In a nearly half-billion-dollar deal, Fairfield Properties, owned and led by the Broxmeyer family, acquired a seven-property portfolio with 1,496 units last year, further cementing the firm’s stature as the island’s largest residential landlord.

The 40-year-old Melville-based firm closed on the $472.5 million sale of Home Properties, owned by Lone Star Funds, making it by far the largest multifamily transaction on the island last year.

“It goes to our business model and strategy,” Gary Broxmeyer, a partner at Fairfield Properties, said of the deal. “We transform properties.”

Although Fairfield Properties sometimes builds from scratch, it typically buys decades-old buildings, invests and upgrades them.

“We’re looking to continue to build out our brand of residential multifamily communities throughout Long Island,” Michael Broxmeyer, a partner at Fairfield Properties, added. “If there’s an opportunity, we take advantage of it.”

With the Long Island portfolio deal, Fairfield Properties grew to more than 12,000 units, primarily in Nassau and Suffolk with about 2 percent in Queens. It acquired about 85 percent and built 15 percent — or 1,000 units — since its founding in 1974.

“This acquisition significantly adds to their portfolio,” CBRE’s Jeff Dunne said. “It was probably the biggest multifamily deal on Long Island ever.”

“This acquisition significantly adds to their portfolio,” CBRE’s Jeff Dunne said. “It was probably the biggest multifamily deal on Long Island ever.”

At the bargaining table

Obstacles, competition and alliances all played a part in the deal of the year.

Dallas-based Lone Star obtained the seven-building Long Island portfolio in 2015 as part of a $4.36 billion acquisition of Rochester, N.Y.-based Home Properties. The deal came to about $7.6 billion, including the assumption of debt. Lone Star typically owns properties for three to five years and sells.

Dunne said 15 firms made offers. It was largely a mix of joint ventures between operating partners and private equity funds, real estate equity funds and family offices.

Lone Star specified that the buyer had to be set up as a REIT. Fairfield Properties didn’t initially meet that requirement.

Fairfield Properties formed an alliance with Maryland-based real estate investor Federal Capital Partners (FCP) to finance the acquisition of the properties, which were built between 1951 to 1973.

Fairfield Properties, which employs 375 staffers, provided all of the common equity for the acquisition, while FCP provided preferred equity in private REIT form to buy the portfolio, Gary Broxmeyer said.

After Fairfield Properties bought the portfolio, it sold off one of the properties — Fairfield Courtyard in Bay Shore — and picked up another — The Preserve, an 80-apartment townhome property in Coram owned by Eagle Rock Properties.

“Before we bid, we all agreed unanimously that we wanted to swap it with a property more conducive for us,” Gary Broxmeyer said.

The Preserve’s seller, Eagle Rock, is a Manhattan-based company in business for more than 20 years focusing on the Northeast and Mid-Atlantic region. The company said its average deals range from $20 million to $50 million.

The Preserve is adjacent to the Fairfield Townhomes at Coram, already owned by Fairfield Properties. “This was a chance to purchase the third building and consolidate it,” Gary Broxmeyer said.

“We sold the Bay Shore property, which worked tremendously well with Eagle Rock’s existing portfolio,” he added. “Like a marriage, like a matchmaker, it worked out.”

CBRE’s Dunne said Eagle Rock was “motivated to pursue Fairfield Courtyard at Bay Shore to bolster their current portfolio of Northeast workforce housing.”

To have and to hold

Unlike the portfolio’s previous owner Lone Star, Fairfield Properties tends to act as a long-term owner. And the company may have benefited from difficulties in developing multifamily housing on Long Island.

“It’s highly occupied,” Dunne said of Long Island multifamily units. “When you compare to other parts of the region like Brooklyn, Westchester, Fairfield County or the waterfront in Jersey, Long Island does not have units being built on a per capita basis compared to those areas.”

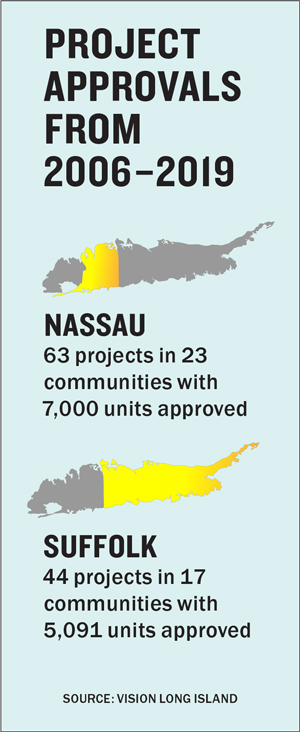

That shortage has led to a bigger push for more multifamily housing from local municipalities.

“As people age, they want to rent,” said Mitch Pally, CEO of the Long Island Builders Institute. “Some single-family homes in many communities have illegal apartments in them. People want to have a real apartment.”

While new construction is helping fill demand (see sidebar), Fairfield Properties’ Lone Star portfolio buildings, constructed between the 1950s and the 1970s, will require some updating.

“Fairfield has done a good job in acquiring properties at prices that they believe are appropriate,” Pally said. “They go in and fix them up.”

The company plans to install maple cabinets, higher-end appliances, vanities and other finishes. It’ll also add or improve clubhouses with upgrades from wallpaper to flooring to new fitness equipment.

The renovations come with increased rents for tenants, but the company declined to comment on how much it may raise the rents at these properties.

Meanwhile, the company hasn’t been standing still this year since the seven-property deal.

Since the Lone Star acquisition, Fairfield Properties has acquired another nine buildings with 583 units, bringing its total units acquired for 2019 to 2,079.

“We’ll continue to look for strategic acquisitions throughout Long Island. We’ve been very active,” Michael Broxmeyer said. “We have a desire to broaden our brand throughout Long Island.”