlike the small cadre of Russian oligarchs buying trophy penthouses, Chinese buyers penetrated the market at all price points.

“No one is filling the gap created by China,” Debbas said.

In addition, foreign buyers’ capital is not being deployed elsewhere. “Their money on the sidelines,” he said. “It’s not going anywhere.”

Compass broker Nikki Sun — who was born in China, grew up in New Zealand and now works in New York — said she noticed a drop-off at the end of 2016 and made a point of building out her American client base. “I realized years ago that focusing on foreign buyers was not going to be sustainable for me,” she said.

In addition to her main brokerage business, Sun is now developing a platform for Chinese renters that will accommodate Chinese payment apps, including WeChat and Alipay. “The entire American market is way behind the remote cashless society,” she said.

Haber, too, has tried to be more flexible. “If you don’t adapt your business, you are going to run into trouble,” he said.

Jonathan Miller, president and CEO of appraisal firm Miller Samuel, said that while foreign investment in new development condos had declined in New York, foreign investment across the country is still strong. “Even if there’s a pullback, investment is still elevated,” he said, adding that buyers are now focusing on different assets in different parts of the country.

And some New York brokers said they are seeing an uptick among certain groups.

CORE broker Jason Lanyard said he’s recently seen an increase in interest from his Indian clients, particularly for new developments.

“There is such a sensitivity to pricing,” Lanyard said. “I think what Indian buyers would have recognized is that the market can’t stay down for long.”

Lanyard makes regular trips to India, and estimated he had sold about nine properties to Indian buyers over the past three quarters — a positive sign for the high-end market.

But the increase in volatility seems to be hitting all parts of the globe, with pending economic ramifications in Europe in connection with Brexit, the rise of global nationalism and a geopolitical crisis sweeping through South America.

That is putting more pressure on domestic buyers.

“We are in a similar situation to what we had in the late ’80s and early ’90s where we were very much dependent on local buyers and investors,” Debbas said.

“Until and unless the local buyers start to go back into the market, the likelihood of foreign investors coming back into our market is very unlikely in the short term.”

Correction: This story has been updated to reflect that Sofia Falleroni is an agent at Corcoran, not Compass.